This post was written exclusively for Investing.com

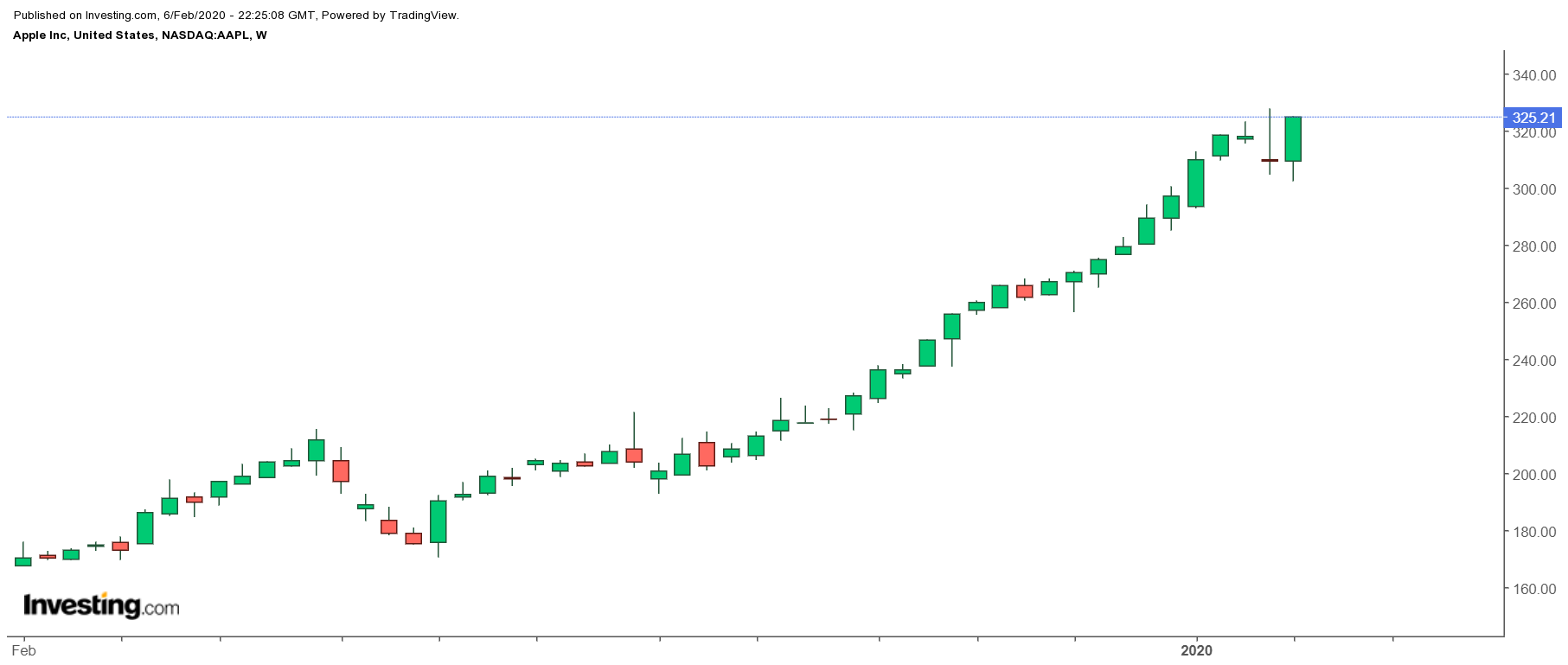

On Feb. 6, 2019, Apple (NASDAQ:AAPL) shares closed at a price of around $175, and one year later, those shares are now trading at nearly $325. Clearly, a lot can change — and fast.

The stock's impressive jump has come as investors have increasingly looked to the future of the company, one that entails a more diversified revenue stream made up of the iPhone, services and wearables. But if you thought the shares's rally was behind it, guess again.

Traders are betting that the stock will only continue to climb, while some see it increasing even further over the next month. Meanwhile, the company just reported significantly better quarterly results the week of Jan. 27, which has prompted analysts to upgrade future earnings and revenue estimates.

