We recently turned cautiously bullish after holding in our bearishness since the 2018 plunge that remained a hair's breadth away from a formal bear market.

However, signs have been mounting that perhaps investors have been lulled into a sense of complacency. We're also questioning our own recent bullishness, as we’re concerned investors are thinking only about the short term, despite increasing long-term risks.

Bearish put options pricing has been dropping relative to call options, reaching extremely low levels, infrequently reached throughout this bull market.

The recent rally was spread among 82 of the companies listed on the S&P 500 Index who have been trading above their 200 DMAs – a two-year high. This suggests wide participation and when coupled with the lowest put/call ratio, we see a red flag.

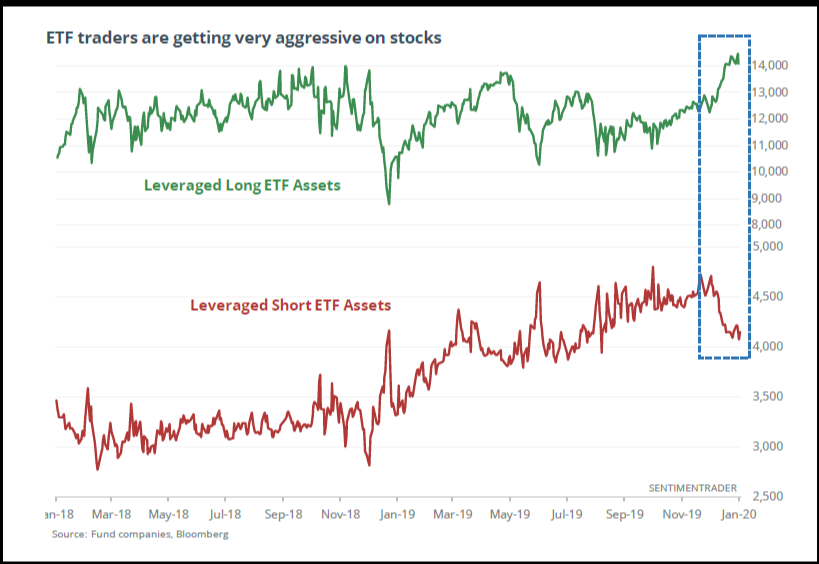

Another gauge whose measure is extreme – and therefore potentially unsustainable – are ETFs. Traders seem to be placing many eggs in few baskets, overwhelmingly betting that the rally in equities will keep going.

As we can see in the chart, traders sharply increased leverage longs, while drastically dropping leveraged shorts, another sign of a potential herd mentality.

While the price is headed toward a new record high, the RSI and MACD both provide negative divergences. If the RSI were to retest its previous low and break it, we could potentially see the price follow.

For the RSI, it’s the most overbought condition since January 2018, while for the MACD it’s the highest since February 2019.

Trading Strategies

Conservative traders would sit this out, as the trend is still up.

Moderate traders may risk a short with a close below 3,200, below the December lows.

Aggressive traders may risk a contrarian short position, providing they understand the risks and have prepared a trading plan accordingly.

Trade Sample