- Seasonal trends can reveal hidden opportunities for portfolio growth.

- December often marks a bullish phase for key commodities.

- We'll discuss how copper, gold, silver, and lean hogs could potentially outperform during this time.

- Take advantage of our Extended Cyber Monday offer—your last chance to secure InvestingPro at a 55% discount!

Timing can be everything in the world of investing, and seasonal patterns offer a unique edge for traders and investors.

These recurring trends—rooted in historical data and market logic—highlight periods when certain assets tend to outperform.

As December approaches, four commodities are stepping into their seasonal bullish phase: copper, gold, silver, and lean hogs. Here's how you can capitalize on these opportunities.

1. Copper: A Seasonal Favorite for Early-Year Gains

Copper tends to find its footing in November and December, setting the stage for a rally that typically runs from December 13 to February 24. Over the past 52 years, this pattern has played out 70% of the time, delivering an average return of 5.4%.

There are multiple ways to invest in copper:

- Stocks: Consider shares of major players like Freeport-McMoran Copper & Gold (NYSE:FCX), Antofagasta (OTC:ANFGF), or Rio Tinto (NYSE:RIO).

- Futures and CFDs: Trade copper on the NYMEX, COMEX, or the London Metal Exchange (LME). The ticker “HG” allows leveraged positions with minimal capital.

- ETFs and Mutual Funds: Options like Global X Copper Miners ETF (NYSE:COPX) or WisdomTree Copper (LON:COPA) offer diversification with low fees.

2. Lean Hogs: Riding the Holiday Demand Surge

Pork demand spikes during the holiday season, pushing prices higher in December. The bullish seasonal window for lean hogs typically runs from December 10 through New Year's Day, fueled by peak consumption trends. A broader uptrend often extends into July.

Top investment options include:

- Futures: Trade lean hogs on the CME Globex platform using the ticker “HE.” Contracts are accessible with a low capital requirement.

- ETFs and Stocks: Tyson Foods (NYSE:TSN) and WisdomTree Lean Hogs (LON:HOGS) are attractive choices for exposure to this market.

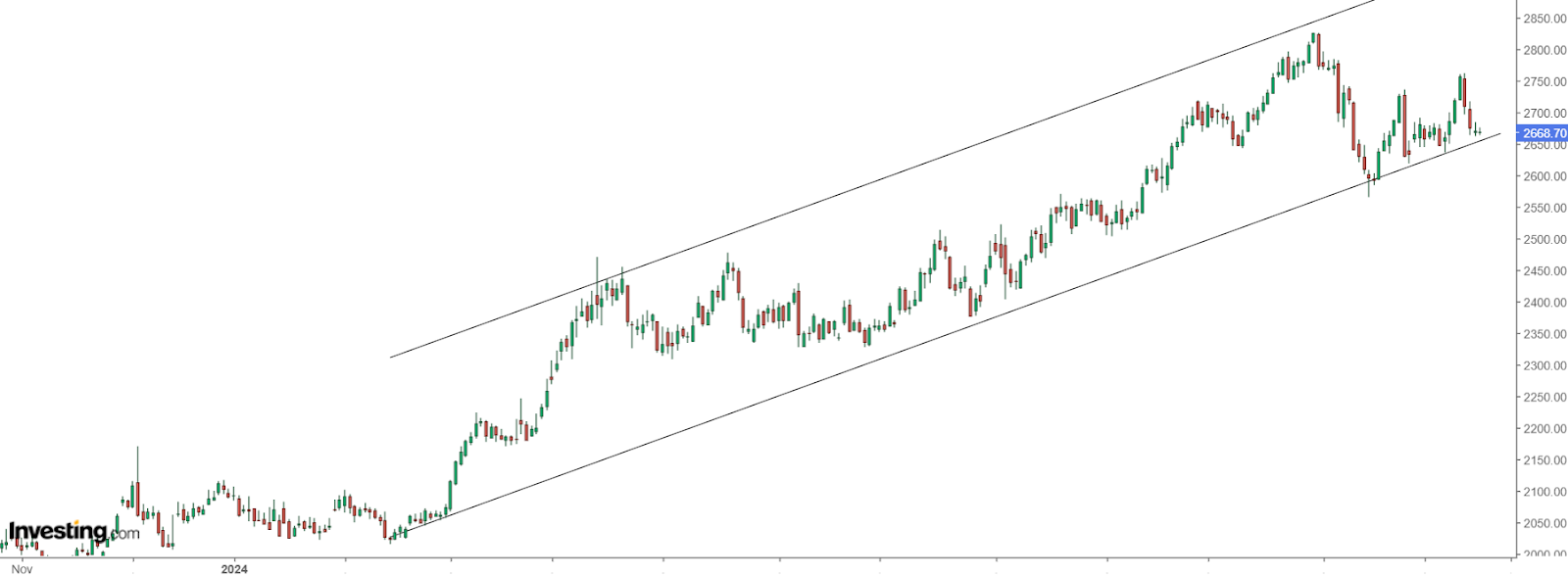

3. Gold: A Potential Double Seasonal Boost

Gold’s seasonal shine comes from two key drivers: the Indian wedding season in late autumn and the Lunar New Year in China, which fuels demand from late January to early February.

This golden window runs from November through February, offering a historical average return of 5.4% over the past 49 years. March, however, tends to bring a pullback.

Investment pathways include:

- Stocks: Newmont Goldcorp (NYSE:NEM), Barrick Gold (NYSE:GOLD), and Wheaton Precious Metals (NYSE:WPM) are leading names.

- Futures and CFDs: The ticker “GC” lets traders access gold futures on CME Globex with flexible hours.

- ETFs: SPDR Gold Shares (NYSE:GLD) stands out with over $57 billion in assets and a low expense ratio.

4. Silver: Industrial Demand Fuels Seasonal Strength

Silver shines brightest between December 16 and February 20. Historically, this period has delivered an average return of 7.19% since 1968, driven by robust industrial orders as the year closes.

Ways to invest include:

- Stocks: Look at First Majestic Silver (NYSE:AG), Pan American Silver (NYSE:PAAS), or Fortuna Silver (TSX:FVI) Mines (NYSE:FSM) for direct exposure.

- Futures and CFDs: Trade silver contracts on COMEX using the ticker “SI.”

- ETFs: The iShares Silver Trust (NYSE:SLV) is a top choice for its liquidity and cost efficiency.

Seasonal trends aren’t guaranteed, but they can offer compelling opportunities when supported by market logic and historical data. As December unfolds, these four commodities present a timely chance to diversify and grow your portfolio.

***

Curious to learn how top investors are structuring their portfolios for 2025 with high-potential stocks?

Take advantage of our Extended Cyber Monday offer—your last chance to secure InvestingPro at a 55% discount—and gain insights into elite investment strategies and access over 100 AI-driven stock recommendations every month.

Interested? Click on the banner below to discover more.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.