Inflation appears to be rolling over and markets are starting to consider the possibility that the Federal Reserve’s hawkish monetary policy will soon start to ease. But the critical question of how quickly inflation pressure softens leaves more than a trivial amount of uncertainty to ponder.

The best-case scenario: pricing pressure will retreat sharply from recent highs. No one can discount that possibility, but it’s still premature to assume that upcoming inflation reports will reflect a robust retreat.

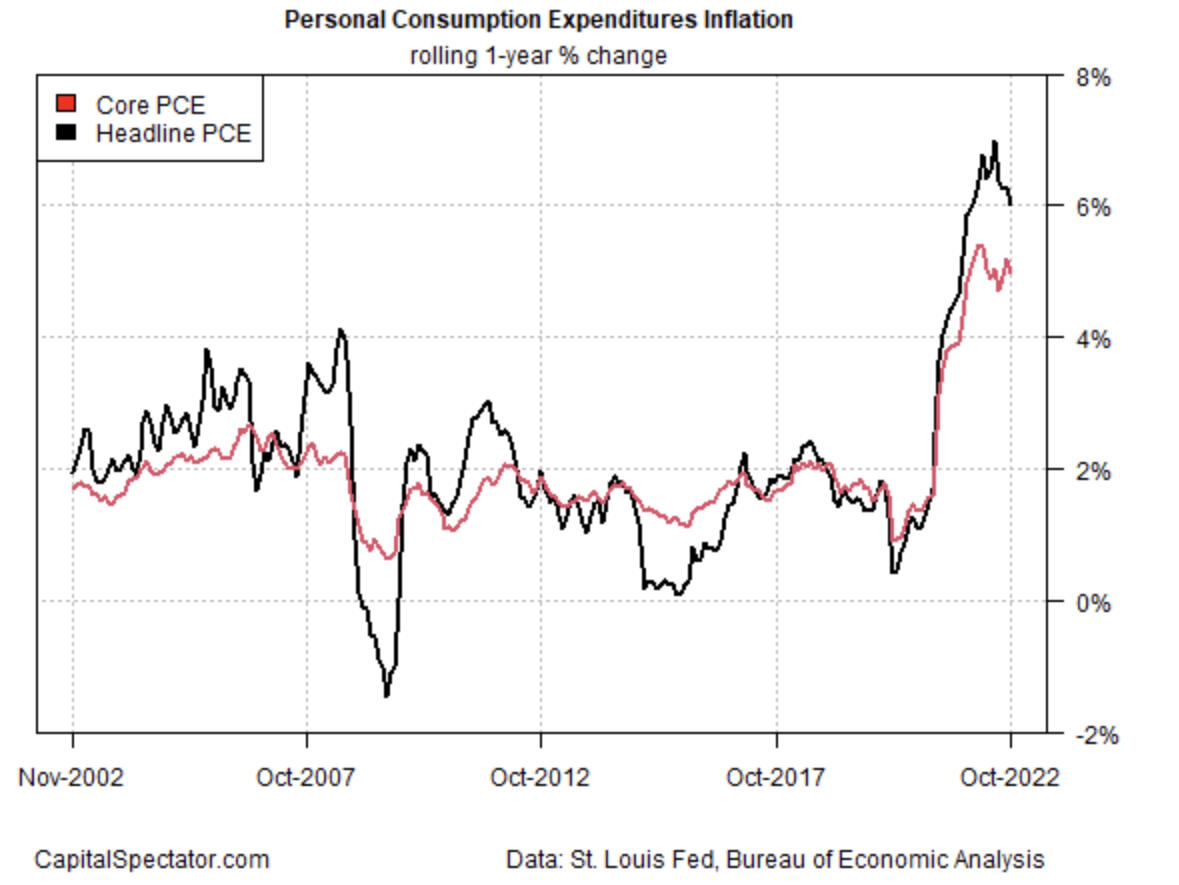

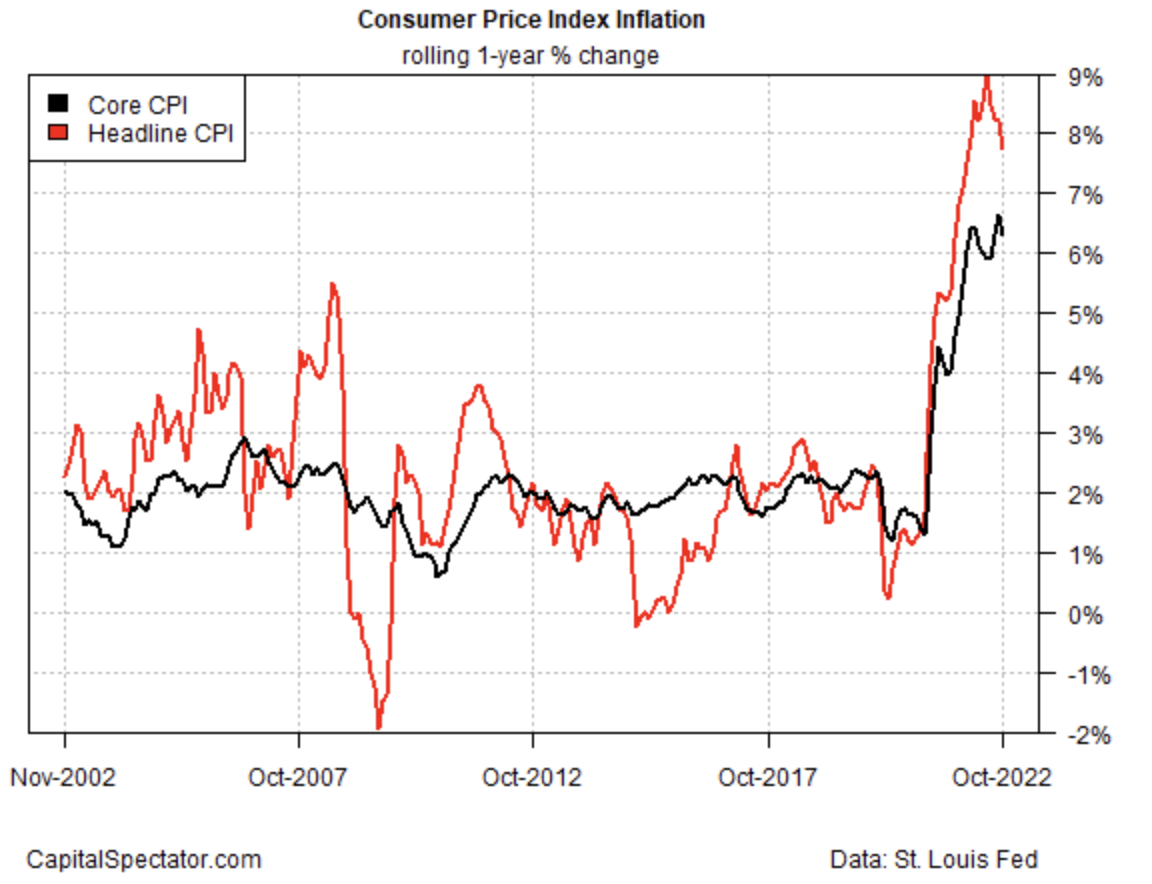

For perspective, U.S. consumer inflation still remains far above the Fed’s 2% target on a year-over-year basis through October. Although the trend has retreated modestly, core PCE inflation—the Fed’s preferred measure of pricing pressure—still looks sticky at the roughly 5% level.

The main mystery: What would it take to convince the Fed to pause rate hikes? The next question: What degree of “good” inflation news is required to trigger rate cuts? There’s no shortage of speculation and modeling, but the bottom line is that the path ahead remains highly uncertain. At some point rate hikes will end. But the elephant in the room that should keep investors humble: the Fed’s credibility is on the line to a degree last seen in the late-1970s and 1980s.

In the previous threat to central bank credibility the challenge was met and the Fed’s reputation emerged intact and strengthened. Paul Volcker, in short, broke inflation’s back. The Fed needs a repeat performance and will probably do whatever it takes to ensure that outcome. Let’s be clear: nothing less than a distinct win over inflation is the game-plan. If the Fed is to emerge from this challenge with its reputation intact, it knows it can’t settle for half measures that leave markets debating about whether inflation has truly been tamed. Given the blunt efficacy and lags with monetary policy that implies erring on the side of caution by tightening more than is necessary, perhaps much more.

What might indicate the all-clear signal for the Fed? Core PCE inflation that holds below 4% for several months is a rough guesstimate. How quickly will those numbers arrive? No one really knows, including the Fed. For guidance, we can use the Fed’s projections: in September the central bank forecast that core PCE will be 4.5% for 2022 and fall to 3.1% next year and then 2.3% in 2024. Let’s use that as a best-case scenario. Plausible, but still open for debate.

The next major inflation report arrives next week with the release of consumer prices for November (Dec. 13). The critical datapoint to watch: core CPI, which continued rising at a 6%-plus level in October vs. the year-earlier level.

