- Key market indicators signal sustained growth as investor optimism stays high.

- Tech stocks, led by giants like Nvidia, continue to power the market’s rally.

- Strong consumer confidence and bullish sentiment point to more gains ahead.

- Get ready for massive savings on InvestingPro this Black Friday! Access premium market data and supercharge your research at a discount. Don't miss out - click here to save 55%!

As the stock market powers through new highs, fueled by investor optimism and resilient fundamentals, three compelling indicators suggest this bull run isn’t slowing down anytime soon.

Brokers offering extended hours saw a significant spike in volume last week post-elections, with Robinhood (NASDAQ:HOOD) reporting its largest overnight session since launching 24-hour trading last year, with volume soaring 11 times its typical overnight activity.

Similarly, Interactive Brokers (NASDAQ:IBKR) set its own records, executing 349,910 trades, including 188,168 in U.S. equities and 161,742 in derivatives.

Following a record-breaking day with over $160 billion in options traded, confidence is strong across sectors, and a potent mix of favorable seasonal trends, election outcomes, and fresh market leadership supports continued gains.

While many factors drive the market’s momentum, there are three key reasons why this rally still has plenty of room to run.

1. Indexes' Strong Performance Following Elections

History shows that markets tend to gain following a presidential election, and this year is no exception.

The Dow Jones Industrial Average, S&P 500, Nasdaq, and Russell 2000 have all experienced solid post-election surge.

On average, the Dow Jones has climbed 2.38%, the S&P 500 2.03%, the Nasdaq 1.50%, and the Russell 2000 has surged by 4.93%.

Additionally, when the S&P 500 gained over 17.5% by November, it finished the year strong—rising in 12 out of 14 instances for November and December.

Based on history, strong performances following elections back this outlook, with stocks rising nine times out of ten a year after an election, averaging a 15.2% gain.

2. Tech Stocks Set to Power the Dow

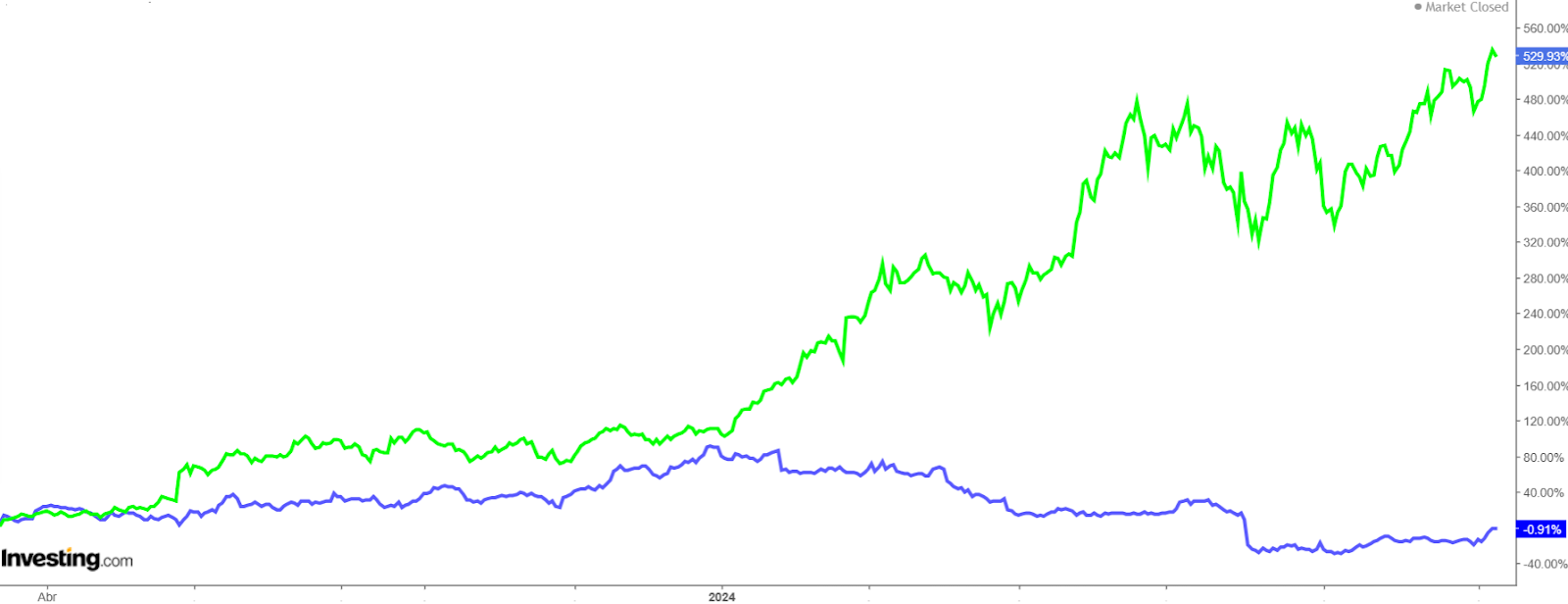

The tech sector continues to dominate, and recent changes to the Dow Jones only emphasize its growing weight. Nvidia's (NASDAQ:NVDA) entry into the Dow, replacing Intel NASDAQ:INTC), marks a significant shift.

With a tech-heavy index now led by giants like Nvidia, Apple (NASDAQ:AAPL), and Microsoft (NASDAQ:MSFT), investors are betting on continued strength in the sector, which has historically been a key driver of market gains.

Nvidia, in particular, has had a stellar year and is expected to post strong results, further fueling investor optimism.

3. Consumer Confidence Remains Strong and Investor Sentiment Remains Bullish

The market's resilience is supported by a surge in consumer confidence, with sentiment at an all-time high.

The latest Conference Board survey revealed that confidence in stock prices rising through 2025 is stronger than ever, and traders have built the largest long position in U.S. stock futures in history.

This optimistic outlook signals that investors are not just buying into the current momentum—they're betting on sustained growth well into the future.

In terms of investor sentiment, the latest American Association of Individual Investors (AAII) survey shows an uptick in bullish sentiment, rising by 2.1 percentage points to 41.5%, well above the historical average of 37.5%.

Meanwhile, bearish sentiment dropped by 3.3 percentage points to 27.6%, remaining below the long-term average of 31%.

This reflects an overall positive outlook, with investors feeling confident about the direction of the market heading into the final stretch of the year.

With these three factors in play—investor confidence, historical trends, and the tech sector's dominance—the stock market’s bull run shows no signs of slowing down anytime soon.

Claim 55% off on the Black Friday sale today! Click on the banner below.

***

Disclaimer: This article is for informational purposes only. It is not intended as a solicitation, offer, advice, or recommendation to purchase any asset. All investments should be evaluated from multiple perspectives, and it is important to remember that any investment decision and the associated risks are the sole responsibility of the investor. Additionally, no investment advisory services are provided.