- The S&P 500 recently made new highs while tech stocks have remained in an uptrend.

- However, the Dow Jones has been overlooked by investors so far.

- So in this piece, we will take a look at 5 Dow Jones stocks you can consider adding to your portfolio.

- If you invest in the stock market, get an interesting discount HERE! Find more information at the end of this article.

In 2024, technology stocks, especially those related to artificial intelligence, have maintained their uptrend.

Meanwhile, the S&P 500 achieved a historic milestone by surpassing 5,000 points, reaching this level for the first time in its history.

This progression from 4,000 to the 5,000-point milestone took 719 trading sessions.

Our focus today shifts to the Dow Jones Industrial Average, where we will take a look at five stocks that the market expects to register double-digit gains this year.

Utilizing the InvestingPro tool, we can access relevant data and information to analyze these stocks in detail.

1. Chevron

Chevron (NYSE:CVX) was founded in 1879 and headquartered in California, the result of the dissolution of the Standard Oil trust.

In a period of more than forty years, John Rockefeller led Standard Oil to be the largest company in the world for a long time. It has major oil and natural gas fields, oil refineries and oil tankers.

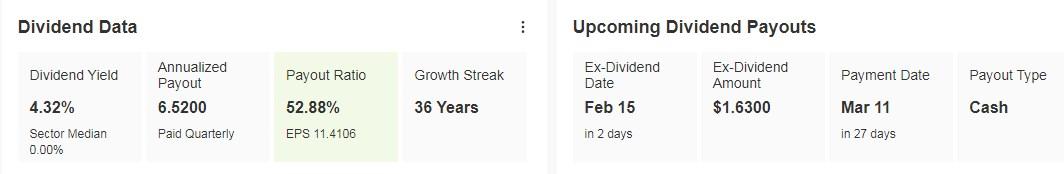

On March 11 it will distribute a dividend of $1.63 and to be eligible to receive it you must hold shares before February 15, the dividend yield being +4.32%.

Source: InvestingPro

Major oil and gas companies (such as BP (LON:BP), Chevron, Exxon Mobil (NYSE:XOM), Shell (LON:RDSb) and TotalEnergies (EPA:TTEF) collectively returned more than $111 billion to shareholders through dividends and buybacks.

Sector strategy differed between the U.S. and European companies, with the former focusing on boosting oil production and the latter allocating more capital to renewable and low-carbon projects.

On April 26 it will publish its results and for the 2024 computation the forecast is for a revenue gain of +3.7%.

Source: InvestingPro

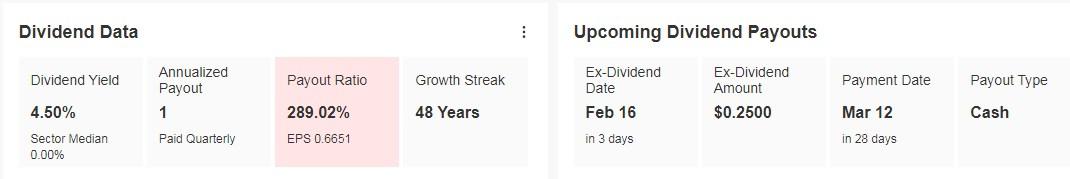

With data at the close of the week, the potential given by the market stands at $177.53, around +17.50%.

Source: InvestingPro

2. Walgreens Boots Alliance

Walgreens Boots Alliance (NASDAQ:WBA) is a multinational holding company that owns the retail pharmacy chains Walgreens in the United States and Boots in the United Kingdom, as well as several pharmaceutical manufacturing and distribution companies.

It was founded in 1909 and is headquartered in Deerfield, Illinois.

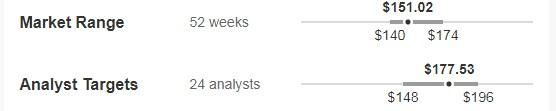

It will pay a dividend of $0.25 on March 12, and to be eligible to receive it, shares must be held prior to February 16, with the dividend yield being +4.50%.

Source: InvestingPro

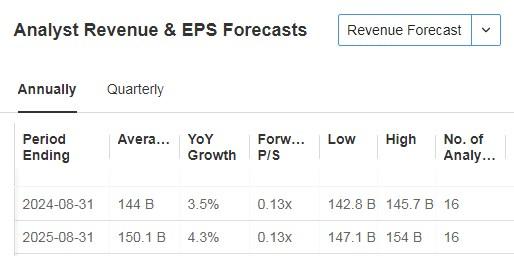

On March 27 it will publish its accounts and for the 2024 computation the forecast is for a revenue gain of +3.5%.

Source: InvestingPro

With data at the close of the week, the potential given by the market stands at $26.06, around +17.15%.

Source: InvestingPro

3. Cisco Systems

Cisco Systems (NASDAQ:CSCO) is a global company based in San Jose, California, founded in 1984 and mainly engaged in the manufacture, sale, maintenance and consulting of telecommunications equipment.

