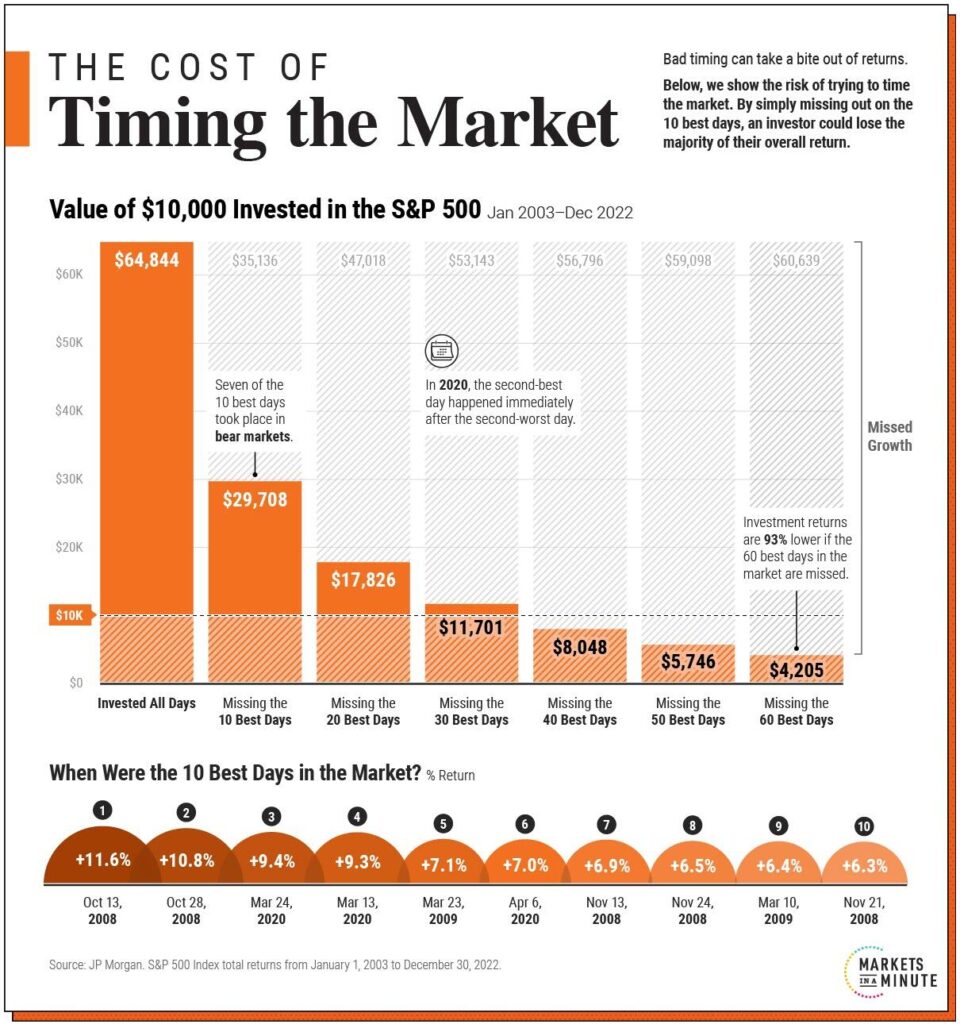

About once a year, I have to address the issue of chasing the “10 Best Days” of the year. Statista recently presented the analysis:

“There is clear evidence that market timing is difficult. Often, investors will sell early, missing out on a stock market rally. It can also be unnerving to invest when the market is flashing red.

By contrast, staying invested through highs and lows has generated competitive returns, especially over longer periods. The graphic below shows how trying to time the market can take a bite out of your portfolio value, using 20 years of data from JP Morgan.”

The financial media regurgitates this same analysis whenever there is a market correction.

“If an investor were to simply miss the 10 best days in the market, they would have shed over 50% of their end portfolio value. The investor would finish with a portfolio of only $29,708, compared to $64,844 if they had just stayed put.”

What is interesting is that this analysis is almost always the same. We addressed the same in March last year as the market stumbled following the Russian invasion of Ukraine.

