- Retail sales data, Q3 earnings season barrage, geopolitical fears in focus.

- Lululemon is a buy on news it will be joining the S&P 500.

- Pfizer is set to underperform after providing shock guidance cut.

- Looking for more actionable trade ideas to navigate the current market volatility? Members of InvestingPro get exclusive ideas and guidance to navigate any climate. Learn More »

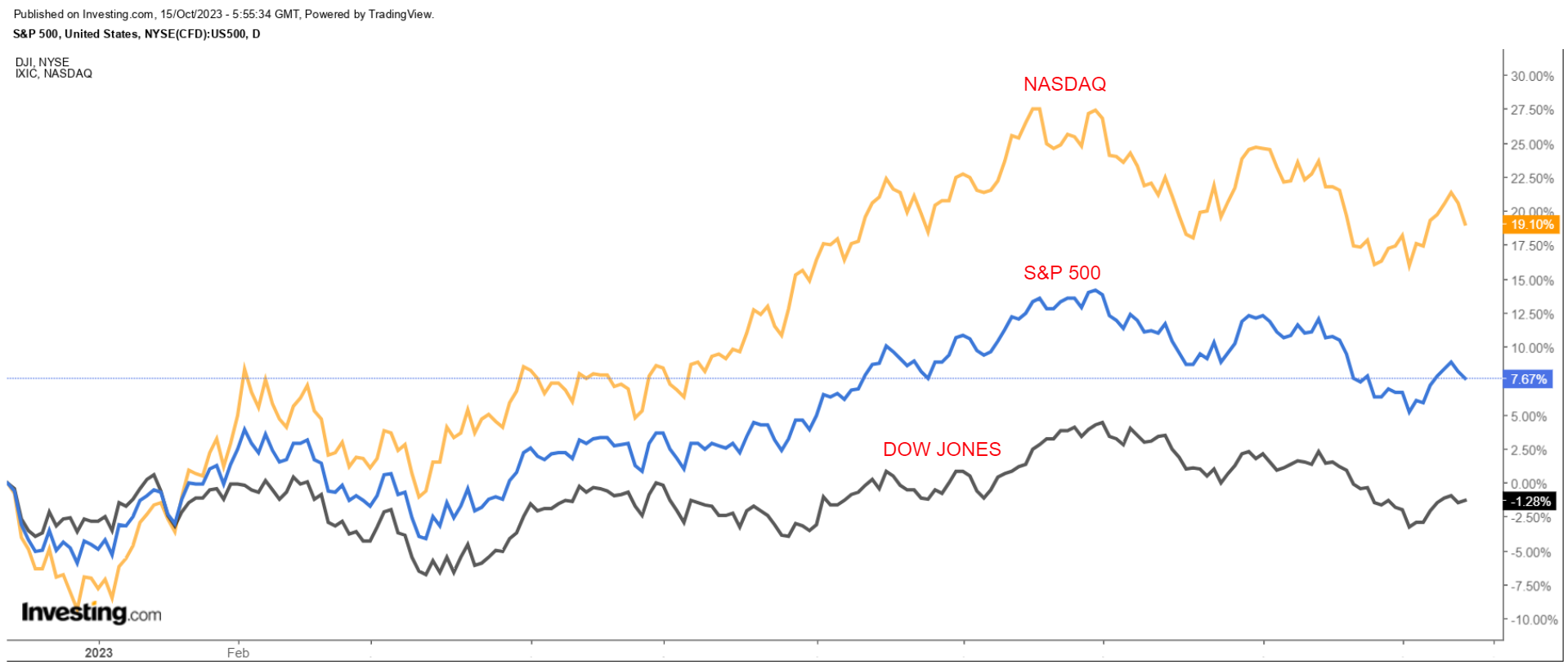

Stocks on Wall Street ended mostly lower on Friday to wrap up a volatile week, as a spike in oil prices and rising inflation expectations soured investors on riskier bets.

