- Reports Q1 2022 results on Thursday, Jan. 27, after the market close

- Revenue Expectation: $118.68 billion

- EPS Expectation: $1.89

When reporting quarterly earnings later today, Apple (NASDAQ:AAPL) needs to show that the supply-chain disruptions that limited its ability to sell more hardware are easing. Otherwise, it will be difficult for the world’s most-valued company to arrest a slide in its shares and prove to investors that its multiples are still at reasonable levels.

In line with the broader market, shares of Apple have been slumping over the past few weeks. After hitting a record high of $182.94 in early January, the iPhone maker lost around 12% of its market value, closing at $159.69 a share on Wednesday.

In October, during the company’s last earnings report, Chief Executive Officer Tim Cook warned that semiconductor shortages were affecting pretty much every product the Cupertino, California-based company makes in its global factories, even though demand remained robust.

Furthermore, Cook stressed that the shortages, along with COVID-19 restrictions, delayed shipments of the company’s flagship iPhones and other popular gadgets, amounting to a loss of around $6 billion in potential sales.

Record Holiday Season

Despite supply chain hurdles, Apple is still on track for a record holiday season, with analysts projecting a sales increase of 6% to $118.68 billion in the final three months of the calendar year.

But there is some consensus that it won’t be the blockbuster quarter that Apple had initially envisioned. Shortages and delivery delays have frustrated many consumers. And with inflation and the Omicron variant bringing fresh setbacks, consumer sentiment might be declining as well.

According to Bloomberg, Apple told its suppliers last month that iPhone demand was slowing.

We believe, however, that these challenges are short-term in nature and can’t hide the fact that Apple has entered another super growth cycle, fueled by its latest iPhone models and soaring demand for its wearables and other gadgets as well as its services.

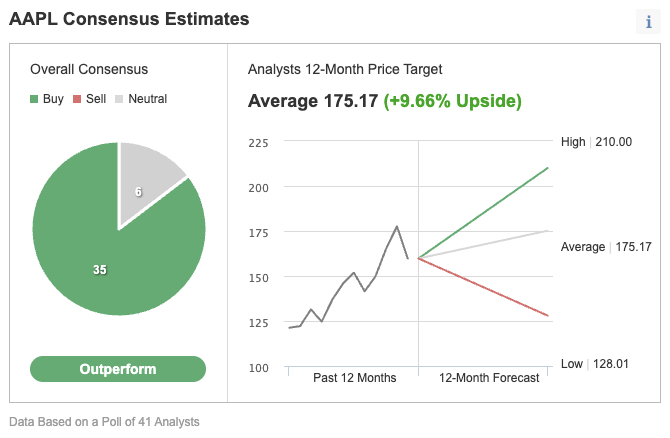

That’s perhaps the reason why the majority of 41 analysts polled by Investing.com are recommending buying Apple stock. Their consensus price target of about $175 implies a 9.66% upside potential.

Chart: Investing.com

However, in a recent note, analysts at JPMorgan said AAPL shares are not cheap relative to earnings. Still, the company’s positive outlook for 2022 should keep investors happy, especially in the fiscal second-quarter when iPhone sales could touch $49.2 billion.

Its note said:

“We believe investors will continue to justify the premium earnings multiple (30x) on expectations of further earnings upgrades, driving the shares higher with the positive outcome from a combination of a modest fiscal, first-quarter beat and a better outlook.”

Bottom Line

While Apple may disappoint some shareholders by not producing a blockbuster quarter due to supply-chain disruptions and the spread of the Omicron variant, we believe any post-earnings weakness is a buying opportunity for long-term investors, given the enormous pent-up demand for its products and services.