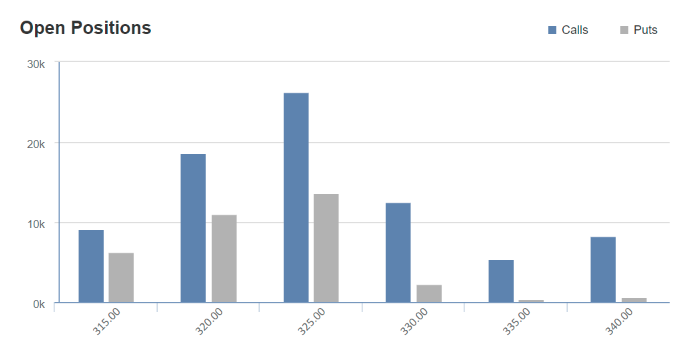

Betting Shares Stay Above $325

Options traders have made bets in recent days that suggest that Apple’s stock will rise in the weeks ahead. The open interest levels for the Apple March 20 $325 calls increased by around 10,700 contracts on Feb. 5. It appears that the trader also sold the $325 put contracts creating a spread transaction, with the open interest for those contracts rising by nearly 11,500 contracts. It establishes a bet that Apple’s shares will continue to surge and stay above $325 over the next month.

Strong Results

One reason a trader may be making this optimistic bet is the company’s powerful quarterly results last week, which easily beat estimates. Apple reported revenue that came in at $91.8 billion, which was better than estimates by almost 4%. Meanwhile, earnings beat estimates by nearly 10% at $4.99 per share. Due to the massive quarterly results and better than expected fiscal second-quarter guidance, analysts’ have been boosting their forecasts significantly.

Since the company reported results, earnings estimates have increased by almost 7% for fiscal 2020 to $13.95 per share, a growth rate of 17.3%. Also, revenue estimates have risen by nearly 3.5% to $285.6 billion and a growth rate of 9.8%.

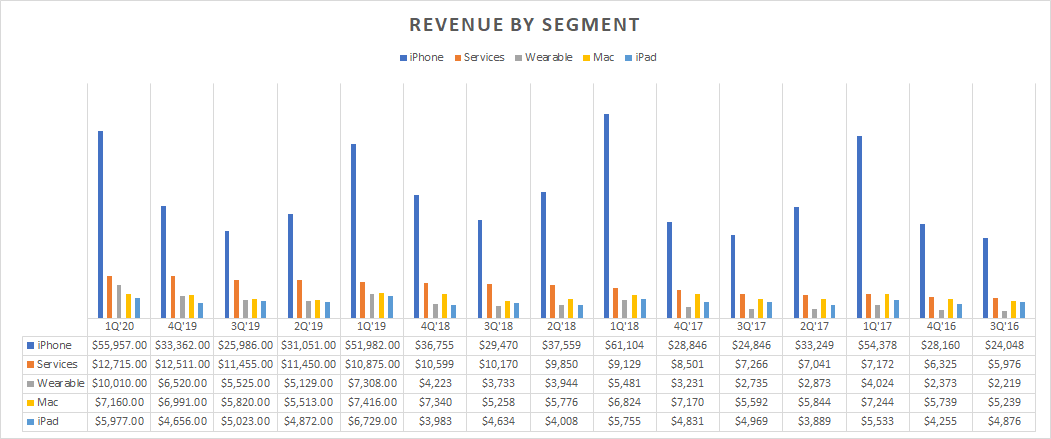

A Diversified Revenue Stream

It leaves the stock trading with a one-year forward PE ratio of 20.6. That is not a cheap earnings multiple on a historical basis for Apple. However, one reason why shares have risen so dramatically over the past year is due to the re-rating of the stock as the company has diversified its revenue stream, from one that was primarily iPhone-driven to one that has seen explosive growth in its services and wearable businesses.

(Compiled from Apple (NASDAQ:AAPL) quarterly reports)

During the fiscal first quarter, the company saw strong growth from its service and wearable units with revenues rising by 17% and 37%, respectively. The increasing growth resulted in the two business segments advancing to the second and third-biggest sources of revenue for Apple after the iPhone. Service revenue grew to $12.7 billion, while wearables grew to total revenue of $10.1 billion, making the combined revenue roughly $23 billion, and accounting for almost 25% of the company’s overall revenue in the quarter, which was higher than the 21.6% it accounted for in the first quarter of 2019.

Due to the ebbs and flows of the iPhone, the first quarter is likely to be the trough of the cycle for the combined business units this year, which might mean that services and wearables continue to rise as a percentage of the overall revenue throughout the year, and perhaps longer-term.

It is likely the driving force behind the higher PE ratio investors are affording the stock presently, and if shares should return to the pre-earnings PE ratio, before the latest upward revisions at around 21.5, the stock could climb to about $335.

However, this is not to say that it will be an easy journey ahead for Apple; indeed, it's likely that it won’t be. Especially with a stock that is so heavily tied to headlines regarding China, either via the trade war or now the coronavirus.

Disclosure: Michael Kramer and the clients of Mott Capital own AAPL. Michael Kramer is a financial market strategist and the portfolio manager of the Mott Capital Thematic Growth Portfolio.

Mott Capital Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Past performance is not indicative of future results.