- U.S. retail sales, retailer earnings, debt ceiling drama in focus this week.

- Walmart stock is a buy with earnings beat on deck.

- Home Depot shares are a sell amid expected weak Q1 results.

- Looking for more top-rated stock ideas to protect your portfolio amid the increasingly uncertain economic climate? Members of Investing Pro get exclusive access to our research tools and data. Learn More »

Stocks on Wall Street ended slightly lower on Friday, as investors continued to assess the outlook for the economy, inflation, and interest rates.

For the week, the blue-chip Dow Jones Industrial Average lost 1.1%, while the S&P 500 dipped 0.3%. The tech-heavy Nasdaq Composite eked out a small gain of 0.4%.

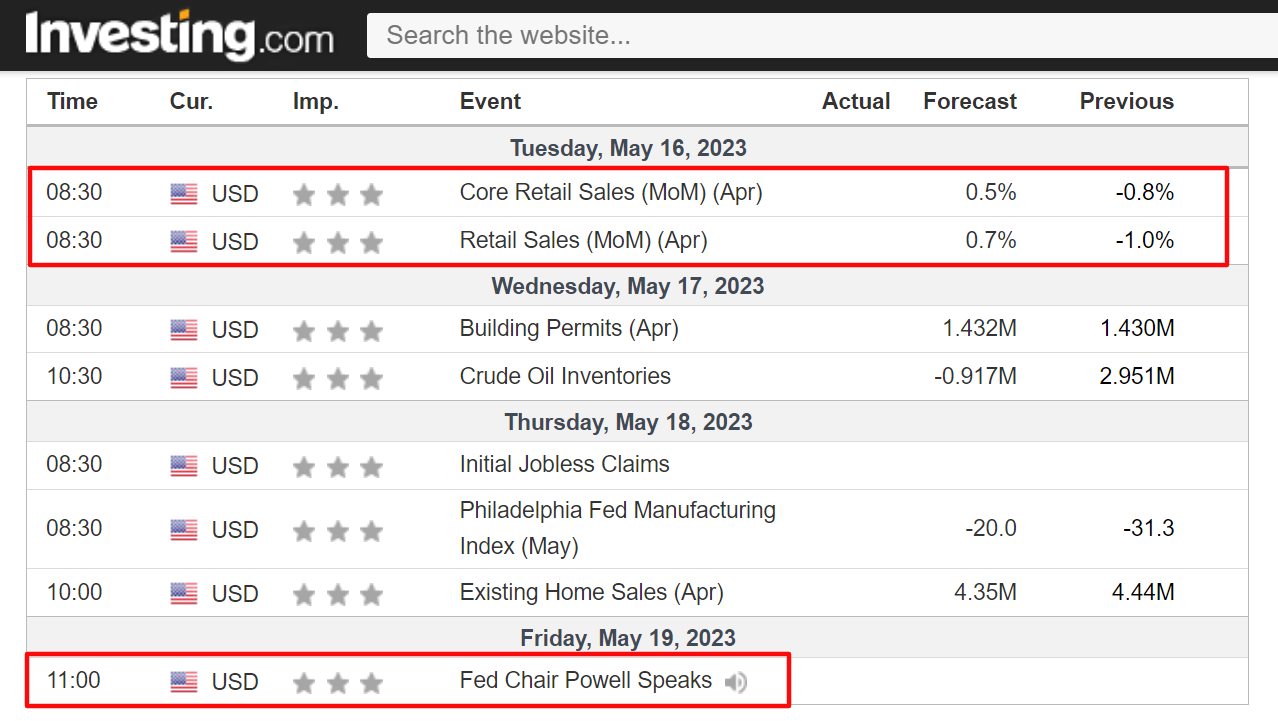

The week ahead is expected to be another eventful one. On the economic calendar, most important will be Tuesday’s U.S. retail sales report for April, with economists estimating a headline increase of +0.7% after spending fell -1.0% during the prior month.

