- Core PCE inflation, Q1 GDP, Fed Speakers will be in focus this week.

- Micron is a buy with a strong beat-and-raise quarter expected.

- Walgreens Boots Alliance is a sell with downbeat earnings on deck.

- Looking to know when to buy or sell? Unlock access to InvestingPro’s AI-selected stock winners for just 60 cents a day!

Stocks on Wall Street finished mostly lower on Friday, weighed down by a decline in shares of market bellwether Nvidia (NASDAQ:NVDA), which dragged down the technology sector.

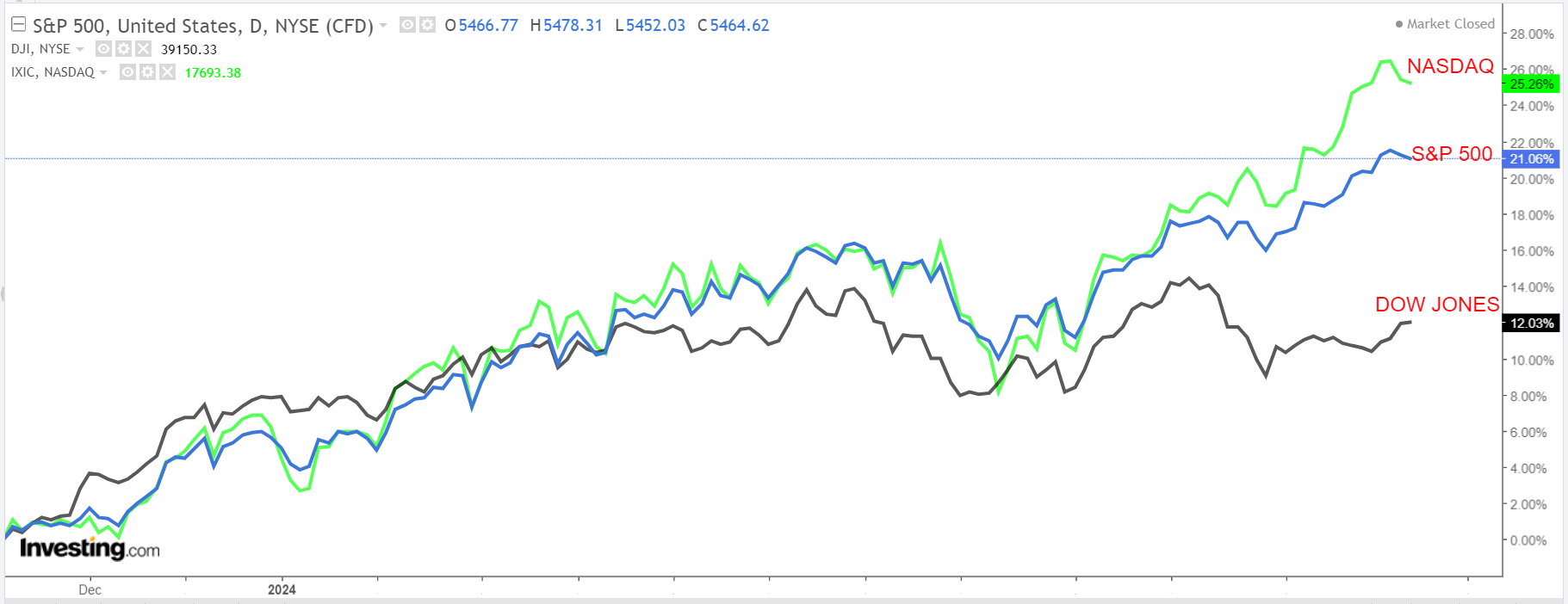

Despite that, it was a mostly positive week for the stock market. The blue-chip Dow Jones Industrial Average rose 1.4% for its best weekly performance since May, the benchmark S&P 500 added 0.6%, while the tech-heavy Nasdaq Composite finished flat.

Source: Investing.com

The week ahead is expected to be another busy one as investors assess how much juice is left in the AI-inspired rally on Wall Street and when the Fed may decide to cut interest rates.