Despite Friday’s weak performance, the blue-chip Dow Jones Industrial Average rose 0.8% on the week, the benchmark S&P 500 tacked on 0.4%, while the tech-heavy Nasdaq Composite dipped 0.2%.

The week ahead is expected to be another busy one as investors continue to assess the outlook for the economy, inflation, interest rates and corporate earnings.

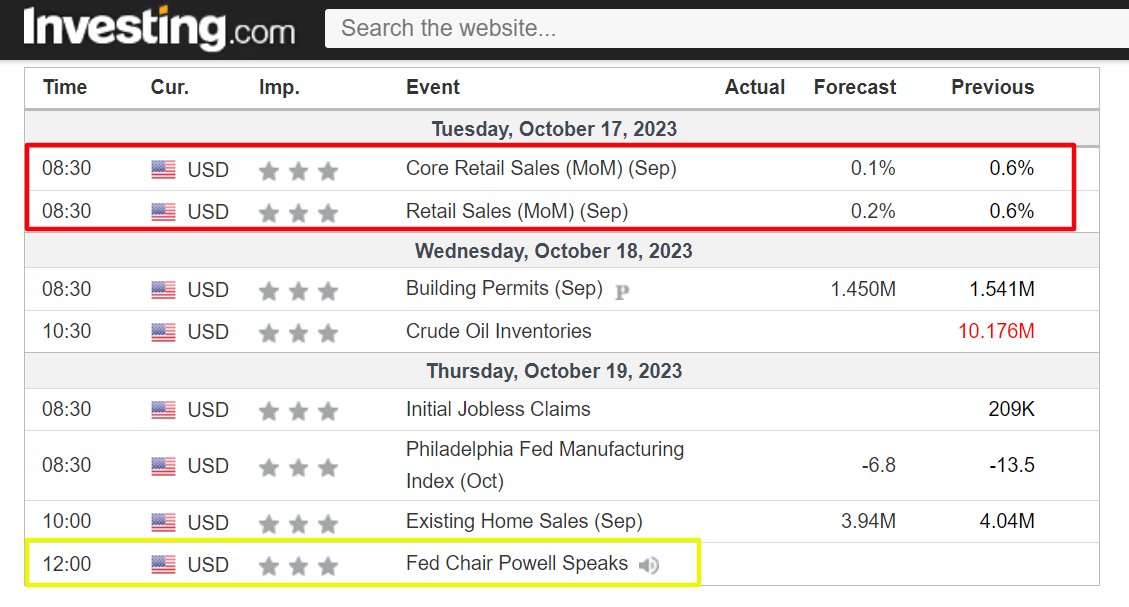

Most important on the economic calendar will be Tuesday’s U.S. retail sales report for September, with economists estimating a headline increase of 0.2% after sales rose 0.6% during the prior month.

Investors will also scrutinize a speech from Fed Chair Jerome Powell on Thursday for clues on the outlook for interest rates. As of Sunday morning, financial markets see a 94% chance of the Fed holding rates at current levels at its November meeting, according to Investing.com’s Fed Rate Monitor Tool.

Meanwhile, third quarter earnings season shifts into high gear, with Tesla (NASDAQ:TSLA) and Netflix (NASDAQ:NFLX) leading the charge. Other high-profile companies reporting include Bank of America (NYSE:BAC), Goldman Sachs (NYSE:GS), Morgan Stanley (NYSE:MS), American Express (NYSE:AXP), Johnson & Johnson (NYSE:JNJ), Procter & Gamble (NYSE:PG), AT&T (NYSE:T), American Airlines (NASDAQ:AAL), United Airlines (NASDAQ:UAL), and Taiwan Semiconductor (NYSE:TSM).

In addition to earnings, investors will also monitor news out of the Middle East amid growing fears that the Israel-Hamas war could escalate geopolitical tensions in the region.

