- The war in Ukraine still rages on

- U.S. defense companies have been at the forefront of supplying new weapons to Ukraine

- Let's take a look at three of them and how they have fared since the war started

A few months after the outbreak of war in Ukraine, Sky News collaborated with the Stockholm International Peace Research Institute (SIPRI) to publish a report revealing the details of NATO States' deliveries to Ukraine. The report highlighted that Britain and the United States were the top suppliers of new weapons.

In the United States, RTX Corp (NYSE:RTX) and Lockheed Martin (NYSE:LMT) are major beneficiaries, providing Javelin-guided missiles, FIM-92 Stinger anti-aircraft sets, and GMLRS-guided surface-to-surface missiles. Now, over a year later, let's check how these companies are faring.

We'll also keep an eye on General Dynamics Corporation (NYSE:GD), as it is scheduled to release its quarterly results next week.

1. RTX Corporation

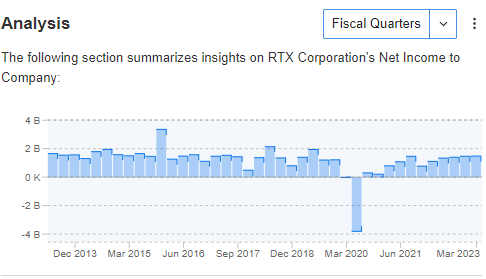

In the first half of 2023, RTX Corporation's stock (formerly Raytheon Technologies) has been going through a consolidation phase. Meanwhile, on the fundamental side, the defense company has received steady orders, including a recent confirmation from Defense Advanced Research Projects Agency (DARPA) to build HAWC systems, helping steady revenues. The company's chart shows consistent revenue and net profits, which have been maintained over the past two years.

Source: InvestingPro

Source: InvestingPro

Despite the recent deceleration, the company's stock price continues to follow an upward trend. Currently, the critical technical level to watch is around $93 per share. If the stock price breaks below this level, it could lead to a more significant correction, with a potential target near $82 per share.

If RTX Corp's upcoming results surpass expectations, it could significantly reduce the probability of a bearish scenario, and the stock may likely continue to consolidate.

2. General Dynamics Corporation

Next week, we'll also see General Dynamics Corporation, an American company that manufactures systems for land forces and navies, releasing its Q2 2023 results.

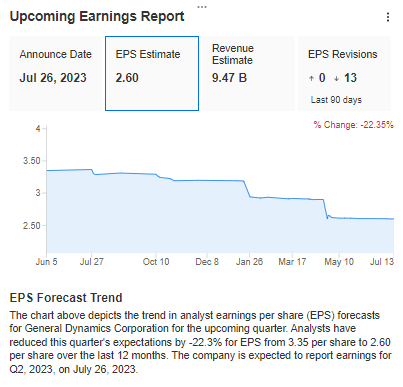

As we anticipate the earnings announcement, it's worth noting that analysts are currently forecasting earnings per share of $2.60 and revenue of $9.47 billion. What's striking is that expectations have declined by over 20% in the past few months, with 13 downward revisions.

This indicates growing caution among analysts about the company's performance, making the upcoming earnings report a pivotal event for investors to watch closely.

Source: InvestingPro

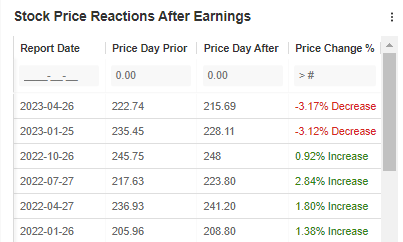

Furthermore, when analyzing recent market reactions, it becomes evident that even when companies report data that surpass forecasts, it doesn't always lead to a positive market reaction, as seen in the last two quarters.

Source: InvestingPro

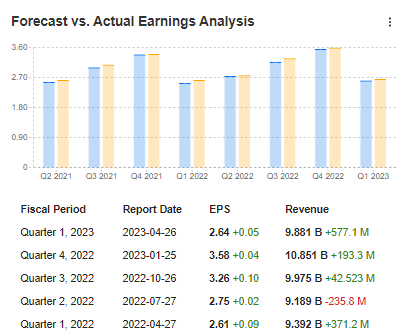

Source: General Dynamics Corporation

Hence, it is crucial to exercise caution when seeking long positions. The critical line of defense should be around the $200-$205 area. A breakout below this level would serve as a warning signal for bullish investors.

3. Lockheed Martin Corporation

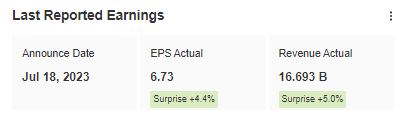

On Tuesday, Lockheed Martin Corporation's results were revealed, and they surpassed forecasts.

Source: InvestingPro

Although Lockheed Martin Corporation's results were better than forecasts, the stock has been in a dynamic downward momentum for several days. This could lead to a potential test of the crucial support area at $445 per share.

Just like with General Dynamics Corporation, we should closely watch how the market reacts to this level to understand its impact on maintaining the upward trend. The $445 support area is of utmost importance, and whether it holds or breaks could signal the stock's future direction.

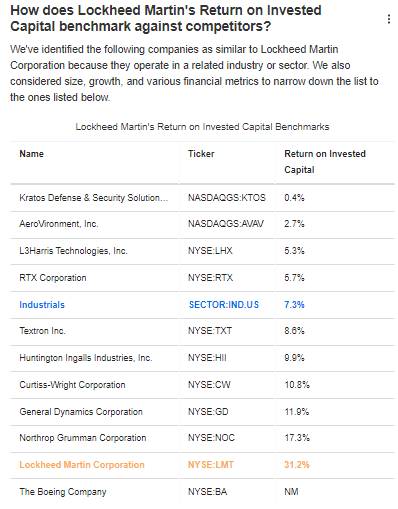

From a purely fundamental standpoint, it's essential to highlight the ROE ratio, which stands out from the competition with an impressive score of 31.2%.

Source: InvestingPro

This indicator, the ROE ratio, shows how much profit the company generated from the equity contributed by its shareholders. Having such a high result is a very positive signal and can be a key element in supporting the company's stock price in the medium and long term.

***

Access first-hand market data, factors affecting stocks, and comprehensive analysis. Take advantage of this opportunity by subscribing and unlocking the potential of InvestingPro to enhance your investment decisions.

And now, you can purchase the subscription at a fraction of the regular price. Our exclusive summer discount sale has been extended!

InvestingPro is back on sale!

Enjoy incredible discounts on our subscription plans:

- Monthly: Save 20% and get the flexibility of a month-to-month subscription.

- Annual: Save an amazing 50% and secure your financial future with a full year of InvestingPro at an unbeatable price.

- Bi-Annual (Web Special): Save an amazing 52% and maximize your profits with our exclusive web offer.

Don't miss this limited-time opportunity to access cutting-edge tools, real-time market analysis, and expert opinions.

Join InvestingPro today and unleash your investment potential. Hurry, the summer sale won't last forever!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of asset is evaluated from multiple points of view and is highly risky and, therefore, any investment decision and the associated risk remains with the investor. The author owns the stocks mentioned in the analysis.