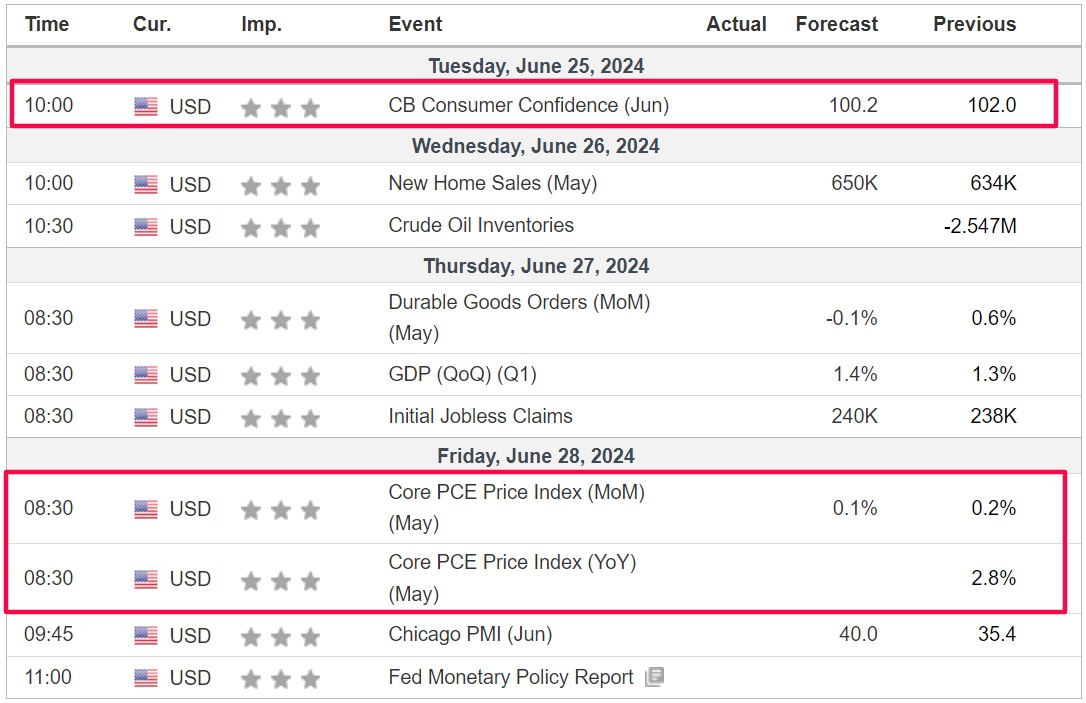

Most important on the economic calendar will be Friday’s core PCE price index, which is the Fed's favorite inflation gauge. That will be accompanied by a heavy slate of Fed speakers, with the likes of district governors Christopher Waller, Michelle Bowman, Mary Daly, Lisa Cook, and Patrick Harker all set to make public appearances.

Source: Investing.com

Investors have largely pushed back expectations for the Fed’s first cut to September, as per the Investing.com Fed Rate Monitor Tool.

Elsewhere, the earnings schedule for next week includes reports from heavyweights FedEx (NYSE:FDX), Nike (NYSE:NKE), Micron (NASDAQ:MU), and Walgreens Boots Alliance (NASDAQ:WBA).

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another which could see fresh downside. Remember though, my timeframe is just for the week ahead, Monday, June 24 - Friday, June 28.

