This article was written exclusively for Investing.com

- Coinbase profits from exchange volume and asset class market cap expansion grew in 2021

- Pick and shovel play on the cryptocurrency asset class

- COIN’s listing pushed shares to an unsustainable level

- The price dropped and has been trading below its pre-issue reference price

- COIN is a buy below $250 per share

Love them or hate them, cryptocurrencies have offered market participants unprecedented returns over the past decade. However, the road to profits via the digital token asset class has been hair-raising, with wild price swings in either direction.

In 2021, Bitcoin traded within an over $40,500 range—from $28,383.16 to $68,906.48. At the $41,600 level on Jan. 10, the price was over $7,000 below the midpoint of the 2021 trading range.

The second leading cryptocurrency, Ethereum, traded in a $4,150 range, from $716.919 to $4,865.426. At the $3050 level on Jan. 10, Ethereum was still above the average of its 2021 trading range.

These incredible price swings can be a nightmare for investors, but they create a paradise of opportunities for nimble traders with their fingers on the pulse of volatile markets.

Coinbase Global (NASDAQ:COIN), the Wilmington, Delaware-based cryptocurrency exchange is the world’s leading crypto bookie. The exchange facilitates buying and selling in the leading cryptos.

COIN went public during April 2021. As of Jan. 10, 2022 the stock was trading below its initial $250 reference price after reaching a lofty level post its public debut during the first day of trading on Apr. 14, 2021. Shares closed yesterday at $225.01.

At under the $250 level, COIN could be a best bet for 2022 as the cryptocurrency asset class continues to grow.

Coinbase profits from exchange volume and asset class market cap expansion grew in 2021

According to the company's own description, Coinbase provides infrastructure and technology for the cryptoeconomy for retail users. It's also an exchange marketplace with a liquidity pool for transacting crypto assets for institutions.

As well, it provides technology and services enabling ecosystem partners to build crypto-based applications and securely accept crypto assets as payment. The company was founded in 2012, only two years after Bitcoin burst on the scene.

COIN is the premier cryptocurrency exchange, which makes it similar to the Chicago Mercantile Exchange (CME) and Intercontinental Exchange (ICE), in that they all facilitate financial transactions albeit in different markets.

The cryptocurrency asset class’s market cap grew from $767.482 billion at the end of 2020 to $2.166 trillion at the end of 2021, an over 182% increase last year. After the recent decline, the market cap was at the $1.92 trillion level on Jan. 10.

Pick and shovel play on the cryptocurrency asset class

A pick and shovel play in any market refers to a strategy wherein one invests in the underlying technology used to produce some sort of merchandise or service rather than investing in the product itself. In other words, one invests in companies that support the growth of the underlying business.

Pick and shovel companies may or may not move higher and lower with the prices of the primary asset they're involved with.

In the world of cryptocurrencies, COIN operates as a facilitator. Like the CME, ICE, and a sports bookie, COIN earns revenues on transaction volume since it takes a fee from buyers and sellers to execute trades.

While revenues are not based on prices, bull markets tend to encourage more volume as market participants are inclined to be more active when prices rise rather than fall.

COIN’s listing pushed shares to an unsustainable level

Coinbase didn't take the traditional IPO route when it went public. Rather, it listed directly on the NASDAQ.

In this way the company avoided investment banking fees and lock-up periods for early investors. The stock began trading on Apr. 14. The excitement over the asset class that took Bitcoin’s price from five cents in 2010 to nearly $70,000 per token at the 2021 high pushed COIN shares to a peak of $429.54 on its first trading day.

Like many new technology sector entrants to the stock market, COIN shares reached an unsustainable level on Apr. 14 as its market cap rose to the $100 billion level, higher than the CME or ICE (NYSE:ICE) at their respective all-time highs. The pre-listing price was $250 per share.

