- Gold has stabilized near record highs in recent weeks

- The factors that have pushed the yellow metal higher since the beginning of the year remain valid.

- What are the best stocks to take advantage of Gold's rise?

- For less than $9 a month, InvestingPro's Fair Value tool helps you find which stocks to hold and which to dump at the click of a button.

Gold surged this year, reaching an all-time high of $2,570.4 per ounce last month, gaining over 20% since the start of the year. After this strong rally, the metal has since consolidated within a narrow range, suggesting these gains may be sustainable with potential for further growth.

Several key factors remain in play, including ongoing central bank purchases, geopolitical tensions, potential election-related volatility, and lingering uncertainty surrounding the economy and stock market.

Bank of America recently projected that gold could hit $3,000 within the next 12 to 18 months, citing rising inflows into gold-backed ETFs and other bullish drivers. Meanwhile, Goldman Sachs has set a target of $2,700 per ounce by the end of 2025.

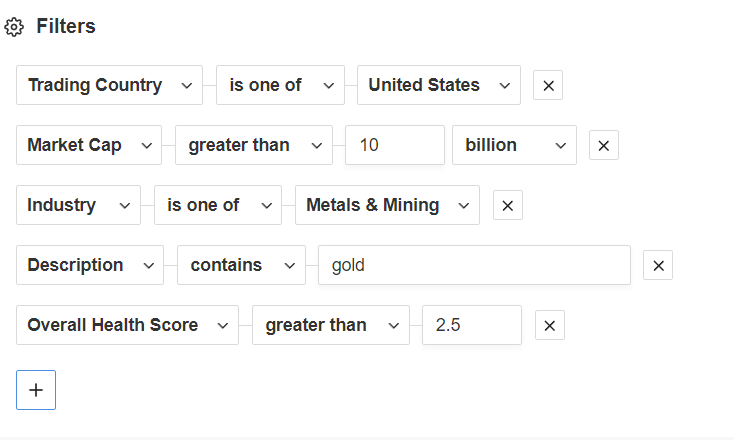

Given this backdrop, it’s no surprise that stock market investors are turning their attention to gold stocks. To help identify the best opportunities for capitalizing on a potential continued rise in gold prices, we used the InvestingPro screener to highlight stocks that meet key criteria.

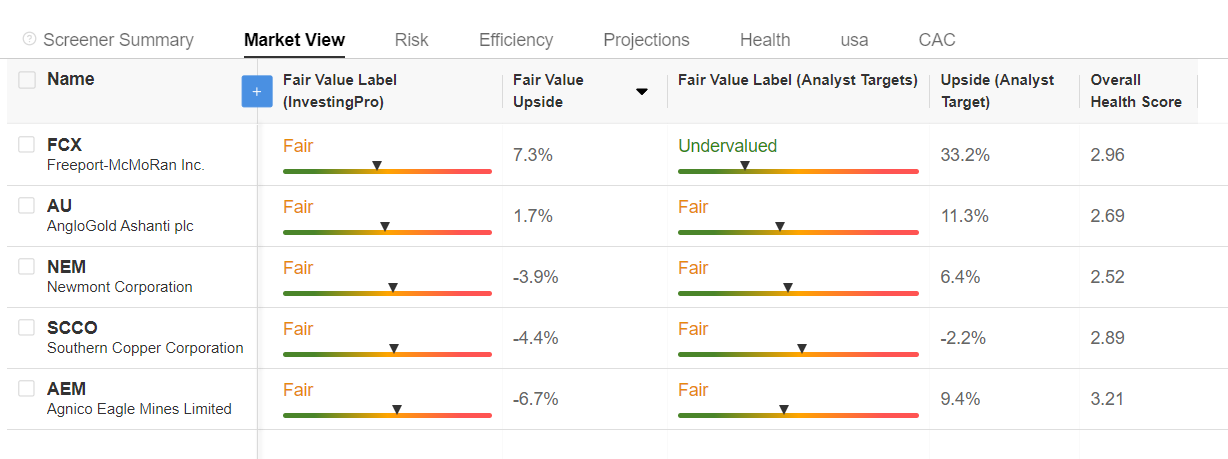

The search identified 5 stocks: Freeport-McMoran Copper & Gold Inc (NYSE:FCX), AngloGold Ashanti Ltd ADR (NYSE:AU), Newmont Goldcorp Corp (NYSE:NEM), Southern Copper Corporation (NYSE:SCCO) and Agnico Eagle Mines Limited (NYSE:AEM).