Elsewhere, on the earnings docket, there are just a handful of corporate results due, including Walmart, Home Depot, Target (NYSE:TGT), TJX Companies (NYSE:TJX), Foot Locker (NYSE:FL), Cisco (NASDAQ:CSCO), Alibaba (NYSE:BABA), and Baidu (NASDAQ:BIDU).

Meanwhile, any updates on raising the United States' $31.4 trillion debt ceiling will also be watched by investors, as the country races to avert an unprecedented default.

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another which could see further downside.

Remember though, my timeframe is just for the week ahead, May 15-19.

Stock To Buy: Walmart

I believe Walmart's (NYSE:WMT) stock will outperform in the week ahead, with a potential breakout to a new record high on the horizon, as the retail giant’s first quarter earnings report will surprise to the upside in my view.

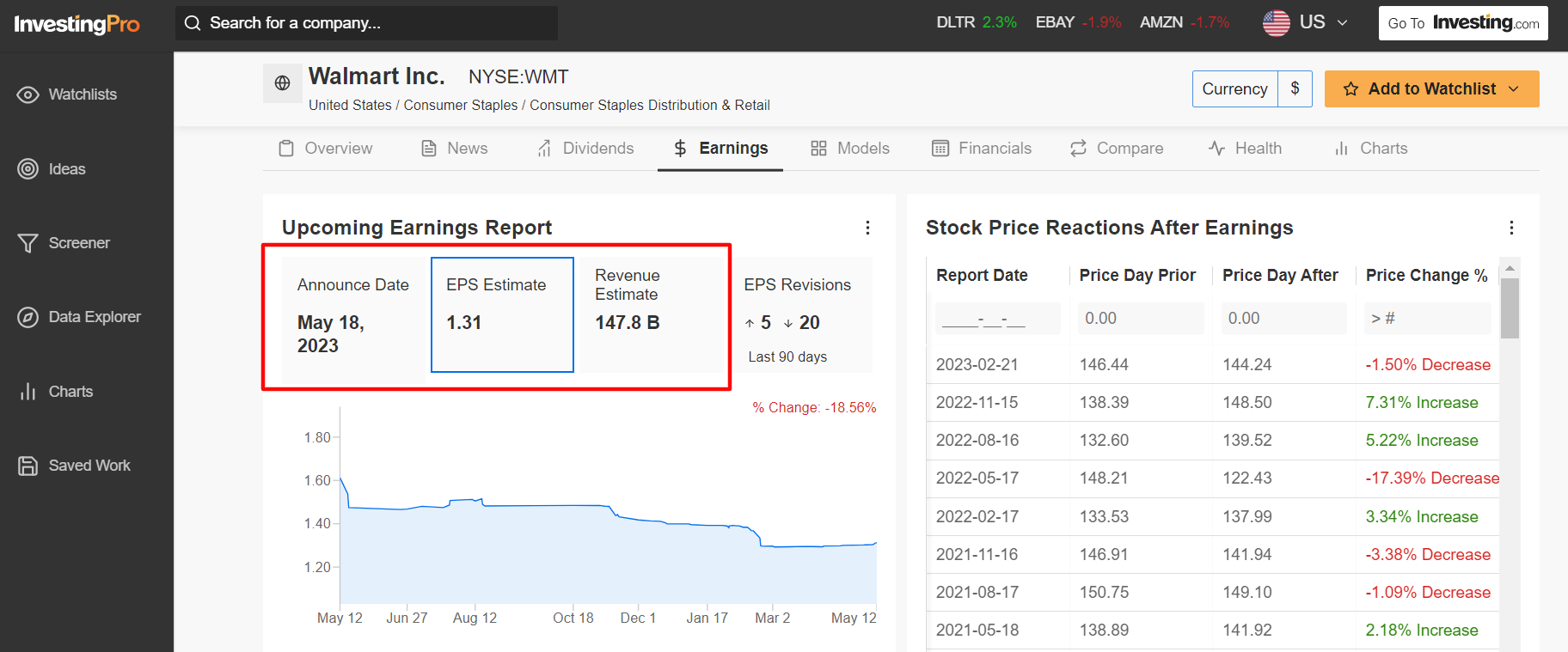

Walmart is scheduled to deliver its Q1 update before the U.S. market opens on Thursday, May 18. According to the options market, traders are pricing in a swing of around 4% in either direction for WMT stock following the report.

