- With the Fed expected to deliver more hikes this year, many have started to worry about a possible recession.

- I used the InvestingPro stock screener to search for high-quality companies with strong fundamentals, increasing dividend payouts, and strong upside ahead.

- Looking for more actionable trade ideas to navigate the current market volatility? InvestingPro Summer Sale is on: Check out our massive discounts on subscription plans!

As fears of a looming recession begin to mount, investors seek refuge in stable and income-generating investments. In such times, high-quality dividend-paying stocks stand out as attractive options that can offer a combination of potential capital appreciation and regular income, regardless of economic conditions.

By focusing on companies with solid fundamentals, robust cash flows, and a track record of consistent dividend payments, investors can position themselves to navigate through uncertain times while potentially benefiting from long-term growth and dividend stability.

Taking that into consideration, I used the InvestingPro stock screener to search for high-quality dividend stocks to buy amid the current market environment.

By utilizing the InvestingPro stock screener's comprehensive analysis and filtering capabilities, investors can uncover dividend-paying stocks that provide a reliable income stream and exhibit the potential for long-term growth, making them resilient options in uncertain economic climates.

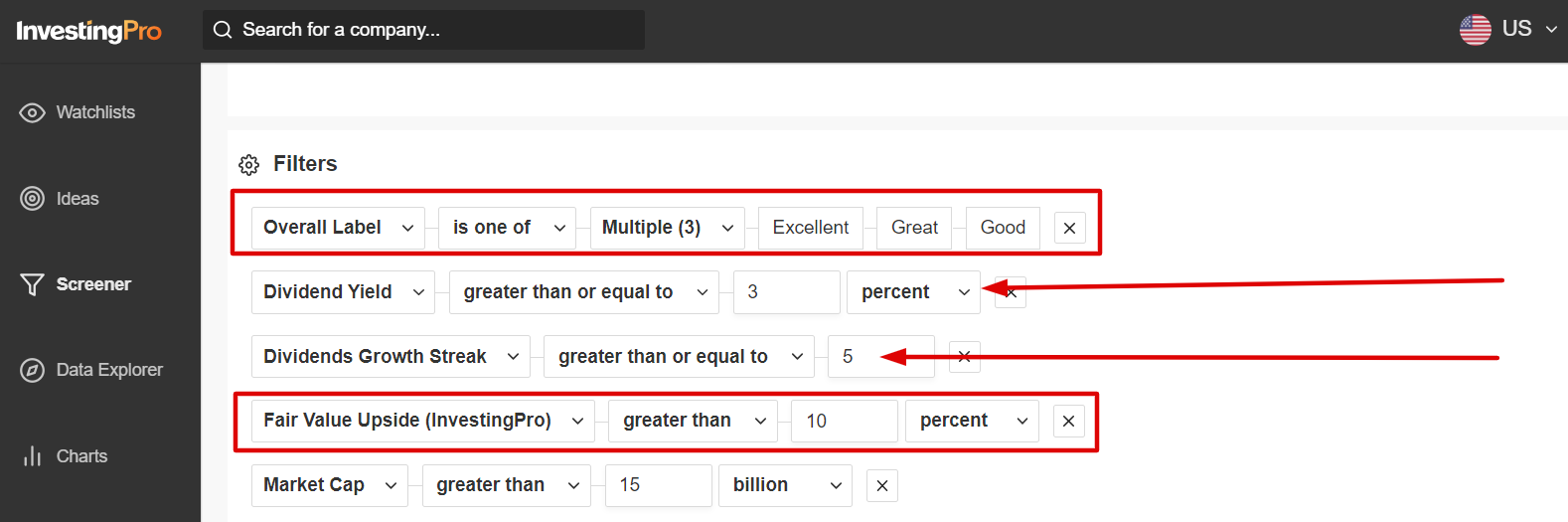

I first scanned for companies with an InvestingPro Health Label of ‘Excellent,’ ‘Great,’ or ‘Good.’

I then filtered for stocks with a dividend payout yield of 3% or above and a dividend growth streak of at least five years.

