This article was written exclusively for Investing.com

- A bullish trend in the fats

- Higher highs and higher lows in the feeders

- Explosive price action in hogs

- Feed prices are bullish for the meats

- COW is a livestock ETN product

As we head into the second quarter of 2021, some commodities enter the peak season for demand. Gasoline requirements increase as the weather improves and peaks during the summer months when vacationers put more mileage on their automobiles. After a pandemic-ridden 2020, we are likely to see explosive demand over the coming months as vaccines go into arms, people return to the workplace and take those long overdue vacations.

Another group of commodities that experience turbocharged demand during the summer months is the meats. After the snow melts and the warm winds begin to make outdoor gatherings comfortable, barbecue grills come out of storage. The barbecue is a great American tradition during the summer when the aroma of grilled steaks, burgers, hot dogs, ribs, and chicken fills the air. The annual grilling season begins with the Memorial Day weekend holiday in late May and runs through Labor Day in early September. In 2020, the grilling season was a bust because of social distancing guidelines. Many people will look to make up for the lost season in 2021.

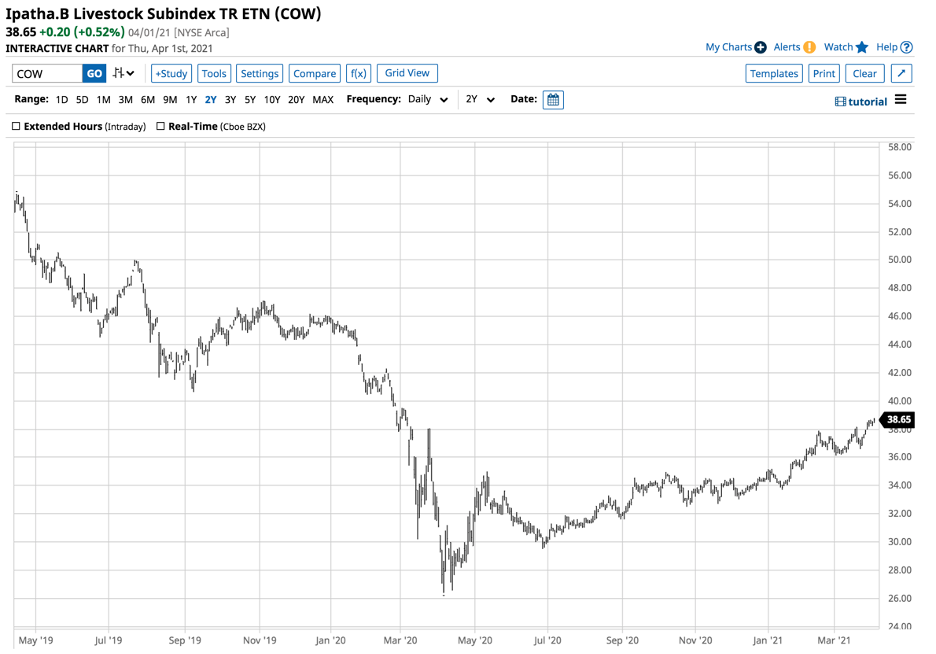

Cattle and hog prices are already looking towards the peak season as the June contracts are the active months. The iPath® Series B Bloomberg Livestock Subindex Total Return (NYSE:COW) tracks meat prices.

A bullish trend in the fats

In the world of cattle ranching, the “fats” are the cattle that are the live cattle that trade on the Chicago Mercantile Exchange. Once cattle reach their potential to gain and weigh between 1,050 and 1,500 pounds, they qualify as fed or live cattle. Live cattle futures are financially settled to the CME Feeder Cattle Index and represent the average wholesale beef prices.

Charts courtesy of CQG

As the chart highlights, the price of live cattle futures made higher lows and higher highs since Oct. 26, 2020, when they reached a bottom at $1.0310 per pound. The latest high came last week as the price reached $1.2360, nearly 20% higher over the past five months.

The total number of open long and short positions moved from below 277,000 to above 337,300 contracts since late October. Rising open interest as the price of a futures market appreciates tends to be a technical validation of a bullish trend.

Higher highs and higher lows in the feeders

Feeder cattle are also financially settled futures on the CME. Feeders consist of calves weighing 600-800 pounds.

After finding a bottom at $1.27 per pound on Oct. 19, 2020, the feeders have followed the same bullish pattern as the fats. Last week, the price of the May futures contract reached a new high at $1.53475, 20.85% above the October 2020 low. Open interest in the feeders has also increased with the price, rising to the 45,775-contract level last week.

Explosive price action in the hogs

While beef prices have been trending steadily higher over the past five months, lean hog futures have exploded to the upside. The lean hog futures contract reflects the price of hog carcasses and is a benchmark for pork’s price.

The June lean hog futures price has rallied from a low of 76.925 in mid-November 2020 to its latest peak at $1.06725 on Apr. 1, a rally of 38.7%. Like in the fats and the feeders, the open interest metric moved higher as the pork price rallied. The total number of open long and short positions stood at the 287,628 level at the end of last week, the highest since early 2020.

Feed prices are bullish for the meats

2020 was a challenging year for beef and pork producers and consumers. The global pandemic caused bottlenecks in supply chains as processing plants experienced slowdowns or shutdowns. Producer price dropped to multiyear lows. The nearby live cattle or fats fell to 81.45 cents per pound in April 2020, the lowest price since 2009.

Feeder cattle reached $1.0395 per pound during the same month, the lowest price since 2010. Lean hogs dropped to 37.0 cents in April 2020, a level not seen since 2002. While producers suffered under the weight of the lowest prices in years, consumers did not benefit. The bottlenecks caused retail beef and pork prices to skyrocket, and many markets rationed supplies because of shortages. The 2020 grilling season was the worst of times for animal protein producers and the carnivores they feed.

What a difference a year has made in the meat markets. While the end of the pandemic is the primary reason for higher prices, production costs have increased dramatically from last year. Soybean meal is the leading ingredient in animal feed.

The chart shows that continuous soybean meal futures fell to a low of $278.80 last April and exploded to a high of $474.10 in January. The price pullback to near the $410 level at the end of last week, which is still 46.8% higher than in April 2020. The cost of feeding animals to grow to processing weights has increased substantially over the past year. Meal prices have declined since January as another outbreak of African Swine Fever infected China’s hog population. A shortage of pork in China, the world’s leading consumer of the meat, is pushing lean hog futures higher, making it the best-performing meat futures market so far in 2021.

COW is a livestock ETN product

The 2021 barbecue season is going to be far different than last year when social distancing limited gatherings. The Memorial Day weekend, July 4, the Labor Day holiday, and the period between, could see explosive growth in meat demand on a year-on-year basis. The trend is always your best friend in markets. In cattle and hogs, they remain higher as we head towards the peak demand season for 2021.

The most direct route for a risk position in the cattle or hog markets is via the CME’s futures products. For those market participants that do not venture into the futures arena, the iPath Series B Bloomberg Subindex Total Return ETN (COW) provides an alternative. The fund summary for COW states:

COW has $27.303 million in assets under management. The ETN trades an average of 19,455 shares each day and charges a 0.45% management fee.

Source: Barchart

In April 2020, when cattle and hogs reached lows, COW bottomed at $26.40. At $38.65 at the end of last week, the ETN was 46.4% higher.

Cattle and hog prices are trending higher as we head into the 2021 peak grilling season. We are likely to see a continuation of higher lows and higher highs over the coming weeks and months.