Shares in online accommodation marketplace, Airbnb (NASDAQ:ABNB) fell on concerns about the potential impacts of the Omicron variant of COVID-19 on global travel.

But, coronavirus aside, the stock has been having a rough time for a while. Although there is general agreement that the company has a compelling value proposition which it has executed well, regulatory risks could significantly impact the business.

Cities rely on lodging taxes from hotels and motels and are concerned about protecting this source of income. In addition, a growing constituency is warning that ABNB short-term rentals aimed at vacationers and business travelers reduce the housing stock available to permanent residents and drive up rents.

ABNB has created a globally-recognized and respected brand for brokering short-term stays in privately-owned residences. This is an incredible accomplishment, but the question for investors is whether the shares represent an attractive risk-return proposition.

Source: Investing.com

The last year has been a rollercoaster for ABNB shareholders, with the shares ranging from a 12-month low close of $121.51 on Dec. 15, 2020 to a high close of $216.84 on Feb.11, 2021.

After falling from the $200+ levels in February and March, the shares recovered to close at a recent high of $207.04 on Nov. 16. The shares are currently about 12% below this level.

ABNB is a young company and its entire history as a public company has been in the shadow of COVID-19—it is hard to believe that the IPO was less than one year ago.

Estimating the fair value of the shares depends on evaluations of a host of uncertainties about travel volumes, changes in regulations, and interest rates. The value of a company is based on estimates of the net present value of future earnings. When most of the expected earnings are relatively far into the future (as with ABNB), the share value is quite sensitive to assumptions about interest rates. The discount factors used to bring future earnings to net present value are primarily determined by rates.

Rather than attempt to forecast all of the factors necessary to value ABNB, I rely on two forms of consensus outlooks. In evaluating complex problems, consensus estimates are often the best sources of guidance. The first of the consensus outlooks I consider is the Wall Street consensus rating and price target. The second is the market-implied outlook, which is a probabilistic price outlook that is implied from the prices of options on a stock.

The price of an option on a stock reflects the market’s consensus estimate of the probability that the share price will rise above (call option) or fall below (put option) a specific level (the option strike price) between now and when the option expires.

By analyzing the prices of calls and puts at a range of strike prices, all with the same expiration date, it is possible to calculate a probabilistic outlook that reconciles the options prices. This is the market-implied outlook.

I last analyzed ABNB on Mar. 24, 2021. The Wall Street analyst consensus outlook suggested that the shares had little or no expected upside for the next 12 months, although the consensus rating was bullish or neutral, depending on the source. The market-implied outlook was strongly bearish. I assigned a bearish rating overall.

In the 8+ months since my post, ABNB has been very volatile. While the shares are modestly higher than on Mar. 24, ABNB has substantially underperformed the S&P 500 over this period.

I have updated the market-implied outlook for ABNB and examined the current Wall Street consensus outlooks in order to reconsider my rating for ABNB.