Panic selling not only locks in losses but also puts investors at risk for missing the market’s best days.

Looking at data going back to 1930, Bank of America found that if an investor missed the S&P 500′s 10 best days in each decade, total returns would be just 91%, significantly below the 14,962% return for investors who held steady through the downturns.” – Pippa Stevens via CNBC

However, as Paul Harvey used to quip, “In a moment…the rest of the story.”

Best Days Occur During Bear Markets

Here is the problem with the analysis. What about the losing days?

While those doing the analysis do mention the losing days, they dismiss the impact. Here is the “rest of the story” from Statista.

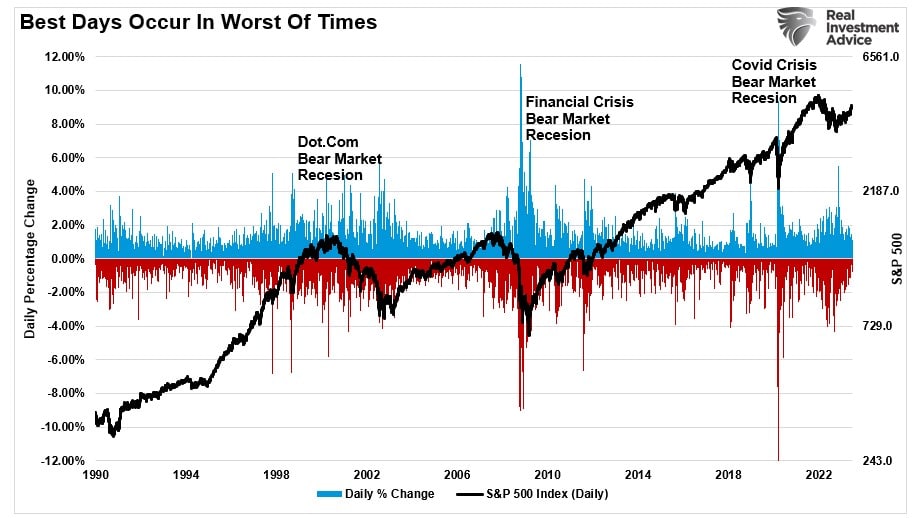

“Why is timing the market so hard? Often, the best days take place during bear markets. Over the last 20 years, seven of the 10 best days happened when the market was in bear market territory. Adding to this, many of the best days take place shortly after the worst days.“

Such was the same conclusion by Pippa Stevens’ in 2022.

“The firm noted this eye-popping stat while urging investors to ‘avoid panic selling,’ pointing out that the ‘best days generally follow the worst days for stocks.’”

Think about that for a moment.

“The best days generally follow the worst days.“

The statement is correct, as the S&P 500’s largest percentage gain days tend to occur in clusters during the worst of times for investors.

The analysis of “missing out on the 10-best days” of the market is steeped in the myth of the benefits of “buy and hold” investing. As a strategy, buy and hold works great in a long-term rising bull market.

However, 'buy and hold' generally fails as a strategy during a bear market for a straightforward reason: Psychology.

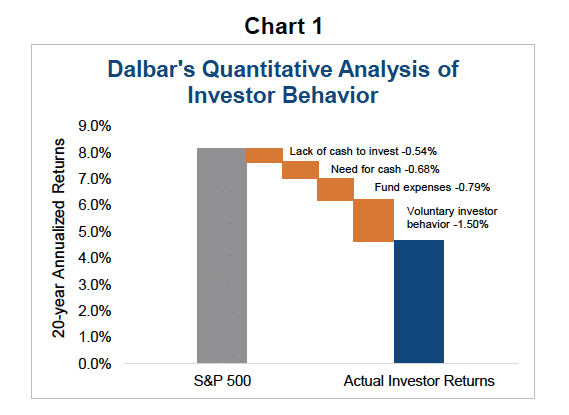

I agree investors should never panic sell, as such emotional decisions are always made at the worst possible times. As Dalbar regularly points out, individuals always underperform the benchmark index over time by allowing behaviors to interfere with their investment discipline.

