In this Bittensor (TAO) price prediction 2024, 2025-2030, we will analyze the price patterns of TAO by using accurate trader-friendly technical analysis indicators and predict the future movement of the cryptocurrency.

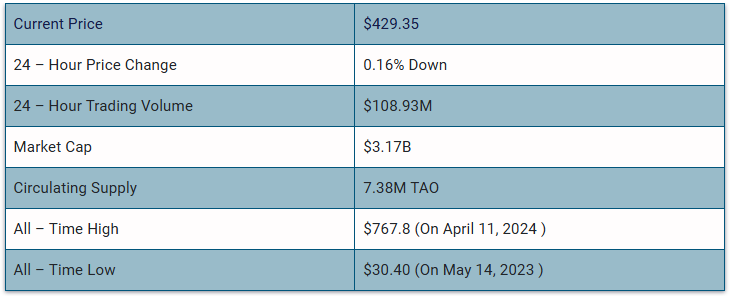

Bittensor (TAO) Current Market Status

What is Bittensor (TAO)

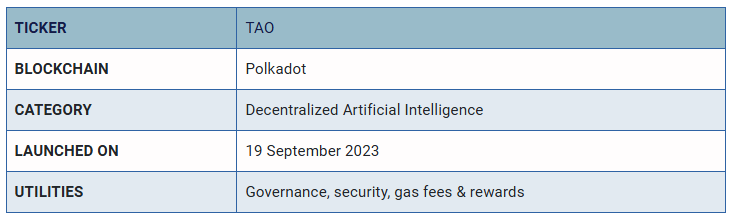

Bittensor (TAO) is a decentralized artificial intelligence (AI) platform that focuses on building a global, collaborative network of machine learning models. Bittensor aims to create a decentralized intelligence protocol where developers can contribute and monetize their AI models. The project leverages blockchain technology, particularly within the Polkadot ecosystem, to enable secure and transparent transactions between participants in the network.

Bittensor emphasizes the principles of fairness, collaboration, and open access to AI capabilities. Participants can stake TAO tokens to access the network or earn rewards by contributing their machine learning models. The platform strives to democratize AI and create a more inclusive and decentralized AI ecosystem. For the latest and more detailed information, it’s recommended to check the project’s official channels and documentation.

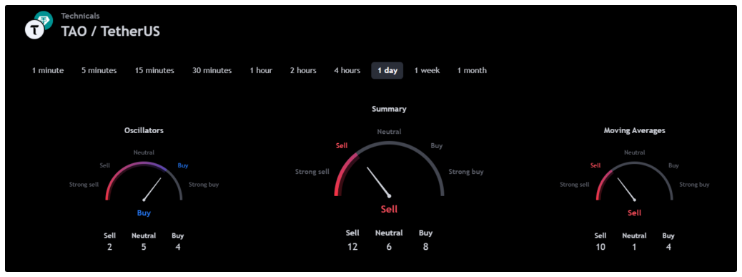

Bittensor 24H Technicals

Bittensor (TAO) Price Prediction 2024

Bittensor (TAO) ranks 25th on CoinMarketCap in terms of its market capitalization. The overview of the Bittensor price prediction for 2024 is explained below with a daily time frame.

In the above chart, Bittensor (TAO) laid out a descending channel, also known as a falling channel, is a bearish technical analysis pattern formed by two parallel downward-sloping trendlines. The upper trendline connects a series of high points, indicating resistance where the price struggles to rise above, while the lower trendline connects the lower points, acting as support.

This pattern suggests that sellers are in control, with the price consistently making lower highs and lower lows. Traders often look to sell near the upper trendline and buy near the lower trendline, as the price typically oscillates within this defined range. Overall, the descending channel helps traders identify potential shorting opportunities and assess market sentiment.

At the time of analysis, the price of Bittensor (TAO) was recorded at $429.35. If the pattern trend continues, then the price of TAO might reach the resistance level of $553.0, and $677.9. If the trend reverses, then the price of TAO may fall to the support of $406.3, and $458.4.