Wall Street Analyst Consensus Outlook for ABNB

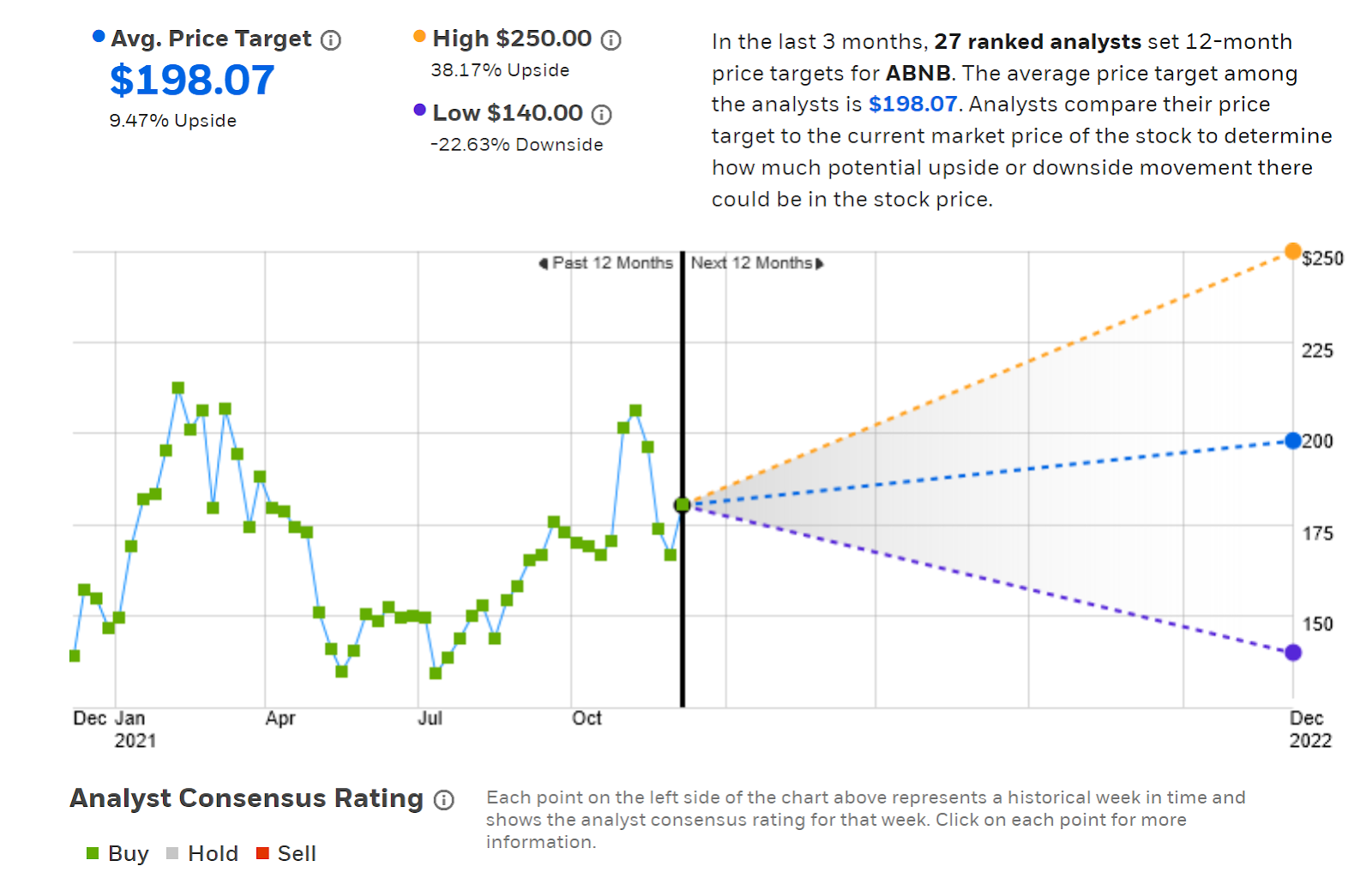

E-Trade calculates the Wall Street consensus outlook by combining the views of 27 ranked analysts who have published ratings and price targets for ABNB over the past 90 days. The consensus rating for ABNB is bullish and the consensus 12-month price target is 9.47% above the current share price.

Of the 27 analysts, 14 assign a buy rating to ABNB, 12 give the stock a hold rating, and only 1 has a sell rating. There is a large spread in the price targets, which reduces confidence in the predictive value of the consensus.

