- The two tech stocks discussed below offer significant upside potential beyond the usual tech giants.

- Both companies are poised to benefit from powerful industry tailwinds and strategic innovation.

- InvestingPro's AI models indicate double-digit growth potential, supported by strong financial health scores.

- Looking for more actionable trade ideas? Try InvestingPro for under $8/Month.

Nvidia (NASDAQ: NASDAQ:NVDA) has rightfully garnered attention for its groundbreaking advancements in AI and semiconductor technology.

However, there are other tech stocks that are poised for significant growth but have yet to capture the same level of interest from the broader market.

ON Semiconductor (NASDAQ:ON) and Jabil Circuit (NYSE:JBL) stand out as interesting opportunities for investors seeking substantial returns outside the mainstream tech giants.

Here’s why these two stocks are worth a closer look for those aiming to diversify their tech investments and uncover hidden potential.

1. ON Semiconductor

- Current Price: $76.30

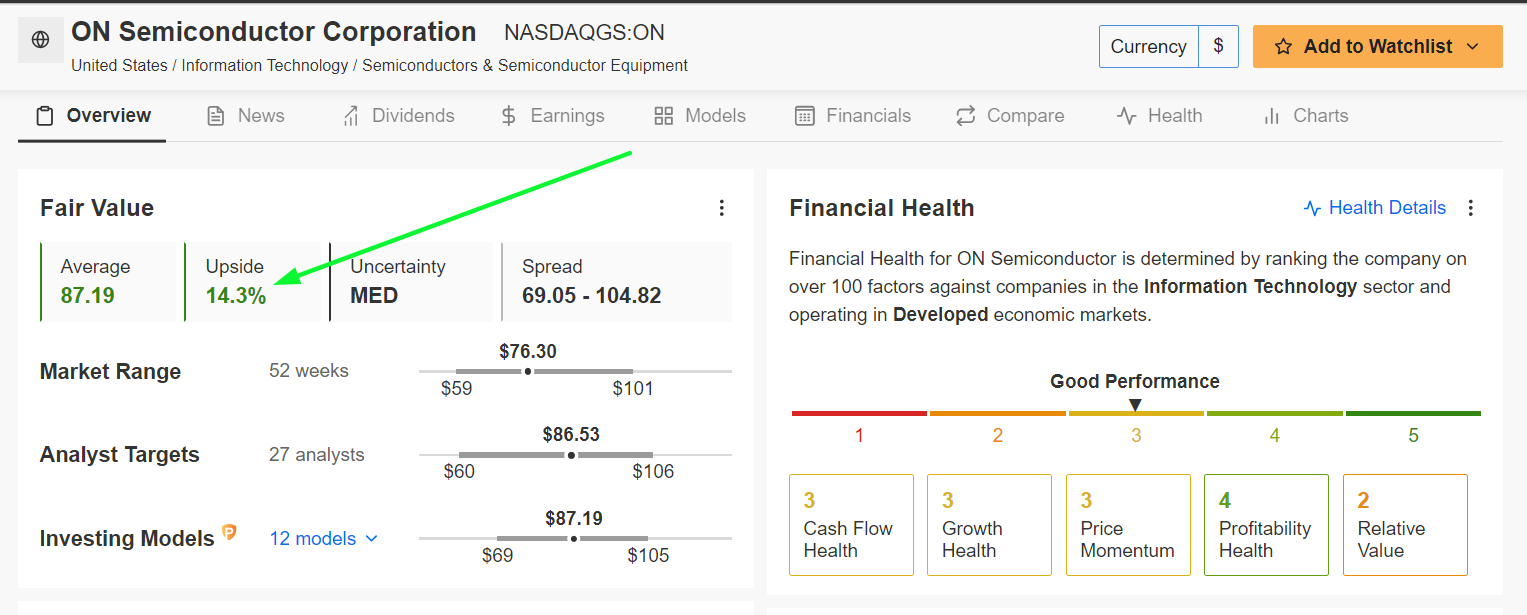

- Fair Value Price Target: $87.19 (+14.3% Upside)

ON Semiconductor has emerged as a crucial player in the semiconductor industry, providing intelligent power and sensing solutions that are indispensable in high-growth sectors such as automotive, industrial automation, and communications.

The company's products are increasingly critical as industries shift toward electric vehicles (EVs), advanced driver-assistance systems (ADAS), and renewable energy solutions.

As these industries expand, the demand for ON Semiconductor's products is expected to soar, driving the company’s revenue and profitability higher.

ON’s strategic focus on innovation has allowed it to build a robust product portfolio tailored to the needs of the future.

The company’s investments in energy-efficient technologies and its ability to meet the stringent requirements of the automotive industry have set it apart from its competitors.

Furthermore, ON has effectively managed supply chain challenges, maintaining strong production capabilities even in a constrained environment.

Source: Investing.com

ON stock closed at $76.30 on Thursday, earning the Scottsdale, Arizona-based semiconductor supplier company a valuation of $32.7 billion. Shares are off by 8.7% year-to-date.

According to AI-powered Fair Value models from InvestingPro, ON Semiconductor has an upside potential of +14.3%, making it a compelling investment opportunity. The company also boasts an above-average Financial Health Score, which highlights its solid balance sheet, consistent profitability, and strong cash flow generation.

