- EUR/USD has risen due to escalating US-China trade tensions, despite markets anticipating an ECB rate cut in April.

- China has announced tariffs on US goods in response to US tariffs, increasing fears of further trade war escalation, Euro becomes a beneficiary.

- Technically, EUR/USD is testing resistance at the 1.1100 hurdle and approaching overbought levels, suggesting a retracement may be on its way.

EUR/USD has been on a good run this week and jumped this morning as tensions between the US and China escalated. The latest escalation has left the US Dollar and, in particular, the US Dollar Index on the back foot.

The DXY is testing last week's lows at the time of writing, and this has helped EUR/USD rise despite markets pricing an ECB rate cut in April.

US Dollar Index Daily Chart, April 9, 2025

Source: TradingView

The performance of the Euro has surprised me, to say the least. This morning, we saw traders fully price ECB rate cuts in April for the first time. This was followed by Morgan Stanley (NYSE:MS) lowering the Euro area's 2025 GDP forecast to 0.8% vs the prior forecast of 1.0% while also saying that they expect the ECB benchmark rate to reach 1.5% in December 2025 vs the prior forecast of June 2026.

This was further echoed by a Reuters report, which stated that the European Central Bank (ECB) now expects Trump’s tariffs to hurt the Eurozone's growth more than was first thought. Sources say the earlier estimate of a 0.5 percentage point impact is too low, with one suggesting it could exceed 1 percentage point.

These are supposedly dovish moves for the Euro, which under normal circumstances might have seen a market reaction. However, given the dynamics around the trade war, markets have been focusing elsewhere. We have discussed this at length of late, the trade war overshadowing economic data releases and news. This trend seems to be intact for now.

US-China Trade War Escalates

US President Donald Trump's additional tariffs on China went into effect yesterday, with China refusing to bow to President Trump's wishes. Instead, Chinese authorities through the Finance Ministry announced that it will impose additional tariffs of 84% on US goods to come into effect on April 10.

The news sent risk assets like S&P 500 tumbling this morning as fears ramped up over further escalation. China added more firms to the unreliable list as China's Premier Li chaired a symposium on the economic situation with experts and businesses.

Premier Li acknowledged that while external factors may cause pressure the Government is ready to deal with it. Premier Li also touched on expanding local demand, something he called a long-term goal.

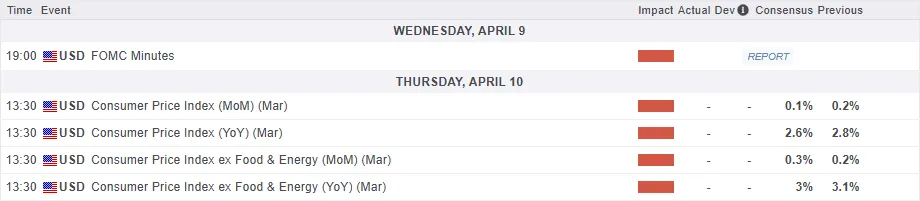

The Federal Reserve (Fed) will release the minutes from its March meeting later today. However, since this meeting happened before the tariff announcements, traders might not pay much attention to it as tariffs continue to dominate the discourse.

If this is the case, expect any further tit-for-tat between US-China to lead to potential EUR strength against the US dollar based on recent history.

Technical Analysis on EUR/USD

EUR/USD Daily Chart, April 9, 2025

Source: TradingView.com

Looking at the EUR/USD daily chart, the pair is on course for a third successive day of gains.

The pair is currently testing an area of resistance at the 1.1100 hurdle. Can the rally continue?

There is definitely scope for further upside, but I think that will require a prolonged standoff between the US and China. Any deal that may arise between the two could send EUR/USD tumbling..

As we have seen above, tariffs are having an impact on everything from growth to monetary policy at present.

Looking at the period 14-RSI and it is approaching overbought levels once more. This means that a retracement the likes of which occurred on April 3 could repeat itself.

This is definitely worth monitoring moving forward.

Key Levels to Pay Attention to

Support

- 1.1000

- 1.0948

- 1.0900

Resistance

- 1.1100

- 1.1200

- 1.1250

Most Read: {{art-200659235||Gold grinds above $3000/oz. Are bulls ready to take charge?}}