- Despite great earnings, Eni keeps trading at half the P/E multiple of its peers due to country/political risk

- Operationally, Eni is doing well but it doesn't have an edge on its competitors

- If you’re bullish on oil, there are better bets out there

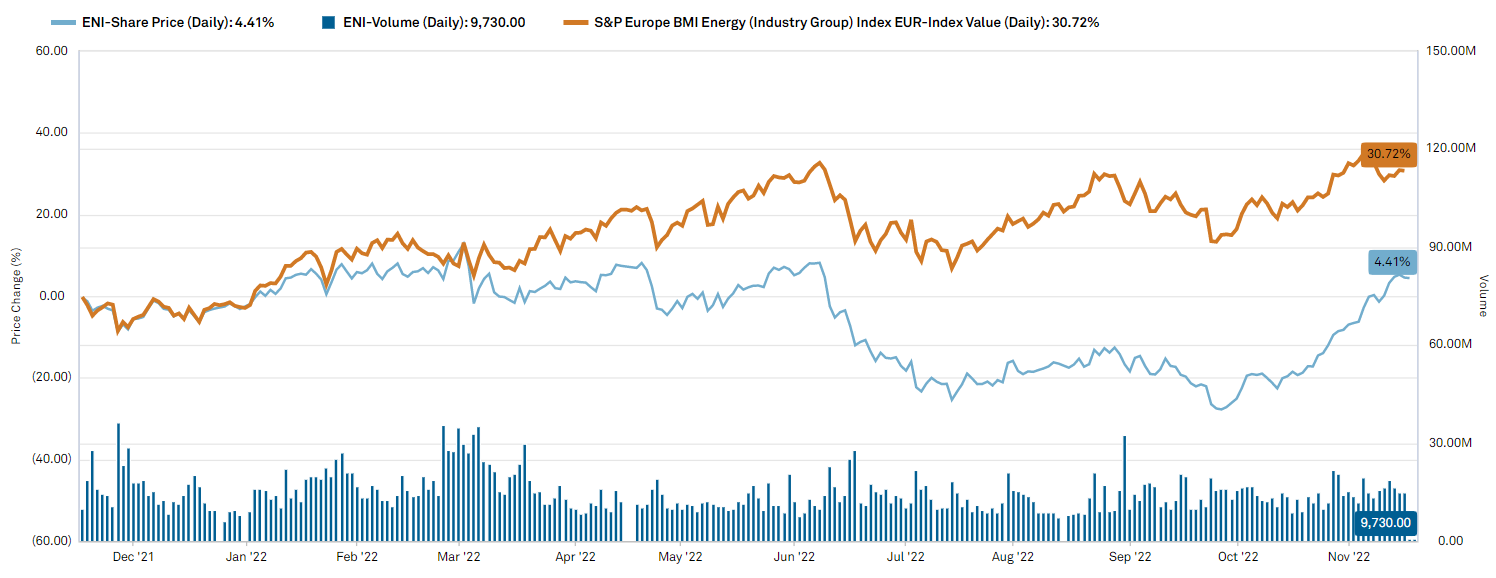

Despite strong earnings and signs that point to a promising future – such as a new dividend/buyback policy and a possible IPO of its renewable segment - Eni SpA (BIT:ENI) (NYSE:E) continues to trade at a steep discount compared to its peers. While most EU and U.K. oil giants are at ATHs, Eni is barely at pre-Covid levels. This has always been the case for Italian companies, yet the discrepancy is still worth taking a look at.

Source: CIQ

Latest Earnings

Eni is Italy’s part-state-owned oil and gas giant – with the Italian government holding 33% of shares – and is counted among the world's seven oil supermajors. On Friday, October 28th, Eni joined the other six supermajors in revealing 3Q results just shy of 2Q’s record numbers.

