- Apple, the heaviest weighted company in the S&P 500, reports earnings this Thursday

- Apple warned earlier this year that the second half could be rough due to supply-chain hurdles

- Due to strong iPhone demand, analysts are upbeat about the company’s growth prospects

In a week packed with earnings reports from some of the most-valued public companies, the latest numbers from Apple (NASDAQ:AAPL) are crucial to get insight into an array of themes affecting the market, such as consumer demand, supply chains, the effect of the soaring USD dollar and higher interest rates.

The iPhone maker, which has the heaviest weighting on the S&P 500, is scheduled to report on Thursday, Oct. 27, after the market close.

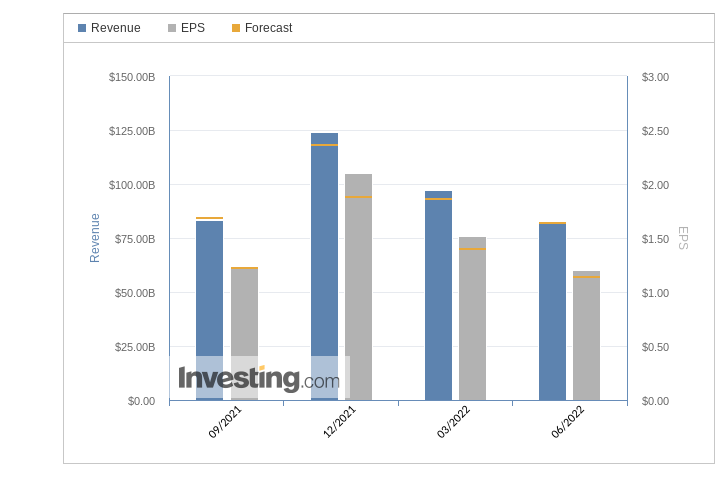

According to analysts’ consensus estimates compiled by Investing.com, the company’s sales for the quarter ended on Sept. 30 are expected to have expanded 6% to $88.76 billion when compared with the same period a year ago. The earnings per share are expected to remain roughly flat at $1.27.

Apple warned earlier this year that the second half of this year could prove rough due to supply chain hurdles and the weakening demand from China and Europe. But these headwinds, so far, haven’t caused the damage as big as earlier anticipated.

Apple Earnings History

Source: Investing.com

This year, Apple introduced the iPhone 14, new AirPods Pro earbuds, and new Apple Watch models. The latest pre-order data showed that the iPhone 14 Pro Max was the best-selling model, surpassing what the older version did in a similar timeframe.

Due to Apple’s product strength, the analyst community is generally upbeat about Apple’s growth prospects. According to InvestingPro data, there has been only 4% downward revision in the company’s EPS estimates during the past 90 days.

Source: InvestingPro

The major driver of this optimism is Apple's wealthy and loyal consumer base, in theory, more resilient to macroeconomic headwinds. During the previous quarter, Apple’s iPhone and iPad both performed better than feared, while other products -- including Macs and wearables -- fell short of analysts’ projections. Services, a key growth area for Apple, also showed some weakness.

Still, there are some signs that the current challenging conditions are hampering growth for Apple’s flagship iPhones. The company is backing off plans to increase production of its new iPhones this year after an anticipated surge in demand failed to materialize, Bloomberg reported last month.

“The Cupertino, California-based electronics maker has told suppliers to pull back from efforts to increase assembly of the iPhone 14 product family by as many as 6 million units in the second half of this year,” the report said citing sources.

Global demand for personal electronics has also been suppressed by surging inflation, recession fears and disruption from the war in Ukraine. The smartphone market is expected to shrink by 6.5% this year to 1.27 billion units, according to data from market tracker IDC.

Bottom Line

Apple earnings may show some slowdown in demand when it reports later this week. But the market isn’t expecting any major negative surprise.

Disclosure: At the time of writing, the author was long on Apple stock. The views expressed in this article are solely the opinion of the author and should not be taken as investment advice.

***

The current market makes it harder than ever to make the right decisions. Think about the challenges:

- Inflation

- Geopolitical turmoil

- Disruptive technologies

- Interest rate hikes

To handle them, you need good data, effective tools to sort through the data, and insights into what it all means. You need to take emotion out of investing and focus on the fundamentals.

For that, there’s InvestingPro+, with all the professional data and tools you need to make better investing decisions. Learn More »