- In the previous edition, we discussed 5 stocks to fuel your portfolio gains in 2024.

- In this piece, we will take a look at 5 more stocks that you can consider adding to that list.

- These five stocks will ensure exposure to different sectors as well.

- Looking to beat the market in 2024? Let our AI-powered ProPicks do the leg work for you, and never miss another bull market again. Learn More »

In the last article, we delved into 5 stocks poised for success in 2024. Today, we shift our focus to the remaining stocks.

To analyze insightful data, we will harness the power of the InvestingPro tool.

1. Chevron

Chevron (NYSE:CVX) is one of the world's largest energy companies.

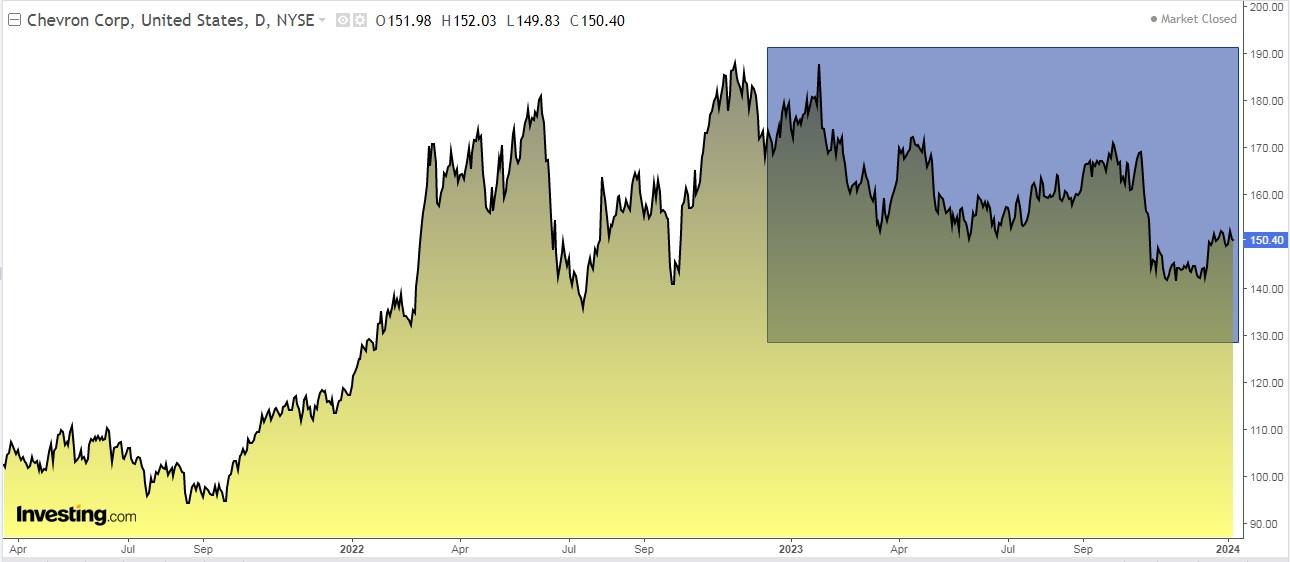

Its shares fell in 2023 because 2 of its largest oilfields suffered production shortfalls, and investors found the deal whereby Chevron paid $60 billion to buy Hess (NYSE:HES) expensive.

Its stock is cheap and trades at 10.8 times projected 2024 earnings. In addition, it intends to repurchase $20 billion in shares annually.

Thus, it trades at a 15% discount to its average cash flow multiple and should have a total return (dividends + buybacks) of around +12% after the Hess deal closes.

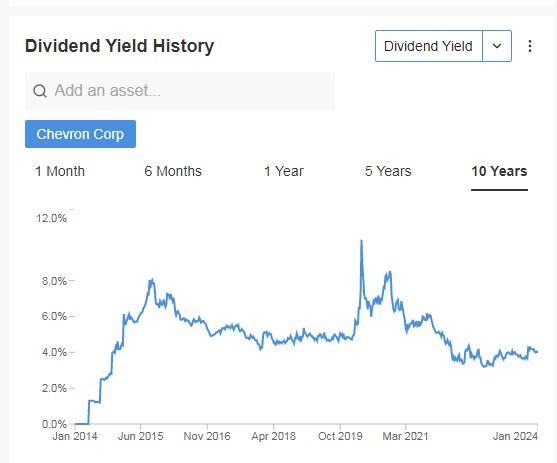

Its dividend yield is +4.04%.