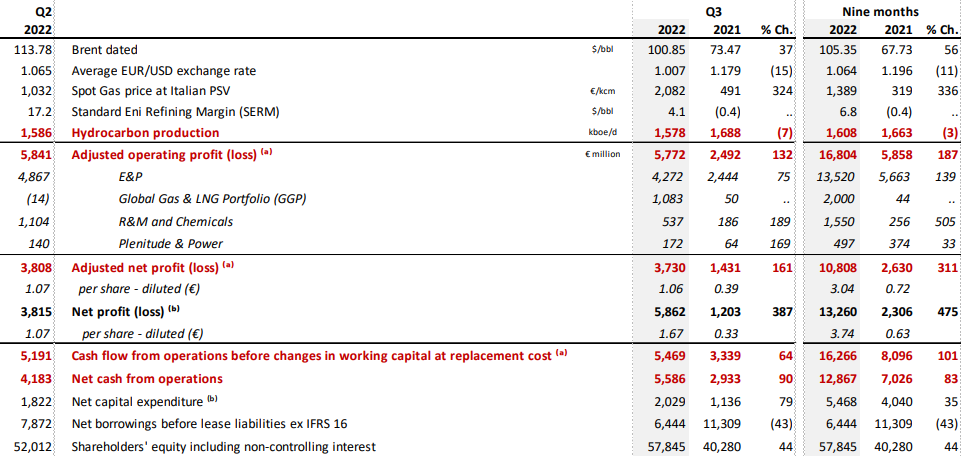

EBIT came in at €5.77b, 18% above expectations and up 132% YoY. More importantly, the number was in line with 2Q, despite the drop in oil prices. The core was strong with record results in Refining & Marketing and Global Gas & LNG. Exploration & Production maintained 2Q levels despite a slight downtick in volume, which was down 12% QoQ due to lags that have since been solved.

Surprisingly, capex guidance was met – a sign that the company can greatly increase profits while keeping capex under control. Eni also used the current circumstances to continue deleveraging its balance sheet. Thanks to a 9M reduction of €2.5b, net debt now sits at €12.7b compared to €22.8b two years ago.

As is the case with many oil and gas companies across the world, and surely in Europe, Eni will be subject to a windfall tax. The extra 25% will be charged in 2022 and is estimated to cost the company €1.4b, €560m of which has already been paid. Of course, the remaining €840m must be considered, but they shouldn’t take away from what are truly great results.

Source: Eni

New Dividend Policy

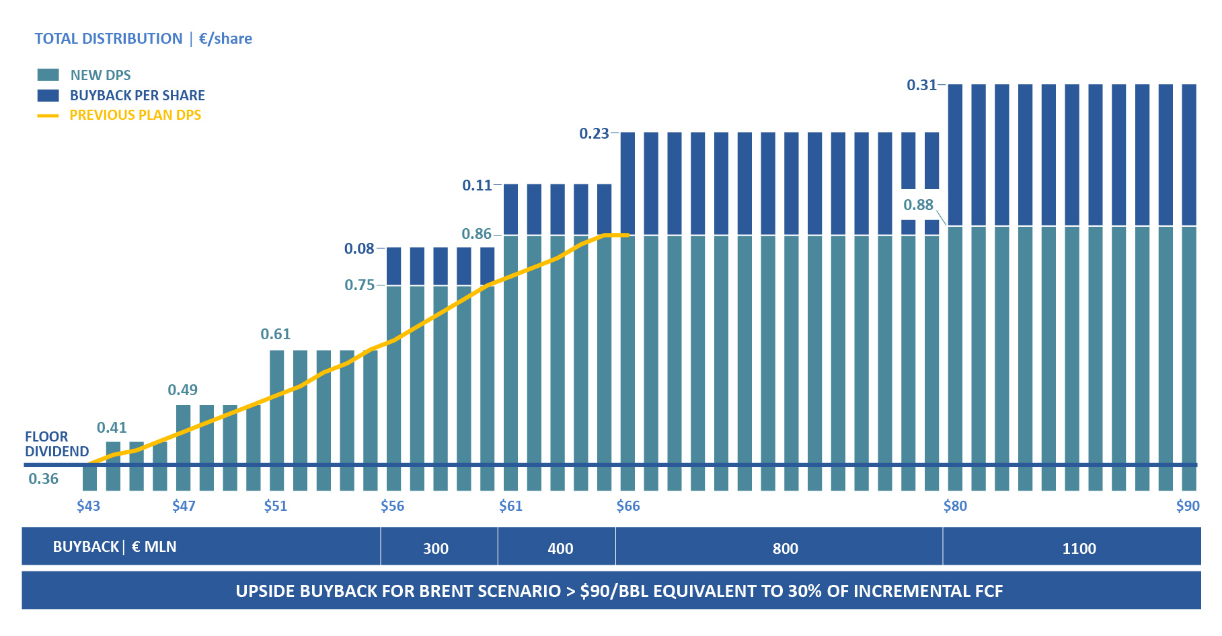

With Eni’s YTD cash flow from operations sitting at €16.4b, many of you may be wondering how (and how much) the company is going to distribute to shareholders. Eni has announced that it will be implementing a new dividend policy with a variable quarterly dividend as opposed to a semi-annual one. The policy - which is based on oil price scenarios evaluated in July and October - will allow the company greater discretion in distributing cash to shareholders, which is especially important in volatile times like these.