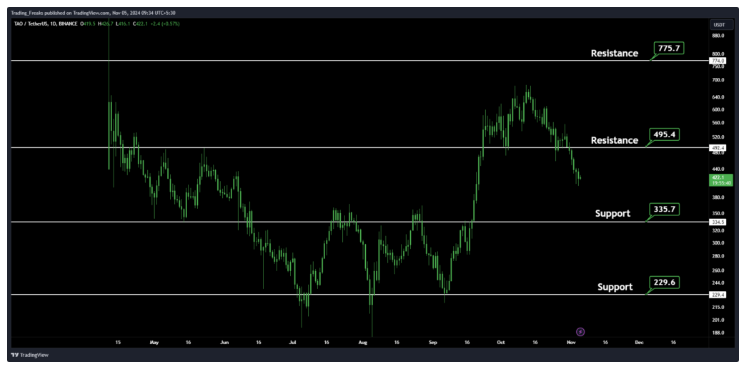

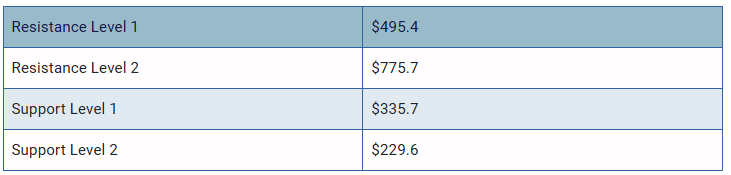

Bittensor (TAO) Resistance and Support Levels

The chart given below elucidates the possible resistance and support levels of Bittensor (TAO) in 2024.

From the above chart, we can analyze and identify the following as the resistance and support levels of Bittensor (TAO) for 2024.

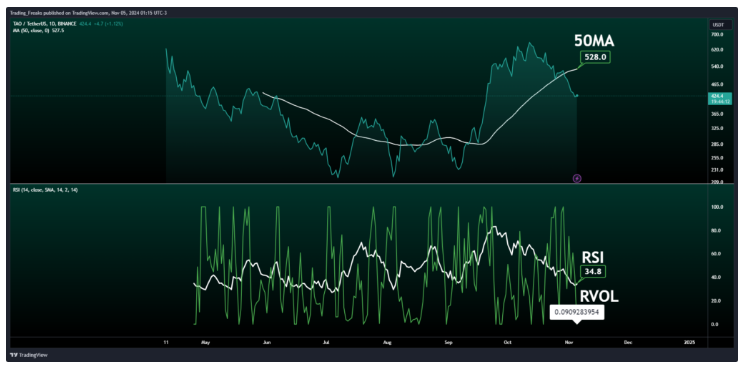

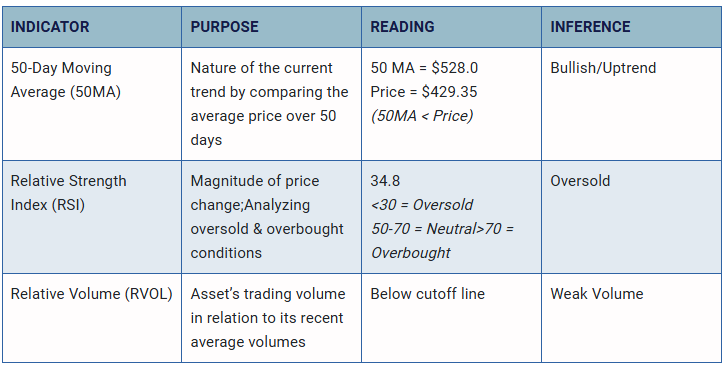

Bittensor (TAO) Price Prediction 2024 — RVOL, MA, and RSI

The technical analysis indicators such as Relative Volume (RVOL), Moving Average (MA), and Relative Strength Index (RSI) of Bittensor (TAO) are shown in the chart below.

From the readings on the chart above, we can make the following inferences regarding the current Bittensor (TAO) market in 2024.