Its dividend yield is +3.11%.

Source: InvestingPro

February 14 will be the time to know its numbers. It comes from good previous results with an increase in earnings per share (EPS) of +7.7%.

Source: InvestingPro

With data at the close of the week, the potential given by InvestingPro models stands at $56.84, around +13.45%.

Source: InvestingPro

4. Verizon Communications

Verizon Communications (NYSE:VZ) is a global broadband and telecommunications company.

The company was formerly known as Bell Atlantic Corporation and changed its name to Verizon Communications in June 2000. It was incorporated in 1983 and is headquartered in New York.

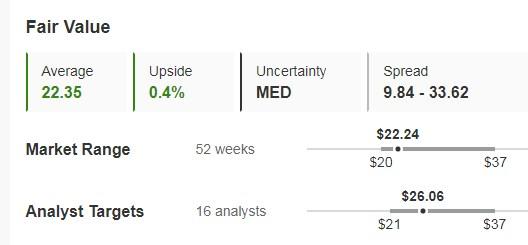

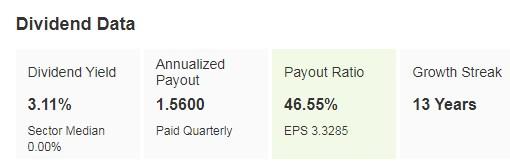

Its dividend yield is +3.11%.

Source: InvestingPro

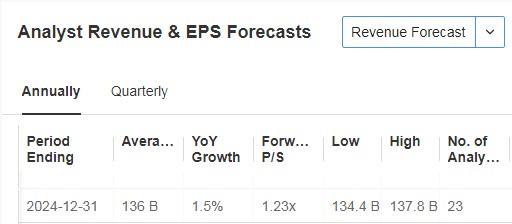

It will release its accounts on April 22 and for the 2024 computation the forecast is for a revenue gain of +1.5%.

Source: InvestingPro

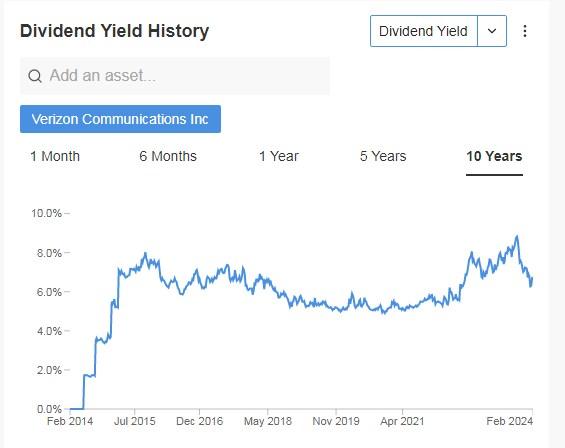

With data at the close of the week, the potential given by the market stands at $44.91, around +13%.

Source: InvestingPro

5. 3M Company

From the abbreviation Minnesota Mining and Manufacturing Company, 3M Company (NYSE:MMM) is a multinational company dedicated to researching, developing and marketing diversified technologies, offering products and services in various areas such as industrial equipment. It was founded in 1902 and is headquartered in Saint Paul, Minnesota.

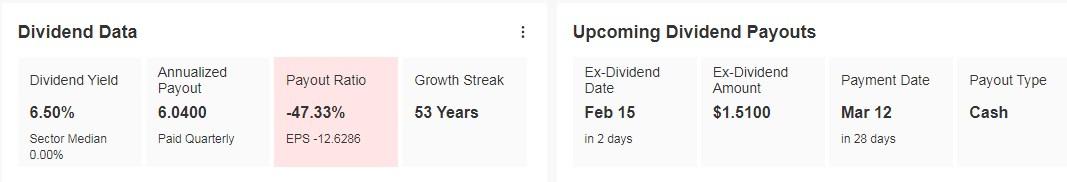

On March 12, it will distribute a dividend of $1.51 and in order to receive it, shares must be held before February 15, with the dividend yield being +6.50%.

Source: InvestingPro

On April 23 it will publish its results and for the 2024 computation the forecast is for an earnings per share (EPS) gain of +4.2%.

Source: InvestingPro

With data as of the close of the week, the potential given by InvestingPro models stands at $109.62, up around +18%.

Source: InvestingPro

***

Do you invest in the stock market? Set up your most profitable portfolio HERE with InvestingPro!

Apply discount code INVESTINGPRO1 and you'll get an instant 10% discount when you subscribe to the Pro or Pro+ annual or biyearly plan. Along with it, you will get:

- ProPicks: AI-managed portfolios of stocks with proven performance.

- ProTips: digestible information to simplify a lot of complex financial data into a few words.

- Advanced Stock Finder: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics.

- Historical financial data for thousands of stocks: So that fundamental analysis professionals can delve into all the details themselves.

- And many other services, not to mention those we plan to add in the near future.

Act fast and join the investment revolution - get your offer HERE!

Disclaimer:The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.