Despite a difficult environment for retailers, I believe Walmart is poised to deliver a better-than-expected print as it benefits from ongoing changes in consumer behavior due to lingering inflationary pressures that are causing disposable income to shrink.

The Bentonville, Arkansas-based big-box retailer - which operates more than 5,000 stores across the U.S. - has topped Wall Street’s sales estimates for 12 straight quarters dating back to Q1 2020, while missing profit estimates only twice in that span, demonstrating the strength and resilience of its business.

Source: InvestingPro

According to InvestingPro, Walmart is expected to post earnings per share of $1.31, a slight improvement when compared to EPS of $1.30 a share in the year-ago period. Revenue is forecast to rise 4.4% year-over-year to $147.8 billion as it benefits from strong grocery sales and the increased trade down among wealthier consumers due to inflation.

Q1 same-store sales - which are expected to climb 5.3% compared to last year - will likely top estimates as U.S. consumers flock to its stores amid the current economic backdrop of persistently high inflation and recession fears.

As such, I believe Walmart CEO Doug McMillon will provide surprisingly solid guidance for the current fiscal year as the discount retailer continues to gain market share in the food and groceries business.

WMT stock ended Friday’s session at $153.07, its highest closing price since Nov. 28, 2022. Shares currently stand less than 5% away from a record high of $160.77 reached in April 2022.

At current levels, Walmart has a market cap of $412.9 billion, earning it the status of the world’s most valuable brick-and-mortar retailer and the 14th largest company trading on the U.S. stock exchange, ahead of names like JPMorgan Chase (NYSE:JPM), Procter & Gamble (NYSE:PG), Mastercard (NYSE:MA), Chevron (NYSE:CVX), and Coca-Cola (NYSE:KO).

Year-to-date, Walmart’s stock is up 8%, significantly outperforming the 0.5% gain recorded by the SPDR® S&P Retail ETF (NYSE:XRT), which tracks a broad-based, equal-weighted index of U.S. retail companies in the S&P 500.

Not surprisingly, Walmart currently boasts a ‘Financial Health’ score of 3.0 out of 5.0 on InvestingPro. That should bode well for Walmart investors as companies with health scores greater than 2.75 have outperformed the broader market by a wide margin over the past seven years, dating back to 2016.

Stock To Sell: Home Depot

I believe shares of Home Depot (NYSE:HD) will suffer a disappointing week ahead as the home improvement retailer’s latest earnings will likely reveal a sharp slowdown in both profit and sales growth due to the tough economic climate.

