- Apple, Microsoft, Alphabet, Amazon, and Meta Platforms report next week

- Guidance updates will likely make or break the current market rally

With the NASDAQ Composite languishing in bear market territory amid a broad-based selloff in the tech space, Wall Street shifts into high gear next week with some of the biggest names in the market set to release financial results.

1. Microsoft

- Earnings Date: Tuesday, July 26 after the close

- EPS Growth Estimate: +5.5% yoy

- Revenue Growth Estimate: +13.5% yoy

- Year-To-Date Performance: -21.2%

- Market Cap: $1.98 Trillion

Microsoft (NASDAQ:MSFT) beat expectations on both the top and bottom lines in the previous quarter and gave upbeat guidance. Consensus estimates call for the software and hardware giant to report a 13.5% year-over-year (yoy) increase in revenue to $52.4 billion and EPS of $2.29 for its fiscal fourth quarter amid solid demand for its cloud computing products.

Investors will focus on growth in Microsoft’s booming Intelligent Cloud segment, which includes Azure, GitHub, SQL Server, Windows Server, and other enterprise services. The key unit saw sales growth of 26% in its most recent quarter to $19.1 billion, while revenue from its Azure cloud services grew 46%.

Revenue growth in the Productivity and Business Processes segment, including Office 365 cloud productivity software, Teams communications app, LinkedIn, and Dynamics products and cloud services, will also be of interest after increasing 17% to $15.8 billion in the last quarter.

Shares in the world's second most valuable company are down 21.2% year-to-date and nearly 24% below their all-time peak. Despite recent volatility, the Redmond, Washington-based tech behemoth’s stock still looks like a good bet given the strong performance of its commercial cloud business.

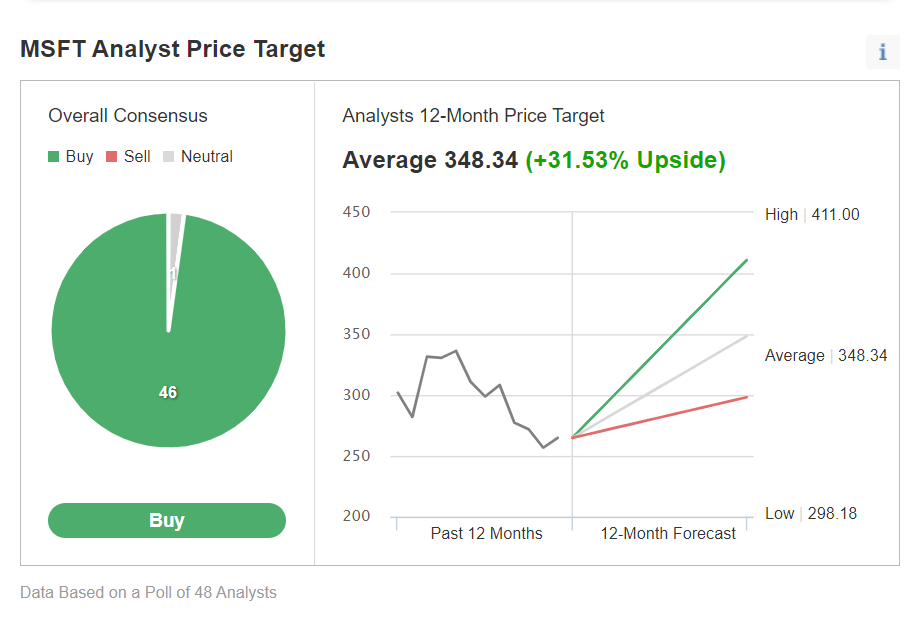

Source: Investing.com

46 out of 48 analysts surveyed by Investing.com rate Microsoft’s stock as a ‘buy’ with an average price target of around $348, representing an upside of nearly 31.5%.