Source: InvestingPro

These attributes position ON Semiconductor as a resilient player in the tech sector, ready to capitalize on the accelerating demand for smart, connected technologies.

2. Jabil Circuit

- Current Price: $107.64

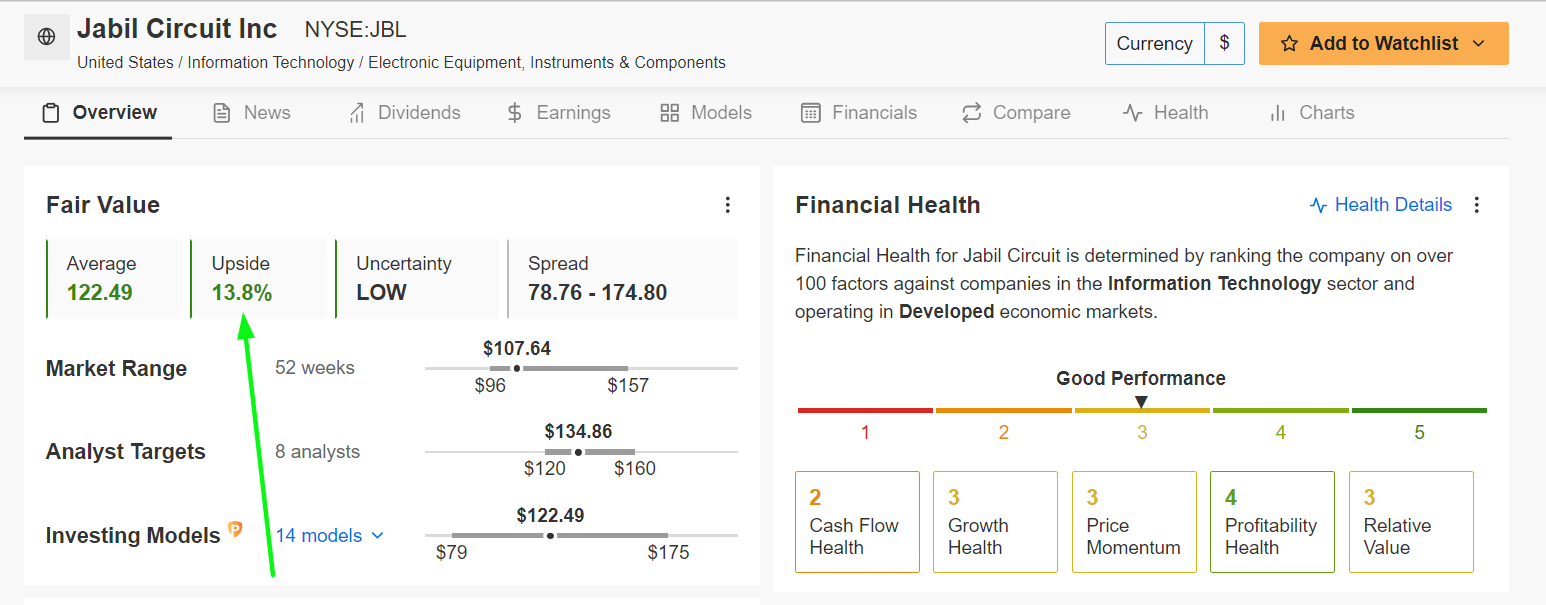

- Fair Value Price Target: $122.49 (+13.8% Upside)

Jabil Circuit is a global leader in manufacturing services, providing design, production, and product management solutions for a wide range of industries, including electronics, healthcare, automotive, and aerospace.

The company’s diverse client base and deep expertise in advanced manufacturing technologies make it an indispensable partner for many leading brands worldwide.

Jabil has been a significant beneficiary of the ongoing digital transformation, with increasing demand for electronics, 5G infrastructure, and electric vehicles driving its growth. The company’s ability to innovate and adapt to the evolving needs of its customers has allowed it to consistently outperform expectations.

Jabil’s strategic investments in emerging technologies, such as additive manufacturing and IoT solutions, have further strengthened its competitive position, paving the way for continued success in the years to come.

Source: Investing.com

JBL stock ended Thursday’s session at $107.64, bouncing off a recent 52-week low of $95.85 reached on August 5. At current levels, the St. Petersburg, Florida-based electronics manufacturing services firm has a market cap of $12.2 billion. Shares are down 15.5% in 2024.

With a +13.8% upside potential as per the AI-powered Fair Value models in InvestingPro, Jabil Circuit is another underappreciated tech stock with considerable growth prospects. In addition, Jabil’s above-average Financial Health Score reflects its strong fundamentals, making it a reliable choice for investors seeking steady returns in the tech sector.

Source: InvestingPro

These factors make Jabil a standout in the tech sector, offering investors a reliable avenue for capital appreciation.

Conclusion

While Nvidia continues to dominate the headlines, ON Semiconductor and Jabil Circuit present compelling opportunities for investors looking to diversify their tech portfolios with stocks that have significant upside potential.

Both companies are well-positioned to benefit from industry tailwinds and have strong upside potential according to InvestingPro’s AI-powered models.

Their robust financial health and strategic focus on high-growth areas make them worthy of consideration beyond the more widely recognized tech names.

***

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF, and the Invesco QQQ Trust ETF. I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.