As of yesterday, year to date the NASDAQ Composite is down by 27.36%, the S&P 500 is 17.44% lower, the Russell 2000 is down 23.48% and the Dow Jones Industrial Average is off 12.40%.

Investors are beginning to worry if the market slump will continue and if it does, how much further will markets fall?

It is difficult to predict exactly but there are some useful pointers to get an idea of the extent (in terms of duration and decline) that we might expect.

Examining the S&P graph, we notice a bearish Head and Shoulders, the projection of which could take it to the 3,660 point and the closest support is around 3530.

This would mean a drop of about 27% from the indices high, or a further slide of 10%, a significant correction, but still nothing like 2008 or 1932.

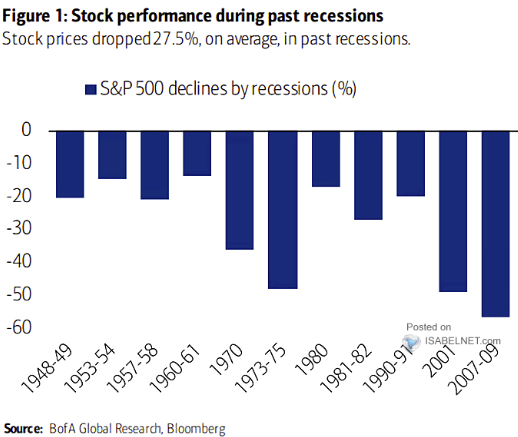

Furthermore, if we look at the chart below, we can see that in recessionary periods, the stock market loses on average 27.5%. So a total correction of 27% would be in line with that.

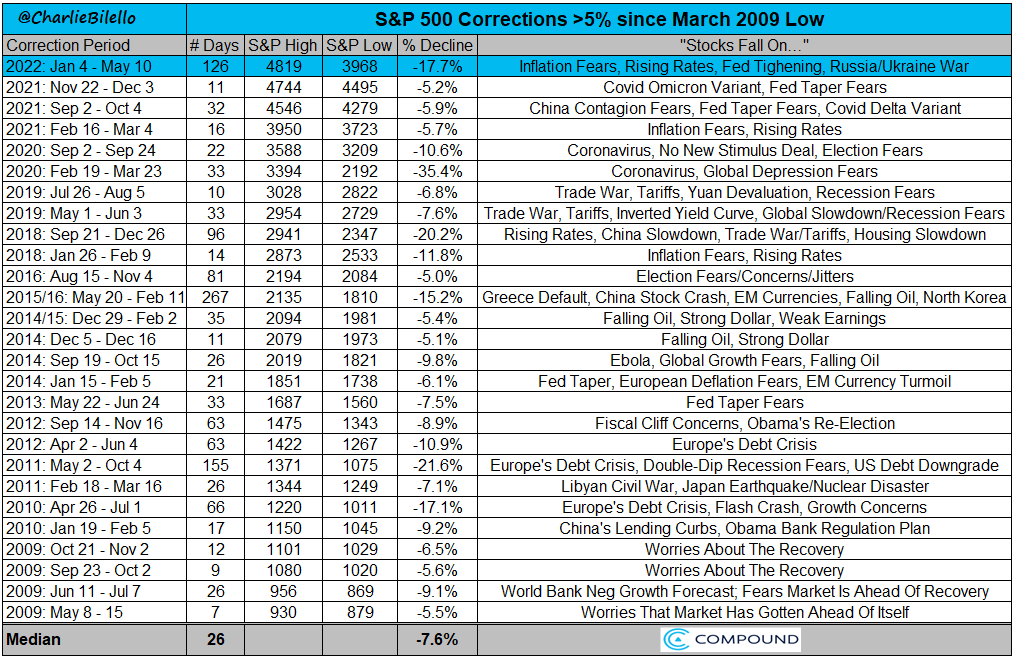

However, it is worth noting that the current period, in terms of duration, is one of the longest declines since 2015 (126 days). In fact, only the 2015-2016 decline was longer (267 days).

So on that basis a drop of 27%, lasting at least another three months does not seem so farfetched.

So if you have a well diversified portfolio which includes some cash, it might be worth considering a gradual return to the market after each additional 7-8% decline. That way even if the market continues to slide, which is possible, gradual entries after each drop mean you will have bought in at a good value level. Then it will just require discipline to wait for the recovery.

Until next time!

If you find my analyses useful and would like to receive updates when I publish them in real time, click on the FOLLOW button on my profile!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice or recommendation to invest as such and is in no way intended to encourage the purchase of assets. I would like to remind you that any type of asset, is valued from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with you.f