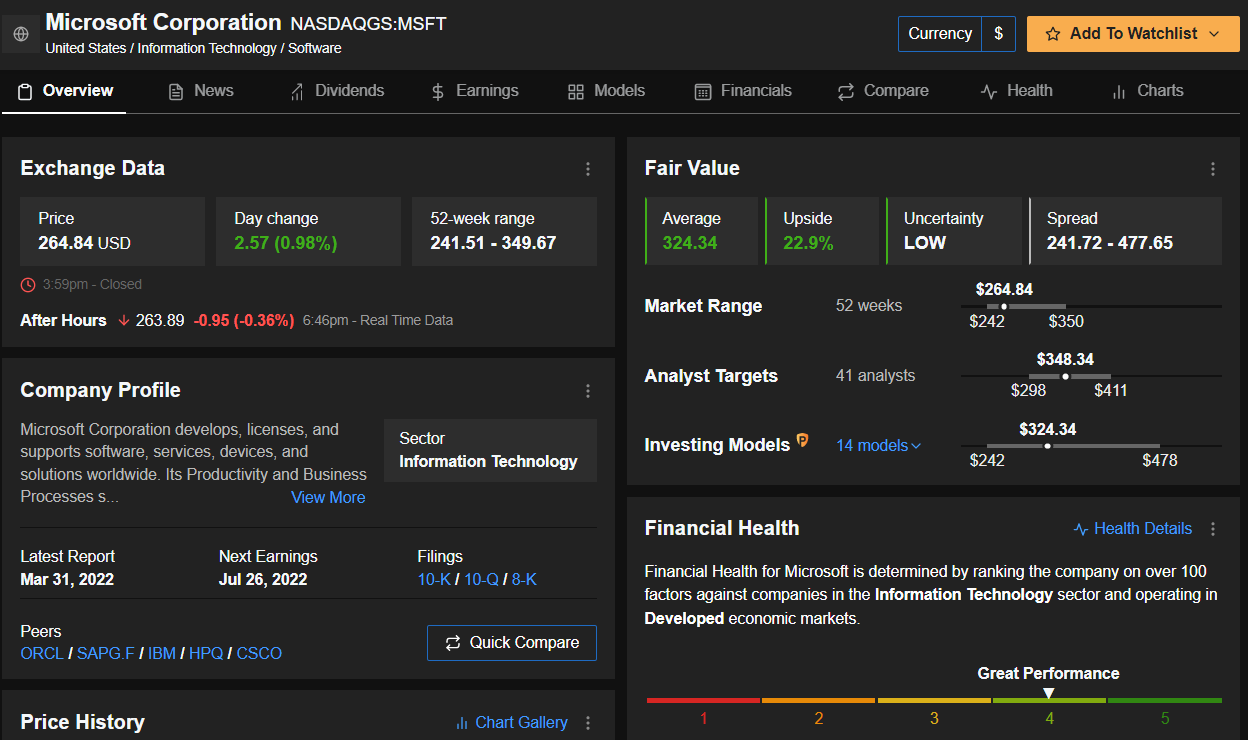

Similarly, the quantitative models in InvestingPro point to a gain of 22.9% in MSFT stock from current levels to $324.34, bringing shares closer to their fair value.

Source: InvestingPro

- Earnings Date: Tuesday, July 26 after the market close

- EPS Growth Estimate: -4.4% yoy

- Revenue Growth Estimate: +13.3% yoy

- Year-To-Date Performance: -21.1%

- Market Cap: $1.50 Trillion

Google-parent Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) missed expectations for earnings and revenue in the last quarter due to a slowdown in the online advertising market. Consensus calls for the tech giant to report a 13.3% increase in revenue to $70.1 billion but a 4.4% slide in EPS to $1.30.

Investors will be laser-focused on growth rates at Google’s core ad revenue business, which saw an annualized gain of 22.3% to $54.6 billion in the previous quarter. YouTube’s ad revenue growth is another relevant topic after falling significantly short of expectations in the last quarter amid mounting competition from Chinese video-sharing app TikTok.

In addition, Alphabet’s Google Cloud Platform should see another quarter of blockbuster growth after sales surged 44% in Q1. The search giant has been investing heavily in its cloud business as it catches up with Amazon Web Service and Microsoft Azure.

Despite shares in Google having fallen 21.4% year-to-date and 24.55 from its record high, it is the third most valuable company on the US market.

