- Q1 earnings season unofficially kicks off on Friday

- The S&P 500 is projected to suffer its first earnings recession since 2020

- Analysts expect a -6.8% yearly profit decline and sales growth of +1.8%

Get ready for more volatility, the next major test for the stock market is upon us.

Wall Street's first-quarter earnings season unofficially begins on Friday, April 14, when notable names like JPMorgan Chase (NYSE:JPM), Citigroup (NYSE:C), Wells Fargo (NYSE:WFC), UnitedHealth (NYSE:UNH), and Delta Air Lines (NYSE:DAL) all report their latest financial results.

Investors are bracing for what may be the worst reporting season in almost three years amid the negative impact of several macroeconomic headwinds, such as rising interest rates, persistently high inflation, and slowing economic growth.

"Analysts and companies have been more pessimistic in their earnings outlooks for the first quarter compared to historical averages," wrote FactSet's John Butters in a note.

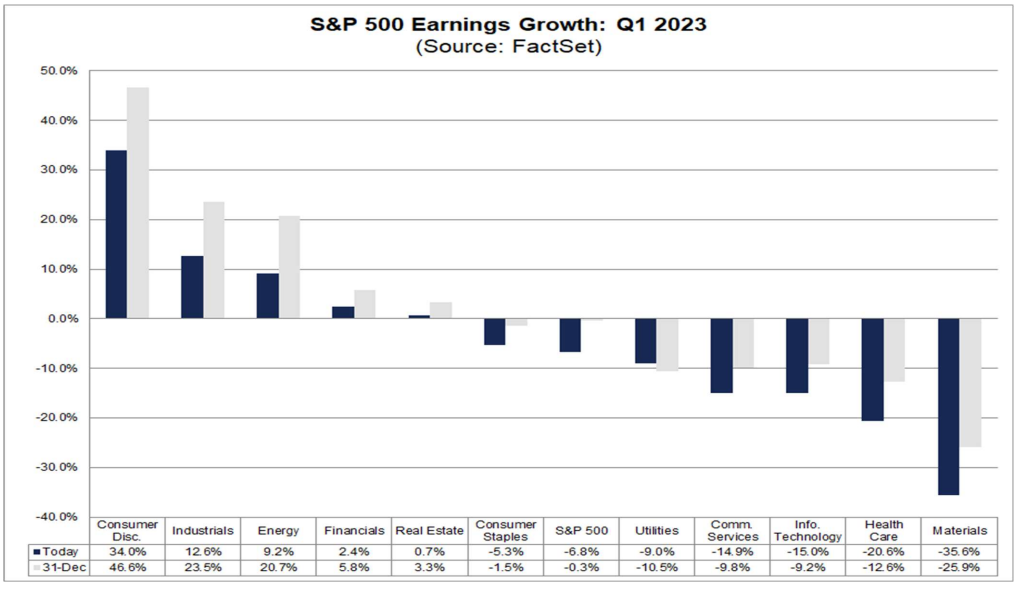

After earnings per share for the S&P 500 fell -4.6% in the fourth quarter of 2022, earnings are expected to drop -6.8% in the first quarter of 2023 when compared to the same period last year, according to data from FactSet.

If -6.8% is confirmed, that would mark the largest year-over-year earnings decline reported by the index since the second quarter of 2020.

It will also mark the second consecutive quarter in which S&P 500 earnings have declined year-over-year, meeting the technical definition of an earnings recession.

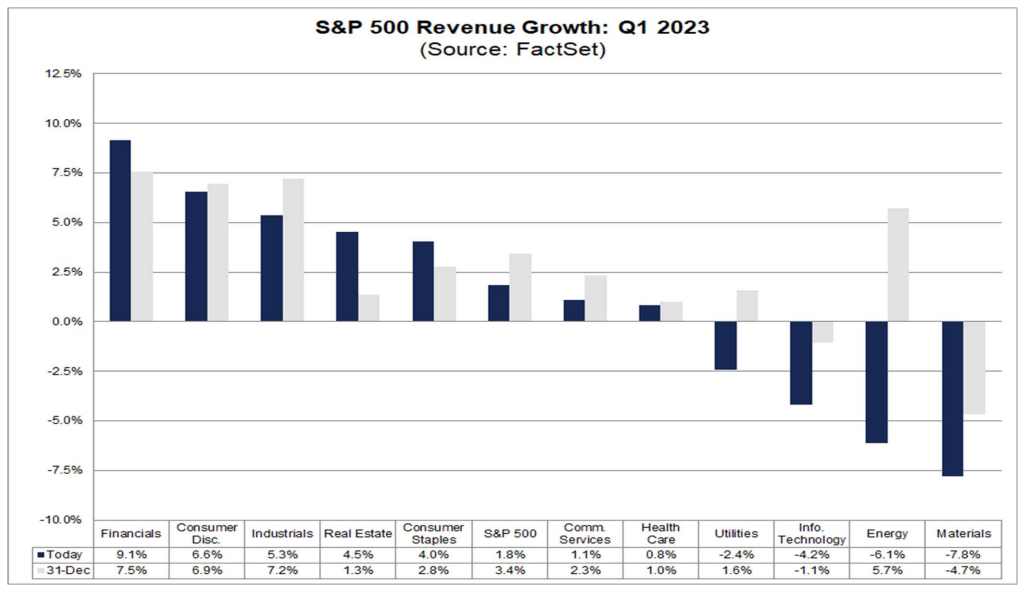

Likewise, Q1 2023 revenue expectations are also worrying, with sales growth expected to rise +1.8% from the same quarter a year earlier. If that is in fact the reality, FactSet pointed out that it would mark the lowest annualized revenue growth reported by the index since Q3 2020.

