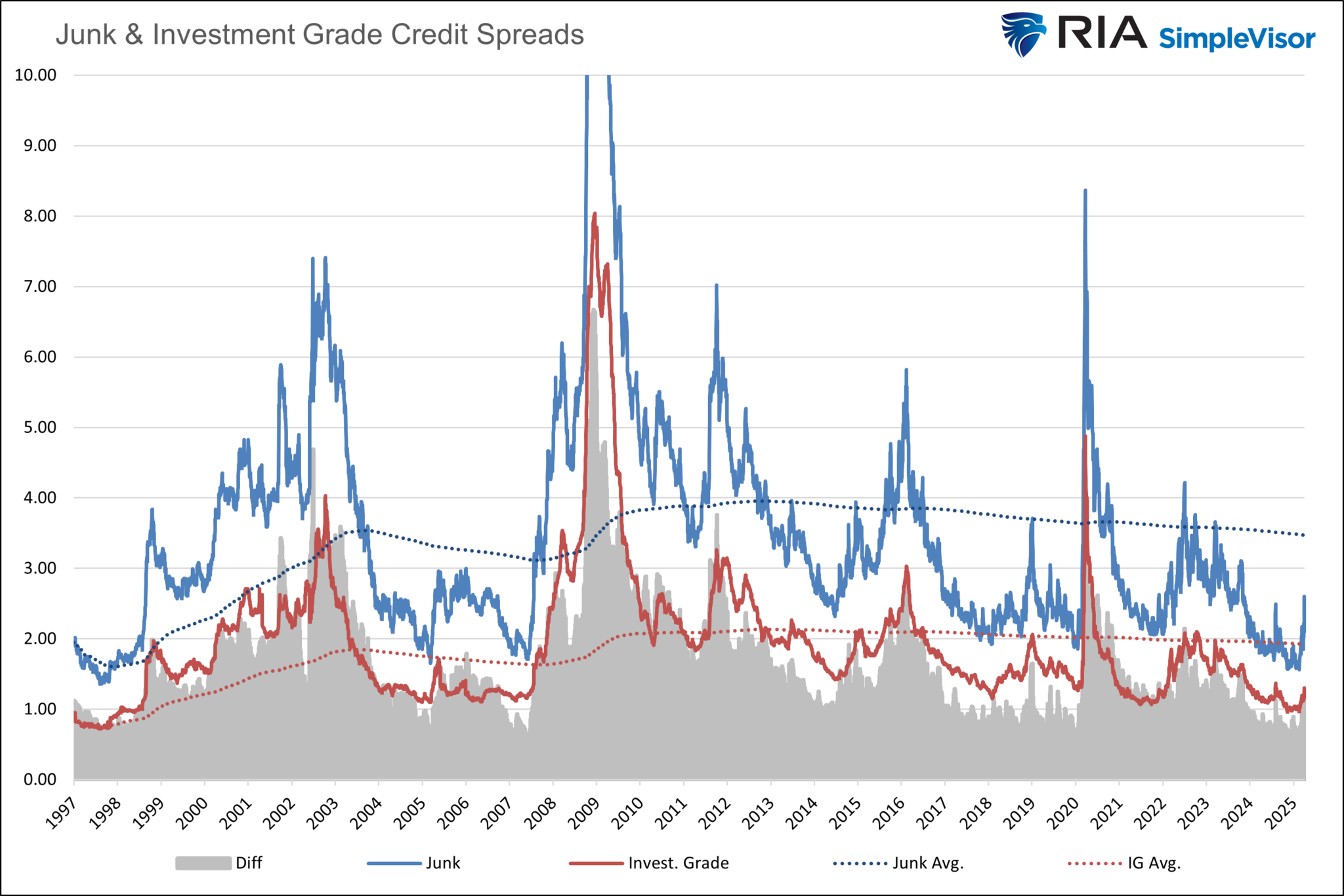

That is the billion-dollar question investors now face. One gauge to help us answer the question is corporate bond yield spreads. When the yield differential between corporate bond yields and risk-free Treasury bonds widens significantly, it signals that bond investors are taking a risk-averse stance. Simply, they are pricing higher odds of corporate defaults, typical when economic growth slows, especially during recessionary periods.

With that, let’s get an update on what corporate yield spreads tell us today. The graph below charts investment grade (BBB) and junk (BB) yield spreads over the last 25+ years. As shown, junk spreads have risen by over 1% since the start of the year, while investment grade is only up by about .30%. The widening spread between the two is a potential sign of market stress.