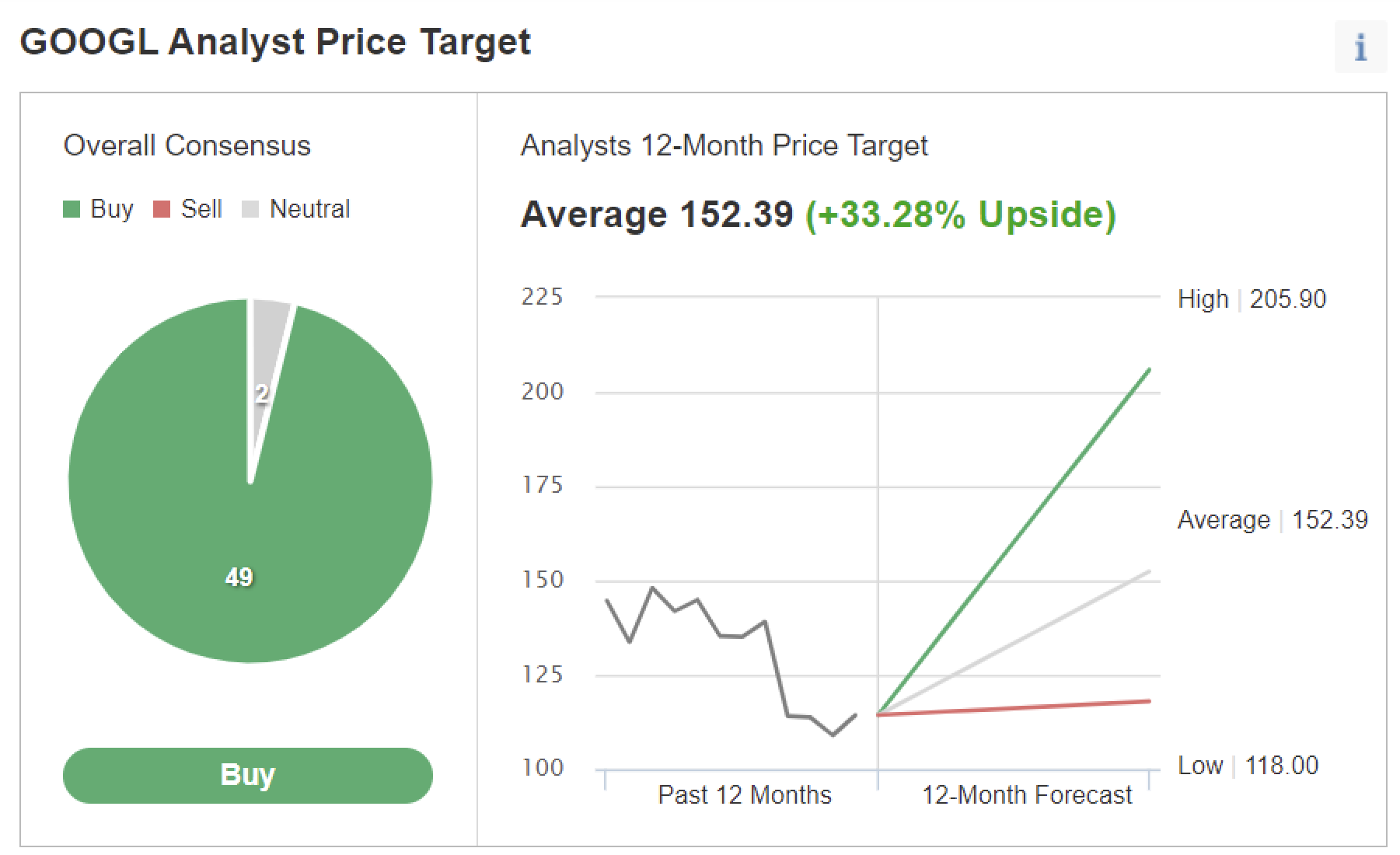

Out of the 51 analysts covering the stock, per an Investing.com survey, the consensus recommendation comes to ‘outperform’ with fairly high conviction as 49 analysts rate GOOGL at ‘buy.’

