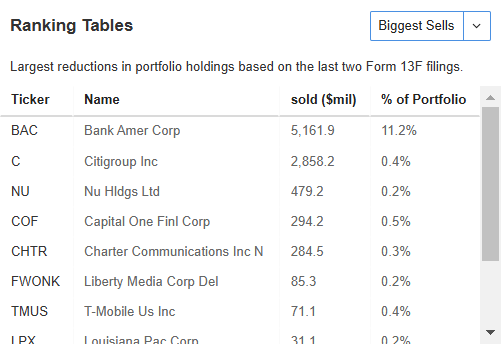

- Warren Buffett sold large shares of Bank of America and Citigroup, increasing his already large cash pile.

- Among his additions, Constellation Brands has a strong position in the beer market but faces challenges such as potential tariffs and increased competition.

- Despite mixed analyst opinions, Constellation Brands is considered undervalued, and Buffett's investment has led to a pre-market price boost.

- Get the AI-powered list of stock picks that smashed the S&P 500 in 2024 for half price as part of our FLASH SALE.

The latest 13F update shows that legendary investor Warren Buffett continued to reduce stock exposure in Q4, even as the market made a succession of new all-time highs. Specifically, the dumping was focused on:

- Bank of America Corp (NYSE:BAC): Sold 117,449,720 shares (-14.72%), with a -1.75% impact on the portfolio

- Citigroup Inc (NYSE:C): Sold 40,605,295 shares (-73.5%), with a -0.96% impact on the portfolio

Additionally, the Oracle of Omaha has completely exited his positions in the SPDR S&P 500 (NYSE:SPY) and the Vanguard S&P 500 ETF (NYSE:VOO). While not significant in terms of quantity, this move is symbolically important.

Source: InvestingPro

*InvestingPro users can check out all the stocks within Buffett's Portfolio by CLICKING HERE in the ideas section of InvestingPro.

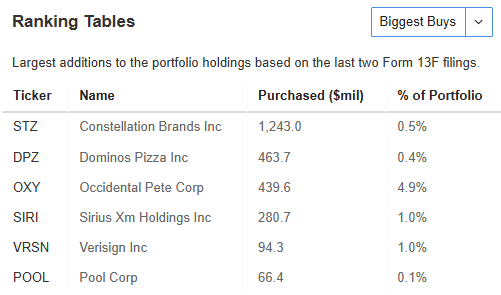

While many are highlighting Buffett's risk aversion at this particular time, it might be worthwhile to also examine his investments. This could provide insight into where the quintessential value investor perceives opportunities in an uncertain environment.

Where is Buffett Betting on?

In particular, major new investments include increased holdings in:

- Domino's Pizza (NYSE:DPZ): 1,104,744 shares purchased (+86.49%), impacting the portfolio by 0.17%

- Occidental Petroleum Corporation (NYSE:OXY): 8,896,890 shares purchased (+3.49%), impacting the portfolio by 0.16%

Buffett's New entry

But the most important new investment made by Berkshire Hathaway (NYSE:BRKa) is Constellation Brands (NYSE:STZ). Buffett acquired 5,624,324 shares, making this position account for 0.5% of the portfolio, with a total value of $1.24 billion.

Buffett's Biggest Buy.

*InvestingPro users can check out all the stocks within Buffett's Portfolio by CLICKING HERE in the ideas section of InvestingPro.

Overview of Constellation Brands

Constellation Brands, a leading alcoholic beverage company, dominates the U.S. imported beer market with its portfolio of premium Mexican beer brands, while also maintaining a presence in the wine and spirits segment.

Strong Dividend Growth

Over the past decade, the company has demonstrated robust growth in its beer division, with flagship brands like Modelo Especial and Pacifico showing significant gains. This success, along with a strategic focus on premiumization, has been supported by healthy free cash flow, projected at $1.6 to $1.8 billion for fiscal 2025. This financial strength has enabled a consistent increase in dividends at a 13.5% growth rate.