Beyond the top-and bottom-line numbers, investors will pay close attention to announcements on forward guidance for the second half of the year, given the uncertain macroeconomic outlook, which has seen recession fears mount lately.

Other key issues likely to come up will be the health of the U.S. consumer, future hiring plans, as well as lingering supply chain concerns.

My personal belief is that a higher percentage of companies will lower their outlook for earnings and sales growth for the months ahead, considering the current economic climate.

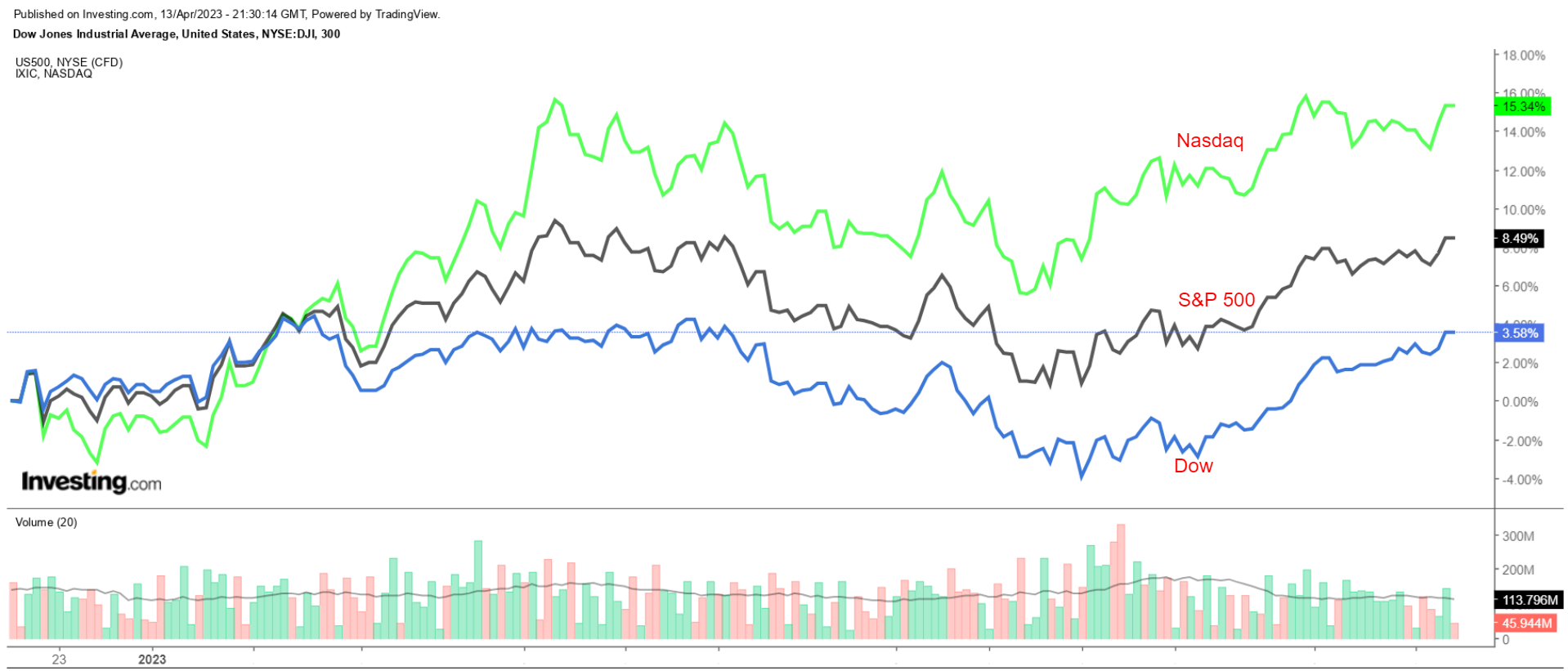

Markets are heading into the Q1 reporting season on strong footing amid growing speculation the Federal Reserve will soon end its rate-hike cycle and possibly cut rates by the end of the year in response to worsening economic conditions and signs of cooling inflation.

The tech-heavy Nasdaq has been the best performer of the three major U.S. indices by a wide margin so far in 2023, surging almost 20% as investors piled back into the battered growth stocks of yesteryear.

Meanwhile, the benchmark S&P 500 index and the blue-chip Dow Jones Industrials Average are up 8.1% and 2.7% respectively year-to-date.

Next Week: Tesla, Netflix Earnings & Housing Data

Next week is expected to be another busy one as Q1 earnings shift into high gear. Bank of America (NYSE:BAC), Goldman Sachs (NYSE:GS), Johnson & Johnson (NYSE:JNJ), and Netflix (NASDAQ:NFLX) are scheduled for Tuesday, April 18.

Tesla (NASDAQ:TSLA), IBM (NYSE:IBM), and Morgan Stanley (NYSE:MS) are due on Wednesday, April 19. Thursday, April 20 sees American Express (NYSE:AXP), and AT&T (NYSE:T) report results.

Procter & Gamble (NYSE:PG) then closes out the week, with its Q1 numbers slated for Friday, April 21.

You can take a deep dive into all those companies' earnings data and expectations on InvestingPro.

In addition to earnings, economic reports, due to pouring in, include the April NY Fed manufacturing index on Monday, and March housing starts on Tuesday.

The April Philly Fed manufacturing index and March existing home sales figures are both set for release on Thursday, while the latest manufacturing and services sector PMI prints are on the agenda for Friday.

The data will be key in determining the Fed’s next move at its May meeting. As of Friday morning, financial markets are pricing in a roughly 70% chance of a 25-basis point rate hike at the Fed’s May 2-3 FOMC meeting and a 30% chance of no action, according to Investing.com’s Fed Rate Monitor Tool.

***

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Technology Select Sector SPDR ETF (XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.