Source: Investing.com

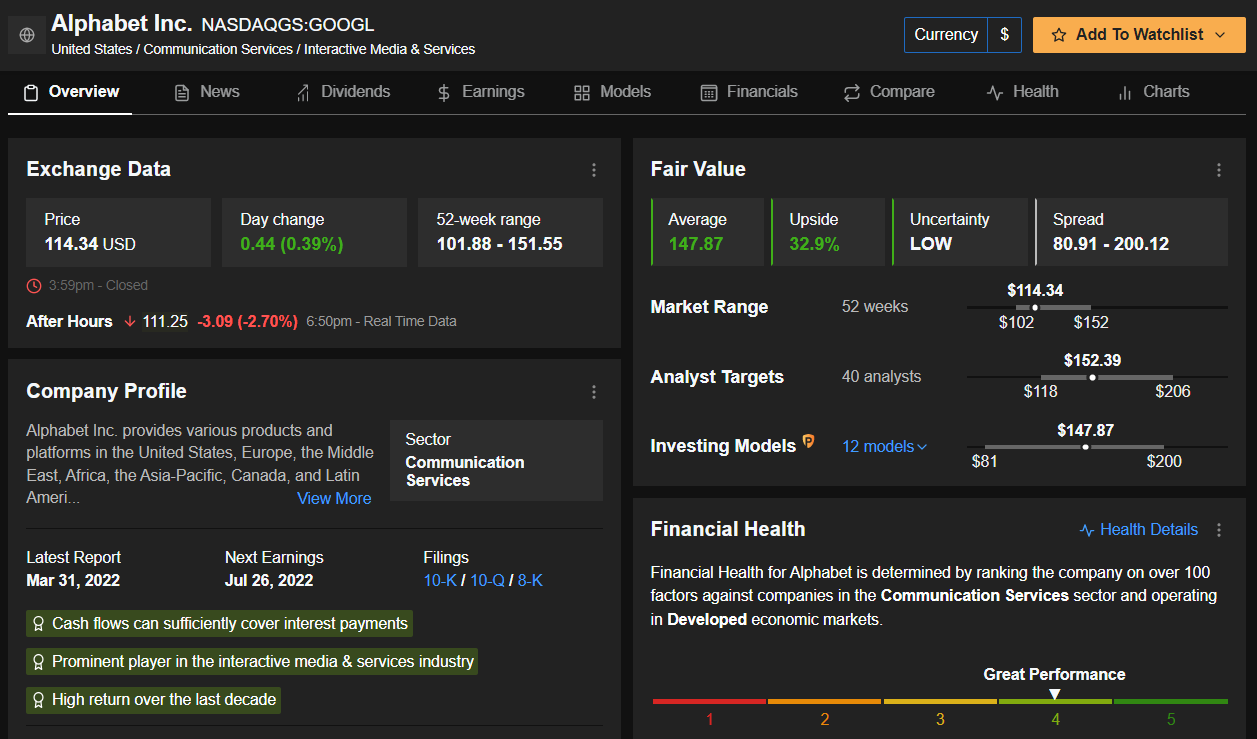

Their average target price of $152.39 gives GOOGL an implied upside of 33.28% over the next year. Likewise, the average fair value price for the shares on InvestingPro stands at $147.87, a potential 33% upside.

Source: InvestingPro

Meta Platforms

- Earnings Date: Wednesday, July 27 after the market close

- EPS Growth Estimate: -28.5% yoy

- Revenue Growth Estimate: -0.2% yoy

- Year-To-Date Performance: -45.5%

- Market Cap: $511.5 Billion

Meta Platforms (NASDAQ:META) beat profit expectations in Q1 but missed sales estimates and consensus calls for the social media giant to record a 28.5% slide in EPS to $2.58 yoy in the upcoming results due to higher costs and investments related to Meta’s hardware and VR segment. Revenue is also forecast to dip 0.2% to $29.0 billion due to weaker advertiser demand and lower ad prices on Facebook and Instagram.

As usual, the market will pay close attention to Facebook’s update on its daily and monthly active user accounts as they are critical metrics for the social network operator. Last quarter it reported daily active users (DAUs) climbed 4% to 1.96 billion, while monthly active users (MAUs) increased 3% to 2.94 billion.

Comments from CEO Mark Zuckerberg will also be in focus as the social media platform is shifting away from an advertising-based business and moves to an increasingly digital future.

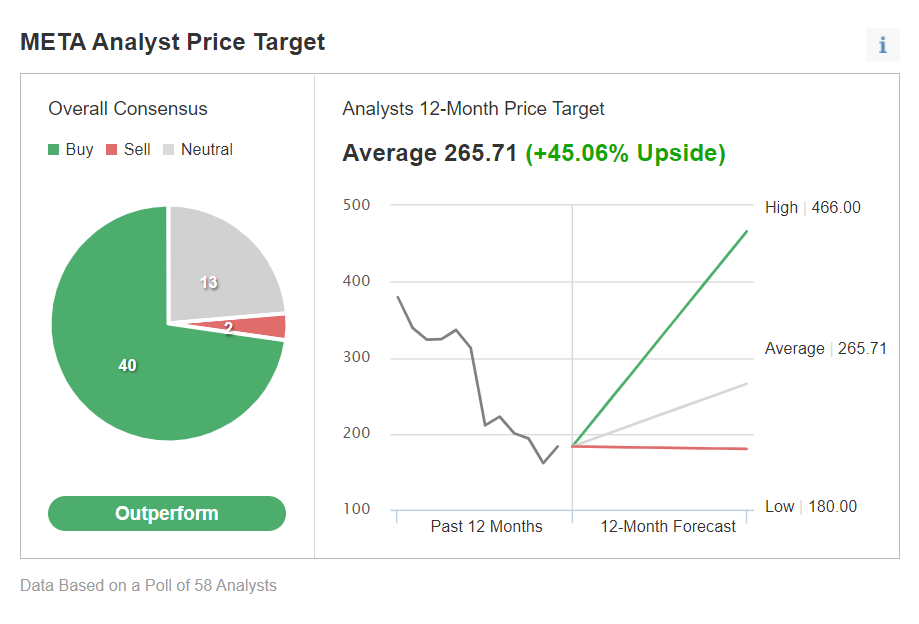

META stock, which is off 45.5% ytd and 52.3% below its record high, recently sank to its lowest level since April 2020. Despite near-term headwinds, most analysts remain generally bullish as per an Investing.com survey which revealed that 53 out of 58 analysts rated it as either ‘buy’ or ‘neutral’.

