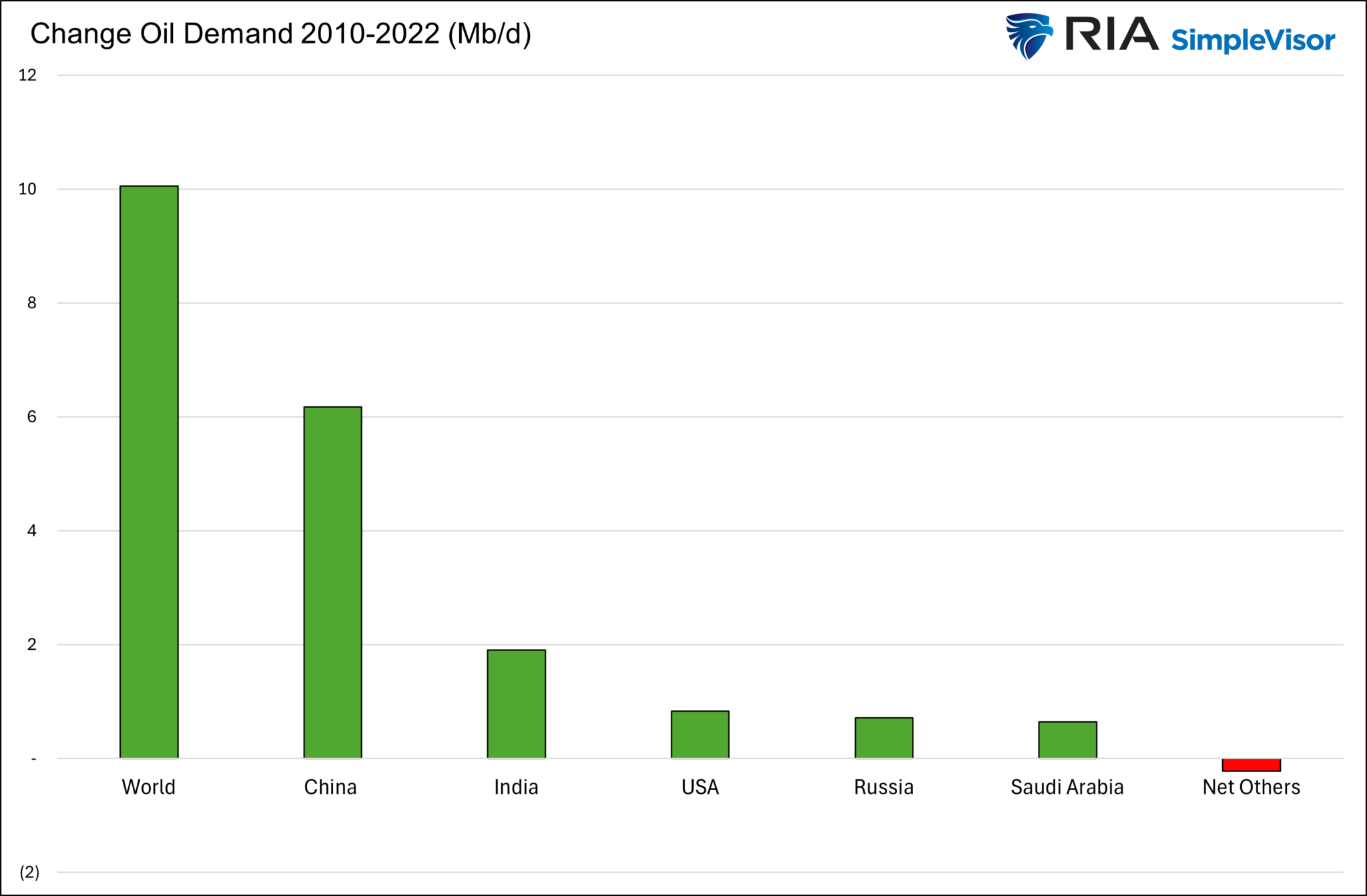

From 2010 through 2022, the US Energy Information Administration (EIA) calculates that global Oil demand grew by 10 million barrels per day (Mb/d). Over 60% of the demand growth was due to China’s phenomenal economic growth. For context, American demand increased by less than 10%. The graph below shows that China once drove global oil demand, but that is no longer true.