Source: E-Trade

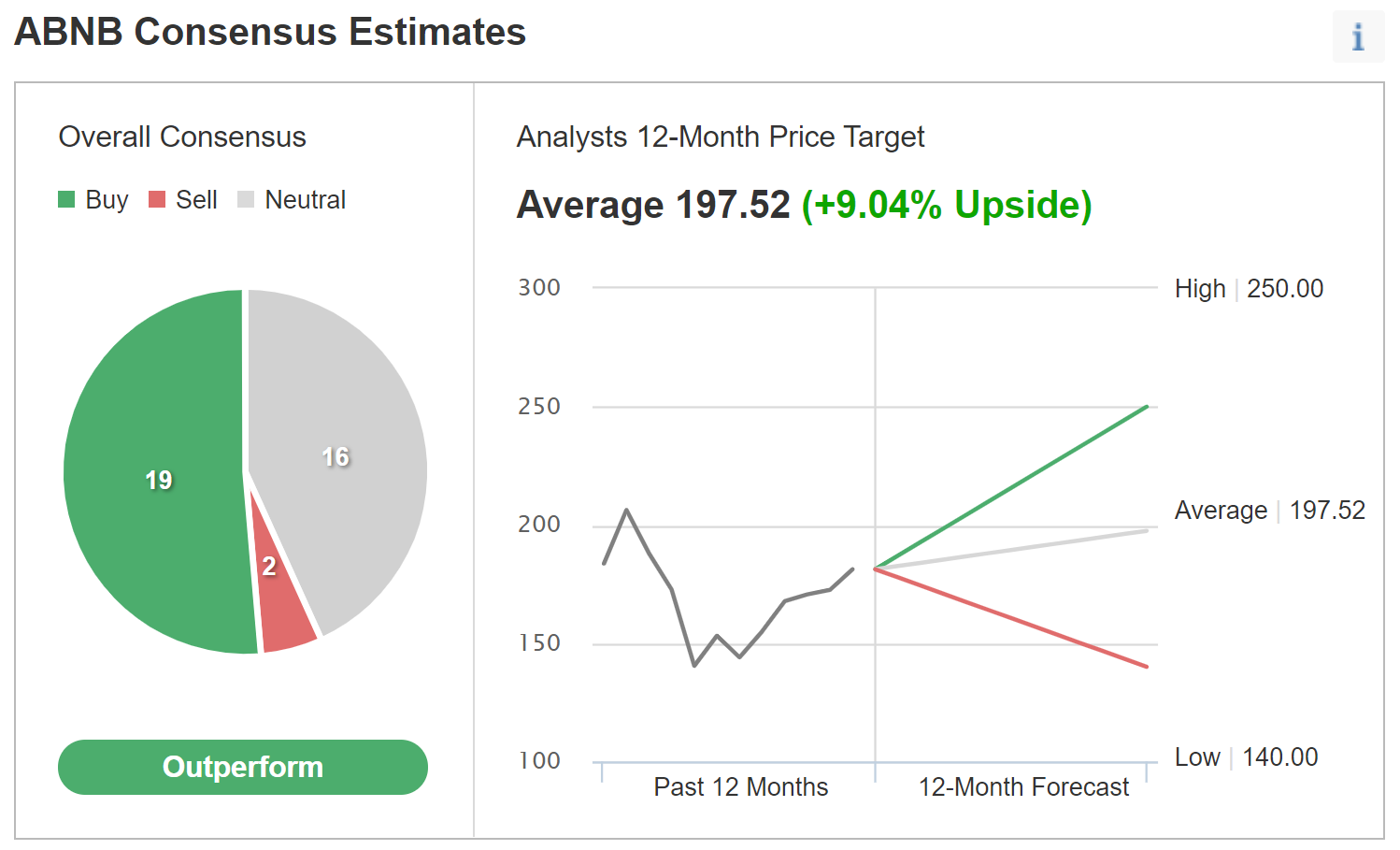

Investing.com combines ratings and price targets from 37 analysts in calculating the Wall Street consensus outlook. The consensus rating is bullish and the consensus price target is 9.04% above the current share price. More analysts assign a buy rating than a neutral rating, but the difference is quite small, similar to the E-Trade consensus cohort.

Source: Investing.com

These two calculations for the Wall Street consensus are similar to each other, with a bullish rating, although a substantial share of the analysts are neutral. The consensus 12-month price targets are very close, implying an expected 12-month price appreciation of 9-9.5%.

Back in March, the consensus 12-month price target was very close to the share price, suggesting no expected precise appreciation for the next year. The current consensus outlook is improved, but the question is whether an expected return of less than 10% is worth the risk (assuming one accepts the consensus outlook at face value). The high level of dispersion in the price targets suggests low confidence in the consensus, however.

