- Some stocks have risen by nearly 24% over the past 5 fiscal years

- These stocks have managed to effectively double the S&P 500's 12% returns over the same period

- Can these gems continue to do so over the coming years?

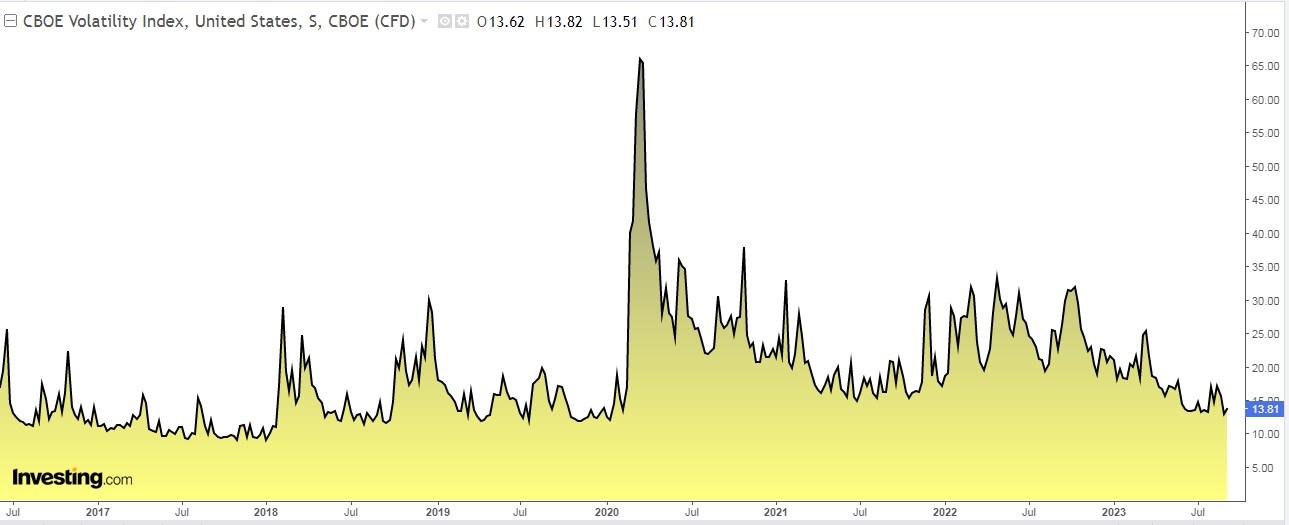

While global stock markets, including Europe and Japan, have been displaying remarkable strength over the last few weeks, the trading volume on the S&P 500 in August dipped 20% below the average of the previous month.

Still, the CBOE Volatility Index wrapped up the week at its lowest level since January 2020. But despite the mounting signs of trouble on the horizon, a select group of stocks that have consistently risen over the past five fiscal years kept on showing signs of strength.

But despite the mounting signs of trouble on the horizon, a select group of stocks that have consistently risen over the past five fiscal years kept on showing signs of strength.

These stocks have averaged an impressive nearly +24% gain during this five-year span, effectively doubling the S&P 500's return of +12% over the same period, and look poised to keep outperforming this year.

It's important to note that these gems constitute less than 3% of the S&P 500.

Let's delve into a few of these exceptional performers and harness the power of the professional tool, InvestingPro, to glean essential data and insights.

1. Axon Enterprise

Axon Enterprise (NASDAQ:AXON), headquartered in Scottsdale, Arizona, is a company specializing in the development of technology and weaponry for military and law enforcement applications.

Among its notable products is the Taser gun, capable of launching two projectiles that deliver electric shocks to incapacitate attackers.

Over the past five years, Axon Enterprise has demonstrated exceptional performance, with its shares averaging an impressive +42.2% gain. Remarkably, the company has not experienced any declines in its stock price during this five-year period.