However, the difference (.70%) is still minor on a relative basis. Both yield spreads and the differential are well below their historical averages. While that is good news, remember that corporate yield spreads can move quickly.

So, yes, corporate bond yield spreads can predict recessions to an extent, but they’re not infallible. They’re one piece of the puzzle—reliable in hindsight but cloudy in real time. To get a fuller picture, we look at many gauges, such as consumer sentiment, employment, corporate earnings, the Treasury yield curve, and broad domestic and global economic trends.

What To Watch Today

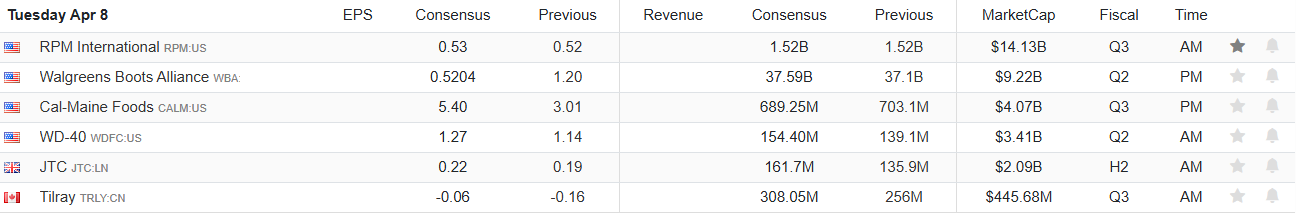

Earnings

Economy

Market Trading Update

Yesterday, we discussed how the market’s technical oversold condition sets it up for a decent rally. Read yesterday’s blog post, “Hope In The Fear,” which details why we believe this is true. When markets are deeply oversold, and the sentiment is extremely bearish, it only requires something positive to send buyers rushing into the market.

We saw a good example of that yesterday, as a fake news headline that the Trump administration was considering a 90-day pause in tariffs sent markets higher by 5% within minutes. Even once the headline narrative was debunked, markets held near breakeven for the rest of the day. I suspect markets are still hoping for some good news soon.

For the day, the markets held recent support levels at the rising trend line from the October 2022 lows. Furthermore, as highlighted, markets reached more extreme oversold conditions yesterday than during the 2022 decline. While we do not expect the market to rush back to new highs.

However, we are likely due for a reflexive rally to sell into, raise cash, and rebalance exposures. Again, as noted, all it will take is some positive news flow from the Administration, which is more likely than not at this juncture. However, nothing is guaranteed, and the administration, at least for now, remains staunchly committed to the tariff structure despite its evident negative impact on the market.

This will likely translate to slower economic growth and further contraction of consumer confidence. Of course, if that happens, we will not be surprised to see the Federal Reserve start cutting rates as soon as its May meeting.

The potential for a reflex rally has increased, with the market pushing well into a negative three-standard deviation decline from its weekly moving average. As we noted in yesterday’s blog:

“Our primary focus on this process will be:”

- Reduce current positions by 1/4 to 1/2 of their current target weights.

- Increase cash levels

- Raise stop loss levels on long-term positions.

- Sell positions that have technically violated previous support levels or exceeded risk tolerances.

- Add to positions that are positioned to benefit from further market stress.

“Following those actions, we will continue to monitor and adjust the portfolio accordingly. At some point, the valuation reversion will be complete, allowing us to reconfigure portfolio allocations for a more bullish environment.”

Stay tuned. More volatility is ahead.