Source: Investing.com

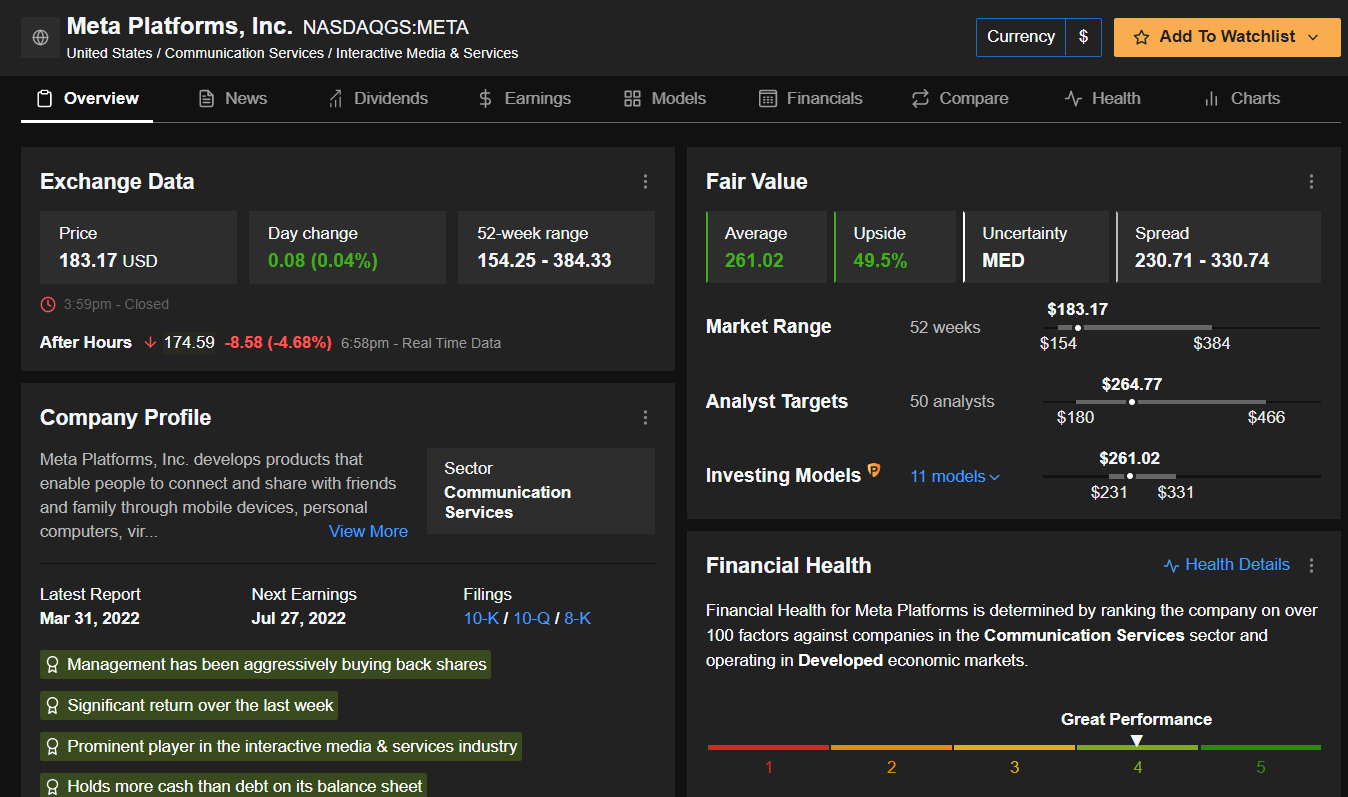

The average fair value price for Meta shares on InvestingPro is $261.02, a potential 50% upside.

Source: InvestingPro

Apple

- Earnings Date: Thursday, July 28 after the market close

- EPS Growth Estimate: -11.5% yoy

- Revenue Growth Estimate: +1.7% yoy

- Year-To-Date Performance: -12.5%

- Market Cap: $2.51 Trillion

Apple (NASDAQ:AAPL) reported impressive earnings last quarter but warned of slower growth ahead, primarily due to supply chain woes. Consensus calls for the iPhone maker to deliver Q3 revenue of $82.8 billion, up 1.7% yoy but EPS is forecast to slide to $1.15

Wall Street will pay close attention to growth in Apple’s iPhone and Mac businesses to see if it can maintain a strong performance despite a deteriorating macroeconomic environment. In the last quarter, iPhone and Mac sales rose 5.5% to $50.6 billion and 14.7% to $10.4 billion, respectively. As well as Apple’s booming services business, which includes sales from the App Store, music and video subscription services, extended warranties, licensing, and advertising, and posted yoy revenue growth of 17.3% in fiscal Q2.

