- The Dow has technically entered a bull market after Jerome Powell's comments yesterday

- Still, those that want to play the rebound should keep in mind that macro risks remain

- Here are three stocks with solid financial health and attractive upside potential, according to InvestingPro

As Wall Street tries to stage a rebound after a long and painful bear market, investors are increasingly searching for stocks that offer a compelling buying opportunity.

But despite the fact that the Dow Jones Industrial Average entered a technical bull market after Powell's comments yesterday, broad market risks remain elevated. Thus, even for playing a possible rebound, it is wise to choose names with solid financial balances and the capacity to weather any short-term headwinds.

Below, we look at three popular stocks with solid financial health and attractive 12-month upside potential. We will also find out when they present their results, what is expected from their performance, and their dividend yield.

To do this, we will use the InvestingPro tool.

1. Abbott Laboratories

Founded in 1888 by Wallace Calvin Abbott, the Chicago-based pharmaceutical behemoth Abbott Laboratories (NYSE:ABT) has a solid history and a global footprint capable of securing financial stability in the face of macroeconomic uncertainty.

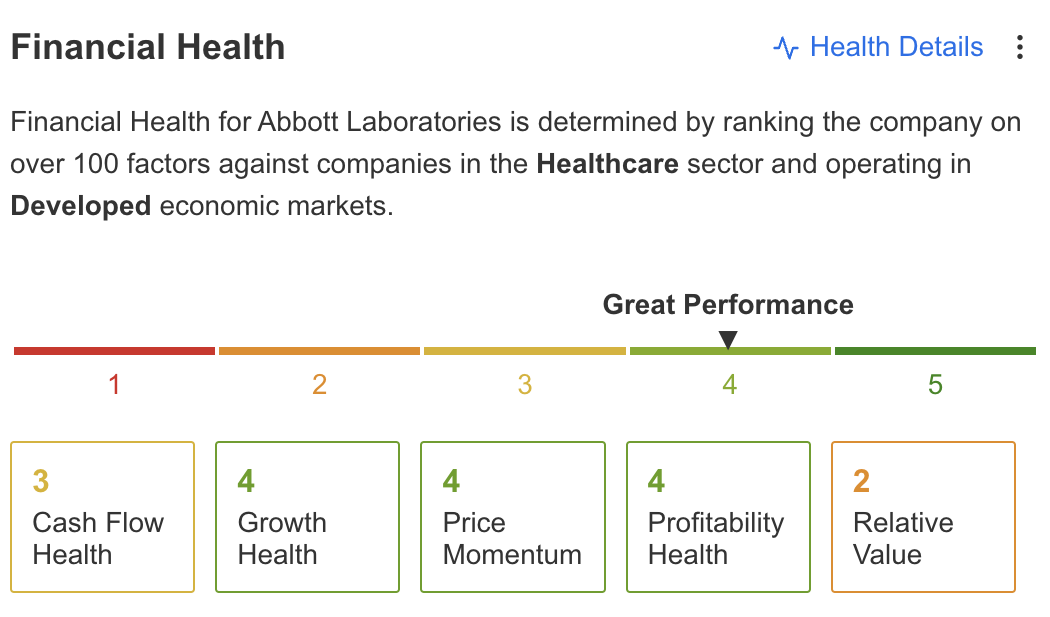

With operations in 150 countries and a global workforce of around 113,000 employees, ABT holds a "Great Performance" score in InvestingPro's financial health screener.

Source: InvestingPro

After beating Q3 earnings per share expectations by 22%, the company appears on track for more solid results in its next report, scheduled for January 25, 2023. Wall Street is forecasting earnings per share to come out at $0.91.

