- Reports Q4 2021 results on Tuesday, Feb. 1, after the market close

- Revenue Expectation: $4.47 billion

- EPS Expectation: $0.75

When Advanced Micro Devices (NASDAQ:AMD) reports its latest quarterly earnings on Tuesday, after the close, the chip-maker will have to show that the high-powered growth that sent its shares soaring over the past two years is still in force.

The ongoing sell-off in growth stocks has hit AMD shares hard this month, sending its stock down almost 30%, approximately double the losses that the benchmark Philadelphia Semiconductor Index suffered during the same period.

This rapid unraveling for the Santa Clara, California-based AMD, whose shares closed at $105.24 on Friday, comes after solid gains during the past two years, backed by its market share expansion at a time when close competitor Intel (NASDAQ:INTC) struggled to bring new chips to market.

AMD expects $4.5 billion in sales in the fourth quarter, fueled by the company’s computing and graphics segments. That represents 39% growth when compared with the same period a year ago. If the company is able to deliver this acceleration, sales for the current fiscal year will grow by more than 50%.

AMD is also better positioned to outperform when chip shortages are hurting many industry players during the COVID-19 pandemic. The differentiator is AMD's long-term relationship with main supplier, Taiwan Semiconductor Manufacturing (NYSE:TSM), which operates some of the world’s leading chip producing plants.

Expanding Market Share

Amid a robust sales environment, AMD is also succeeding at keeping costs under control in order to increase its profitability. Its gross margin was 48% in the third quarter, up from 44% during the same period last year since customers were willing to pay more for the company's chips. It forecast gross margins at 49.5% in the fourth quarter.

AMD’s fast expanding market share and its track record of exceeding expectations have prompted many top analysts to turn bullish on its stock.

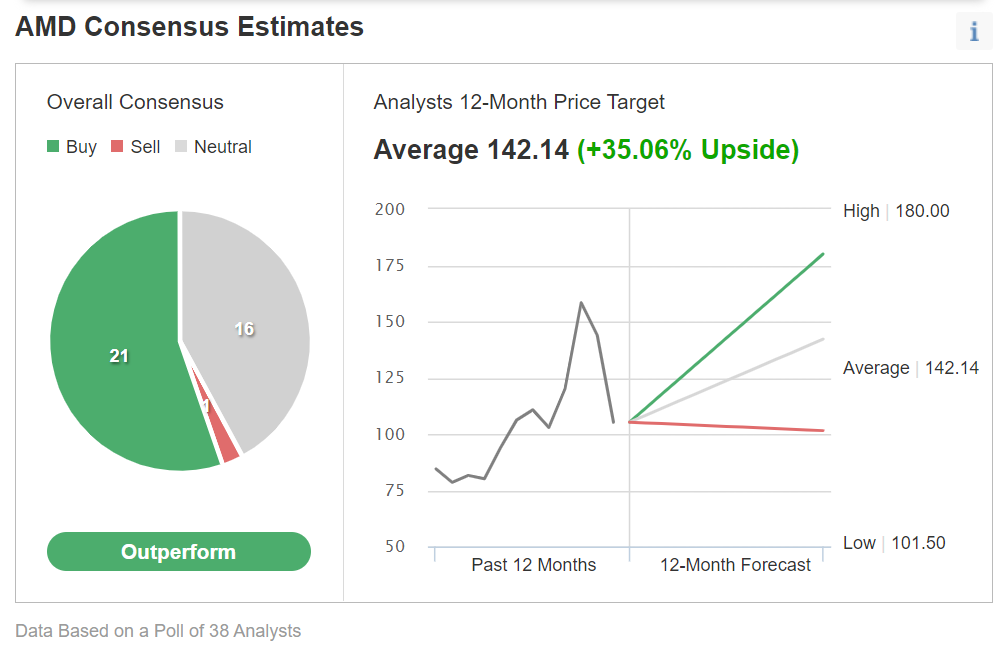

Of 38 analysts polled by Investing.com, 21 have an “outperform” rating on the stock, while 16 are neutral.

Chart: Investing.com

Their 12-month consensus price target of $142.14 implies a 35% upside potential.

In addition, AMD is one of the leading chip manufacturers likely to benefit from global companies planning to boost capital expenditures in order to participate in the “metaverse,” the next generation of the internet that will enhance social connection and include virtual worlds with real economies.

While AMD’s fundamentals remain strong, there are some risks in the short term that don’t justify another powerful rally in the stock this year.

Piper Sandler, in a recent note to clients, downgraded AMD to neutral with a price target of $130 a share. Its note said:

“Our downgrade is driven by a combination of factors: 1) our concerns about a slowdown in the PC market during 2022, 2) the earnings and growth headwind from closing the Xilinx (NASDAQ:XLNX) deal, and 3) the broader market dynamics around high-multiple, high-growth technology stocks.

"Given these three dynamics, we feel there is more downside risk than upside risk at this point in time.”

Bottom Line

AMD shares are under pressure after rallying strongly during the past two years. This pullback, in our view, is a buying opportunity for long-term investors.

The market gains that AMD made in recent years are translating into robust earnings growth, providing a solid reason for investors to remain bullish about the company’s prospects.