Regardless of which direction the market goes next week, below I highlight one stock likely to be in demand and another which could see fresh downside.

Remember though, my timeframe is just for the week ahead, Monday, October 16 - Friday, October 20.

Stock To Buy: Lululemon

I believe Lululemon's (NASDAQ:LULU) stock will outperform in the week ahead, after it was announced that shares of the yoga wear retailer will be added to the benchmark S&P 500 index.

S&P Dow Jones Indices said late Friday that the Vancouver-based athletic apparel maker will join the widely followed index - which tracks the stock performance of 500 of the largest companies listed on the U.S. stock market - before the start of trading on Wednesday, October 18.

Lululemon is replacing video-game company Activision Blizzard (NASDAQ:ATVI), whose $69 billion acquisition by Microsoft (NASDAQ:MSFT) was completed on Friday after clearing numerous regulatory hurdles.

History has shown that stocks often enjoy a boost after the announcement of their addition to the S&P 500. In general, stocks making the jump usually benefit from increased liquidity and greater interest from individual and institutional investors, two factors that can potentially propel a company’s share price higher.

Indeed, past studies have found that companies added to the S&P 500 experience increases in their stock price as passive investment funds that are benchmarked to the index are forced to buy shares in order to realign with the S&P 500’s new composition.

LULU stock ended Friday’s session at $377.69, not far from a 52-week high of $406.75 touched on September 1. At current levels, Lululemon has a market cap of around $48 billion, making it one of the most valuable exercise apparel companies in the world.

Shares are up 17.9% year-to-date, much better than the 3% decline recorded by the SPDR® S&P Retail ETF (NYSE:XRT), which tracks a broad-based, equal-weighted index of U.S. retail companies in the S&P 500.

It should be noted that Lululemon’s stock remains extremely undervalued according to the quantitative models in InvestingPro, and could see an increase of about 18% from Friday’s closing price to its ‘Fair Value’ target of roughly $446.

Despite a difficult environment for retailers, investors have turned more bullish on the sportswear brand as it benefits from favorable consumer demand trends and an improving fundamental outlook. Lululemon has beaten Wall Street’s profit expectations for 13 consecutive quarters, a testament to the strength of its underlying business, its loyal customer base, as well as strong execution across the company.

