- When market volatility strikes, investors often turn to dividend stocks as a safe harbor.

- Companies with strong fundamentals, consistent dividend payouts, and resilience during economic downturns can provide both income and potential for capital appreciation.

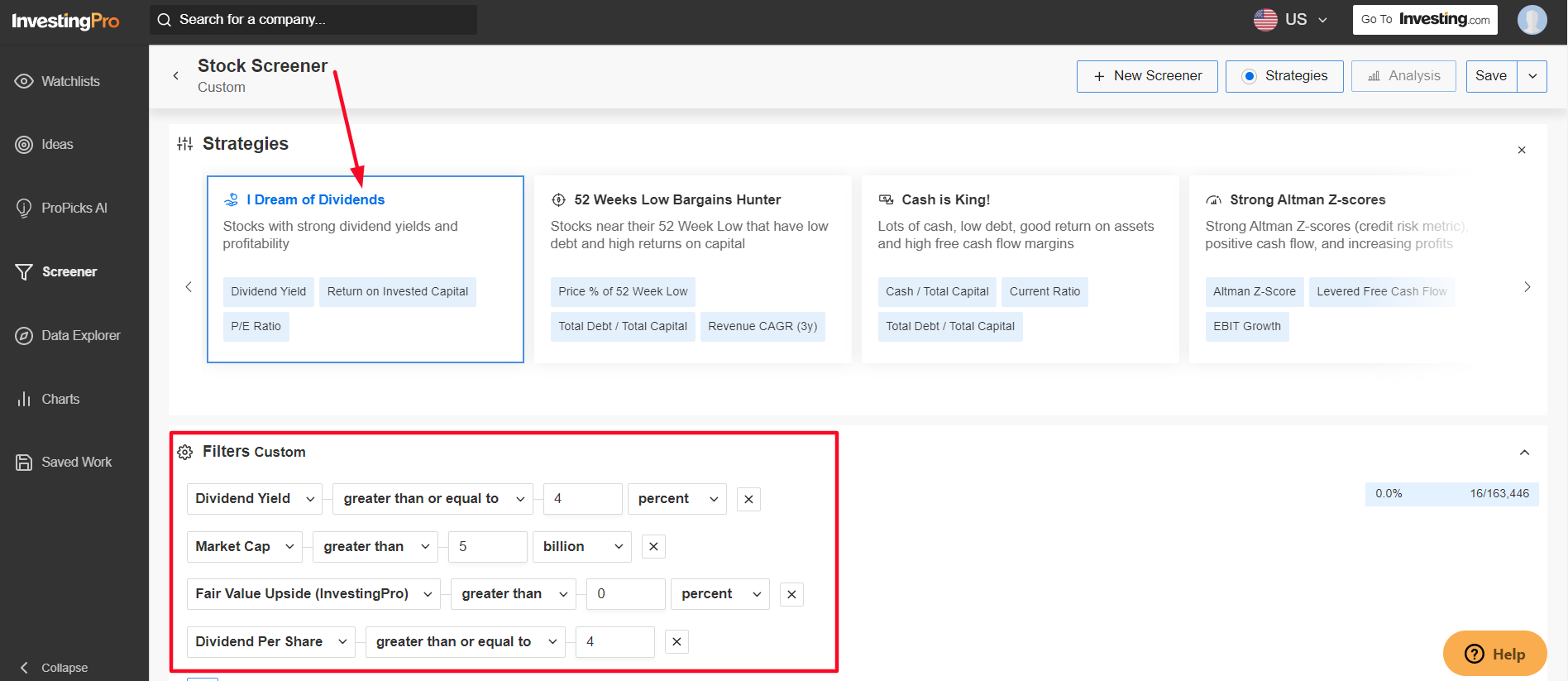

- As such, I used the InvestingPro stock screener to find high-quality dividend-paying stocks with strong upside ahead.

- Looking for more actionable trade ideas? Try InvestingPro for under $8/Month.

In times of market volatility and economic uncertainty, dividend stocks can offer a sense of stability and income that growth stocks may not provide.

Companies with strong fundamentals and consistent dividend payouts are particularly attractive as they can weather market storms while continuing to reward shareholders.

Using the InvestingPro ‘I Dream of Dividends’ stock screener, I managed to easily identify three solid dividend-paying stocks with strong upside ahead worth considering amid the current market backdrop.

Source: InvestingPro

Each of these companies is well-positioned to weather the ongoing market volatility, offering a compelling mix of dividend income, growth potential, and stability.