Source: InvestingPro

On February 2, it presents its accounts for the quarter. Looking ahead to 2024 the forecast is for earnings per share (EPS) to grow by +4.9%.

Source: InvestingPro

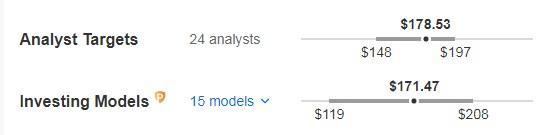

It has 25 ratings, of which 19 are buy, 6 are hold and none are sell.

The market sees potential at $178.53, while InvestingPro models see it at $171.47.

Source: InvestingPro

2. Alibaba

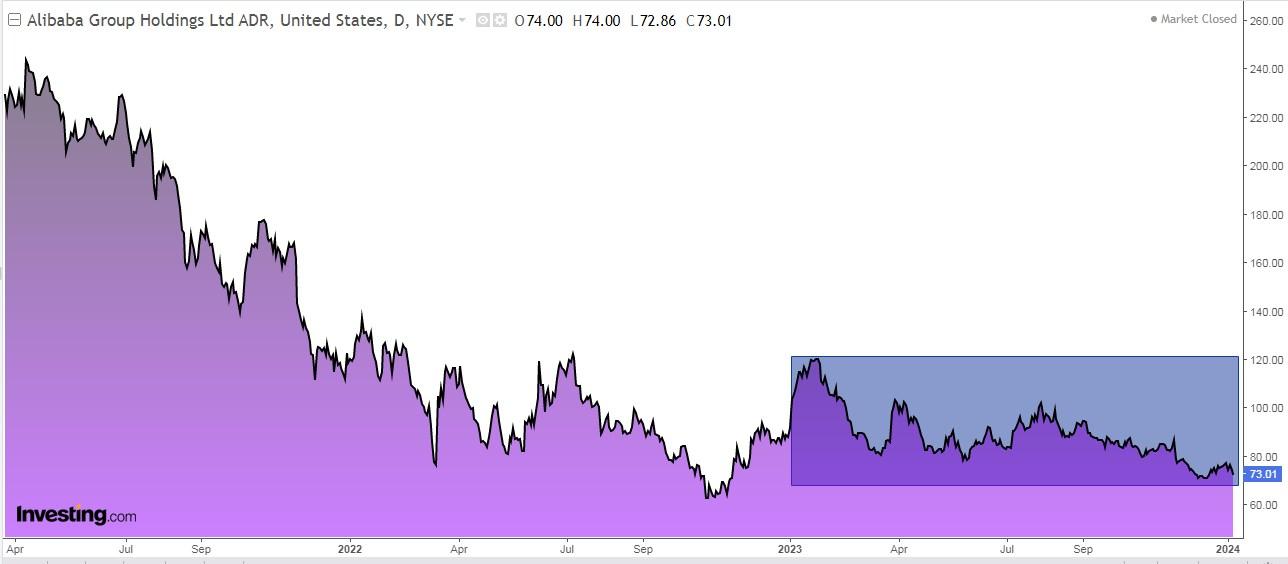

Alibaba (NYSE:BABA) is one of the cheapest tech companies in the world. Its U.S.-listed shares trade at just eight times projected earnings in its current fiscal year ending in March.

Adding its e-commerce unit in China, its logistics and cloud computing businesses, and a stake in Ant Financial, the sum of the company's parts amounts to about $130 per share, nearly double the current share price.

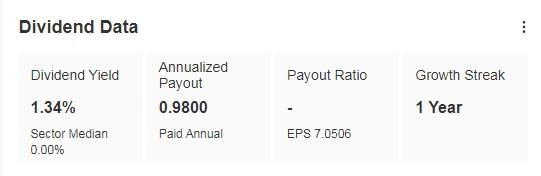

Its dividend yield is +1.34%.

Source: InvestingPro

On January 31, we will know its accounts and earnings per share (EPS) are expected to increase by +6.34% and by 2024 by +14.5%, and revenue by +5.5%.

Source: InvestingPro

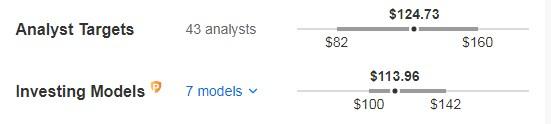

The market gives it a potential of $124.73, while InvestingPro models see it at $113.96.