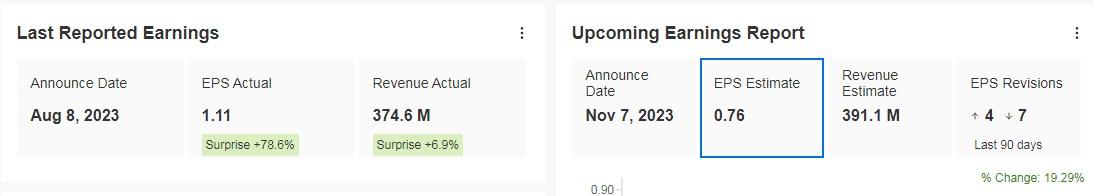

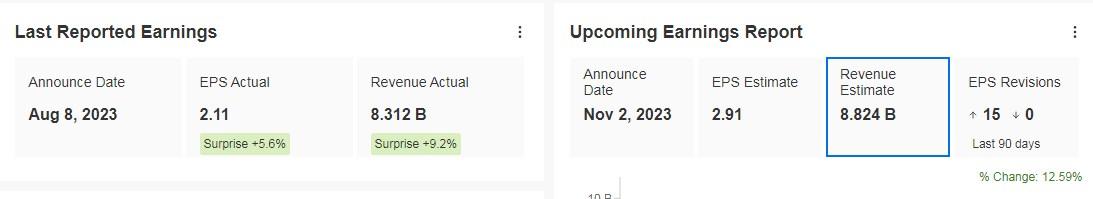

In terms of financial performance, the company's recent earnings report on August 8 was nothing short of spectacular.

It revealed a remarkable +78.6% increase in earnings per share (EPS) and a solid +7% growth in actual revenue.

Looking ahead, Axon Enterprise is poised to announce its next earnings on November 7, and the outlook is equally promising, with anticipated growth in EPS of +19.29% and actual revenue expected to rise by +17.26%. Source: InvestingPro

Source: InvestingPro

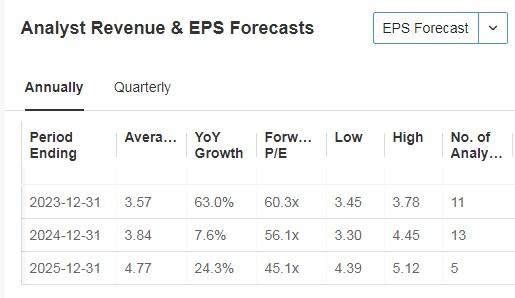

Axon's adjusted earnings increased every year in the last five years, except for a -7% drop last year. The market expects the company's earnings to increase by +63% this year and +7.5% next year.

Source: InvestingPro

It has 12 ratings, of which all are buy. JP Morgan has been the last to pronounce, giving it a potential at $230. For its part, the market gives it an average potential of $235.92.

Source: InvestingPro

Over the past month, Axon stock has exhibited impressive growth, surging by +19.09%. Zooming out to the last three months, it has maintained a substantial upward trajectory, with a solid +12.26% gain.

Interestingly, the analyst target for the stock price aligns closely with the strong resistance levels.

2. Eli Lilly

Eli Lilly (NYSE:LLY), a pharmaceutical company with its headquarters in Indiana, boasts a remarkable history dating back to its founding by Colonel Eli Lilly in 1876. With a presence in 143 countries, it has established itself as a global player in the pharmaceutical industry.