Facing Challenges: Tariffs and Health Studies

Despite its strengths, Constellation Brands is dealing with challenges, including the potential impact of tariffs on Mexican imports proposed by U.S. President Donald Trump. Analysts warn that a 25% tariff could significantly impact earnings per share for fiscal year 2026.

The company also faces increased competition in the Mexican imported beer sector and broader industry challenges, such as regulatory risks highlighted by recent Surgeon General reports linking alcohol consumption to cancer cases.

A Disappointing Quarter

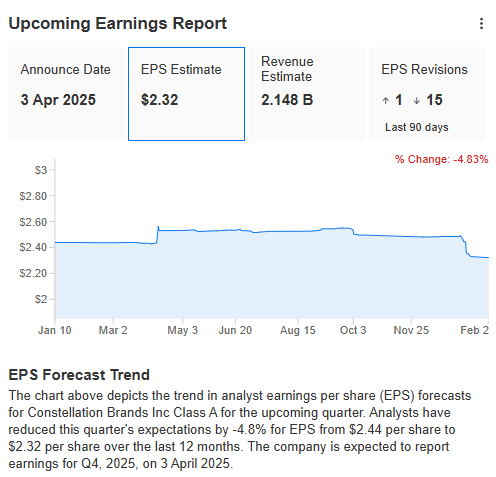

These challenges impacted Constellation Brands' latest quarterly results, where the company reported an EPS of $3.25, which fell short of the consensus estimate of $3.31. As a result, the company has revised its guidance for fiscal year 2025 downward, now expecting EPS to be in the range of $13.40 to $13.80, compared to the previous forecast of $13.60 to $13.80.

Source: InvestingPro

As a result, sentiment on the stock has worsened recently.

The chart above illustrates the trend of analyst forecasts for Constellation Brands' earnings per share (EPS) for the upcoming quarter. Over the past 12 months, experts have reduced expectations for this quarter's EPS by 4.8%, decreasing from $2.44 per share to $2.32 per share. The company is expected to report earnings by April 3, 2025, for Q4.

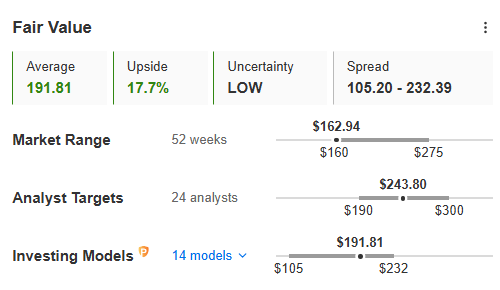

However, brokers are generally divided on the stock's outlook. Some, like Piper Sandler, have downgraded their rating to neutral with a target price of $200. Others, such as RBC Capital Markets, maintain a more favorable stance with a buy rating and a target price of $308.

Fair Value and Target of Constellation Brands

Before markets open on February 18, 2025, an analysis of Constellation Brands shares suggests they are undervalued according to InvestingPro's Fair Value. This analysis indicates a potential upside of 17.7% from the February 17 closing price of $162.94. However, it's important to note that market conditions can change rapidly.

Data as of February 17, '25. Source: InvestingPro

The 24 analysts covering the stock are even more optimistic, setting the average target price at $243.80 per share.

Buffett's Ideas Never Get Old

Into this scenario, Buffett made a move, and as of this writing, the stock has already climbed 8.41% in U.S. pre-market trading today, reaching $176.50 per share. In summary, despite being 94 years old, the Oracle of Omaha's insights continue to hold their appeal.

* InvestingPro members can browse all the stocks in Buffett's Portfolio by CLICKING HERE in the ideas section of InvestingPro.

In addition, InvestingPro offers its member AI-driven ProPicks AI portfolios based on Warren Buffet's very best picks (DISCOVER HERE)

***

Start investing like a PRO, but be quick, our 50% flash discount expires in a few hours!

For those who have not yet signed up for InvestingPro, now is the best time to do so thanks to the incredible FLASH SALE offer!