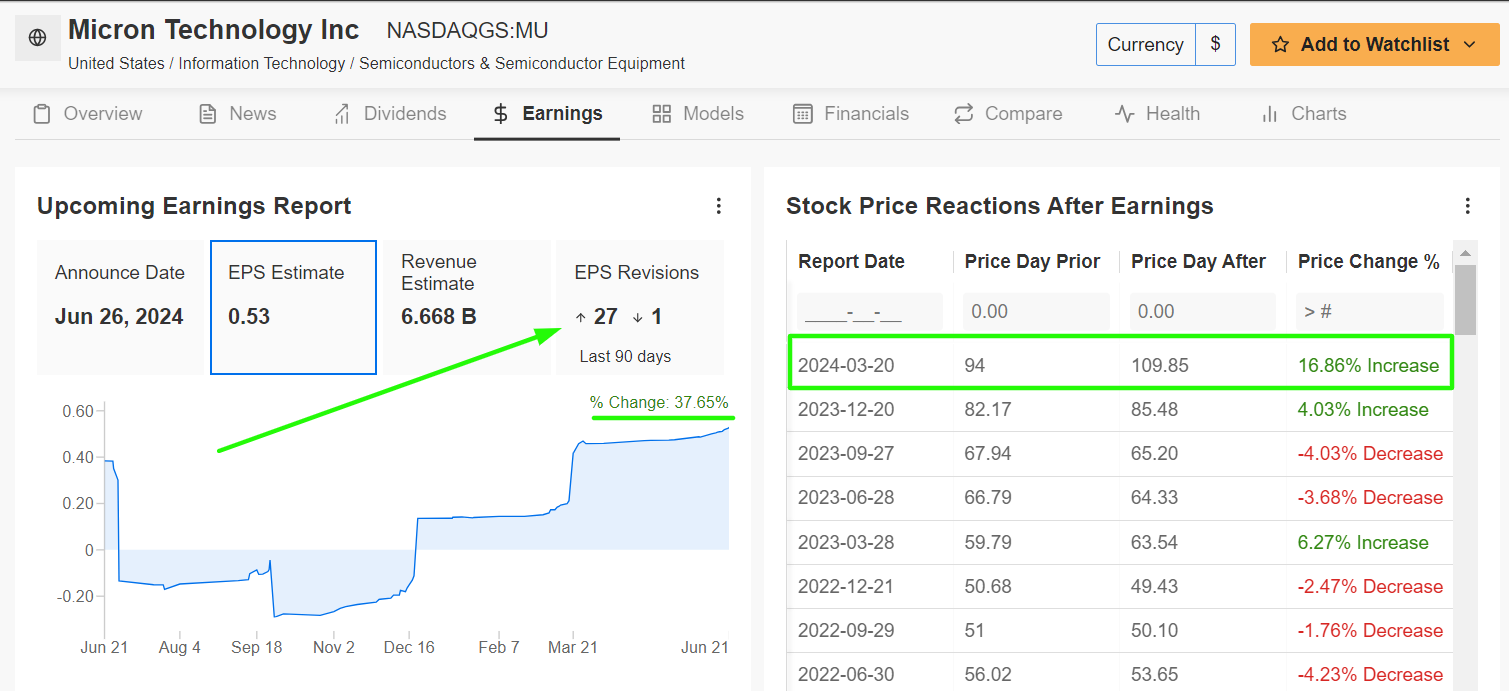

Stock to Buy: Micron

I expect a strong performance from Micron this week, as the memory-chip maker will likely deliver another quarter of solid top-and bottom-line growth and provide an upbeat outlook thanks to robust memory demand from cloud providers.

The Boise, Idaho-based company is scheduled to release its fiscal third quarter earnings report after the U.S. market closes on Wednesday at 4:05PM ET. A call with president and chief executive officer Sanjay Mehrotra is set for 5:00PM ET.

Market participants expect a sizable swing in MU stock after the update drops, according to the options market, with a possible implied move of roughly 11% in either direction.

Earnings have been catalysts for outsized swings in shares this year, as per data from InvestingPro, with shares surging nearly 17% when the memory chip company last reported quarterly numbers in March.

As could be expected, an InvestingPro survey of analyst earnings revisions points to surging optimism ahead of the print: 27 out of the 28 analysts covering the stock upwardly revised their profit estimates in the past 90 days as growth prospects in artificial intelligence remain strong.

Source: InvestingPro

Micron is seen earning $0.53 a share, reversing a year-ago loss of $1.43 per share, amid a cyclical upturn in memory chip sales.

Meanwhile, revenue is forecast to surge 77.6% year-over-year to $6.66 billion, benefiting from sales of high-bandwidth memory devices to data centers running AI applications.

But as is usually the case, investors will key in on Micron’s outlook for the current quarter and beyond. As such, I believe the company will strike an upbeat tone as it remains well positioned to thrive amid the current environment and growing AI trend.

MU stock ended Friday’s session at $139.54, just below its all-time high of $157.50 reached on June 18. At current levels, Micron has a market valuation of $154.5 billion.

Source: Investing.com

Shares have been on a major uptrend since the start of the year, gaining 63.5% so far in 2024.

As InvestingPro points out, Micron has an above-average ‘Financial Health Score’, highlighting its solid earnings prospects, and a robust profitability outlook. Additionally, it should be noted that the company has raised its annual dividend payout for three consecutive years.