In other words, investors regularly suffer from the “buy high/sell low” syndrome.

This is why investors should follow an investment discipline or strategy that mitigates volatility to avoid being put into a situation where “panic selling” becomes an issue.

Let me be clear. An investment discipline does NOT guarantee your portfolio against losses if the market declines. This is particularly true when it plummets, as seen in 2008. However, a solid investment discipline will work to minimize the damage to a recoverable state.

Avoiding The Worst Days Is A Better Endeavor

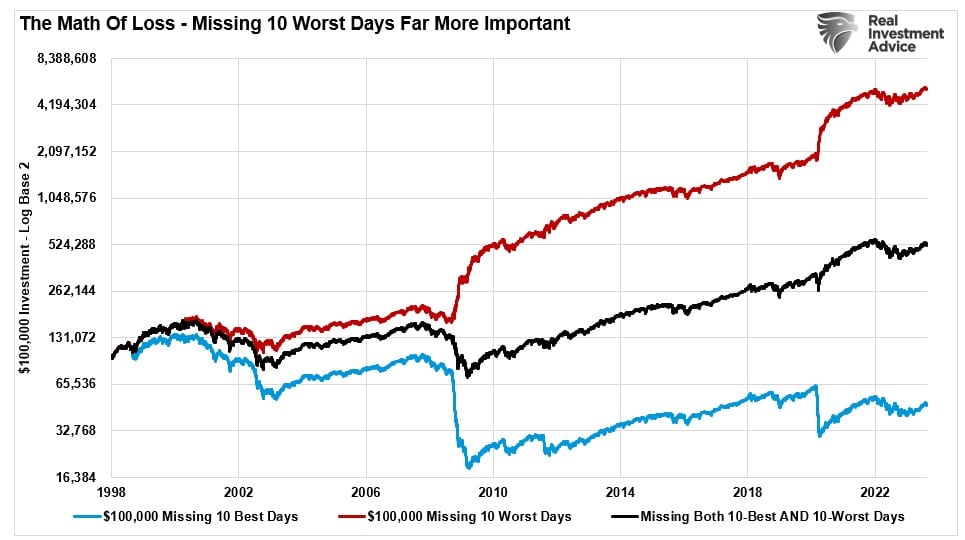

So, if the best days occur during the worst periods for the market, does it not become more logical to focus on avoiding those periods? While missing the “10-Best Days” of the market certainly does impair portfolio performance over time, what about missing the “10-Worst Days?”

How important is this? Over an investing period of about 40 years, missing the “10 Best Days” would cost you about 50% of your capital gains. But successfully avoiding the “10-Worst Days” would have led to 2.5x the gains over “buy and hold.”

Avoiding significant drawdowns in the market is critical to long-term investment success. Obviously, if you are not spending the bulk of your time making up previous losses, more time is spent compounding invested dollars towards long-term goals.

Brett Arends once penned:

“In other words, it’s something of a wash. The cost of being in the market just before a crash, are at least as great as being out of the market just before a big jump, and may be greater. Funny how the finance industry doesn’t bother to tell you that.”

The finance industry doesn’t tell you the other half of the story because it is NOT PROFITABLE for them. The finance industry makes money when you are invested, not in cash.

However, you DO have options.

A Simple Method

Let me take a moment to be very clear.

“I do not strictly endorse ‘market timing,’ which is specifically being ‘all-in’ or ‘all-out’ of the market at any given time. The problem with market timing is consistency.”

This is a critical point. No one, and I do mean no one, including A.I., can effectively time the market over the long term. Being all in or out of the market will eventually put you on the wrong side of the “trade.” Such then leads to a host of other problems.

Furthermore, ask yourself why no “great investors” in history employed “buy and hold” as an investment strategy. Even the great Warren Buffett occasionally sells investments. True investors will buy when they see value and sell when value no longer exists.

There are many sophisticated methods of handling risk within a portfolio. However, even using a basic price analysis method, such as a moving average crossover, can be a valuable tool over long-term holding periods.

Will such a method ALWAYS be right? Absolutely not. However, can such a method reduce the risk of damaging capital losses? Absolutely.