Stock To Sell: Pfizer

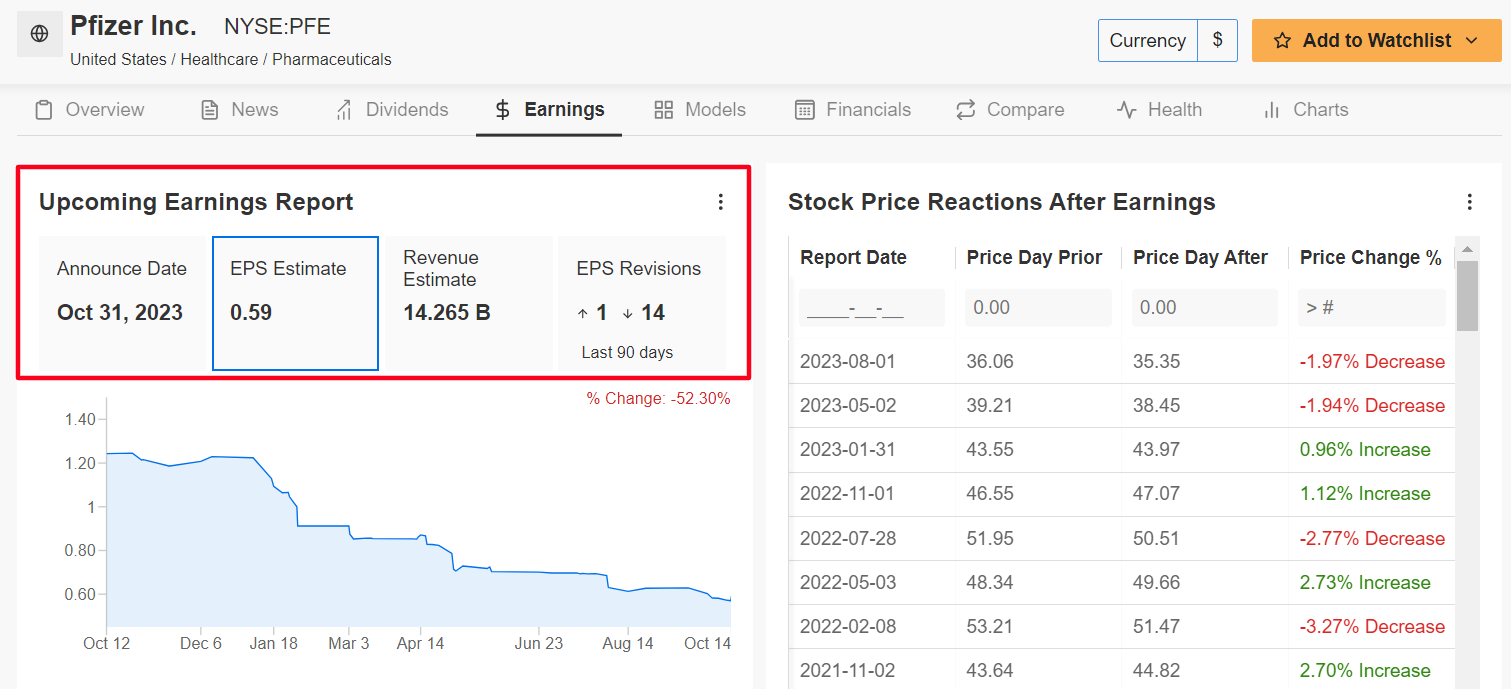

I believe Pfizer's (NYSE:PFE) stock will suffer a challenging week ahead, with a potential drop to new 52-week lows on the horizon, as investors react to fresh negative developments plaguing one of the world’s largest pharmaceutical companies.

Pfizer on Friday cut its full-year revenue forecast by $9 billion due to lower-than-expected sales of its COVID-19 vaccine and treatment. The company foresees a $7 billion reduction in expected revenue for its Paxlovid antiviral Covid treatment pill, and a $2 billion decline in revenue for its Comirnaty Covid vaccine it makes with BioNTech (NASDAQ:BNTX).

As a result, Pfizer’s management now expects 2023 revenue to be in the range of $58 billion to $61 billion, down sharply from its prior forecast of $67 billion to $70 billion.

Pfizer executives, including CEO Albert Bourla, will hold a conference call with investors on Monday at 8:00AM EST to discuss the new outlook.

The pharmaceutical giant also warned that it will take a one-time cash charge of $3 billion, related to severance, among other things, as it implements fresh cost-cutting measures.

PFE stock - which fell to a more than two-year low of $31.77 on September 28 - ended at $32.12 on Friday. At current levels, the New York-based drugmaker has a market cap of $181.3 billion.

Shares have underperformed the broader market by a wide margin in 2023, tumbling 37.3% year-to-date, amid a significant slowdown in sales of its Covid-related product portfolio.

Underscoring several headwinds Pfizer faces amid the current backdrop, an InvestingPro survey of analyst earnings revisions points to mounting pessimism ahead of the company’s Q3 update on October 31, with 14 out of 15 analysts slashing their EPS estimates.

With InvestingPro, you can conveniently access a single-page view of complete and comprehensive information about different companies all in one place, eliminating the need to gather data from multiple sources and saving you time and effort.

Disclosure: At the time of writing, I am long on the Dow Jones Industrial Average, the S&P 500, and the Nasdaq 100 via the SPDR Dow ETF (DIA), the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). Additionally, I have a long position on the Energy Select Sector SPDR ETF (NYSE:XLE) and the Health Care Select Sector SPDR ETF (NYSE:XLV). I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.