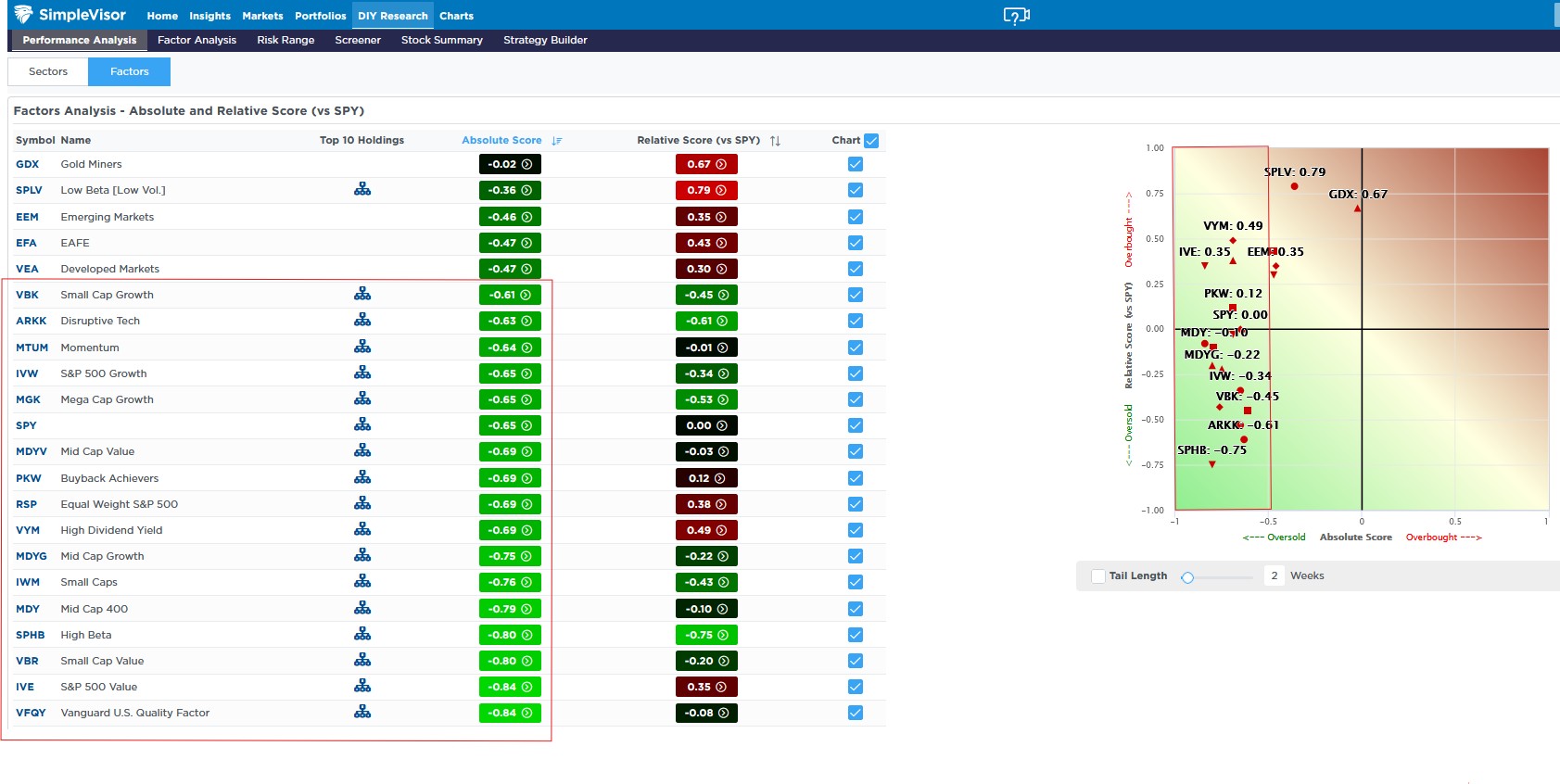

Absolutely Oversold

While the market has sectors and factors that are outperforming relative to the market, almost all are grossly oversold on an absolute basis, per the SimpleVisor analysis below. As we highlight with red boxes below, nearly all stock factors have an absolute score below -.50. Moreover, the quality stocks that were leading the way are now the most oversold.

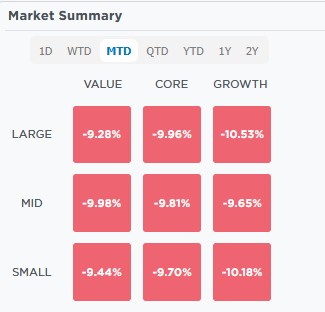

For example, IVE outperformed the S&P 500 and large-cap growth earlier last month. Since then, they have caught down to the broader markets. The second graphic shows that, thus far, there is little difference between the size and quality factors post tariff announcement. Goldminers (GDX) are the only stock factor that hasn’t been washed out.

The third graphic shows that the S&P 500 sectors are also performing poorly on an absolute basis. Consumer staples (XLP) are the best performers, as shown by their absolute score of -.15. Every other sector is at -.50 or below. We suspect that when the market bounces, staples will likely underperform. However, until then, staples appear to be the market safety sector of choice.