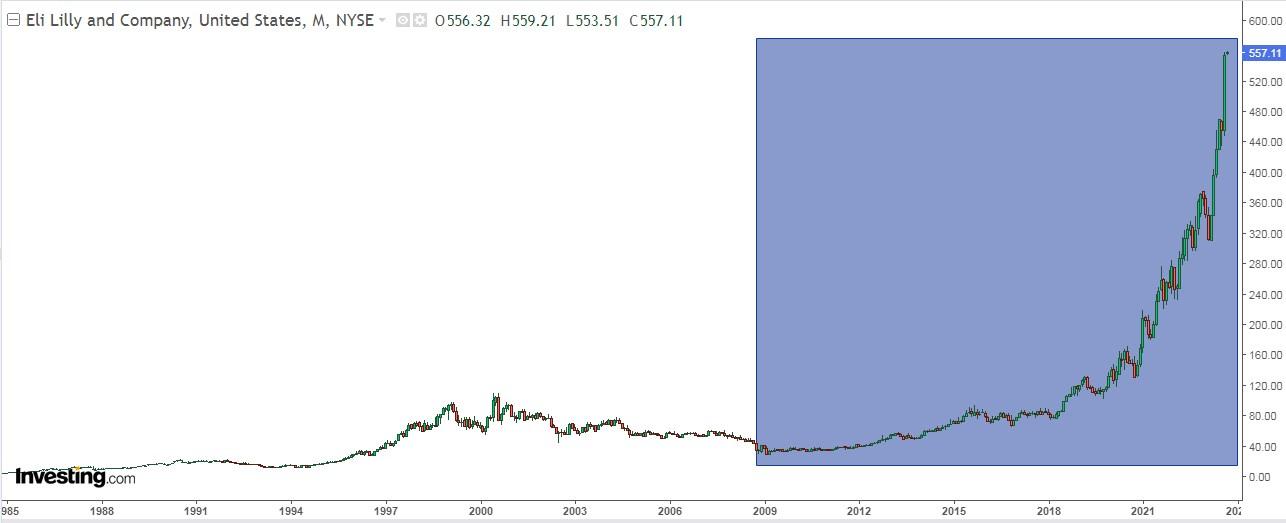

Over the past five years, Eli Lilly's shares have demonstrated impressive performance, with an average annual increase of +38%. Remarkably, the company has not witnessed a decline in any of these five years.

In terms of recent financial performance, the earnings released on August 8 showcased positive results, including a substantial increase in Earnings Per Share (EPS) by +5.6% and a notable growth in real income of +9.2%.

Investors can anticipate further positive outcomes when the company presents its next financial results on November 2. Projections indicate an expected rise in EPS of +12.18% and an increase in actual revenues by +12.59%.

Source: InvestingPro

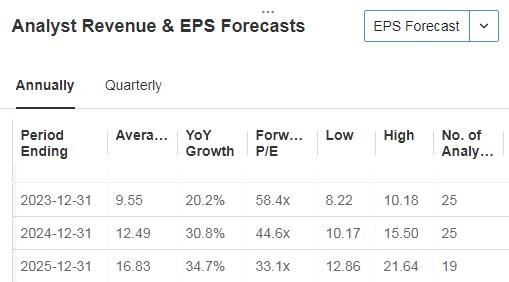

Earnings are expected to increase by almost 20% this year. EPS is also projected to rise by 20.2%, 30.8%, and 34.7% in the next three fiscal years.

Source: InvestingPro

Its shares have risen in the last month by +24.20% and in the last 3 months by +25.66%.

The chart shows the stock's meteoric rise in recent years.

3. O'Reilly Automotive

O’Reilly Automotive (NASDAQ:ORLY), an automotive parts company founded by the O'Reilly family in 1957, has grown to become a prominent player in the industry.

With a presence extending to more than 5,600 stores in the United States and Mexico, the company offers a wide range of tools, supplies, equipment, and accessories for automobiles.

Over the last five years, O'Reilly Automotive's shares have demonstrated strong performance, with an impressive average annual growth rate of nearly +30%.

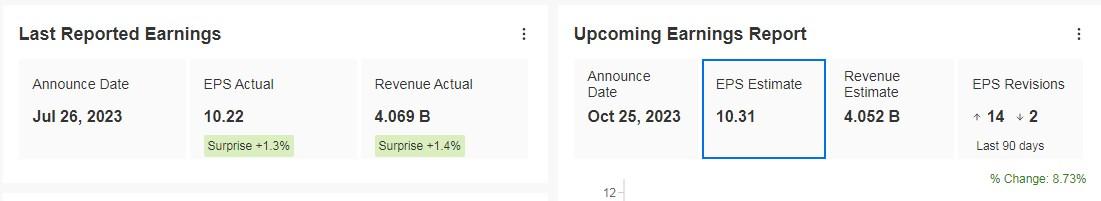

The company's financial results for July 26th exceeded expectations in terms of both actual revenues and earnings.

Investors can look forward to the upcoming release of financial results on October 25, which are anticipated to reveal further positive outcomes.

Projections indicate an expected increase in Earnings Per Share (EPS) by +8.73% and a growth of +3.50% in actual revenues.