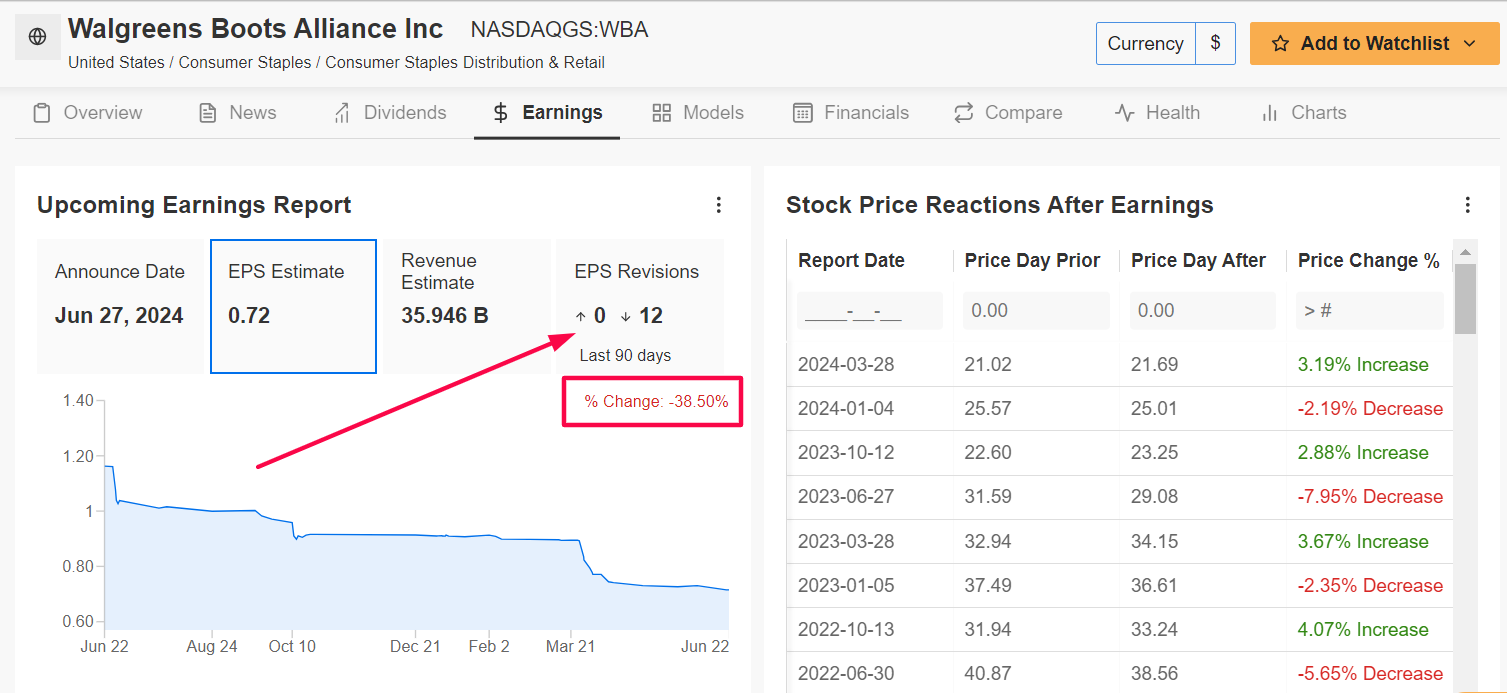

Stock to Sell: Walgreens Boots Alliance

I foresee a disappointing week ahead for Walgreens Boots Alliance, with a potential breakdown to new lows on the horizon, as the retail pharmacy giant’s earnings and guidance will likely disappoint investors due to the challenging macro environment.

Walgreens’ update for its fiscal third quarter is scheduled to come out before the market opens on Thursday at 7:00AM ET.

Market participants expect a sizable swing in WBA stock following the print, with a possible implied move of about 10% in either direction, according to the options market.

Underscoring several near-term challenges facing the company amid the current climate, all 12 analysts surveyed by InvestingPro cut their profit estimates in the past 90 days to reflect a drop of roughly 40% from their initial expectations.

Source: InvestingPro

The Deerfield, Illinois-based pharmacy store chain is seen earning $0.72 per share, declining 28% from EPS of $1.00 in the year-ago period, amid higher cost pressures and declining operating margins.

Meanwhile, revenue is forecast to inch up 1.5% year-over-year to $35.94 billion, as it deals with low consumer spending due to the challenging retail environment and a slow ramp-up of its new healthcare unit.

Taking that into account, I believe there is a growing downside risk that Walgreens could cut its full-year earnings outlook as it continues to spend heavily on a transformation from a retail drugstore chain operator and pharmacy services provider into a full-service health care company.

WBA stock closed Friday’s session at $15.97, not far from a recent low of $14.62, which was the weakest level since December 1997. At its current valuation, the pharmacy chain store has a market cap of $13.8 billion.

Source: Investing.com

The stock was removed from the Dow Jones Industrial Average earlier this year, losing its spot in the blue-chip index to Amazon (NASDAQ:AMZN). Shares are down 38.8% year-to-date, underperforming the broader market by a wide margin.

Not surprisingly, Walgreens has a poor InvestingPro ‘Financial Health’ score of 1.5 out of 5.0 due to fears over its significant debt burden, and downbeat profit and sales growth prospects.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading.

Readers of this article enjoy a limited-time discount of 40% OFF on the yearly and bi-yearly Pro plans with the coupon codes PROTIPS2024 (yearly) and PROTIPS20242 (bi-yearly).

Whether you're a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging backdrop of elevated inflation, high interest rates, and mounting geopolitical turmoil.

Subscribe here and unlock access to:

- Fair Value: Instantly find out if a stock is underpriced or overvalued.

- ProPicks: AI-selected stock winners with proven track record.

- ProTips: Digestible, bite-sized insight to simplify complex financial data.

- Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Ray Dalio, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.