This article was written exclusively for Investing.com

The EUR/GBP managed to bounce back Friday morning on the back of stronger Eurozone PMI data, while disappointing numbers from the UK hurt the pound. Still, I reckon the risks remain skewed to the downside for the EUR/GBP as the Bank of England appears to be more hawkish than the European Central Bank and the Delta variant of Covid is now rising rapidly across some major European nations, which could hurt growth in the coming months.

With the COVID-19 number in the UK increasing at pace, purchasing managers reported deteriorating conditions in July compared to the month before. This hurt sterling after the currency had rebounded sharply earlier in the week on the back of hawkish remarks from a couple of Bank of England officials.

Still, the euro appears to have more downside risks than the pound.

In fact, after the ECB’s dovish policy decision on Thursday, the EUR/GBP may have already started its next downward move.

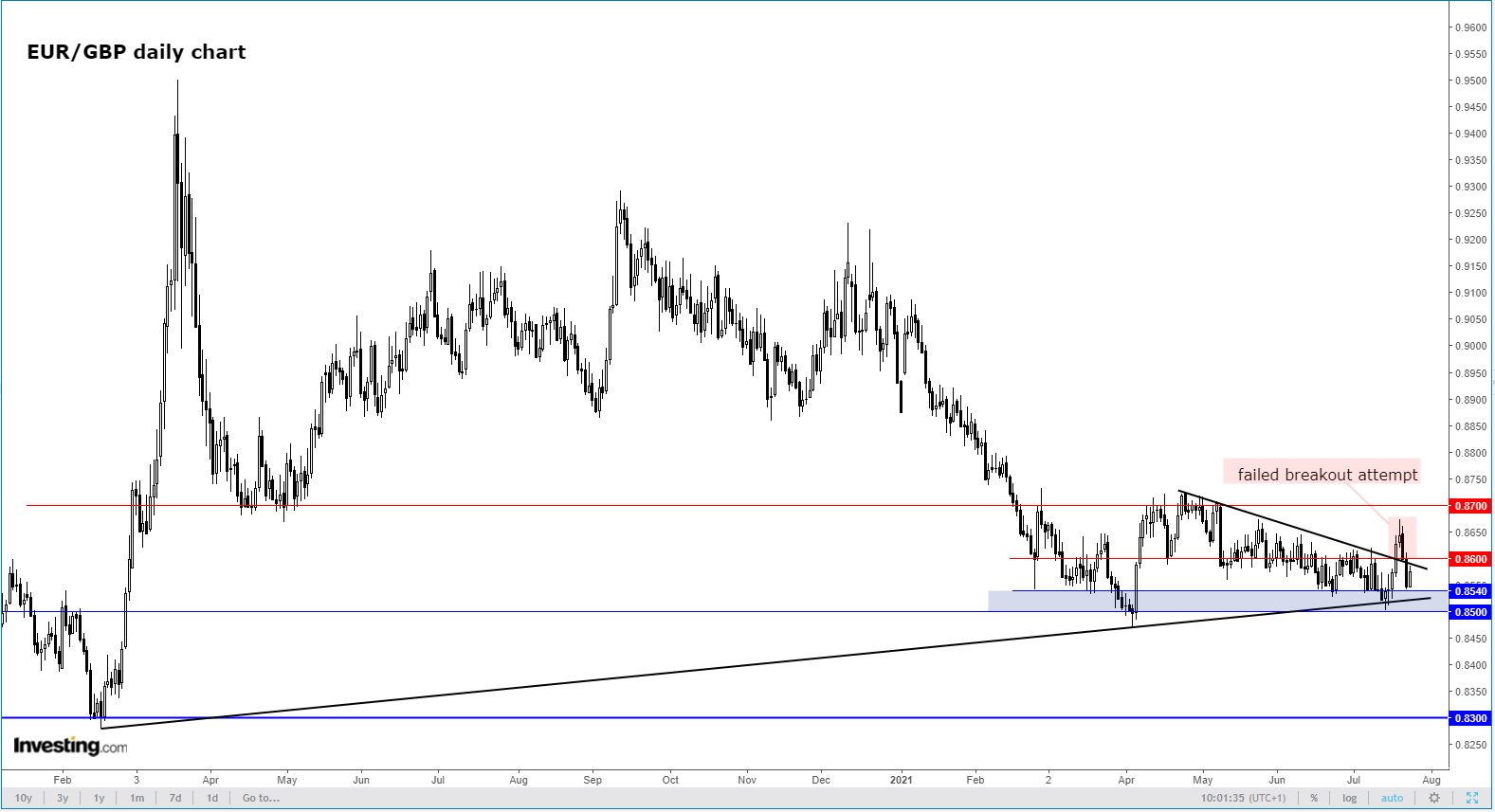

The weekly chart of the EUR/GBP has turned negative from being positive earlier in the week, with the exchange rate once again failing to hold above the 0.86 handle:

Given that the EUR/GBP has been coiling inside a narrow range near its recent lows for the best part of the past 3 months, price action is looking heavy and point to an eventual breakdown that could target the long-term support around 0.8300 next.

Zooming into the daily chart, one can immediately notice that 0.8540 is an important level. Thus, what I am looking for next is a break below this level, which should then pave the way for a re-test of the 0.8500 psychologically-important level. Then, if there is acceptance below the 0.85 handle, that’s when the bulls might rush for the exits, potentially leading to an accelerated downward move.

So, after a period of relative stability, watch out for renewed weakness for the EUR/GBP if support in the 0.8500-0.8540 finally gives way. The key risk to this bearish forecast is if the virus situation gets so bad in the UK that the government is forced to do a U-turn and announces another lockdown. While not impossible, this looks unlikely given the ongoing vaccinations programme, which has been quite rapid in the UK.