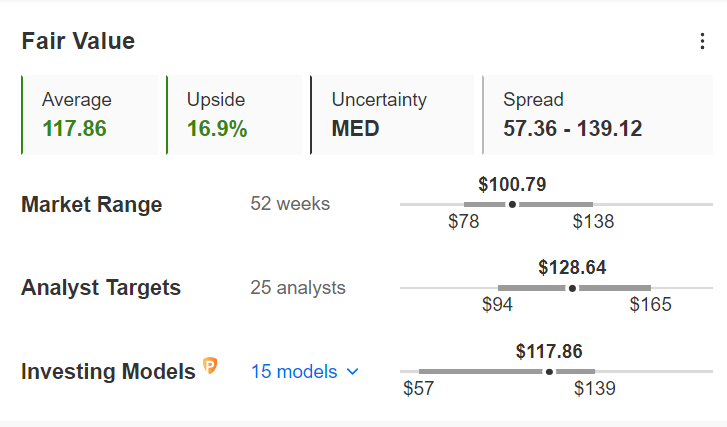

And those names with an InvestingPro ‘Fair Value’ upside greater than or equal to 10% made my watchlist. The Fair Value estimate is determined according to several valuation models, including price-to-earnings (P/E) ratios, price-to-sales (P/S) ratios, and price-to-book (P/B) multiples.

Source: InvestingPro

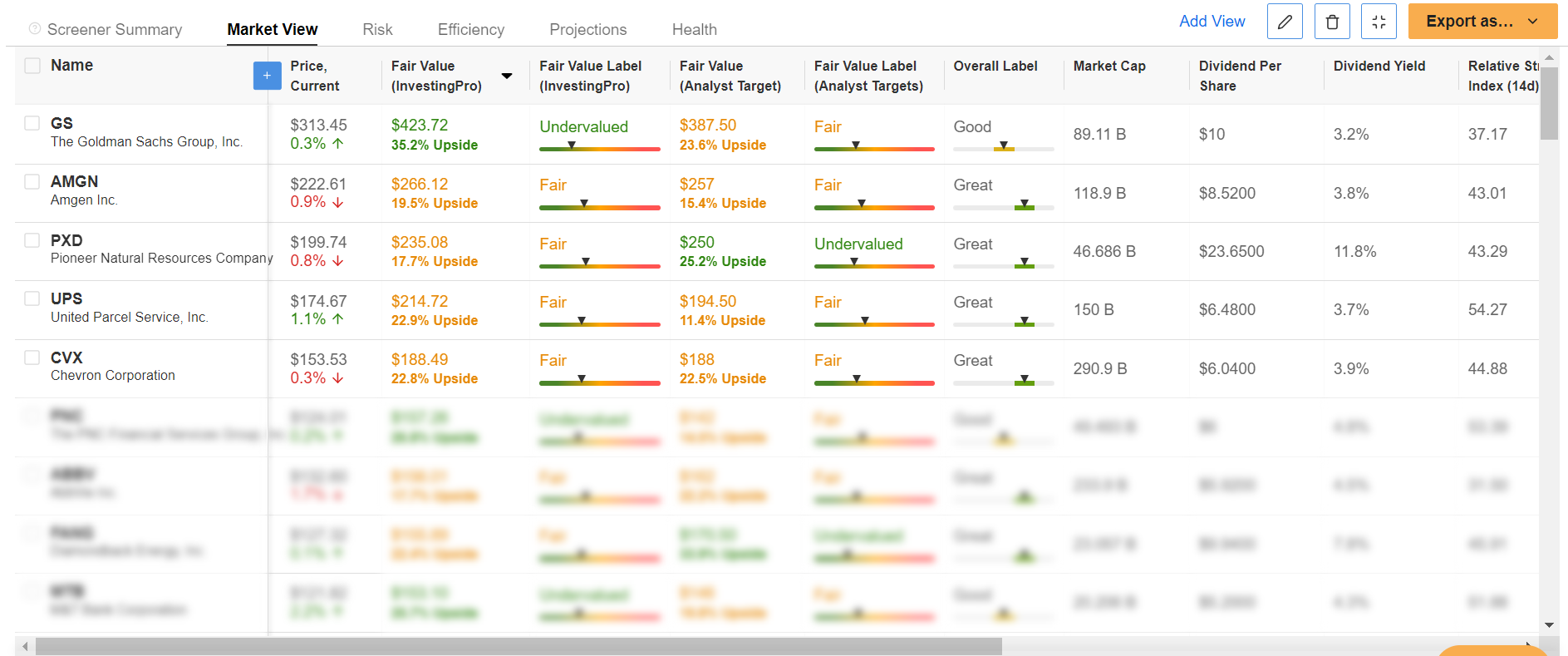

Once the criteria were applied, I was left with a total of 33 companies that have the potential to weather economic downturns and provide investors with a reliable income stream, including Goldman Sachs (NYSE:GS), Amgen (NASDAQ:AMGN), Pioneer Natural Resources (NYSE:PXD), United Parcel Service (NYSE:UPS), and Chevron (NYSE:CVX).