Source: InvestingPro

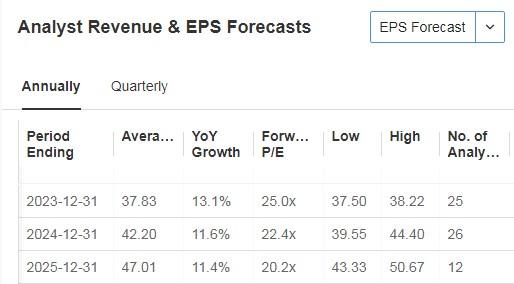

EPS forecasts for the years 2023-2025 are +13.1%, +11.6%, and +11.4%, respectively.

Source: InvestingPro

Over the past month, O'Reilly Automotive's shares have risen by +2.32%. Furthermore, the stock has demonstrated consistent growth over the last three months, with an impressive gain of +5.03%.

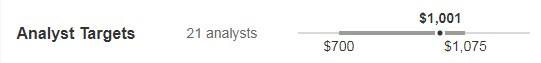

Currently, the company is closely followed by 27 analysts, with their assessments yielding 16 "buy" ratings, 10 "hold" ratings, and 1 "sell" rating.

In terms of its price potential, the market suggests that O'Reilly Automotive has room for further growth, with a potential target price set at $1,001.

Source: InvestingPro

The chart shows its strong rally in recent years.

4. Arthur J Gallagher

Arthur J Gallagher (NYSE:AJG), a leading risk management and insurance brokerage firm headquartered in Chicago, Illinois, boasts an impressive track record of nearly +25% average share price growth over the past 5 years.

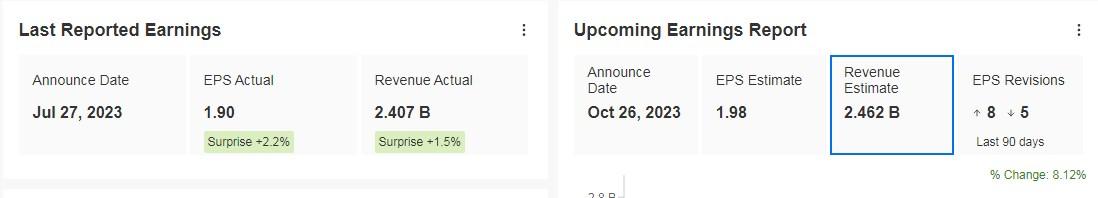

The company, which operates in 130 countries and recently made headlines for its acquisition of Toronto-based A.H. Horn and Associates Limited, reported robust financial performance in its latest earnings on July 27.

It not only exceeded forecasts for actual revenue (+1.5%) but also outperformed in terms of EPS (+2.2%).

Looking ahead to the next earnings report on October 26, the market is optimistic, with expectations of an +8.12% increase in actual revenues.

This suggests continued growth and strength in Arthur J. Gallagher's position in the insurance and risk management industry.

Source: InvestingPro

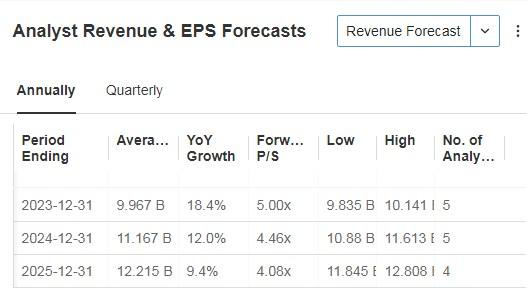

The revenue predictions for the years 2023, 2024, and 2025 are +18.4%, +12%, and +9.4%, respectively.

Source: InvestingPro

The stock is up +4.90% in the last month and +12.29% in the last 3 months.

Like the previous stocks, the chart shows its bullish rise in recent years.

However, it's important to note that these four stocks are not the sole success stories of the past five years.

Other notable performers include Cintas (NASDAQ:CTAS), with an impressive average growth of +25.2% during this period, Progressive (NYSE:PGR) boasting a +19% average increase, and TJX (NYSE:TJX) maintaining a solid +16.5% average growth rate.

***

Hurry up; the InvestingPro Summer sale ends today. Enjoy last-minute discounts on all our subscription plans by clicking here.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.