So, without further adieu, let's delve deep into these companies' fundaments to try and see what makes them a compelling buy at current levels.

1. Prudential Financial

- Year-To-Date Performance: +4.8%

- Market Cap: $38.9 Billion

Prudential Financial (NYSE:PRU) is a global financial services giant, offering a wide range of insurance, investment management, and other financial products and services. With operations in over 40 countries, Prudential serves millions of customers worldwide, providing them with retirement planning, annuities, life insurance, and mutual fund products.

The company’s extensive range of financial products and services across multiple geographies provides it with a robust revenue stream that is less susceptible to economic fluctuations. This diversification allows Prudential to mitigate risks associated with any single market segment, ensuring steady growth.

With an aging global population, demand for retirement and insurance products is expected to grow. Prudential is well-positioned to benefit from these demographic trends, particularly as more individuals seek out financial planning and retirement solutions.

Source: Investing.com

PRU shares closed at $108.72 last night, valuing the Newark, New Jersey-based insurance company at $38.9 billion.

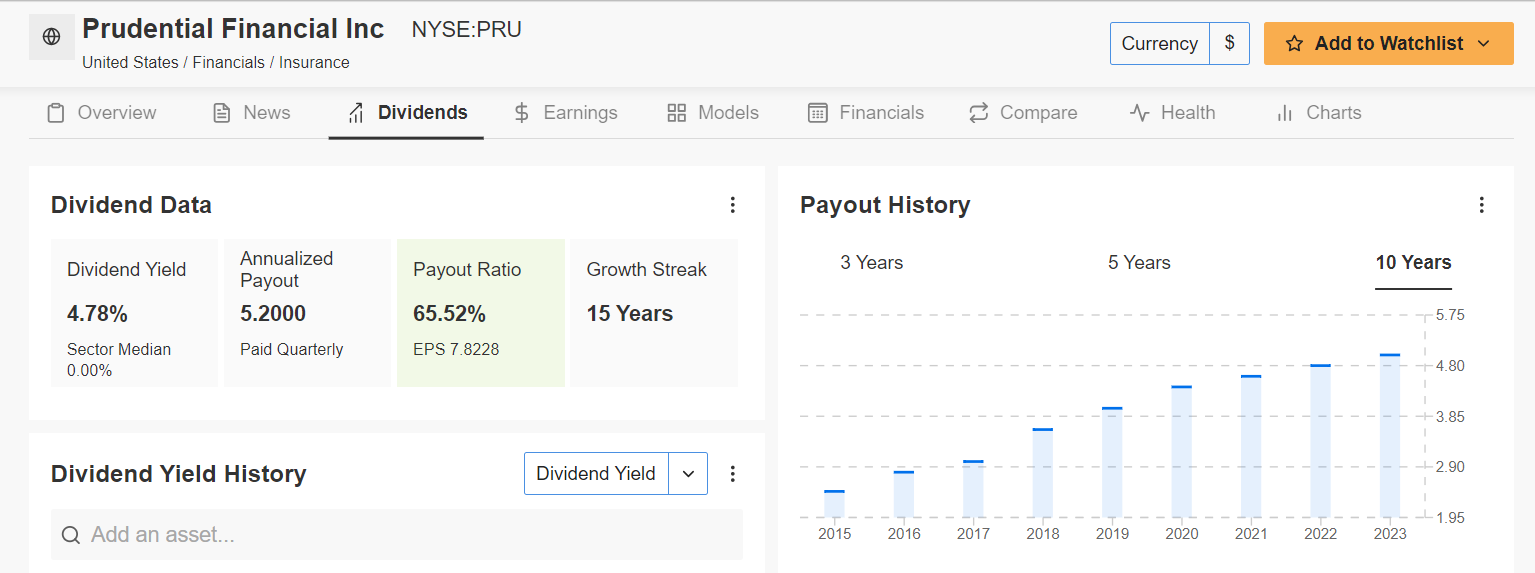

Dividend and Valuation:

Prudential Financial offers a robust annual dividend of $5.20 per share, yielding 4.78%. The company’s strong financial position has allowed it to increase its dividend payout for 15 consecutive years, underscoring its commitment to delivering shareholder value.

Source: InvestingPro

According to InvestingPro’s AI-powered models, PRU is undervalued, with a +22.6% upside to its Fair Value price of $130.91.

Given its strong financial health and stable outlook, Prudential Financial is an excellent choice for investors seeking a combination of income and growth potential in a volatile market.