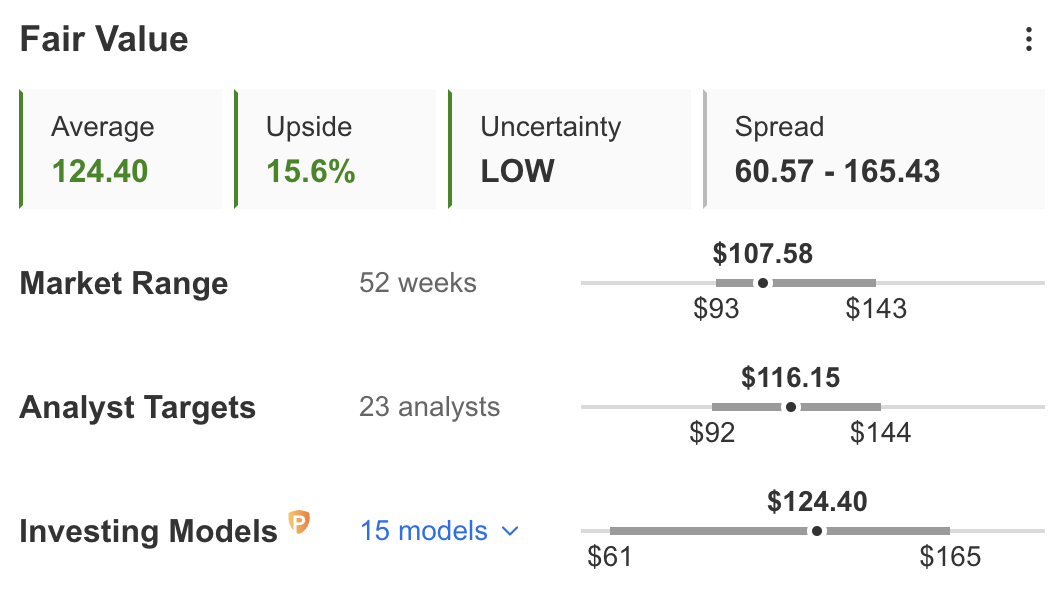

ABT also has a perfect Piotroski Score of 9. That's perhaps why InvestingPro gives it a 12-month upside potential of 15.6%.

Source: InvestingPro

On the technical chart, ABT formed the annual bottom and bounced upwards at the end of October, supported by its bullish channel. Notably, it has broken above the downtrend line.

2. ConocoPhillips

The Houston, Texas-based ConocoPhillips (NYSE:COP) is the third-largest oil company in the United States and one of the largest in the world, with operations in 15 countries. It was created after the merger of Conoco and Phillips Petroleum Company on August 30, 2002.

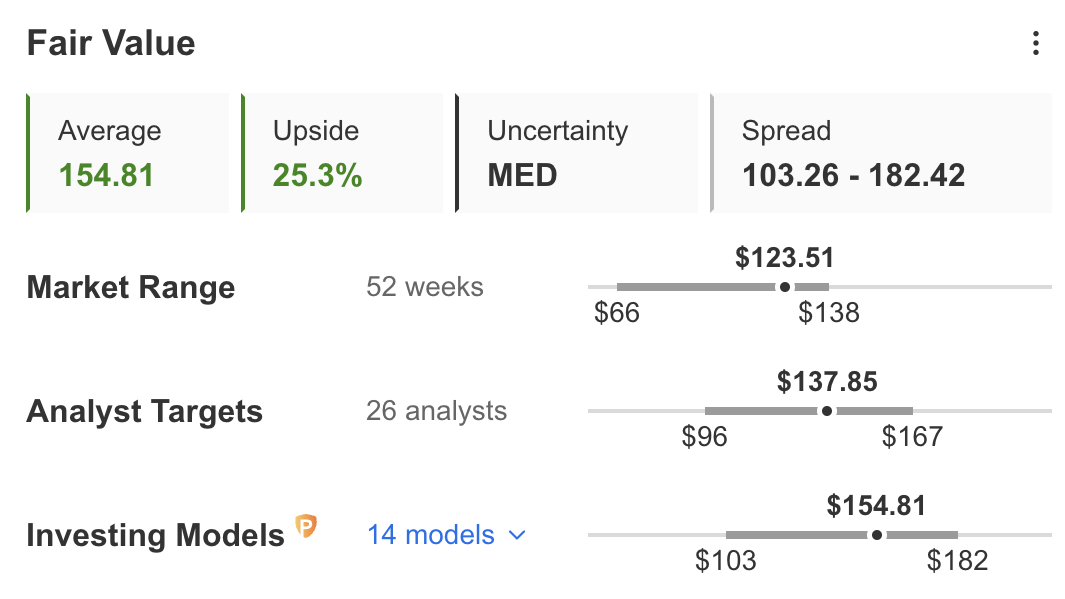

Despite riding the uptrend in energy prices this year, the company still offers a solid 25.3% upside potential, according to InvestingPro.