One weak spot is expected to be the company’s iPad business where sales fell 1.9% in the last quarter, as it copes with supply constraints linked to the global chip shortage.

AAPL stock has fallen 12.5% year-to-date and is 15.1% below its all-time peak.

We foresee the positive trend in Apple resuming in the months ahead, given its dependably profitable business model and enormous cash pile.

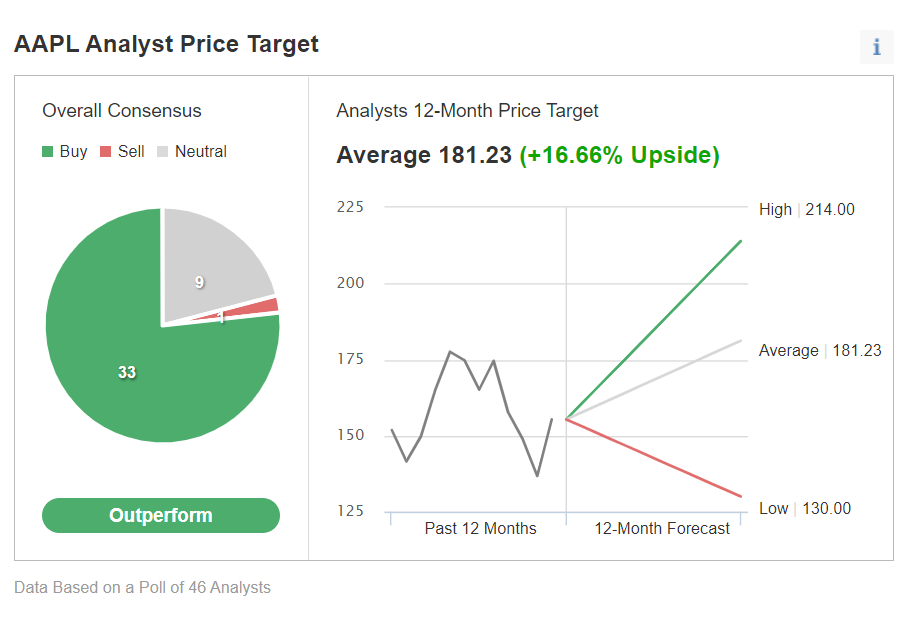

Source: Investing.com

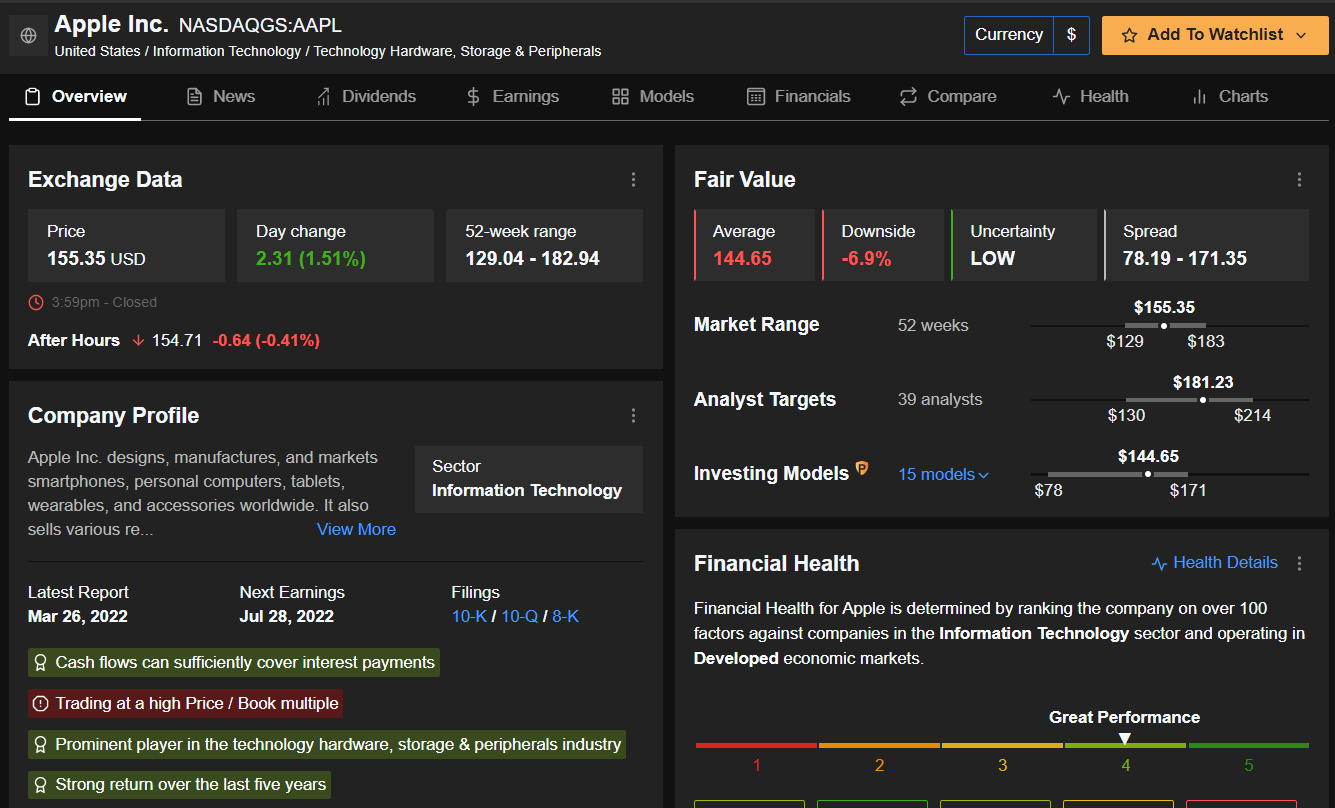

Indeed, 42 out of 46 analysts surveyed by Investing.com rate Apple’s stock either as ‘buy’ or ‘neutral’. Their average target price of $181.23 gives AAPL an implied upside of 16.6%.

In contrast, the average fair value for Apple’s stock on InvestingPro stands at $144.65, a potential 7% downside from the current market value.

Source: InvestingPro

Amazon

- Earnings Date: Thursday, July 28 after the market close

- EPS Growth Estimate: -78.6% yoy

- Revenue Growth Estimate: +5.7% yoy

- Year-To-Date Performance: -25.2%

- Market Cap: $1.27 Trillion

Amazon.com (NASDAQ:AMZN) reported its fourth straight revenue miss in the last quarter and provided a weak outlook. This quarter consensus calls for the e-commerce and cloud giant to report a 6% increase in revenue to $119.5 billion but a 78.6% slide in EPS to $0.15 due to tough yoy comparisons, weakness in its core online retailing business and advertising unity, higher labor expenses, and increased shipping costs related to global supply chain constraints.

Investors will be watching Amazon’s thriving cloud business, which recorded a 37% increase in revenue last quarter, to see if it can maintain its torrid pace of growth.

Perhaps of greater importance will be Amazon’s full-year operating income and revenue guidance as it deals with several headwinds, including an uncertain demand outlook, ongoing supply chain disruptions, higher costs, and a stronger dollar.

