This article was written exclusively for Investing.com

- Wedge pattern leads to upside breakout for leading cryptocurrencies

- Ethereum recently appreciating faster than Bitcoin

- Proof of stake in Ethereum 2.0

- Bitcoin still has the advantage

- Another leg higher for Bitcoin, Ethereum set to challenge November high

On Nov. 10, 2021, Bitcoin and Ethereum each reached record highs. After trading at five cents per token in 2010, Bitcoin reached almost $69,000 per token in 2021. In 2016, Ethereum was at $11.16 and rose to just over $4,865 in 2021.

However, the day the leading cryptos reached their peaks, both closed below the previous session’s low, putting in bearish key reversals on the daily charts. Bitcoin and Ethereum plunged, with Bitcoin reaching a low of $33,075 and Ethereum falling to $2,165 in January. The leading crypto lost around 52.6% of its value, while Ethereum fell 56%.

However, the two leading cryptos by market cap have recovered since the late January lows. Over the past weeks, Ethereum has taken the lead over Bitcoin accelerating more significantly on a percentage basis, though Bitcoin remains the leader, with a market cap that's more than double that of Ethereum.

Wedge Pattern Leads To Upside Breakout For Leading Cryptocurrencies

While the two leading cryptocurrencies are not currently running away to the upside on Apr. 7, they did break out of consolidation patterns to move a bit higher.

Source: CQG

The weekly chart shows that Bitcoin futures have made lower highs since Nov. 10. After reaching a bottom on Jan. 24, a pattern of higher lows emerged. Bitcoin broke out above its first technical resistance level at the early February 2022 high of $45,905 during the final week of March, breaking the bearish pattern. Bitcoin is trading above the $43,400 level at time of writing on Apr. 7.

Source: CQG

The weekly chart of nearby Ethereum futures shows the same pattern, moving above the early February high of $3,292, and breaking the pattern of lower highs. While Bitcoin was around the breakout level on Apr. 5 and has since slipped a bit lower, Ethereum was around $160 per token higher on Apr. 5, though it too has now moved lower.

Ethereum Recently Appreciating Faster Than Bitcoin

In Q1 2022, Bitcoin futures dipped just 0.73% lower while Ethereum posted a 9.94% loss. The cryptocurrency asset class’s market cap dropped to $2.084 trillion on March 31 from $2.166 trillion at the end of 2021, a 3.8% decline. Thus, during Q1, Bitcoin outperformed the asset class while Ethereum underperformed.

However, since the Jan. 24 lows, Ethereum has taken the leadership baton. Nearby Bitcoin futures reached a low of $32,855 and were at the $45,950 level on Apr. 5, a 39.9% gain. Over the same period, Ethereum futures moved to $3,459 from $2,158, or 60.3% higher.

Proof Of Stake In Ethereum 2.0

Ethereum is currently rolling out its 2.0 version. Among the upgrades to the ETH ecosystem will be a shift from PoW to PoS protocols.

Bitcoin and Ethereum 1.0 have proof-of-work protocols (PoW) which use a competitive validation method to confirm transactions and add new blocks to the blockchain. PoW tends to be highly energy-intensive, as it requires substantial computing power.

Proof of stake (PoS) is a cryptocurrency consensus mechanism for processing transactions and creating new blocks in a blockchain. PoS allows owners of cryptocurrencies to stake their tokens, giving them the right to check new blocks of transactions and add them to the blockchain. PoS requires far less energy than PoW protocols.

Perhaps the primary reason for Ethereum’s recent outperformance over Bitcoin is the rollout of Ethereum 2.0 and its leaner, greener PoS protocol. The anticipated launch date for Ethereum 2.0 is sometime during June 2022.

Bitcoin Still Has The Advantage

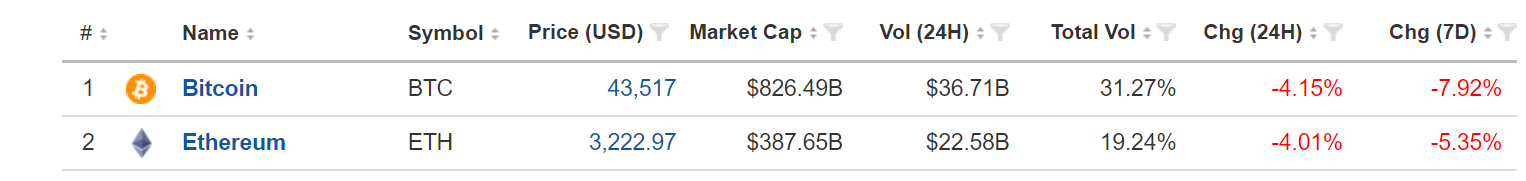

Nevertheless, Bitcoin remains the 800-pound crypto gorilla as of Apr. 7 by virtue of its much heftier market cap.

Source: Investing.com

The chart above shows that Ethereum has a long way to go to catch up with Bitcoin. On Apr. 7, Bitcoin’s $826.49-billion market cap was more than double Ethereum’s $387.65-billion total valuation.

In an asset class flooded with 18,713 other tokens and rising, Bitcoin and Ethereum are by far the leaders. Only 19 tokens have market caps above the $10-billion level, and Bitcoin and Ethereum are the only cryptos worth more than $82.5 billion.

Another Leg Higher For Bitcoin, Ethereum Looks Set To Challenge November High

The breakout from the wedge pattern of lower highs and high lows has not yet ignited Bitcoin and Ethereum. However, if the past volatile performance of the leading cryptos is a guide, that market could be on the verge of another explosive move since digital tokens have alternated from price explosions to implosions, then back to explosions over the past years.

If prices begin to rise, a herd of speculative buying is likely to return to the market. Bitcoin and Ethereum will undoubtedly attract the most significant interest because of their liquidity and past performance.

As well, over recent weeks Ethereum has moved into the leadership position as a rapid mover via its substantial percentage gain since the late January lows. While the asset class’s price variance could take prices to new highs above the Nov. 10 peaks, past performance never guarantees future results. Still, from a technical perspective I wouldn't be surprised to see another explosive rally in the cryptos.