Source: InvestingPro

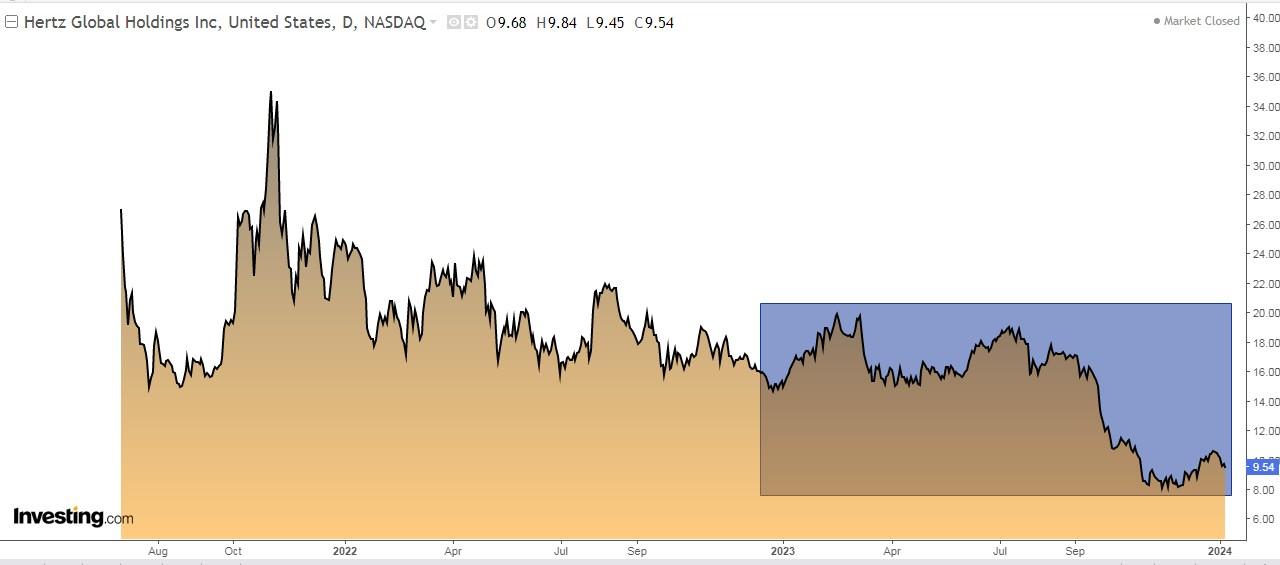

3. Hertz Global

The market didn't like Hertz's (NASDAQ:HTZ) big bet on electric vehicles (11% of its fleet) and it backfired, as the company is earning less than estimated.

But the car rental sector is 90% controlled by Enterprise, Avis, and Hertz, and even with earnings estimates cut, Hertz trades at a low price with 8.6 projected earnings by 2024. It trades at a very attractive price for patient investors.

The company does not distribute a dividend.

It reports its quarterly results on February 26 and is expected to increase its actual revenue by +4.15% and by 2024 by +4%.

Source: InvestingPro

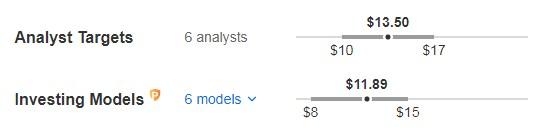

The market sees potential at $13.50, with InvestingPro's models being more moderate, seeing it at $11.89.

Source: InvestingPro

4. Madison Square Garden Sports

Madison Square Garden Sports (NYSE:MSGS) owns two of the most valuable professional teams in their respective sports: the New York Knicks and the Rangers.

According to Sportico estimates, the Knicks and Rangers are worth $7.4 billion and $2.45 billion, respectively. But the company's current market value of just $4.2 billion, plus about $300 million in net debt, is worth about half that.