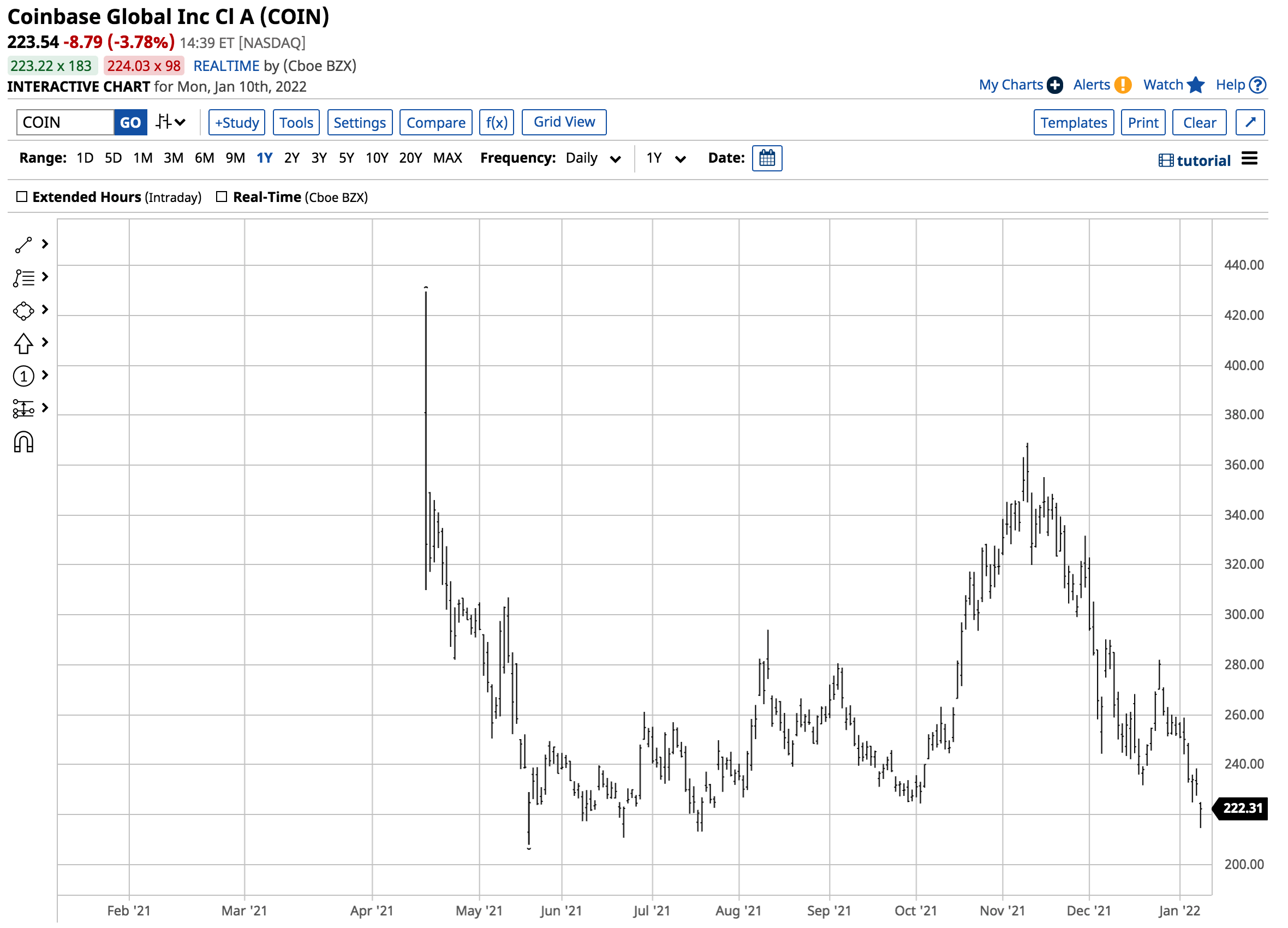

Source: Barchart

As the chart shows, COIN shares dropped like a stone from their Apr. 14 high, reaching $208 per share on May 19, 2021, a little over one month after the listing. COIN shares halved in value from the April peak to the May low.

Trading below its pre-issue reference price since May

Since May, COIN has remained within its trading range. But the price recovered to a lower high at $368.90 on Nov. 29, one day before the two top cryptos, Bitcoin and Ethereum, reached their highs.

Post Nov. 10, Bitcoin and Ethereum put in bearish key reversal patterns on their respective daily charts, leading to a pattern of lower highs and lower lows that has continued in early 2022.

Source: Barchart

The chart shows COIN was trading at below the $225 level on Jan. 10, well below the $250 pre-listing reference price. The first technical support level stands at the July 19, $213.22 low.

Below there, the May 19, $208 bottom is the critical support for the stock. COIN shares reached a low of $214.64 on Jan. 10.

COIN is a buy below $250 per share

Volatility in cryptocurrencies has been unprecedented, with prices more than doubling and halving in 2021. COIN shares have experienced the same volatility as a pick and shovel play on the asset class. Three factors point to higher prices for COIN over the coming years:

- COIN is the leading crypto exchange, so it will likely grow with the asset class.

- Cryptocurrencies are becoming more mainstream assets as a means of exchange and investment vehicles.

- COIN’s technology will allow it to take a leadership role when governments issue digital currencies over the coming years. It is only a matter of time before a digital Chinese yuan, US dollar, euro, and other currencies come to the market.

COIN shares have dropped below the reference price, which is an opportunity for investors. Coinbase provides exposure to the cryptocurrency asset class without requiring a computer wallet. Rather, it's a traditional investment in a nontraditional asset class.

I am a scale-down buyer of COIN shares below the $230 level, leaving lots of room to add on further declines. Over the past years, buying Bitcoin and Ethereum on price weakness has been optimal. COIN is likely to recover when the top cryptos find bottoms and move higher.