Source: InvestingPro

Of those, ConocoPhillips (NYSE:COP) and Kellogg (NYSE:K) were the two that stood out the most to me thanks to their solid fundamentals, healthy balance sheets, and long history of dividend increases.

Start your free 7-day trial with InvestingPro to see the full list of stocks that meet my criteria. If you're already an InvestingPro subscriber, you can view my selections here.

1. ConocoPhillips

- *Year-To-Date Performance: -14.6%

- *InvestingPro Fair Value Upside: +16.9%

At a current price of around $100, InvestingPro has highlighted oil-and-gas behemoth ConocoPhillips (NYSE:COP) to provide robust long-term value for investors in the coming months, making it a smart buy amid the current market backdrop.

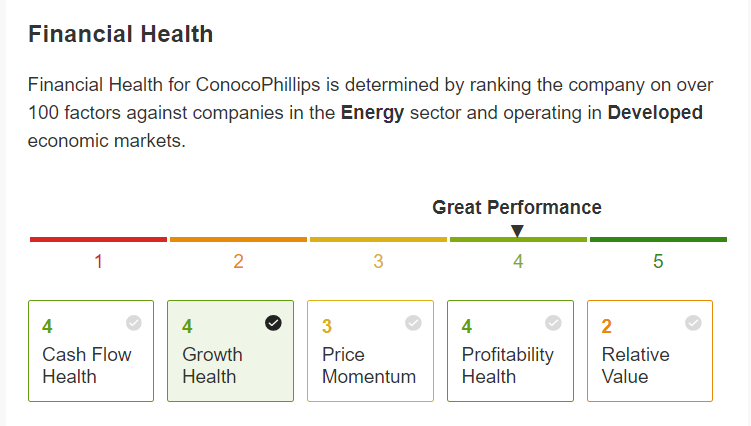

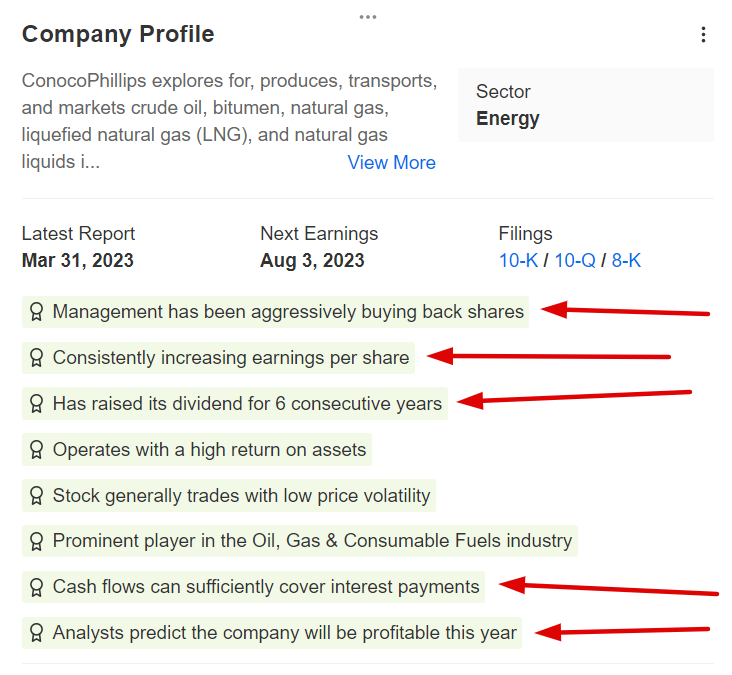

Demonstrating the strength and resilience of its business, the Houston, Texas-based energy company sports a near-perfect InvestingPro Financial Health score of 4 out of 5. The Pro Health score is determined by ranking the company on over 100 factors against other companies in the Energy sector.

Source: InvestingPro

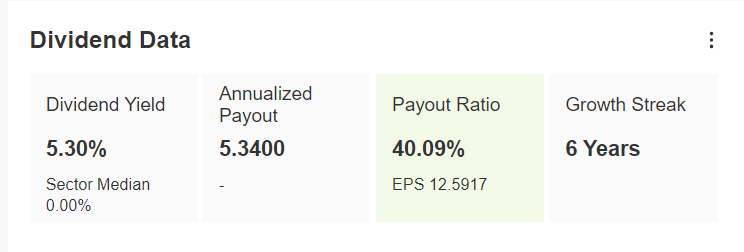

In addition to its encouraging fundamentals, the U.S. oil-and-gas giant remains committed to returning additional capital to its investors in the form of increased cash dividends and share repurchases, regardless of economic conditions.

