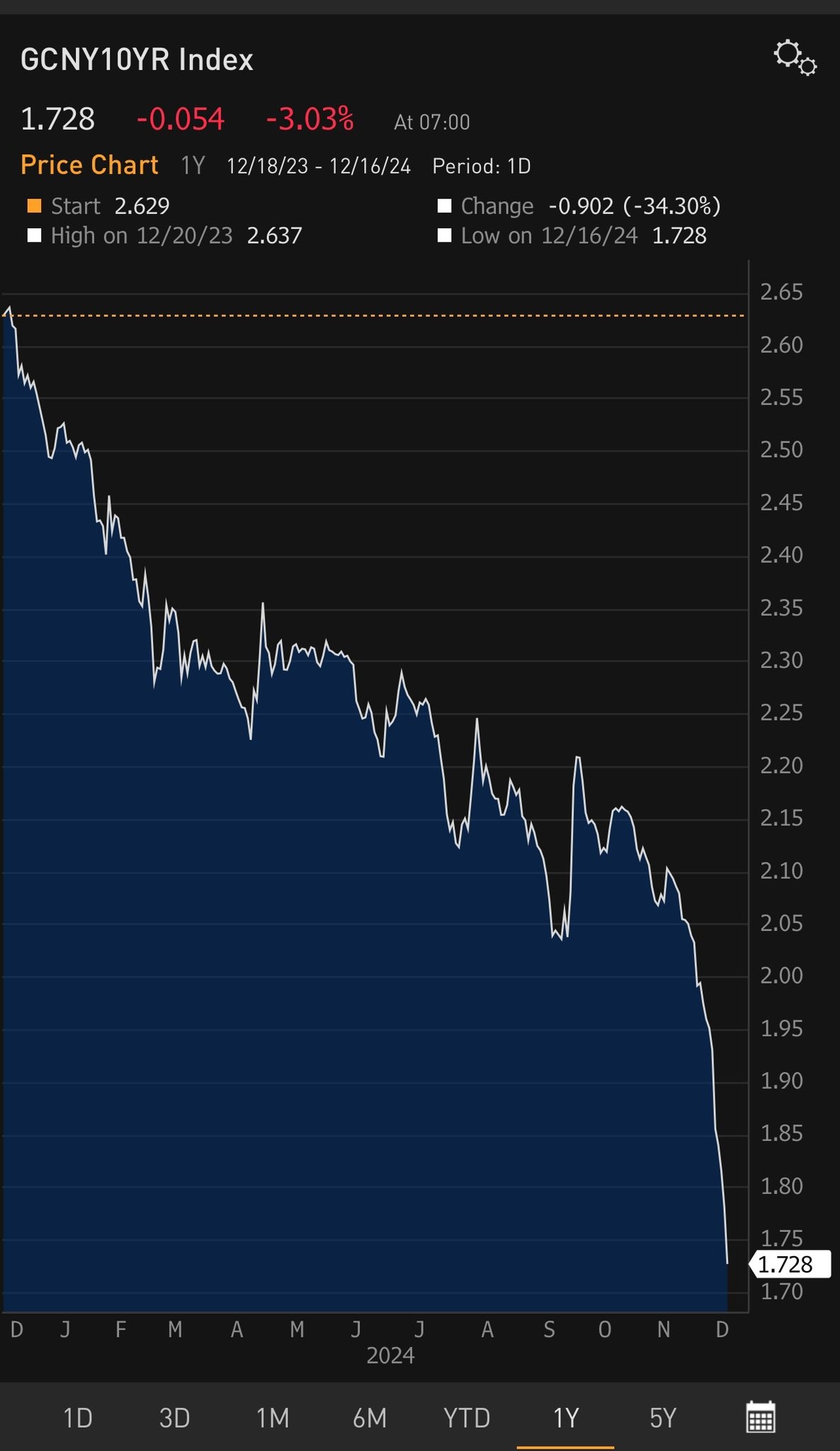

Treasury yields rose sharply following the Fed meeting on Wednesday, yet they are collapsing in the world’s second-largest economy, China. While our economy is robust, large foreign economies, including China, struggle. Our recent article Global Conditions and Commentary, highlights the strong historical relationship between the global economy and the U.S. Moreover, it summarizes the economic stagnation facing most developed nations. Looking ahead, either the U.S. economy continues to diverge from the globe or 75 years of a powerful correlation “catch down” with the U.S. economy. History and math argue caution for investors.

