The pressure on the euro is growing as the gap between expected rate cuts from the Fed versus the ECB keeps widening. The latter is moving closer to cutting interest rates right as the former’s timeline lengthens.

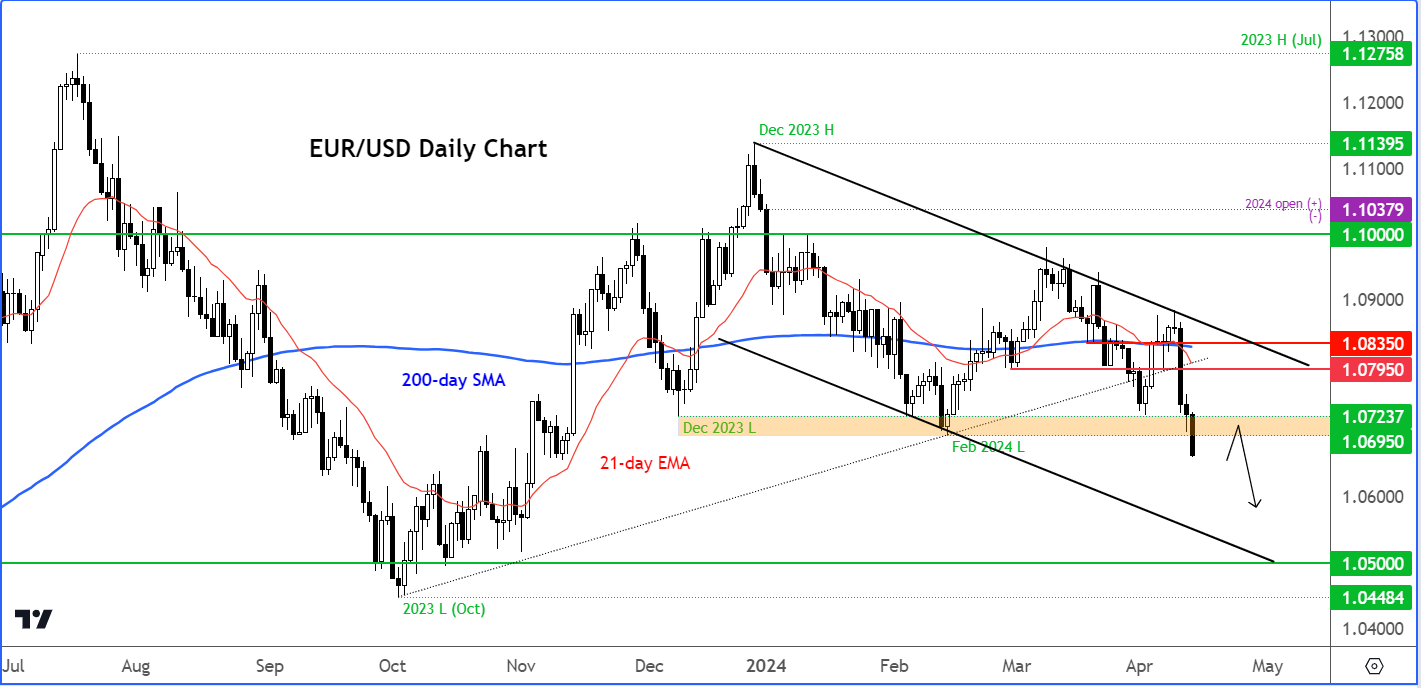

At the time of writing, the EUR/USD was probing its lowest levels since mid-November, after breaking below key support in the 1.0695-1.0725 area.

Today, the US economic calendar includes the University of Michigan surveys and a few Fed speakers. But the next big US macro data is not due until late in the month when the Fed’s favorite measure of inflation is released on April 26.

Until then we may well see the US dollar remain supported on any short-term dips, given that both the US and the rest of the world's rates story – for example, ECB and BOC – have turned more positive for the greenback.

What is causing the decline in EUR/USD?

The EUR/USD had been stuck in a very tight range in recent months and never looked like it was about to take off any time soon anyway, all thanks to consistent weakness in eurozone data.

Its recent weakness reflects the growing divergence in rate paths between the US and Eurozone. Traders not only perceive a higher likelihood of an ECB rate cut in June compared to the Fed, but they are also factoring in more cuts overall for 2024.

The US dollar side of the story is all due to the sticky nature of US inflation, and surprising resilience in data strength overall – plus rising oil prices, which is always dollar-positive.

Consumer Prices in March rose to their highest annual pace since October with a print of 3.5% in mid-week.

That was the fourth consecutive month when CPI overshot market expectations, as prices of many necessities rose sharply, including car insurance, transportation, and hospital services, not to mention rent, electricity, and restaurant prices.

From the Eurozone side of things, a weak economy and cooling price pressure have increased the pressure on the European Central Bank to cut rates sooner rather than later.

On Thursday, ECB President Christine Lagarde acknowledged the potential for a reduction in June. Up to five members of the ECB Governing Council appeared to call for a rate cut at this Thursday’s meeting, according to Bloomberg.

Consensus suggests the ECB's first phase of rate cuts could lower the deposit rate by around 100 basis points from 4%.

What does it all mean for the EUR/USD?

The diverging rates scenario leaves the euro susceptible to additional weakness against the dollar, now that this year’s earlier low near the $1.07 handle has been taken out.

The next downside target could be $1.06 before we potentially see a descent towards $1.05.

EUR/USD technical analysis and trade ideas

The trend for the EUR/USD is getting more bearish now. This week saw the EUR/USD break below some key support levels, initially taking out 1.0795 and now it has broken below a pivotal area between 1.0695 to 1.0725.

Source: TradingView.com

This area had offered significant support back in December and again in February. The EUR/USD has also taken out its bullish trend line that had been in place since October.

With the 21-day exponential moving average now falling below the 200 simple moving average, this is an additional bearish signal. With price action being below these moving averages, this suggests that the path of this resistance is clearly to the downside.

Consequently, I’m expecting that EUR/USD is likely to drop to the 1.06 handle initially ahead of 1.05, and possibly even test the October low at 1.0448 after that. On the upside, resistance now comes in at that broken area of support I mentioned between the 1.0695 and 1.0725 area.

Should we get past there, the next line of resistance or potential resistance comes in at around 1.0795 followed by 1.0835. These were previous support levels as mentioned.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky therefore, any investment decision and the associated risk remains with the investor.