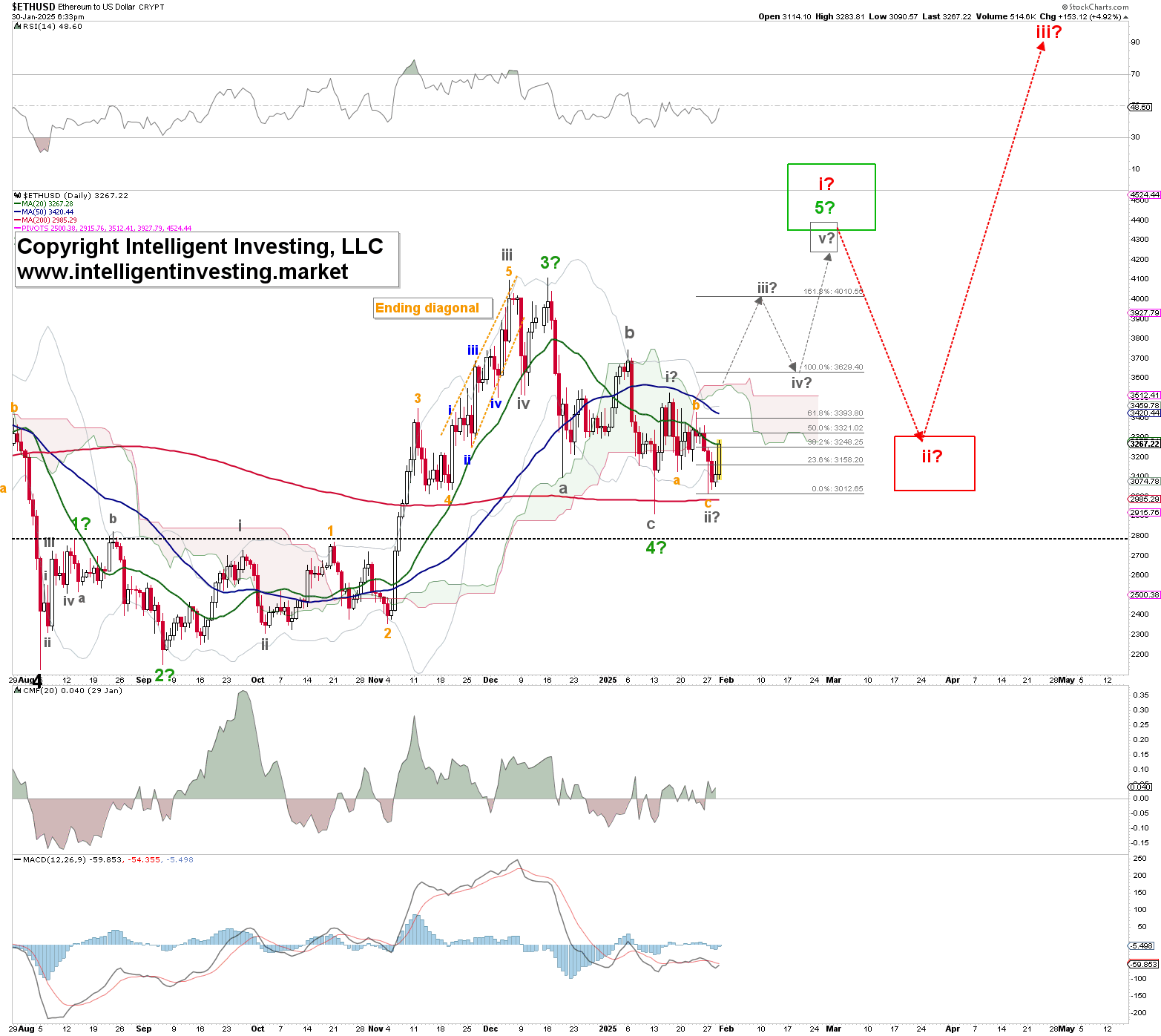

Using the Elliott Wave Principle, we find that Ethereum (ETHUSD), the second-largest cryptocurrency by market cap, has most likely completed five (green) waves up from its August 2024 low and three waves lower into the January 13 low. See Figure 1 below.

This means the red W-i and W-ii are complete, and the red W-iii to ideally ~$9000, is getting started. It will, however, most likely subdivide into five smaller (green) waves, as shown.

However, this EWP count does require confirmation by price breaking above the downtrend line it has been under since December 16 (see the blue arrows) followed by a move above the (blue) 50-day simple moving average (now at $3420). Lastly, we also want to see it move above the red, down-sloping Ichimoku cloud. Those parameters will tell us Ethereum is back in an uptrend. Thus, we keep the question marks on the labels for now.

Namely, based on our previous work, see here, ETHUSD could have experienced a deep green W-4. See Figure 2 below. Such deep 4th waves are not uncommon for cryptocurrencies. This would mean a rally and drop like the green W-1, 2 of the red W-iii, as shown in Figure 1, over the next few weeks are next. But that will then complete the red W-i and W-ii instead. Besides, the pullback under this scenario will be more profound and to around current levels before the red W-iii kicks in.

As you can see, both options lead to much higher prices this year. It is simply a matter of Ethereum choosing a more direct path (Figure 1) over a slightly indirect path (Figure 2).

In the short term, contingent on holding above $3015 and especially the January 13 low at $2910, we expect Ethereum to reach ideally $4400+/-200 before a more significant pullback to ~$3600+/-100 or $3200+/-100 should ensue. We foresee ETHUSD rallying to around $8900 from either pullback level before the next considerable pullback (of around 3000 handles) kicks in.