Source: InvestingPro

After beating market EPS expectations in its latest earnings report by 4.57%, COP expects its next earnings report—scheduled for February 2, 2023—to show a jump in EPS from $1.97 to $3.339.

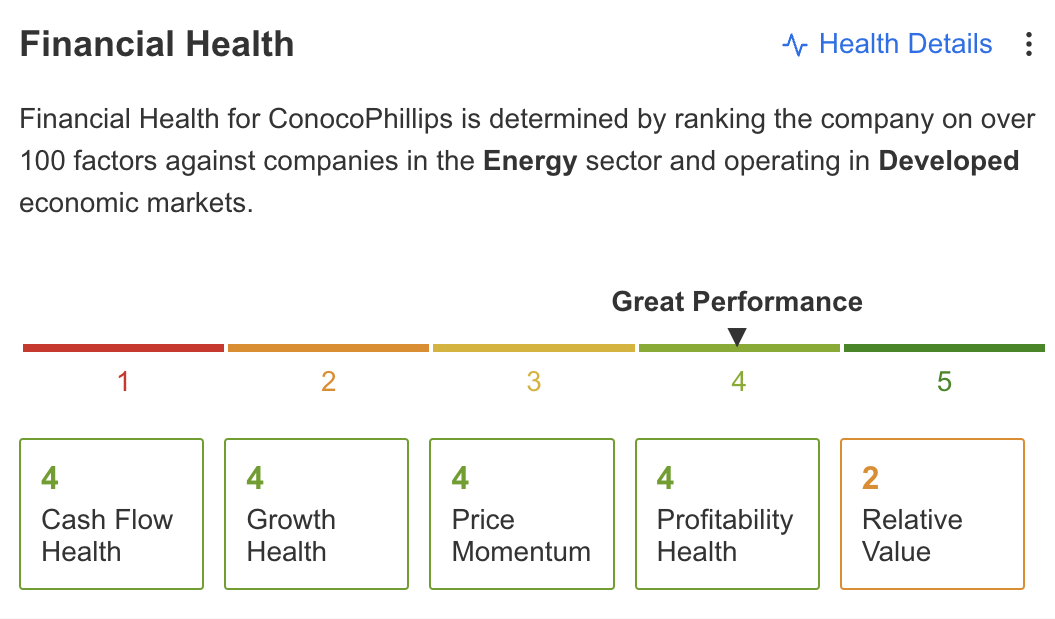

With a "Great Performance" score in InvestingPro's financial health screener, and a hefty dividend yield of 4.2%, to be distributed on December 23, ConocoPhillips is a great pick for those that want to play the current environment safely.

Source: InvestingPro

On the technical chart, in mid-July, COP put an end to the weakness and began to rise strongly, moving comfortably within the range of its bullish channel.

3. Broadcom

The global designer, developer, manufacturer, and supplier of a broad range of semiconductor products and software Broadcom Inc (NASDAQ:AVGO) offers a dividend yield of 3%, with a payout ratio of aroound 67.27% (the percentage of earnings it distributes as a dividend to its shareholders).

The company reported sales of $8.464 billion in the third quarter, up from $6.778 billion a year ago. Net income was $3.074 billion, compared to $1.876 billion a year ago. Despite the solid performance, in the next quarter, earnings per share are expected to increase to $10.28.