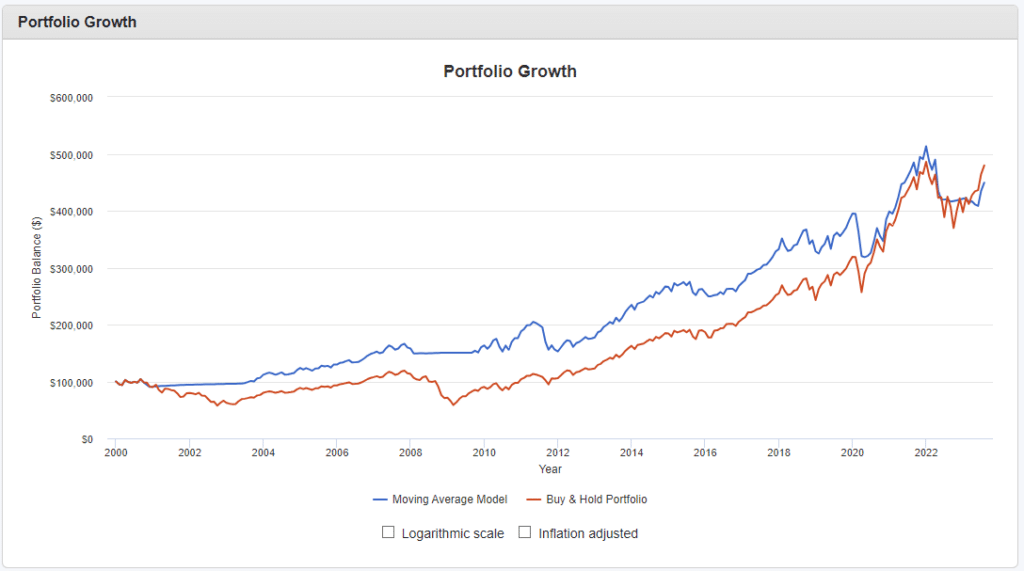

The chart below shows a simple 18-month moving average crossover study. (via Portfolio Visualizer)

What should be obvious is that using a basic form of price movement analysis can provide a practical identification of periods when portfolio risk should be REDUCED. Importantly, I did not say risk should be eliminated, just reduced.

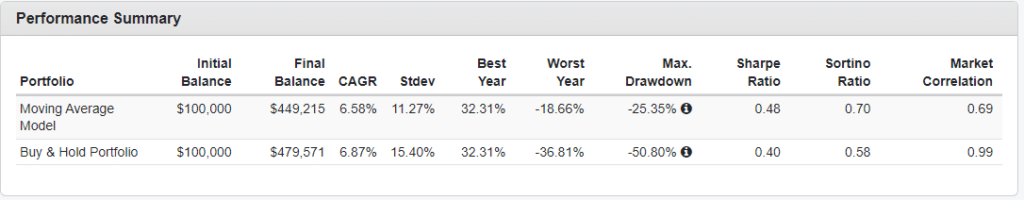

Here are the comparative results. Notice the “Max Drawdown” column.

Again, I do not suggest that such signals mean going 100% to cash.

What I am suggesting is that when “sell signals” are given, that is the time when individuals should perform some essential portfolio risk management such as:

- Trim back winning positions to original portfolio weights: Investment Rule: Let Winners Run

- Sell positions that are not working (if the position was not working in a rising market, it likely won’t be in a declining market.) Investment Rule: Cut Losers Short

- Hold the cash raised from these activities until the next buying opportunity occurs. Investment Rule: Buy Low

Using some measures, fundamental or technical, to reduce portfolio risk by taking profits as prices/valuations rise, or vice versa, the long-term results of avoiding periods of severe capital loss will outweigh missed short-term gains.

Minor adjustments can have a significant impact over the long run.

There is little point in trying to catch each twist and turn of the market. But that also doesn’t mean you must be passive and let it wash all over you.

It may not be possible to “time” the market, but it is possible to reach intelligent conclusions about whether the market offers good value for investors.

You do have a choice.