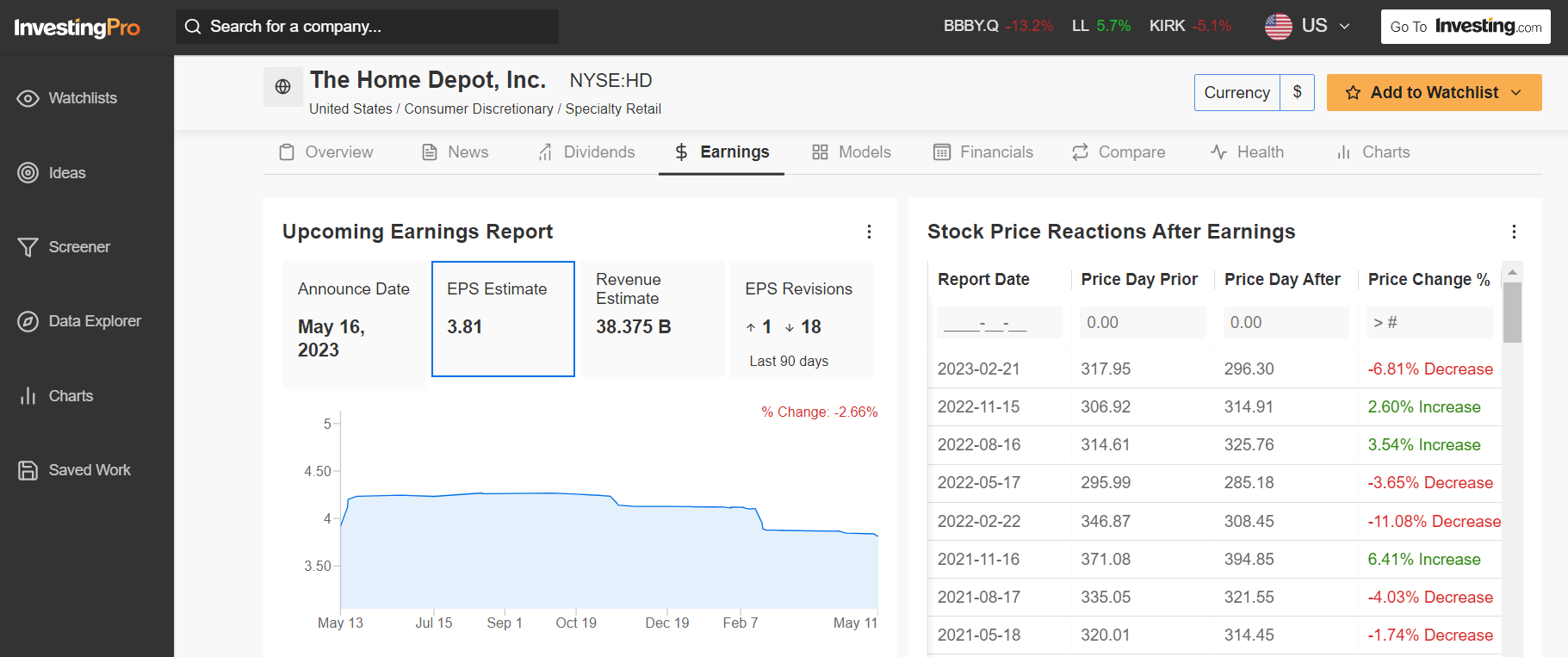

Home Depot’s first quarter financial results are due ahead of the opening bell on Tuesday and are likely to take a hit from weakening demand for its assortment of building materials and construction products from do-it-yourself customers.

Market participants expect a possible move of 3.5% in HD shares following the update, according to the options market.

Source: InvestingPro

Underscoring several near-term headwinds Home Depot faces amid the current environment, analysts have reduced their EPS estimates 18 times in the past three months, compared to just one upward revision, as per an Investing Pro survey.

Wall Street sees the Atlanta, Georgia-based retail heavyweight earning $3.81 a share in the first quarter, declining 6.8% from EPS of $4.09 in the year-ago period, due to the negative impact of rising operating expenses and higher cost pressures. Meanwhile, revenue is forecast to fall 1.4% year-over-year to $38.37 billion.

If confirmed, it would mark Home Depot’s first profit and sales declines in almost three years, as Americans cut back spending on home improvements and renovations due to the uncertain economic outlook.

Looking ahead, it is my belief that Home Depot’s management will strike a cautious tone in its forward guidance given the ongoing slowdown in the housing market, which is a key driver of spending for the home improvement sector.

HD stock closed Friday’s session at $290.47. At current valuations, Home Depot has a market cap of $294.1 billion, making it the largest U.S. home improvement retailer.

Shares have lagged the year-to-date performance of the broader market by a wide margin so far in 2023, falling 8% in contrast to the S&P 500’s 7.6% gain.

Searching for more actionable trade ideas to navigate the current market volatility? The InvestingPro tool helps you easily identify winning stocks at any given time.

Start your 7-day free trial to unlock must-have insights and data!

Here is the link for those of you who would like to subscribe to Investing Pro and start analyzing stocks yourself.

Disclosure: At the time of writing, I am short on the S&P 500 and Nasdaq 100 via the ProShares Short S&P 500 ETF (SH) and ProShares Short QQQ ETF (PSQ). I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.