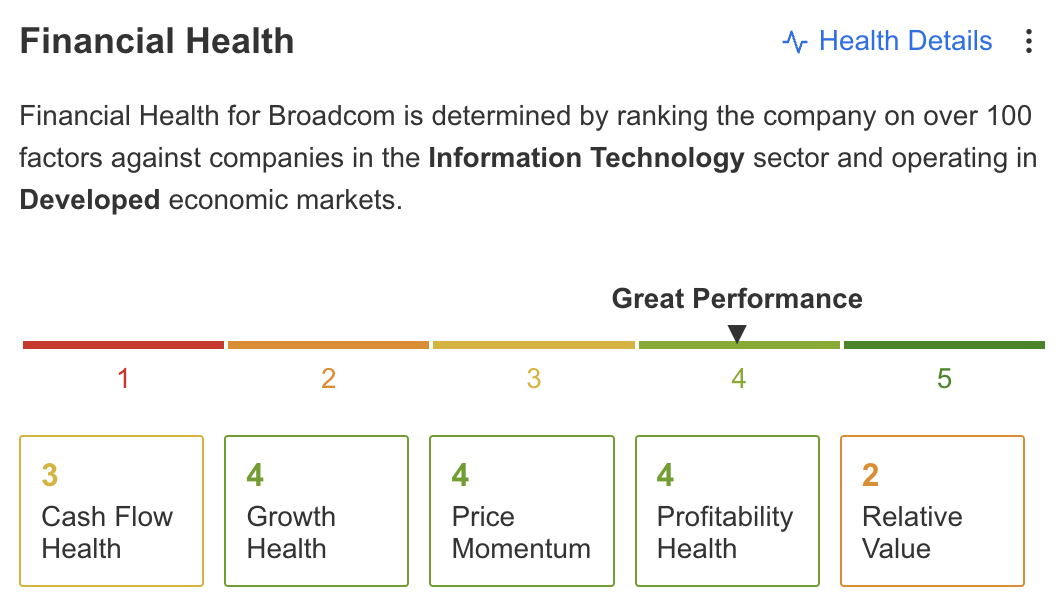

Those results helped the company achieve a solid "Great Performance" financial health score in InvestingPro.

Source: InvestingPro

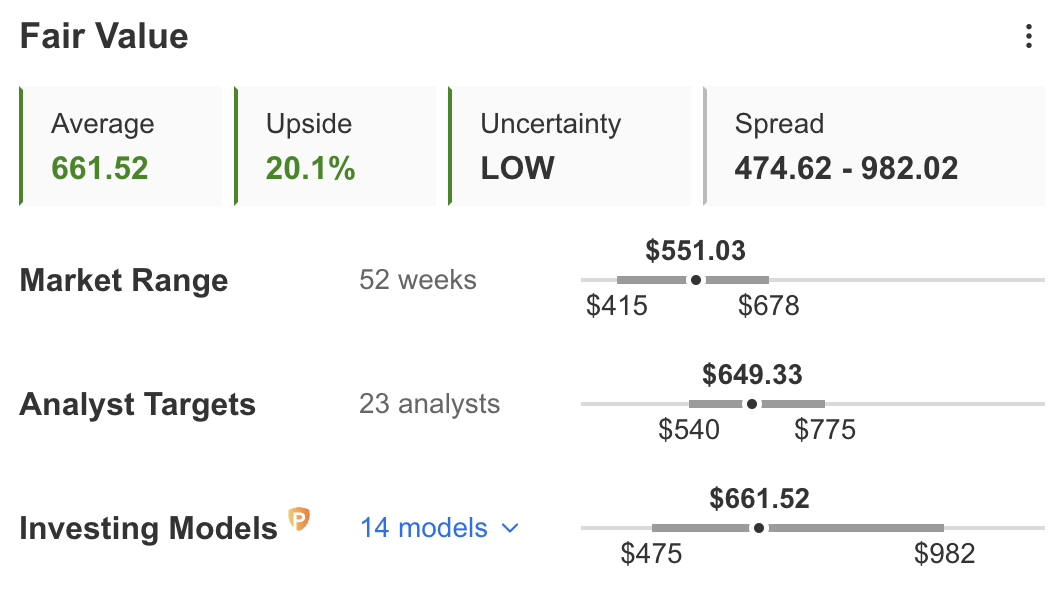

Furthermore, the San Jose, California-based giant has an upside potential of 20%, according to InvestingPro.

Source: InvestingPro

In mid-October, it formed a bottom and has rebounded well since then, moving within the range of a bullish channel. It is approaching its first major resistance since then.

Disclosure: The author does not own any of the securities mentioned in this article.