To add to our body of evidence regarding economic conditions outside of the U.S., we share the graph below of Chinese 10-Year government bond yields. Some of the recent decline is based on fears that Trump will impose significant tariffs on China, further reducing their exports. However, the large majority is based on rapidly weakening economic activity. Chinese investors are flocking to Chinese bonds as they represent a safe harbor in what could be an economic storm.

Like Japan thirty years ago, China grossly overbuilt its infrastructure and must deal with a resulting credit hangover and gross surplus of real estate properties. Similarly, China, like Japan, has poor demographics, further weighing on its economy. We suspect that China will continue to stimulate its economy and try to avoid a much larger problem. However, as Japan learned, massive economic and monetary stimulus isn’t always the answer. On a side note, given the large spread between China and US yields, flows from China to US bonds may likely increase.

What To Watch Today

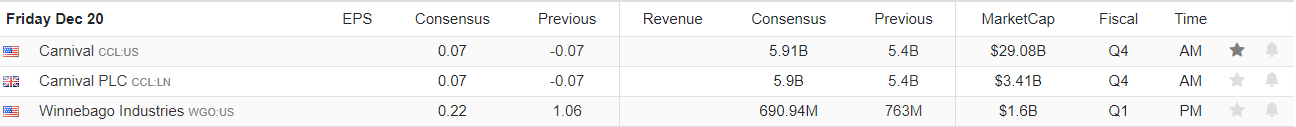

Earnings

Economy

Market Trading Update

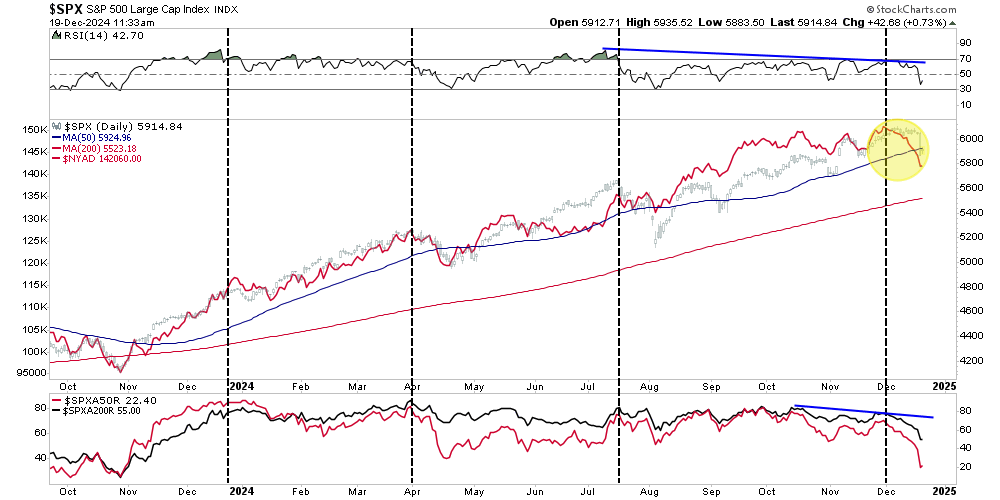

Yesterday, we discussed the impact of the Fed’s decision on the market, which resulted in the most significant one-day drop in stocks since the August “Yen Carry Trade” blow-up. However, the correction was much less about the Fed’s decision and more about the technical backdrop of the market, which has been marred by bad breadth and declining momentum over the last two weeks. We previously suggested that such dynamics eventually lead to a correction; a catalyst is needed. Yesterday, the failure of the continuing resolution to avoid a Government shutdown and the more hawkish adjustment to the Fed’s outlook provided that catalyst. We use a weekly analysis to smooth out the volatility and view the current market dynamics.

As shown, the deterioration in momentum and relative strength, combined with collapsing breadth on multi-measures, all suggested a correction was likely. However, as is always the case, the “timing” of the event is always a difficult challenge. With the markets now decently oversold and trying to hold support, there is a reasonable argument to be made that the traditional year-end rally is still likely.

However, that rally will likely fail to recover to all-time highs and fall well short of Wall Street targets of 6200 this year.

