- Bitcoin has recently surged above $50,000.

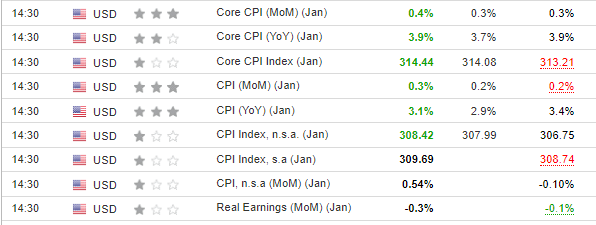

- Meanwhile, yesterday's inflation report came in above expectations.

- If the crypto can stay above $50K, the next psychological barrier is at $60K.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

In the last few weeks, we saw the drawn-out correction in Bitcoin and its main rival, Ethereum, come to an end.

The robust momentum propelled the demand side to breach the psychological barrier of $50,000 per Bitcoin, despite a temporary slowdown triggered by hotter-than-expected US inflation data.

The current session reflects the dominance of buyers, unaffected even by the strengthening US dollar. This scenario suggests the development of a sustained bull market, driven by the upcoming halving and increased funds flowing into ETFs.

In this ongoing bull market, not only Bitcoin but also other major cryptocurrencies, led by Ethereum, have reached new highs for the year.

Sticky Inflation Poses Challenges

The recently released US inflation data indicates that the Federal Reserve cannot yet declare victory. Both key CPI readings exceeded forecasts, highlighting a de facto consolidation that has persisted more or less since last July.

The dynamics of services prices, which rose by 0.7% month-on-month, contribute to the persistence of above-target inflation.

This factor discourages the Fed from initiating quick interest rate cuts, especially given relatively strong GDP readings and historical experiences from the 1970s.

Consequently, the likelihood of rate cuts as early as March is practically ruled out, with the market now shifting its probability assessment to June.

Conversely, the data on food prices appears optimistic, with the latest reading indicating a 1.2% year-on-year increase, the lowest since June 2021.

Additionally, fuel prices, particularly gasoline (down 14.2% year-on-year) and crude oil (down 6.4% year-on-year), have seen declines.

Bitcoin Surges Above $50K

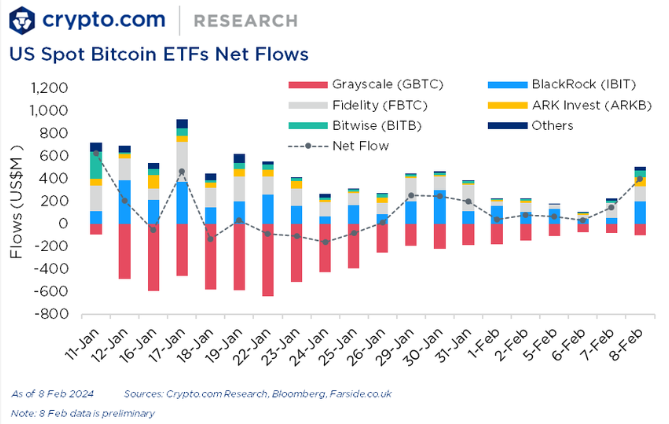

Bitcoin has already surpassed the $50,000 mark. As anticipated, ETFs reflecting the spot price of Bitcoin are gaining popularity among investors, as evident from the robust inflow dynamics.

Crypto.com reported a daily gain of $403 million on February 8 alone. Notably, BlackRock (NYSE: NYSE:BLK) and Fidelity products have emerged as the primary beneficiaries, accumulating total inflows of $7.5 billion.

Source: Crypto.com

The demand generated by the funds is not being matched by the miners, who are only able to generate about 10-15% of the daily demand, which naturally puts demand pressure.

After breaking the $50,000 barrier, the next target for buyers is the next psychological barrier of $60,000.

If this level is broken, then buyers will already be one step away from breaking new historical peaks located in the range of $68-69 thousand.

Possible corrective movements even the shallow ones in the form of a retest of $50 thousand can be considered in the category of the possibility of connecting to the upward trend.

Ethereum is also gaining, having just broken through this year's maximums falling just above $2,700 per coin.

From a technical point of view, the key should be the supply zone located in the $3400 price area, which initiated the dynamic sell-off near $2022.

Reaching and breaking this area will confirm the strength of the bulls with ambitions to go out near the historical highs.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 1,183% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

Don't forget your free gift! Use coupon code OAPRO1 at checkout for a 10% discount on the Pro yearly plan, and OAPRO2 for an extra 10% discount on the bi-yearly plan.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.