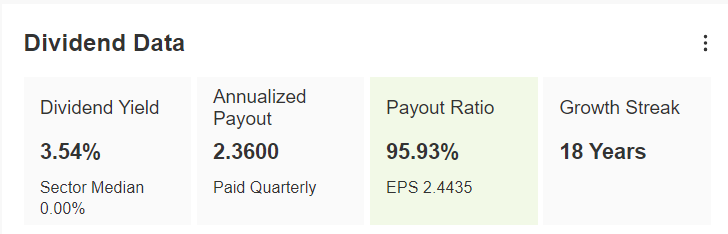

Not only do shares yield a market-beating 5.30%, but the company has also raised its annual dividend for six consecutive years.

Source: InvestingPro

In addition to boosting dividends, ConocoPhillips has also returned capital to stockholders by using share buybacks.

InvestingPro also highlights several additional tailwinds ConocoPhillips has going for it, including a robust earnings outlook, healthy profitability, a pristine balance sheet, and solid cash flow growth.

Source: InvestingPro

As InvestingPro points out, COP stock could see an increase of roughly 17% from current levels, according to several valuation models, bringing it closer to its ‘Fair Value’ price target of $117.86 per share.

Source: InvestingPro

Wall Street also remains optimistic about the energy firm, with all 26 analysts surveyed by Investing.com rating shares as either ‘buy’ or ‘hold.’ With an average price target of around $129, analysts see an upside of 27.6% ahead.

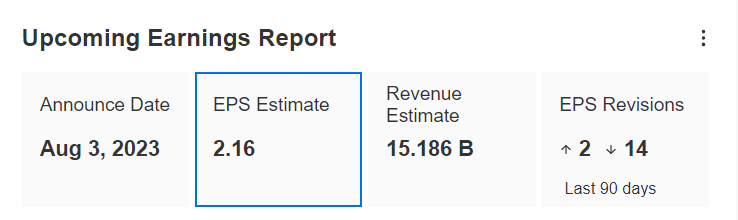

Despite the difficult macro backdrop, Conoco posted upbeat first-quarter financial results on May 4 and raised its full-year production outlook.

Source: InvestingPro

The company is slated to report second-quarter earnings on Thursday, Aug. 3. COP has topped Wall Street’s top-line expectations in 10 of the last 11 quarters while trailing revenue estimates only once in that span, highlighting strong execution across the company.

With InvestingPro, you can conveniently access a single-page view of complete and comprehensive information about different companies all in one place, saving you significant time and effort.

2. Kellogg

- *Year-To-Date Performance: -6.4%

- *InvestingPro Fair Value Upside: +14.8%

Despite the recent downtrend in its stock, InvestingPro has flagged Kellogg (NYSE:K) - which is one of the world’s biggest food manufacturing companies - to provide significant returns for shareholders in the months ahead.

In general, stocks of defensive-minded consumer staple companies whose products are essential to people’s everyday lives tend to perform well in challenging macroeconomic environments.

Kellogg, which has operations in over 180 countries, is best known for producing a wide variety of cheap and affordable cereals and convenience foods, such as toaster pastries, frozen waffles, potato chips, and crackers. Some of the company’s most iconic brands include Corn Flakes, Froot Loops, Rice Krispies, Frosted Flakes, Pop-Tarts, Eggo, Pringles, and Cheez-Its.

The Battle Creek, Michigan-based packaged food giant has proven over time that it can sustain a slowing economy and still provide higher cash dividend payouts thanks to its dependently profitable business model that has successfully weathered plenty of storms in the past.

Kellogg has raised its annual dividend for 18 years in a row, and shares currently yield 3.54%, more than double the implied yield for the S&P 500 index, which is 1.50%.