It's worth noting that Freeport McMoRan has the greatest bullish potential according to InvestingPro Fair Value, and according to analysts.

Agnico Eagle Limited has the highest InvestingPro health score.

In the rest of this article, we'll be taking a closer look at Freeport McMoRan and Agnico Eagle Limited.

1. Freeport-McMoRan

Freeport-McMoran shares started the year strongly bullish, peaking at an all-time high of $55.24 in May, and have since corrected sharply, closing at $41.3 on Wednesday.

However, the chart suggests that the fall is over, as the stock seems to have found a floor in the $40 zone.

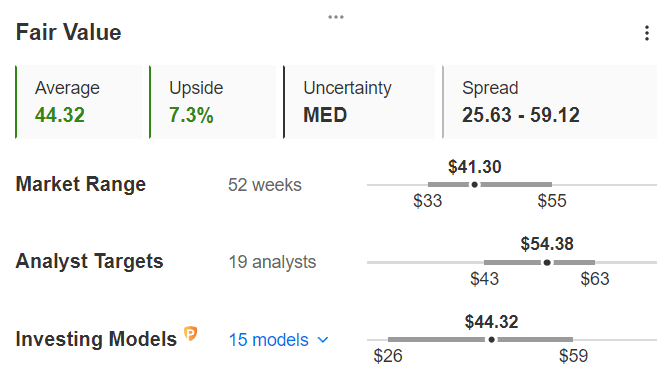

Moreover, the stock is slightly undervalued according to InvestingPro Fair Value, which assigns it a bullish potential of +7.3%.

Analysts, on the other hand, are far more optimistic, valuing the stock on average at $54.38, i.e. over 31% above the current price.

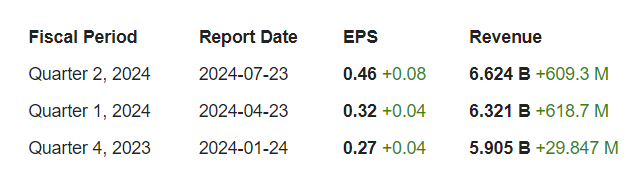

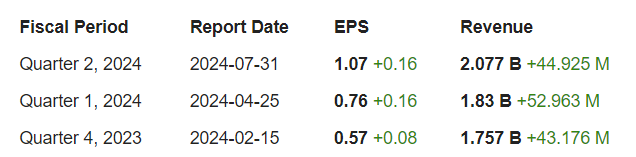

Finally, it seems worth noting that all quarterly results published since the start of the year have exceeded expectations, in terms of both sales and earnings.

This is a solid performance that has a good chance of lasting if gold maintains or accentuates its gains.

2. Agnico Eagle Limited

Agnico Eagle Mines has so far posted a strong uptrend this year, peaking at $83.5 last month, up 58.6% on the start of the year.

The chart trend remains bullish, despite a correction in the last week of August and the first week of September.

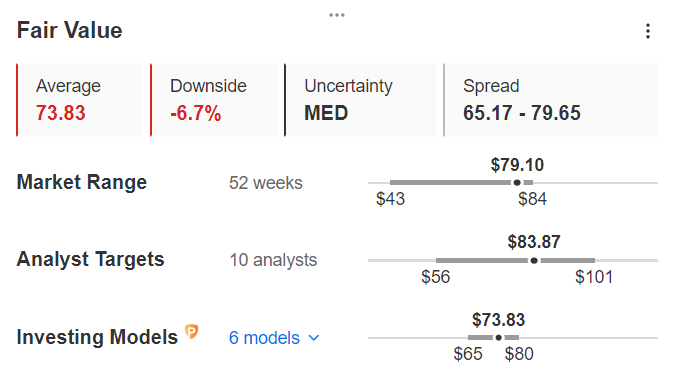

On the other hand, neither analysts nor valuation models attribute significant upside potential to the stock.

Indeed, on average, analysts are giving the stock a target price of $83.87, just 6% above the current price.

Worse still, InvestingPro's Fair Value estimates the stock at $73.83, i.e. 6.7% below the current price. It should be noted, however, that the valuation models do not take into account the bullish potential of gold, whose trend will have a major influence on the share price over the coming months.

On the other hand, recent results have all clearly exceeded expectations, in terms of both sales and EPS.

Conclusion

With many gold stocks having already made strong gains since the start of the year, they could continue to outperform if the yellow metal continues to rise.

All the indications are that the bullish factors that have pushed the metal to all-time highs this year will remain in place over the coming months. In this context, Freeport McMoRan and Agnico Eagle Limited deserve investors' attention.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.