Given the impact oil prices have on inflation, this is an essential macroeconomic factor to consider over the next five to ten years. Furthermore, a report by China’s national oil company, China National Petroleum Corporation, says China’s demand for oil could peak next year—five years before they had expected it to plateau. The EIA expects a similar peak, with demand from China only growing by 300,000 barrels per day next year.

The reason for their diminished demand growth is twofold. First, China has embraced alternative energy sources. Second, and more impactful, China’s economy is maturing. Accordingly, its high economic growth rates, which are not sustainable, are fading. As China’s economic growth simmers at 5% or below and its use of alternative energy sources increases, the driver of oil demand will no longer play that role. If production continues to rise, the price of oil could be under continued pressure in the years ahead.

What To Watch Today

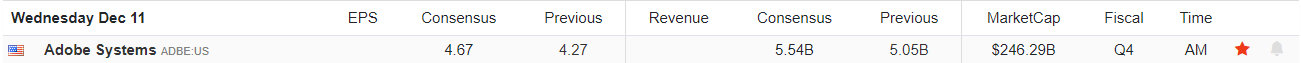

Earnings

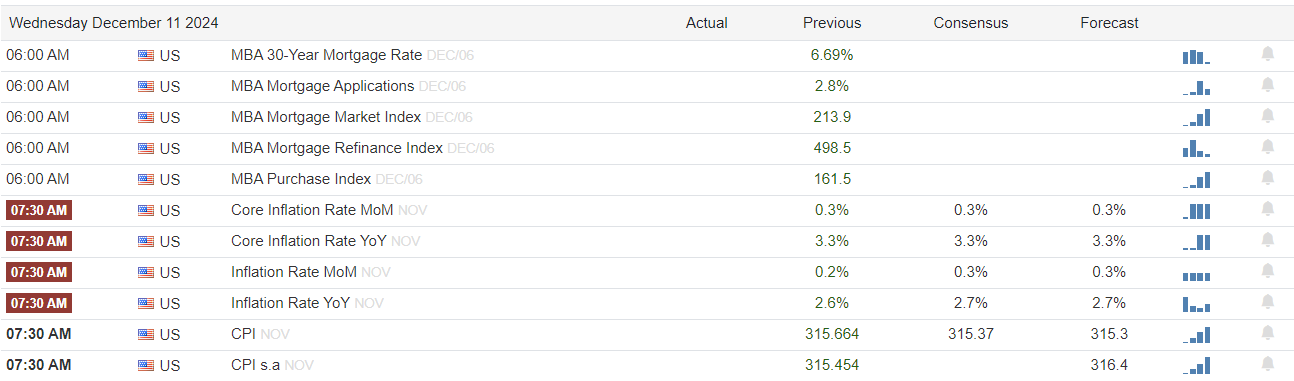

Economy

Market Trading Update

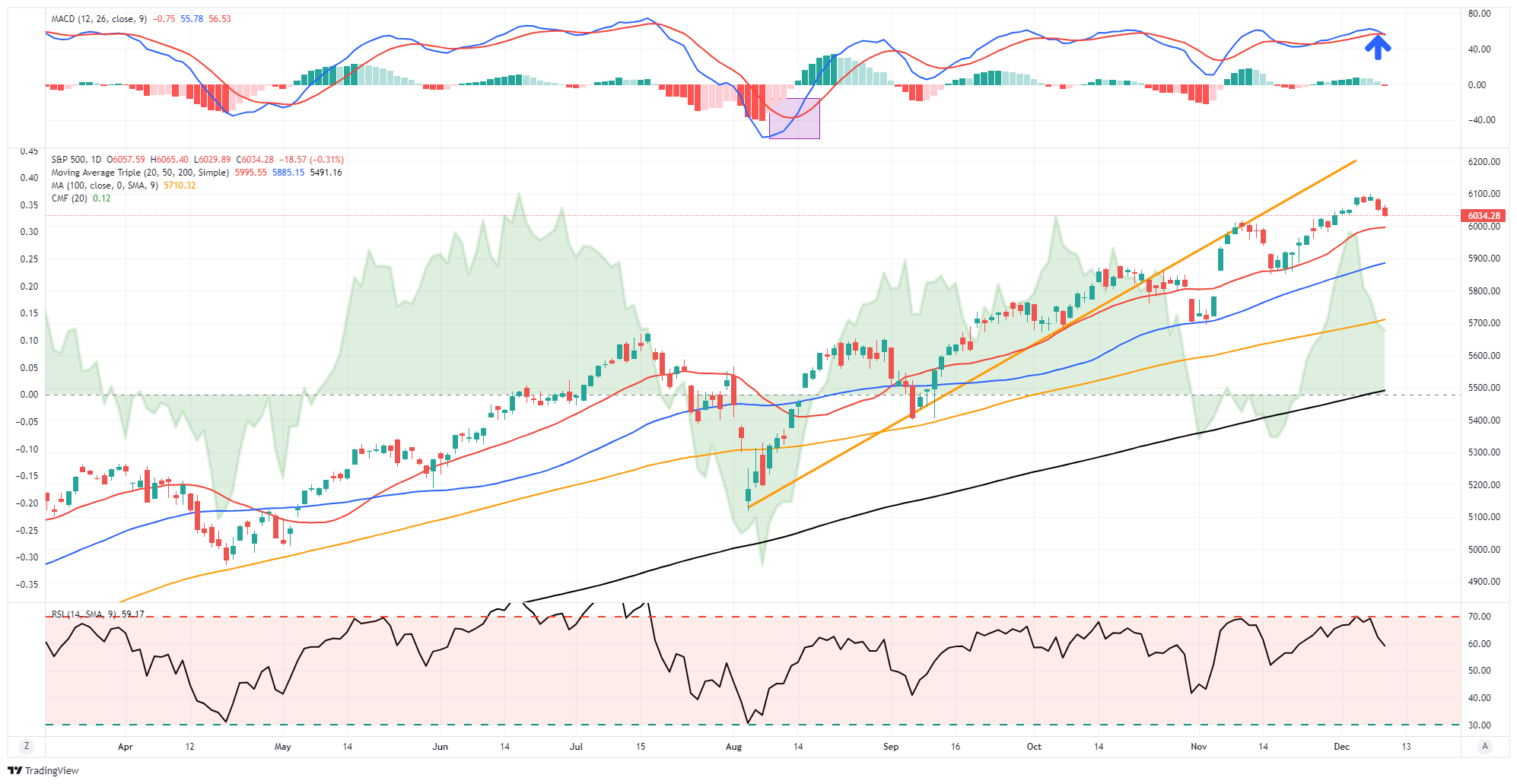

As discussed yesterday, the portfolio rebalancing and distribution period for funds is underway. As expected, this has led to rather sloppy market action, with some of the high flyers getting sold and underperforming companies getting bought. With the previous overbought condition somewhat reversed, the markets will likely bottom between the 20-DMA and 50-DMA. As shown, the 20-DMA will be the first important test of this pullback. The action has been nothing dramatic or abnormal over the past two days, and we could expect to see it continue into the end of the week. As shown, the MACD “sell signal” is approaching, which will apply further downward pressure to the market in the near term.

Continue to manage risk. This is the pullback we repeatedly discussed over the last two weeks, but the good news is that it will set the market up for the rally into year-end. Remain patient for now.