2. Diamondback Energy

- Year-To-Date Performance: +27.3%

- Market Cap: $35.2 Billion

Diamondback (NASDAQ:FANG) Energy is a leading independent oil and natural gas company focused on the acquisition, development, exploration, and exploitation of onshore oil and natural gas reserves in the Permian Basin of West Texas.

Known for its operational efficiency and high-quality asset base, Diamondback Energy is a key player in the U.S. energy sector, consistently delivering strong performance.

The Midland, Texas-based oil-and-gas company’s focus on maximizing operational efficiency and maintaining a strong balance sheet enables it to generate substantial cash flow, even in volatile market conditions. This financial strength supports its ability to continue rewarding shareholders through dividends and stock buybacks.

Source: Investing.com

FANG stock ended at $197.49 yesterday. At its current valuation, Diamondback Energy has a market cap of $35.2 billion.

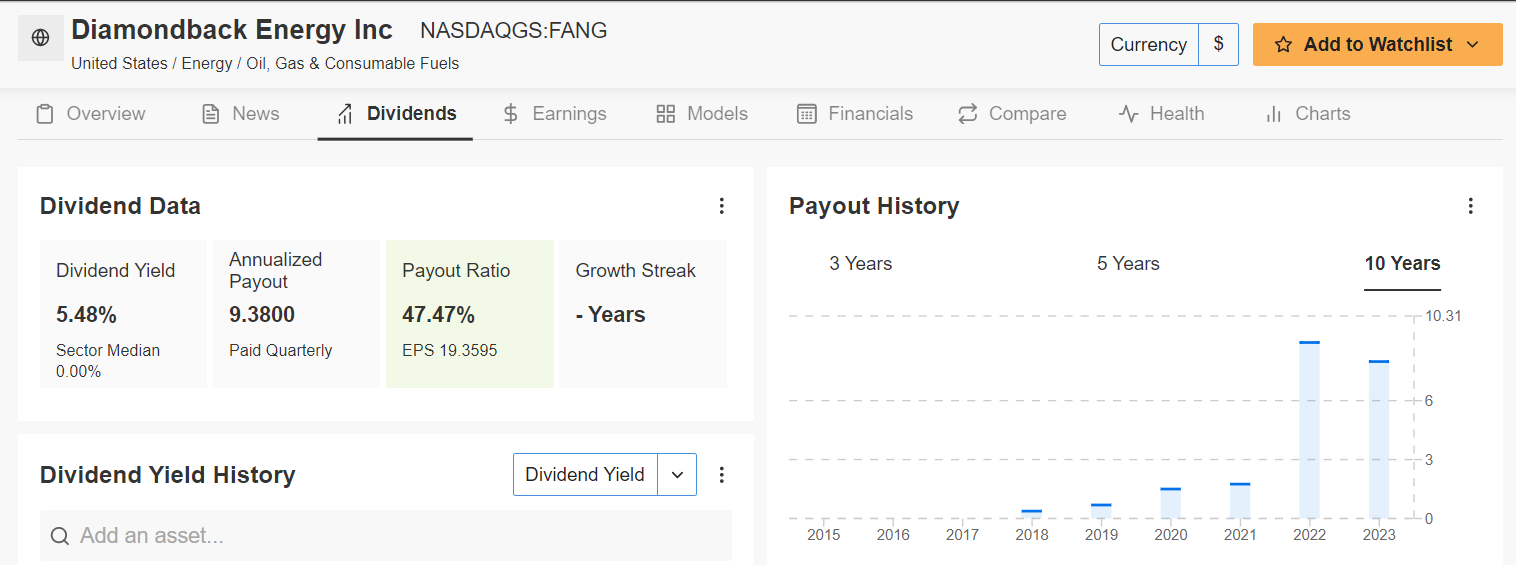

Dividend and Valuation:

Diamondback Energy offers an attractive annual dividend of $9.38 per share, yielding 5.48%. The company’s ability to generate strong cash flows supports its dividend, making it a reliable income source for investors.

Source: InvestingPro

According to InvestingPro’s AI-powered models, FANG has a significant +24.3% potential upside to its Fair Value target of $245.54.

This, combined with the company’s strong financial health and growth prospects, makes Diamondback Energy a compelling choice for investors looking to benefit from both income and capital appreciation.

3. Dillard’s

- Year-To-Date Performance: -5.6%

- Market Cap: $6.2 Billion

Dillard's (NYSE:DDS) is a prominent American department store chain, operating approximately 280 stores across the United States. The retailer offers a broad array of products, including high-end apparel, cosmetics, and home furnishings.