Market-Implied Outlook for ABNB

I have calculated the market-implied outlooks for ABNB for the next 6.4 months (by analyzing options that expire on June 17, 2022) and for the next 13.5 months (by analyzing options that expire on Jan. 20, 2023). I selected these two expiration dates because trading of options that expire in June and January tends to be especially active, adding confidence that the options prices reflect a broad consensus of views. In addition, of course, these two expiration dates provide a view to the middle of 2022 and through 2022 into early 2023.

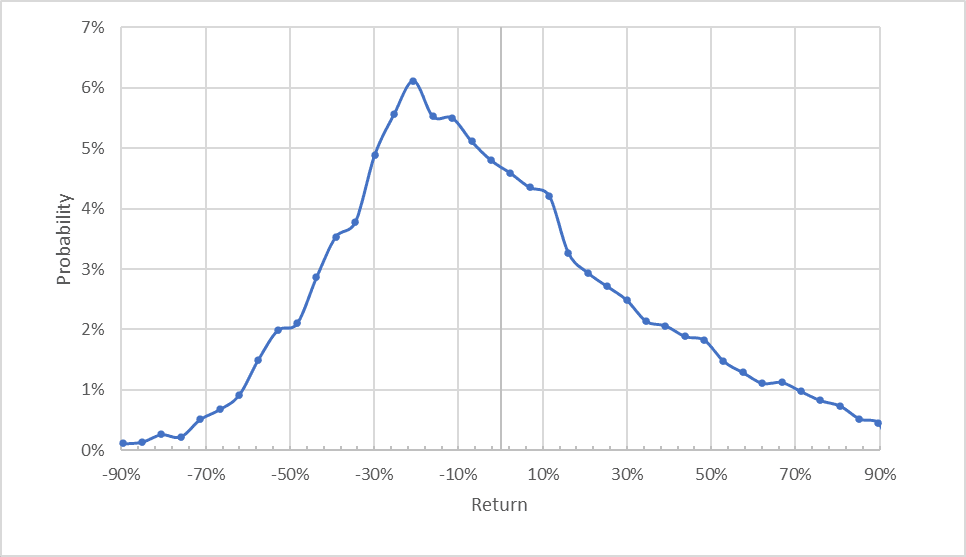

The standard presentation of the market-implied outlook is in the form of a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Source: Author’s calculations using options quotes from E-Trade

The market-implied outlook to the middle of 2022 is notably skewed to favor negative returns. There is a well-defined peak in probability that corresponds to a price return of -21% for this period. The annualized volatility is 54%, which is high for an individual stock.

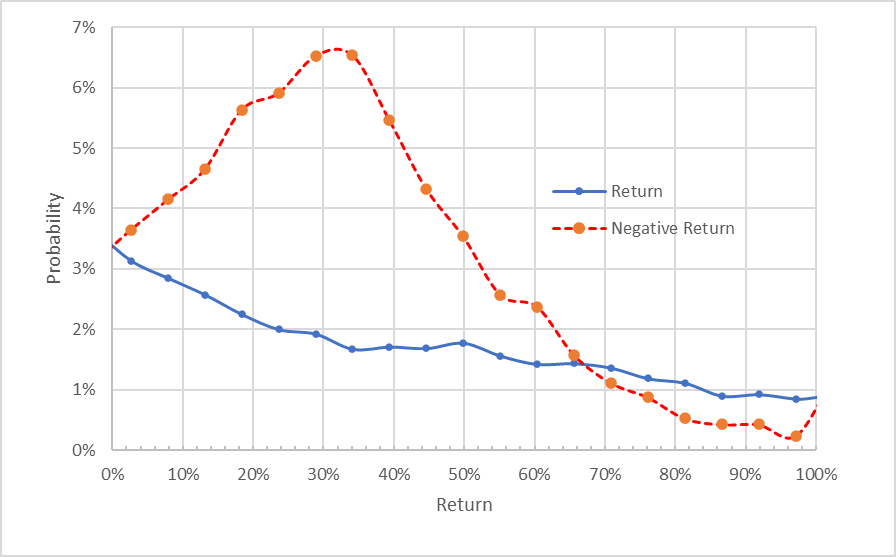

To make it easier to directly compare the probabilities of positive and negative returns, I rotate the negative return side of the distribution about the vertical axis (see chart below).