Curveballs For 2025

As if the last five years haven’t been unpredictable enough, we welcome an unpredictable president back into the White House. Deutsche Bank (ETR:DBKGn) has compiled a list of five “curveballs” to help us gather our thoughts around potential outlying events. These are market-related events that could significantly impact investors’ returns. Their list is as follows:

- The S&P 500 returns more than 20% for a third year or flops.

- AI overshoots or undershoots predictions.

- The US and China strike a grand bargain on trade.

- The dollar reverses its recent strength.

- The Fed ends up hiking rates, inflation reignites, and/or bond vigilantes finally take fright at the size of US budget deficits.

As we approach year-end, plenty of forecasts and similar curveball lists will become available. Our simple advice, which has primarily held since 2020, is to expect the unexpected.

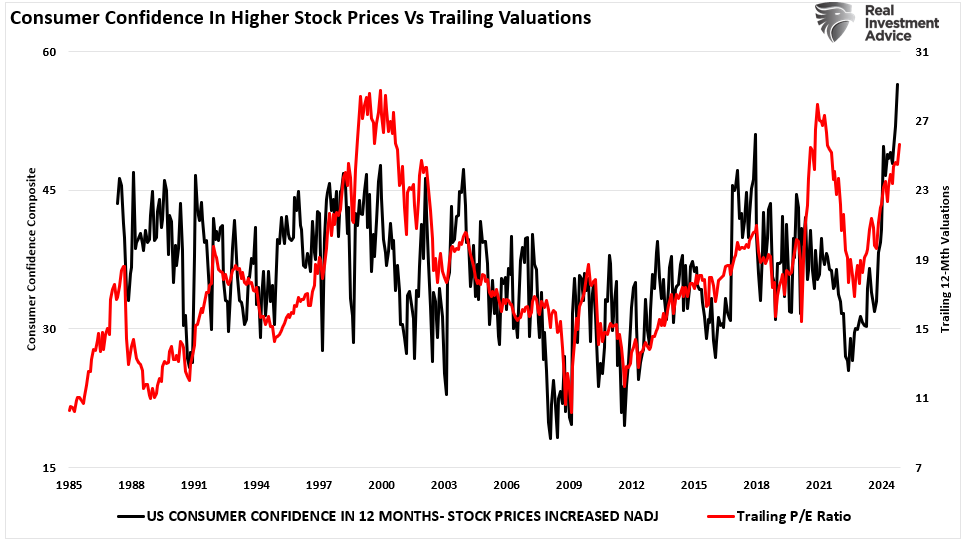

Portfolio Rebalancing and Valuations: Two Risks We Are Watching

While analysts are currently very optimistic about the market, the combined risk of high valuations and the need to rebalance portfolios in the short term may pose an unanticipated threat. This is particularly the case given the current high degree of speculation and leverage in the market. It is fascinating how quickly people forget the painful beating of taking on excess risk and revert to the same thesis of why “this time is different.” For example, I recently posted on “X,” which showed a visual of the 2021 market surge versus 2023-2024. While this time may be different, don’t be surprised if it ends the same.

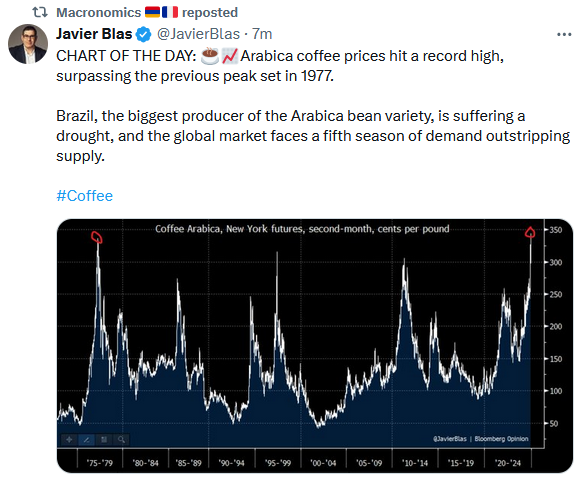

Tweet of the Day