- There may be no recession in 2023, just a period of slower growth

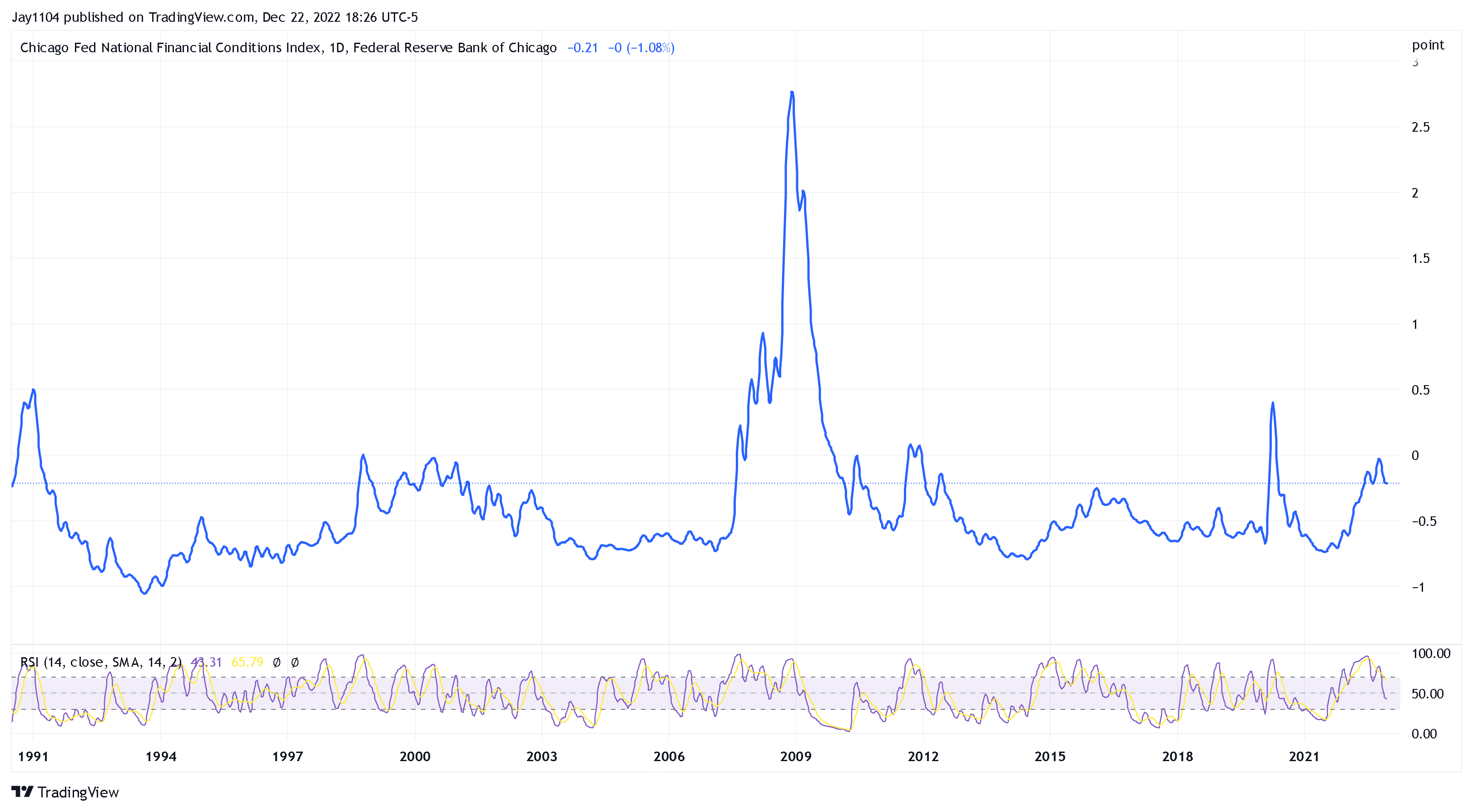

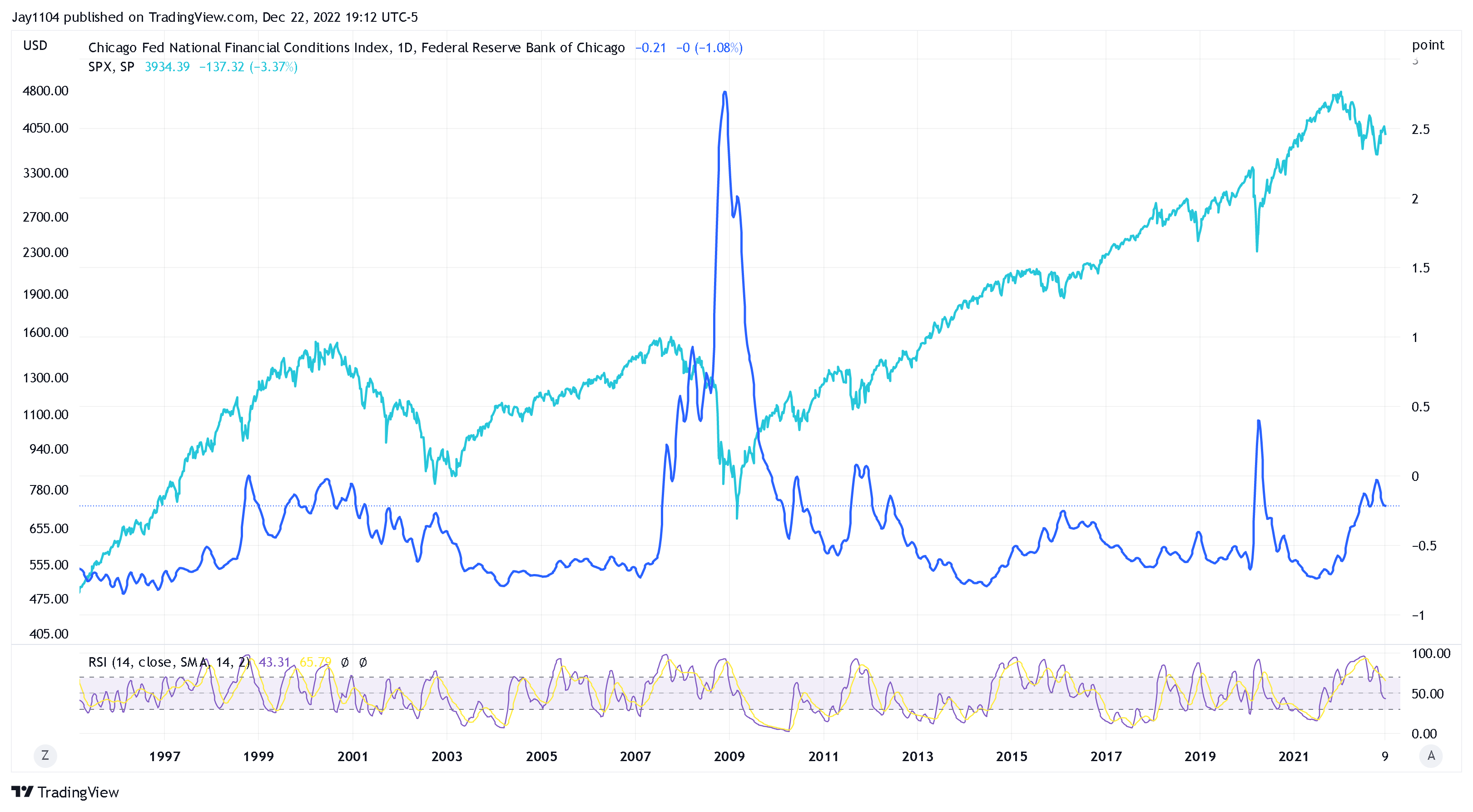

- It will allow the Fed to keep financial conditions tight.

- Tight financial conditions mean a stronger dollar, higher rates, and stagnant stocks

The theme heading into the end of 2022 is focused on expectations for a recession in 2023. While that may be the case, it is hard to find any objective evidence of that happening, despite a few data points here and there. GDP for the third quarter was revised sharply higher recently, and the Atlanta Fed GDPNow suggests fourth quarter growth is likely to be solid.

There could be a recession in 2023, but at this point, it seems more likely that we are heading towards a period of stagnation, where growth slows materially as inflation rates stay sticky and above the Fed’s target. This probably leads to a Fed that sticks to its December FOMC summary of economic projections, keeping rates higher for longer and keeping financial conditions tight.

For financial conditions to remain tight, it means the dollar remains strong, Treasury rates stay elevated, and stocks struggle in 2023.

It doesn’t have to mean the Dollar Index climbs to a new high; the odds do not favor that now that the Bank of Japan has indicated a willingness to shift towards a more hawkish monetary policy stance, which will help strengthen the USD/JPY. But it probably also means the dollar index doesn’t come crashing down as many investors seem to be expecting.

Stronger Dollar

While this may only be a short-term viewpoint currently, the dollar index is trying to bottom between 103.70 and 106, and it has an RSI turning higher. This suggests that the dollar could rally back toward that 110 level in the weeks ahead.

Higher Rates

Like the dollar, the United States 10-Year doesn’t have to make a new high for financial conditions to tighten; it simply needs to rise back to its highs and stay there. Like the dollar, the 10-year appears to be breaking free of a bullish reversal falling wedge pattern, indicating the rate may be heading back to its highs.

A stronger dollar and higher rates will be critical for tightening financial conditions. Financial conditions had eased since the middle of October as the dollar weakened and rates fell.

Stagnant Stocks

The final piece of the equation will be the equity market, and with financial conditions tight, we aren’t likely to see equities rally. It doesn’t mean they have to fall, but from a financial conditions standpoint, they can’t rally meaningfully either. If stocks rally, it will work to ease financial conditions; therefore, stocks are likely to move lower or stay range bound. The other issue is that if financial conditions are tight and work as intended, they should slow economic growth in 2023, which will likely hurt the economy and earnings.

That, overall, will make 2023 a complex landscape to navigate, and with the economy probably drawing close to the no-growth phase and flirting with recession, as many predict, it may make 2023 more challenging than 2022.

***

This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer's views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer's analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer's statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Past performance of an index is not an indication or guarantee of future results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index may be available through investable instruments based on that index. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should know the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment. Michael Kramer and Mott Capital received compensation for this article.