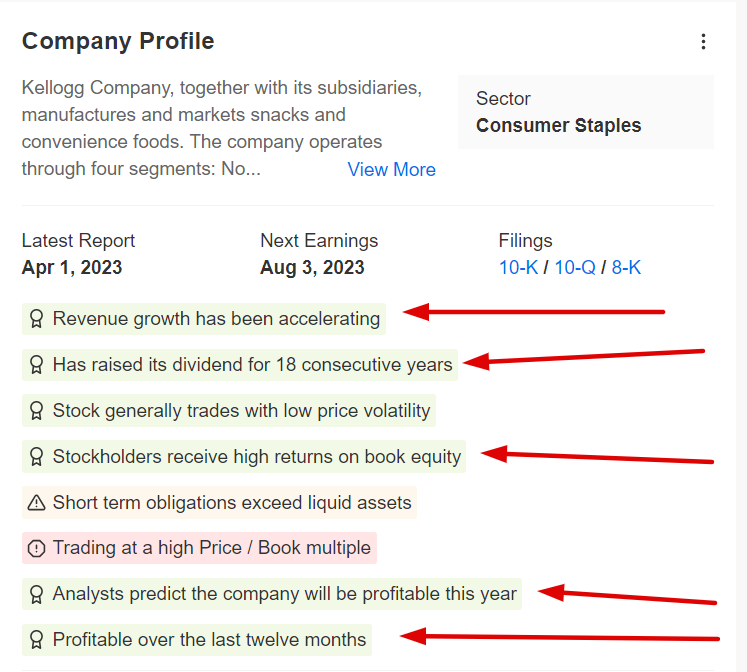

Source: InvestingPro

Besides its growing dividend, InvestingPro points out several tailwinds expected to fuel gains in K stock in the months ahead, with highlights including accelerating revenue growth, high earnings quality, and a robust profitability outlook.

Source: InvestingPro

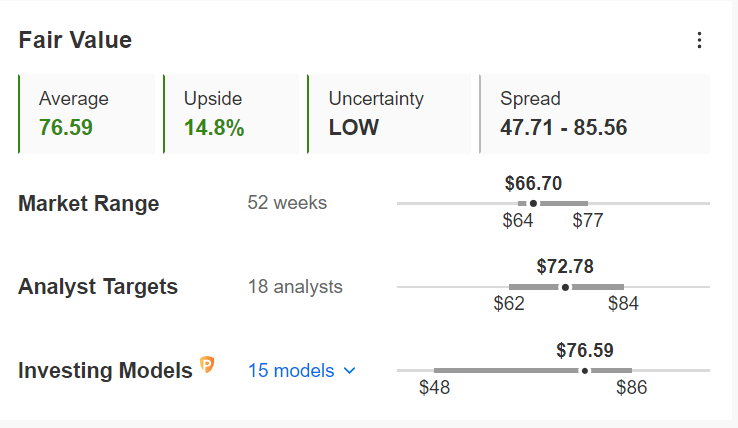

Not surprisingly, Kellogg shares are substantially undervalued according to the quantitative models in InvestingPro. With a Fair Value price target of $76.59, K stock could see an upside of 14.8% from Tuesday’s closing price.

Source: InvestingPro

In a sign of how well its business has performed amid the current environment, Kellogg reported first-quarter profit and sales, which blew past consensus expectations on May 4, thanks to resilient demand for its cereals and snacks.

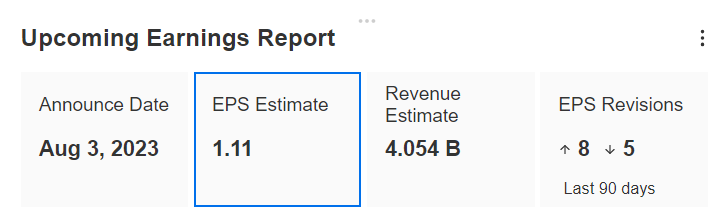

Source: InvestingPro

It is tentatively scheduled to deliver second-quarter numbers on Thursday, Aug. 3. Kellogg has beaten Wall Street’s profit and sales expectations for nine straight quarters, a testament to the strength and resilience of its underlying business.

As part of the InvestingPro Summer Sale, you can now enjoy incredible discounts on our subscription plans for a limited time:

- Monthly: Save 20% and gain the flexibility to invest on a month-to-month basis.

- Yearly: Save a jaw-dropping 50% and secure your financial future with a full year of InvestingPro at an unbeatable price.

- Bi-Yearly (Web Special): Save an astonishing 52% and maximize your returns with our exclusive web offer.

Don't miss out on this limited-time opportunity to access cutting-edge tools, real-time market analysis, and expert insights. Join InvestingPro today and unlock your investing potential. Hurry, Summer Sale won't last forever!

Disclosure: At the time of writing, I am short on the Dow, S&P 500, and Russell 2000 via the ProShares UltraPro Short Dow 30 ETF (SDOW), ProShares Short S&P 500 ETF (SH) and ProShares Short Russell 2000 ETF (RWM). I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.