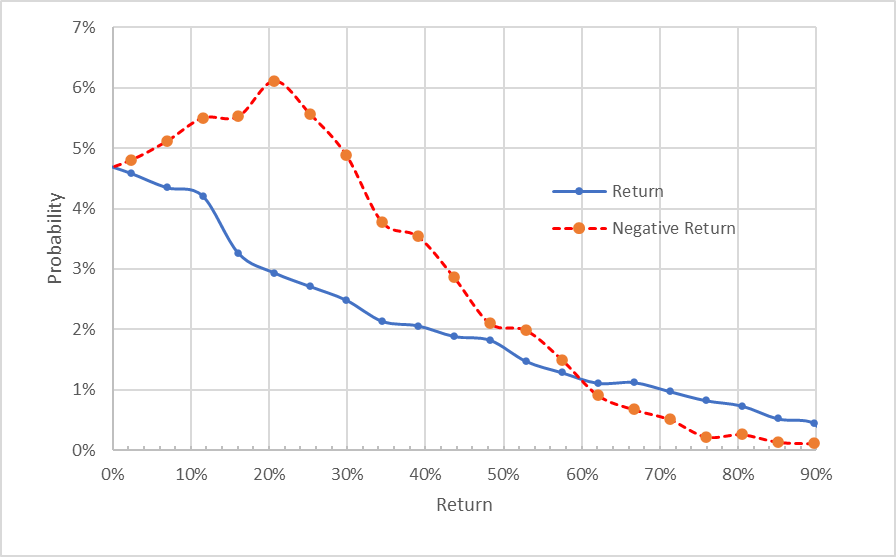

Source: Author’s calculations using options quotes from E-Trade. The negative return side of the distribution has been rotated about the vertical axis.

This view shows that the probabilities of negative returns are considerably higher than for positive returns of the same magnitude for a wide range of the most-probable outcomes (the red dashed line is substantially above the solid blue line over the left ⅔ of the chart).

For a range of the largest-magnitude returns, the probability of positive returns is higher (the right ⅓ of the chart). This shows that there is a small probability of outsized positive returns. This reflects the positive skewness in market expectations. There is a research literature that finds that stocks with this characteristic tend to underperform. This occurs because investors have an affinity for the ‘embedded lottery ticket’ of positive skewness and tend to bid up the prices of stocks with this characteristic.

This market-implied outlook for ABNB is bearish because there is a substantial tilt in the probabilities towards negative price returns. There is also a small but robust probability of outsized positive returns, and this is what attracts many investors.

The 13.5-month outlook to January of 2023 is consistent with the 6.4-month outlook, albeit even more bearish. The outlook has substantial positive skewness and the peak in probability occurs at a price return of -31% over this period. The annualized volatility calculated from this distribution is 51%.

Source: Author’s calculations using options quotes from E-Trade. The negative return side of the distribution has been rotated about the vertical axis.

The market-implied outlook through 2022 is bearish, with high volatility. These results are qualitatively very similar to the market-implied outlooks that I calculated in March.

Summary

Innovative companies that disrupt and transform their industries are rare and Airbnb is such a company. This does not, however, make the shares a good investment.

It is very hard to have confidence in forward-looking analysis for ABNB. The consensus rating from Wall Street is bullish, but there is not a strong majority of analysts who are bullish. The consensus 12-month price target is about 9.25% above the current share price.

Given the high risk (with expected annualized volatility of 50%), this level of expected return is not compelling.

The market-implied outlooks to June of 2022 and to January of 2023 are bearish, with probabilities that substantially favor losses. The stars may align for ABNB over the next year, but the odds are not good. In balancing the bullish consensus rating from Wall Street with the bearish market-implied outlook through 2022, I am changing my rating on ABNB to neutral.