With exuberance and allocation levels still very elevated, it is unlikely that investors have become bearish overnight. I suspect that by next week, we will see a more optimistic spin on the Fed’s latest announcement, with “rate cut” hopes again rising into 2025.

If not, we run the risk that the “Fed may have stolen Christmas” this year.

The Coming Fiscal Headwind

Leading up to the election, we shared commentary from Washington insider Greg Valliere. Today, we share a paragraph of his that we think is very pertinent but grossly overlooked by the bond market.

Fiscal policy is headed for a major change — nothing will pass next year unless it cuts or freezes spending; new hikes in outlays are unlikely, and uncertainty will grip every sector — defense, technology, agriculture. etc. — that has depended on Washington spending for decades. – Greg Valliere

Generally, the markets presume that tariffs are inflationary and that Trump will follow Biden’s steps and run large deficits. History proves tariffs can be inflationary on particular products, but from a macro view, they tend to be disinflationary as they result in economic weakness.

Regarding deficits, Elon Musk, speaking on behalf of Trump, is blasting Republicans for the latest stopgap spending bill. As Greg alludes, the bond market may be way off base assuming reckless deficit spending under Trump.

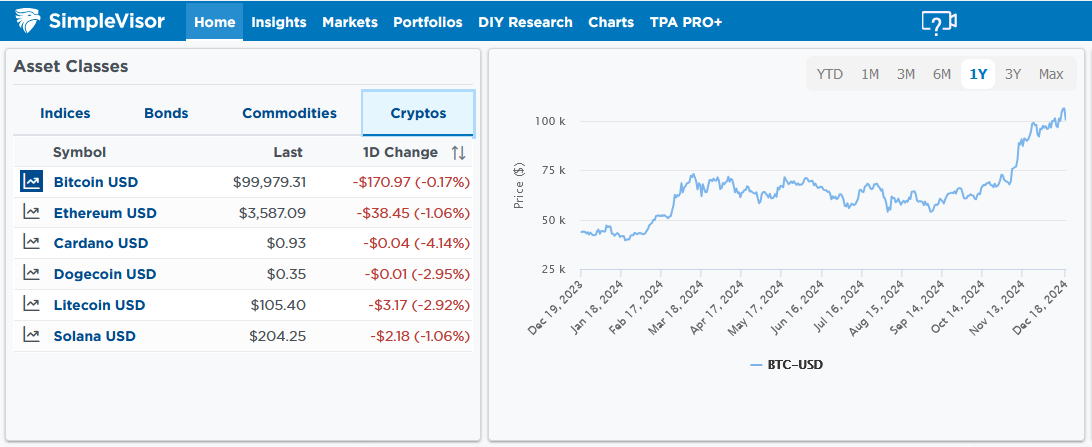

Powell On A Bitcoin Reserve

Bitcoin has rallied partly because speculators believe the U.S. will establish a Bitcoin reserve, which would likely be held at the Federal Reserve. At Wednesday’s FOMC press conference, Powell poured cold water on the reserve idea. Per his reply to a question about the reserve:

We’re not allowed to own Bitcoin. The Federal Reserve Act says what we can own, and we’re not looking for a law change. That’s the kind of thing for Congress to consider, but we are not looking for a law change at the Fed.

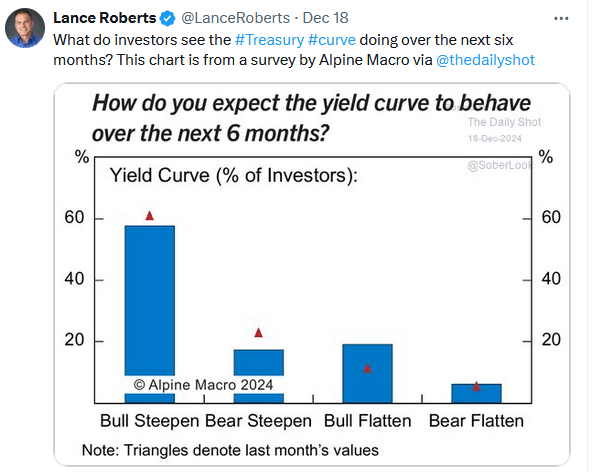

Tweet of the Day