- Amazon stock has nearly shed all its pandemic gains

- It's hard to call a bottom yet for the stock, given the uncertain macroeconomic environment

- However, Amazon continues to seek acquisitions, diversifying its market presence

So far this year, Amazon.com (NASDAQ:AMZN) is the worst-performing stock in the trillion-dollar-market-cap club that includes Apple Inc (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), and Alphabet (NASDAQ:GOOG). The Seattle-based giant's shares have lost about 30% of their value in the past 12 months.

The steep decline has deprived the company's investors of almost all pandemic gains. However, it remains hard to call a bottom for the stock as interest rate hikes keep hitting stocks like Amazon by diminishing the value of their future earnings. Furthermore, inflation is driving up costs, while a stronger dollar is hurting overseas profits.

With a market cap of $1.18 trillion, the Seattle-based Amazon remains the U.S.'s fourth-most valuable company, trailing Apple, Microsoft, and Alphabet. Despite investors' nervousness and the market volatility, I remain bullish on AMZN's growth prospects and expect shares to rebound in the months ahead.

While Amazon's core e-commerce business has been struggling with high costs and slowing growth in consumer demand, the company's other units continue to show strong growth.

Revenue for Amazon Web Services grew 33% in the second quarter to $19.7 billion. Amazon's advertising business, which the company recently began breaking out financial data, grew 18% to $8.8 billion in the quarter.

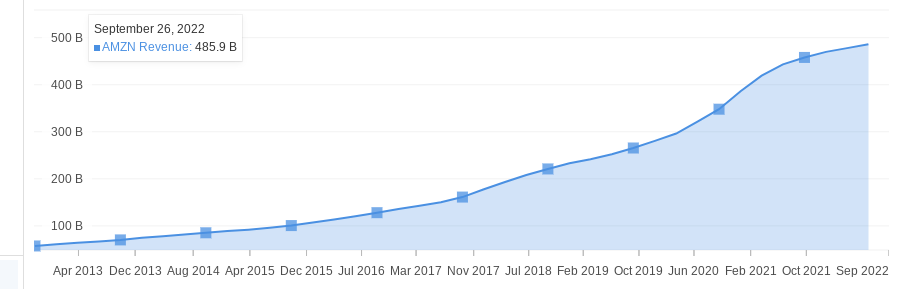

Source: InvestingPro

Belt-Tightening After Massive Expansion

Considering its healthy balance sheet, high free cash flows, and highly diversified business model, it's not difficult to see that Amazon remains in a solid position to withstand the current hostile economic environment.

Furthermore, the company has been taking steps to curb expenses. The total workforce at Amazon shrank by about 100,000 in the second quarter, and the company is cutting back on warehouse space as Chief Executive Officer Andy Jassy unwinds a pandemic-era expansion amid slowing growth. Fulfillment expenses rose less than analysts projected last quarter.

Despite this belt-tightening era, Amazon isn't letting growth opportunities pass. It continues to seek acquisitions that further strengthen its market position and diversify its revenues away from its core e-commerce business.

During the past quarter, Amazon announced the buyout of virtual healthcare company One Medical for $3.49 billion and iRobot Corp., maker of the Roomba vacuum, for $1.65 billion, receiving praises from analysts who see long-term value in these deals.

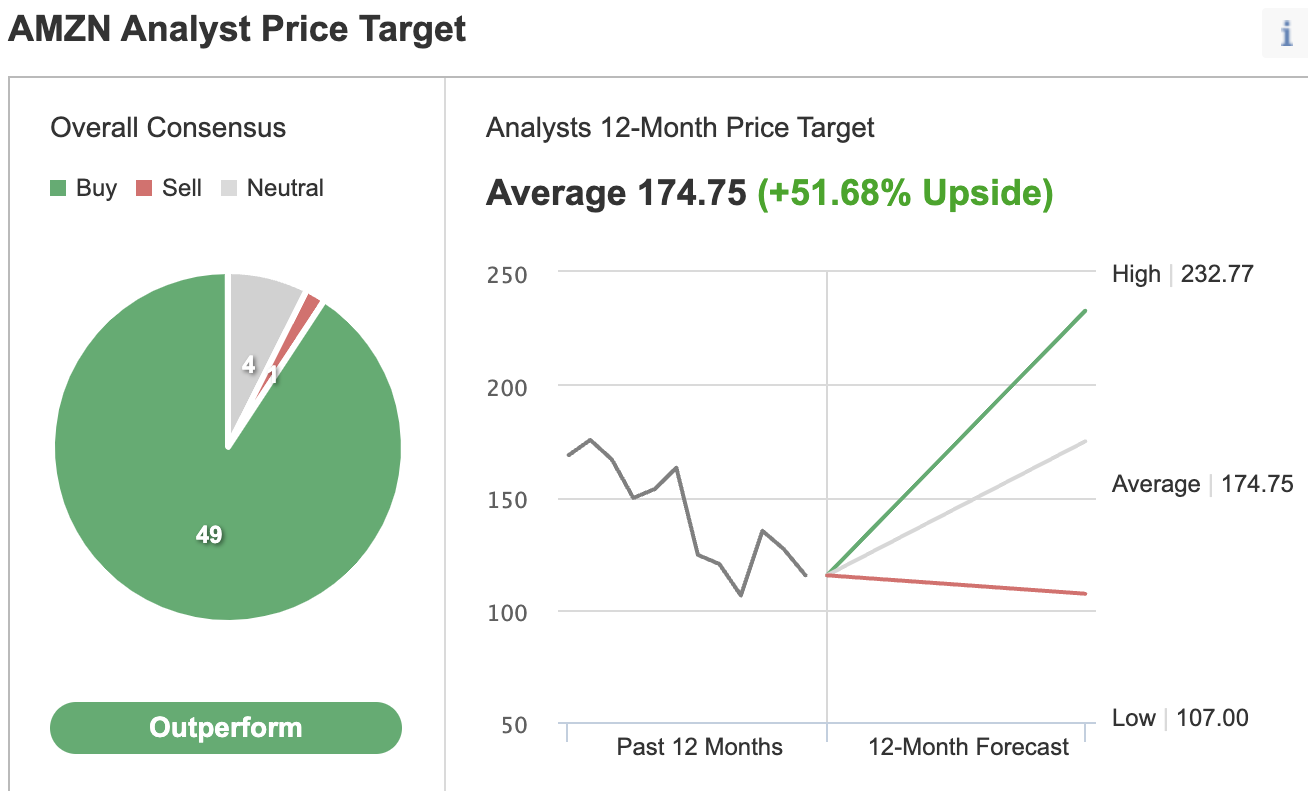

Amazon's leading position in many areas in which it operates is the main reason that most Wall Street analysts rate its stock a buy. In an Investing.com poll of 54 analysts, 49 rate the stock as a buy, with their consensus 12-month price target showing a 51.68% upside.

Source: Investing.com

Of course, owning Amazon still comes at a price, even though the stock has gotten cheaper this year. The stock sells for 47 times the earnings projected over the next 12 months. The Nasdaq 100, by contrast, has an average multiple of about half that.

Still, betting on the company has been hugely profitable for long-term investors, with its stock surging about 900% during the past decade.

Bottom Line

Amazon stock has been the worst performer among the largest mega-cap tech giants in the bear market. But the giant's long-term investment appeal remains intact, given its dominance in e-commerce and explosive growth in its cloud and advertising businesses. On the way up, AMZN is well positioned to outperform its peers, in my view.

Disclosure: At the time of writing, the author is long on AMZN, AAPL, and MSFT. The views expressed in this article are solely the opinion of the author and should not be taken as investment advice.