Known for its upscale merchandise and excellent customer service, Dillard’s has carved out a niche in the retail sector, appealing to a loyal customer base.

In addition to its retail operations, Dillard’s owns a significant portion of the real estate where its stores are located. This ownership not only provides a buffer during tough times but also adds to the company’s overall value. The strategic location of its stores in prime areas further enhances its competitive edge.

Source: Investing.com

DDS stock ended Thursday’s session at $380.91, earning the Little Rock, Arkansas-based company a valuation of $6.2 billion.

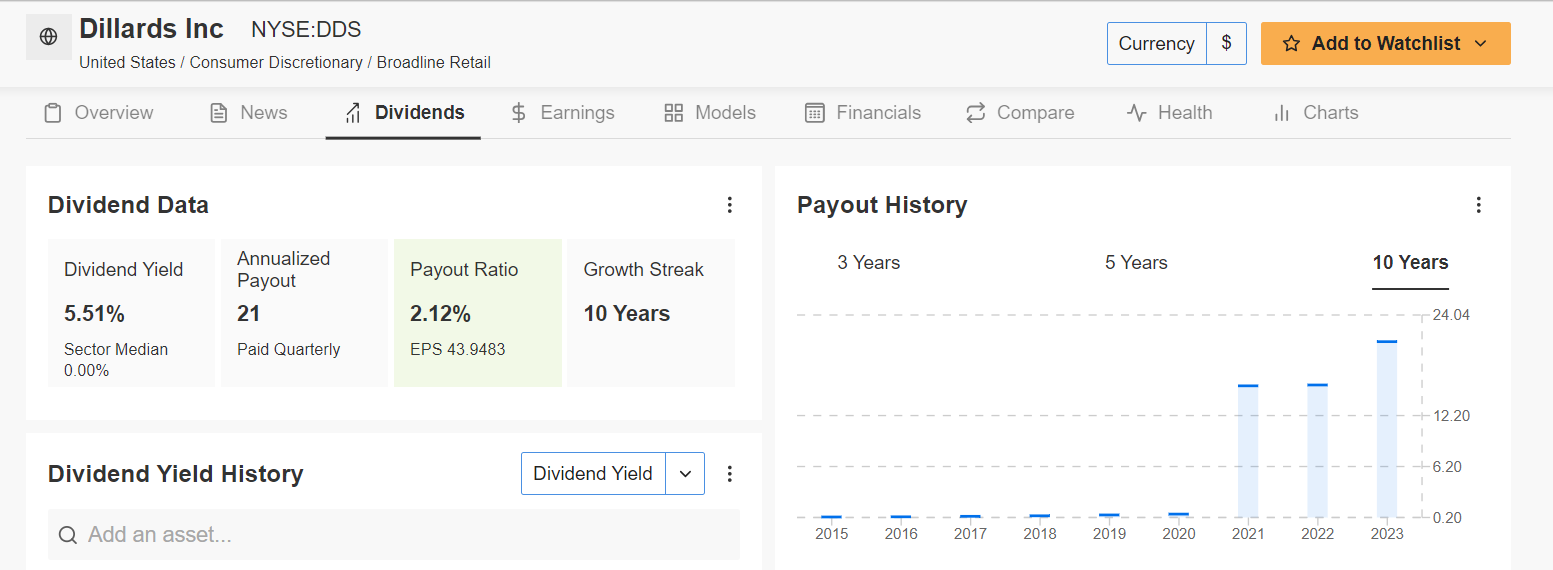

Dividend and Valuation:

Dillard’s offers a substantial annual dividend payout of $21 per share, yielding an impressive 5.51%. The company has consistently raised its dividend for 10 consecutive years, reflecting its commitment to returning value to shareholders.

Source: InvestingPro

According to InvestingPro’s AI-powered models, Dillard's is currently undervalued, with a +7.8% upside to its Fair Value price estimate of $410.61.

This blend of high yield, dividend growth, and potential capital appreciation makes Dillard's an attractive investment, particularly during periods of economic uncertainty.

Conclusion

In an environment of unprecedented market volatility, investing in strong dividend-paying stocks like Prudential Financial, Diamondback Energy, and Dillard’s can provide both income and potential capital appreciation.

Each of these companies is undervalued according to InvestingPro’s AI-powered quantitative models, offering significant upside potential. Moreover, their robust financial health and consistent dividend payouts make them attractive options for investors seeking stability amid market uncertainty.

***

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.