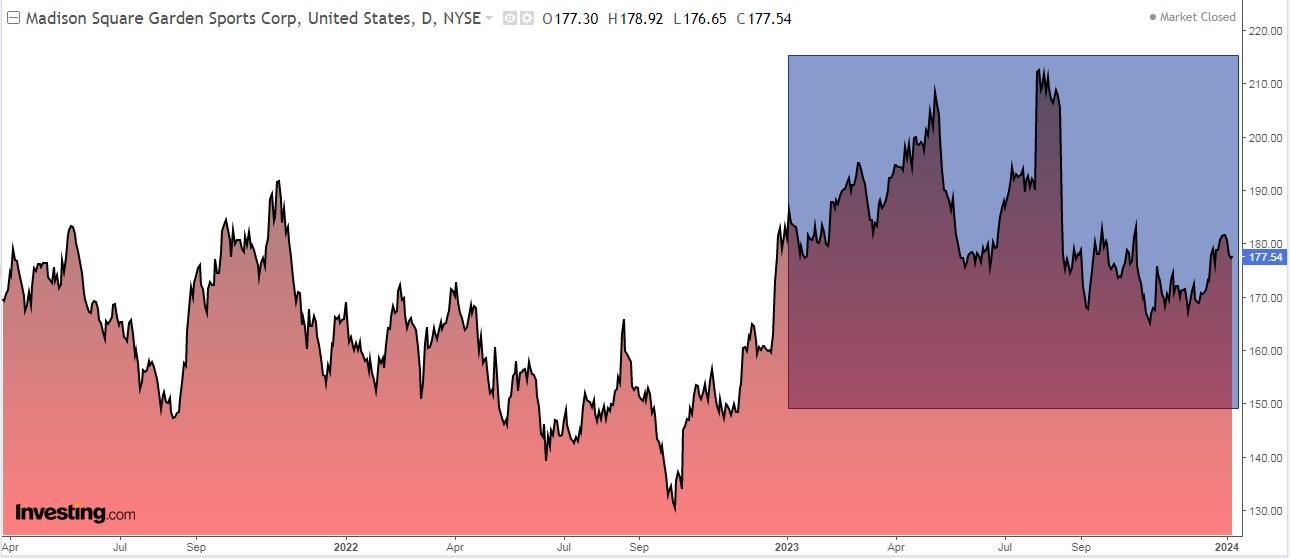

The stock is below where it was five years ago and cheap. It does not distribute a dividend.

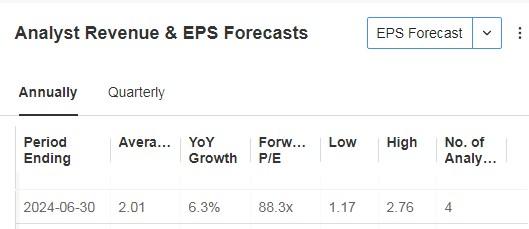

February 2 is the date set to release the quarter's numbers. Looking ahead to 2024, earnings per share (EPS) growth of +6.4% is expected.

Source: InvestingPro

It has 6 ratings, of which 4 are buy, 2 are hold and none are sell.

The market gives it potential at $244.60.

Source: InvestingPro

5. Pepsico

The impact of weight-loss drugs on PepsiCo (NASDAQ:PEP) snack and beverage franchise will likely be minimal.

Although it is named after a soft drink, Pepsi has the best snack franchise and generates more than half of the company's profits, making Pepsi less dependent on sugary soft drinks than Coca-Cola (NYSE:KO).

Its shares trade at 20.7 times projected 2024 earnings, below its five-year average.

Its dividend yield is +3%.

Source: InvestingPro

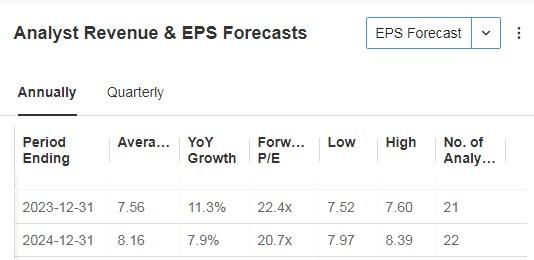

On February 9, we will know its quarterly accounts. For 2024 the forecast is for earnings per share (EPS) growth of +7.9% and revenue of +4.7%.

Source: InvestingPro

InvestingPro models see potential at $191.91.

Source: InvestingPro

***

In 2024, let hard decisions become easy with our AI-powered stock-picking tool.

Have you ever found yourself faced with the question: which stock should I buy next?

Luckily, this feeling is long gone for ProPicks users. Using state-of-the-art AI technology, ProPicks provides six market-beating stock-picking strategies, including the flagship "Tech Titans," which outperformed the market by 670% over the last decade.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of asset is evaluated from multiple perspectives and is highly risky, and therefore, any investment decision and the associated risk remains with the investor.