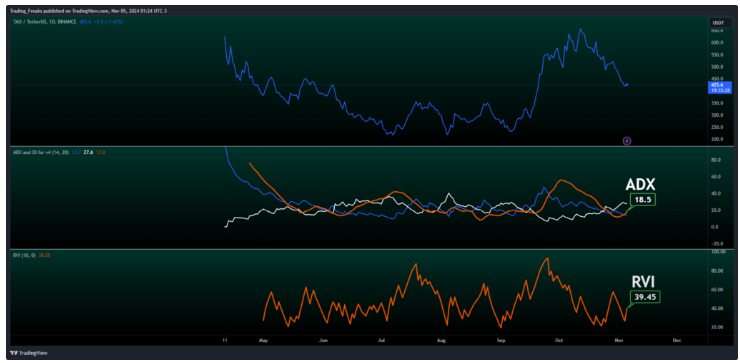

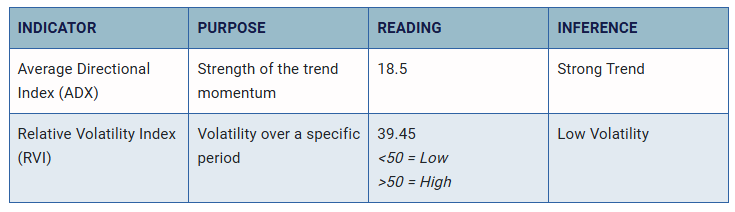

Bittensor (TAO) Price Prediction 2024 — ADX, RVI

In the below chart, we analyze the strength and volatility of Bittensor (TAO) using the following technical analysis indicators — Average Directional Index (ADX) and Relative Volatility Index (RVI).

From the readings on the chart above, we can make the following inferences regarding the price momentum of Bittensor (TAO).

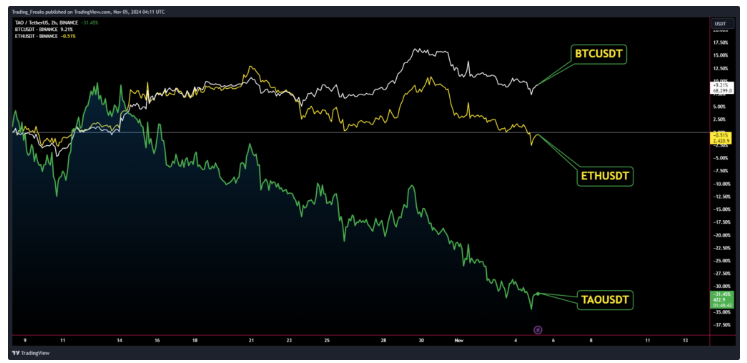

Comparison of Bittensor with BTC, ETH

Let us now compare the price movements of Bittensor (TAO) with that of Bitcoin (BTC), and Ethereum (ETH).

From the above chart, we can interpret that the price action of TAO is dissimilar to that of BTC and ETH. That is, when the price of BTC and ETH increases, the price of TAO decreases, if the price of BTC and ETH decreases, the price of TAO increases.

Bittensor (TAO) Price Prediction 2025, 2026 – 2030

With the help of the aforementioned technical analysis indicators and trend patterns, let us predict the price of Bittensor (TAO) between 2025, 2026, 2027, 2028, 2029 and 2030.

Conclusion

If Bittensor (TAO) establishes itself as a good investment in 2024, this year would be favorable to the cryptocurrency. In conclusion, the bullish Bittensor (TAO) price prediction for 2024 is $1272.2. Comparatively, the bearish Bittensor (TAO) price prediction for 2024 is $337.8.

If there is a positive elevation in the market momentum and investors’ sentiment, then Bittensor (TAO) might hit $1300. Furthermore, with future upgrades and advancements in the Bittensor ecosystem, TAO might surpass its current all-time high (ATH) of $767.68 and mark its new ATH.

This content was originally published by our partners at The News Crypto.