The new policy is also slightly more attractive than the last. While the previous dividend and buyback guidance made no distinction for a Brent >$66 scenario, the new policy continues to incrementally return cash to shareholders through buybacks. At a Brent >$90 scenario, the company would pursue buybacks equivalent to 30% of incremental FCF.

Source: Eni

With Brent at $92, we are currently under the top scenario. Eni’s annualized dividend yield is at 6.40% and its share buyback program is in full swing. The company has acquired 4.32% of the share capital for €1.82b and has another €600m to deploy. As of now Eni is estimated to return 13.2% of its market cap to shareholders through buybacks and dividends.

The updated policy is clearly a step forward for Eni and an adequate change given the times, yet is still lacking compared to peers. TotalEnergies SE (EPA:TTEF), for example, is targeting a 35-40% cash flow payout beginning in 2022.

Plenitude IPO

Through its Plenitude division, Eni has been successfully navigating the transition towards net zero and renewable energy. The division has been growing EBITDA at a 3-year 19% CAGR, achieving solid results, such as winning an EU electric vehicle charging grant spanning eight countries.

Despite the tough market, the division’s performance attracted plenty of interest for a possible IPO in June. In the end, the parent company decided to postpone, which is understandable: Eni doesn’t want to (under)sell a prized asset at a time when European utilities are being battered. The Plenitude IPO will come in due time and will be a big win for Eni shareholders.

Geographic Diversification / Business

Eni is playing an increasingly important role in helping Europe wean off its once-steady and cheap supply of Russian oil and gas. With support from the Italian government, the company has diversified its sources to try to make up for the lost supply.

Most importantly, Eni has doubled down on Algeria, joining BP (NYSE:BP) in a new venture - Azule Energy - that will increase gas supply to Italy by 4b cubic meters (a 36% increase). Eni is also the dominant player in Egypt, which it is helping become a regional hub for natural gas. Given their vicinity to Europe, the two North African gas-producing countries are set to play a big part in substituting Russia, and Eni with them.

Eni is among the best positioned to supply gas in the short term thanks to their operations in Algeria and Congo, which are set to come online by early 2023. The upcoming winter will be Europe’s greatest time of need – any supply available is sure to fetch a premium. By 2024, Eni estimates it will have replaced 100% of Russian supply, contributing to build a Mediterranean gas hub for Europe. Yet, this could be said for almost all oil and gas giants operating in Europe. TotalEnergies made similar predictions, as I wrote a few weeks ago. Eni may hold an advantage over the short term but that is set to fade as the industry adapts to the new norm.

Conclusion

Trading at a clear discount to its peers, Eni’s valuation clearly reflects the significant country risk posed by Italy. The Italian government holds a 1/3 stake in the company, reserving it the right to name directors in a process which often puts politics above the shareholder. The question is whether this country/political risk justifies a P/LTM EPS multiple as low as 3.1x while comps like Total and Shell (LON:RDSa) trade at ∼5.6x. I think it does.

On an operational level, the company is doing well: it can keep EBIT up despite lower spot prices, pay off its debt responsibly, and watch its spending. The new dividend policy is surely advantageous for shareholders. The Plenitude division is another source of value soon to be unlocked, and Eni is also poised to develop the Mediterranean into an LNG hub to serve Europe. While all of these factors are pluses, there isn’t enough to tell me that Eni is doing more than Total, or BP, or Shell. With Brent sitting at $92 a barrel all the oil companies are doing as well if not better. Eni has notoriously traded at a discount, and I think it will continue to do so.

Disclosure: The author does not currently hold a position in Eni S.p.A. This article is written for informational purposes only. It does not constitute a solicitation, offer, advice, counseling, or an investment recommendation.