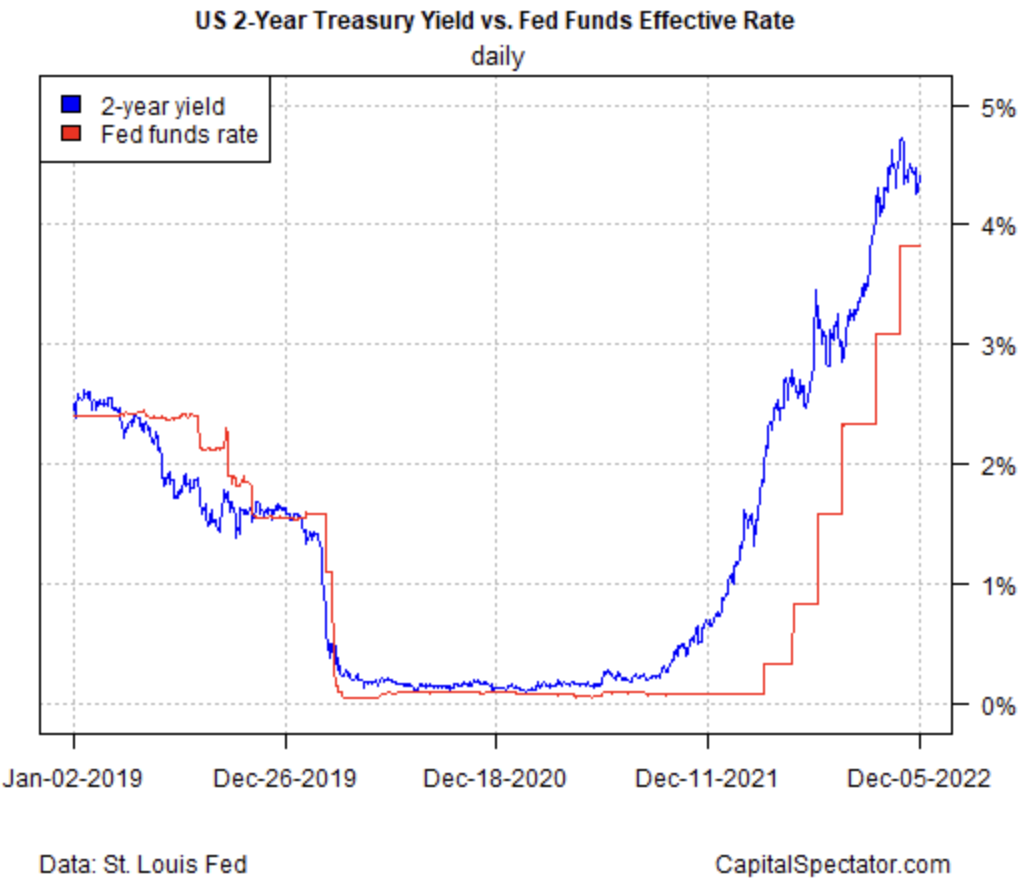

Meanwhile, Fed funds futures continue to price in a high probability (77%) of a downshift in the rate hikes with a 50-basis-points increase at the next FOMC meeting on Dec. 14. By contrast, the prospect for a rate cut is nowhere on the near-term horizon.

Jefferies economist Aneta Markowska predicts:

“I don’t think the Fed will be comfortable cutting rates until unemployment gets close to 5%, or inflation declines south of 3%. Those conditions are unlikely to be met until 2024.”

The Treasury market, however, seems to be considering the possibility that a pause in rate hikes is near, perhaps after the expected hike on Dec. 14. The policy-sensitive 2-year yield—a proxy for predicting the Fed funds target rate—has been in a trading range recently, which implies that putting rate hikes on hold is near.

It’s reasonable to assume that economic headwinds will continue to strengthen as the effects of rate hikes take an increasing toll. In fact, there are signs that a mild recession for the US has already started, as I discussed yesterday. As a result, inflation could decelerate rapidly in the months ahead.

What’s clear, however, is that the Fed can’t afford anything less than a clear win over inflation. The challenge is deciding how soon such a win is possible and how big the price tag for victory.

A best-case scenario may be brewing… unless it’s not. Put former Treasury Secretary Larry Summers in the “not” camp. He told Bloomberg on Friday:

“I suspect [Fed policy makers are] going to need more increases in interest rates than the market is now judging or than they are now saying. My sense is that inflation is going to be a little more sustained than what people are looking for.”

If so, credibility risk will remain front and center in the months ahead.