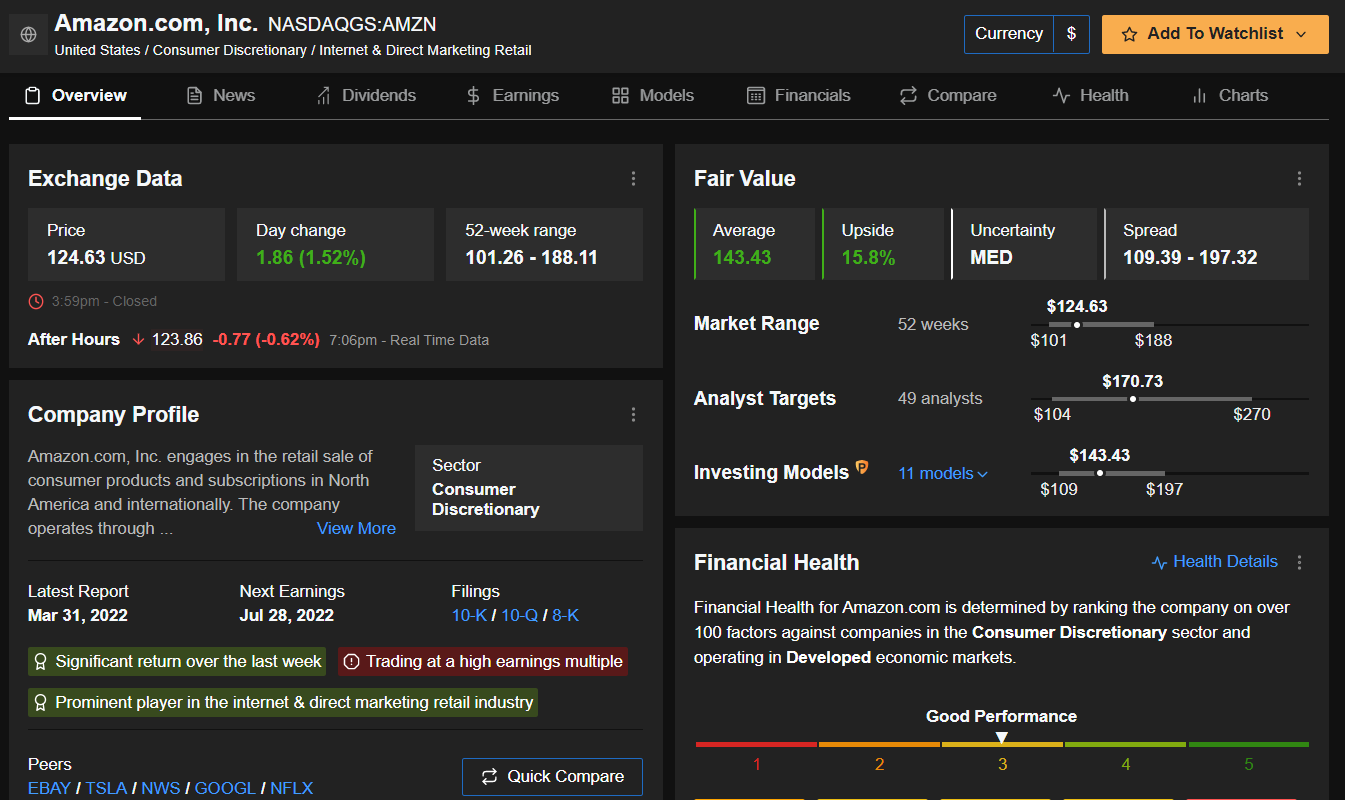

AMZN stock has lost about 25% year-to-date and is roughly 34% away from its all-time high. Despite the anticipated slowdown in profit and sales growth, we believe the stock is well-positioned to move higher, considering its leading position in the e-commerce and cloud-computing spaces.

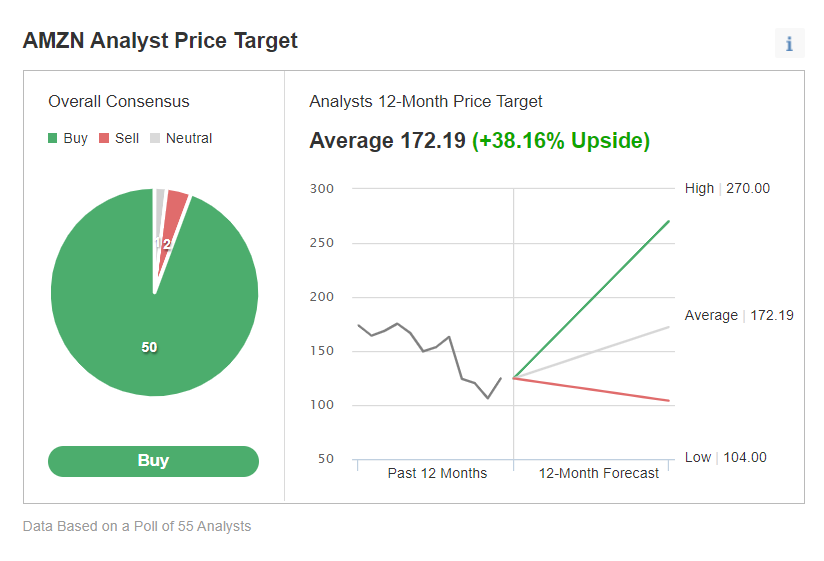

Source: Investing.com

Analysts also remain optimistic about the tech titan: according to an Investing.com survey, 50 out of 55 analysts covering AMZN rate the stock as ‘buy’ with an average price target of around $172.00. According to the Investing Pro model, the stock could increase 15.8% from current levels bringing it closer to its fair value of $143.43 per share.

Source: InvestingPro

Disclosure: At the time of writing, Jesse owns shares in MSFT, GOOGL, and AAPL. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

***

Looking to get up to speed on your next idea? With InvestingPro+, you can find:

- Any company’s financials for the last 10 years

- Financial health scores for profitability, growth, and more

- A fair value calculated from dozens of financial models

- Quick comparison to the company’s peers

- Fundamental and performance charts

And a lot more. Get all the key data fast so you can make an informed decision, with InvestingPro+. Learn More »

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI