- U.S. CPI inflation, regional banking woes, more earnings in focus this week.

- Airbnb stock is a buy with big earnings beat on deck.

- Rivian shares are a sell amid expected weak Q1 results, sluggish outlook.

- Looking for more top-rated stock ideas to protect your portfolio amid the increasingly uncertain economic climate? Members of Investing Pro get exclusive access to our research tools and data. Learn More »

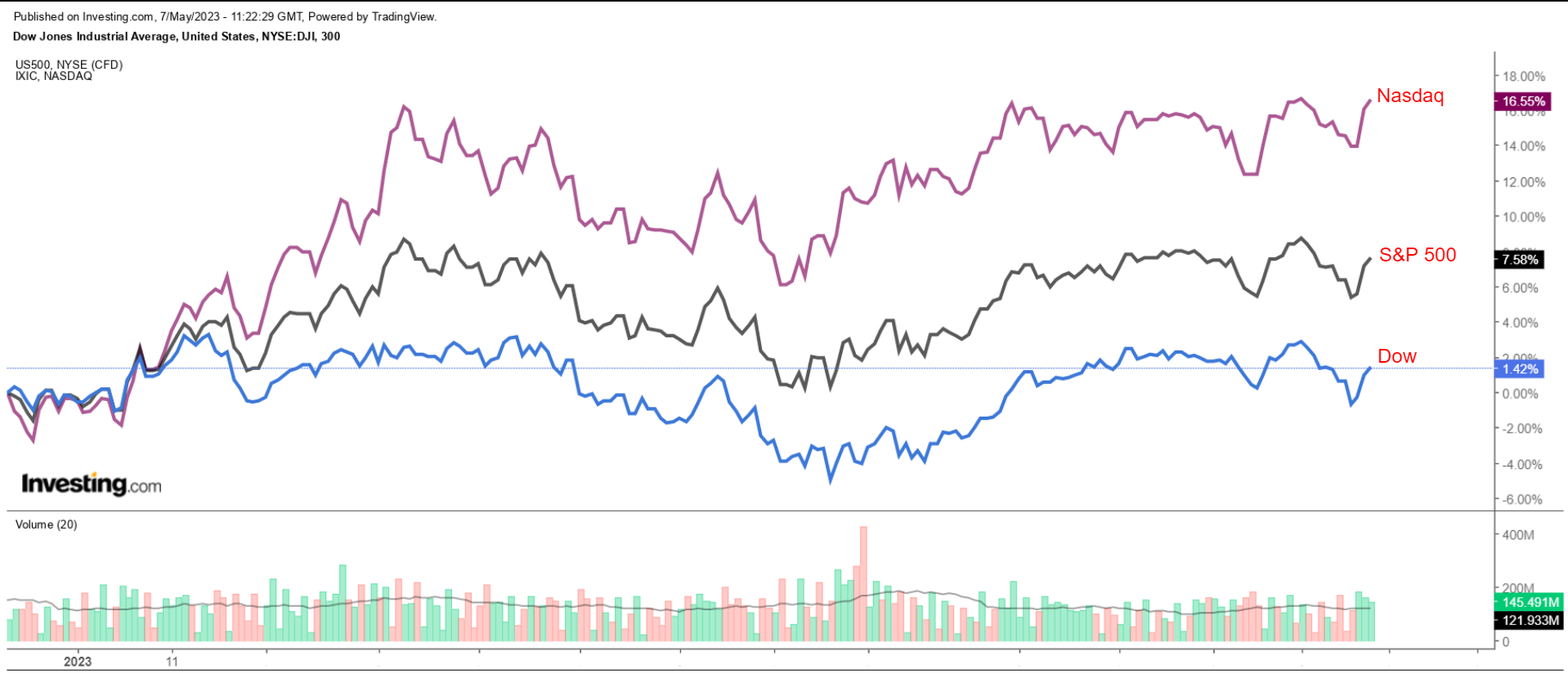

Stocks on Wall Street rallied on Friday, with the Dow posting its biggest one-day percentage gain since Jan. 6, as investors cheered a strong U.S. jobs report and upbeat earnings from market-darling Apple (NASDAQ:AAPL).

Adding to the bullish momentum, regional bank shares, such as PacWest Bancorp (NASDAQ:PACW) and Western Alliance (NYSE:WAL), rebounded from their sharp declines tied to the collapse of First Republic Bank (OTC:FRCB).

Despite Friday’s rally, the blue-chip Dow and the S&P 500 logged their worst week since March. The 30-stock Dow lost 1.2%, while the S&P 500 fell 0.8%. The tech-heavy Nasdaq Composite eked out a small gain of 0.1%.

The week ahead is expected to be another eventful one as investors continue to gauge the outlook for inflation, interest rates, and the economy. Bank crisis developments will also be in focus amid ongoing concern over the health of the regional banking system.

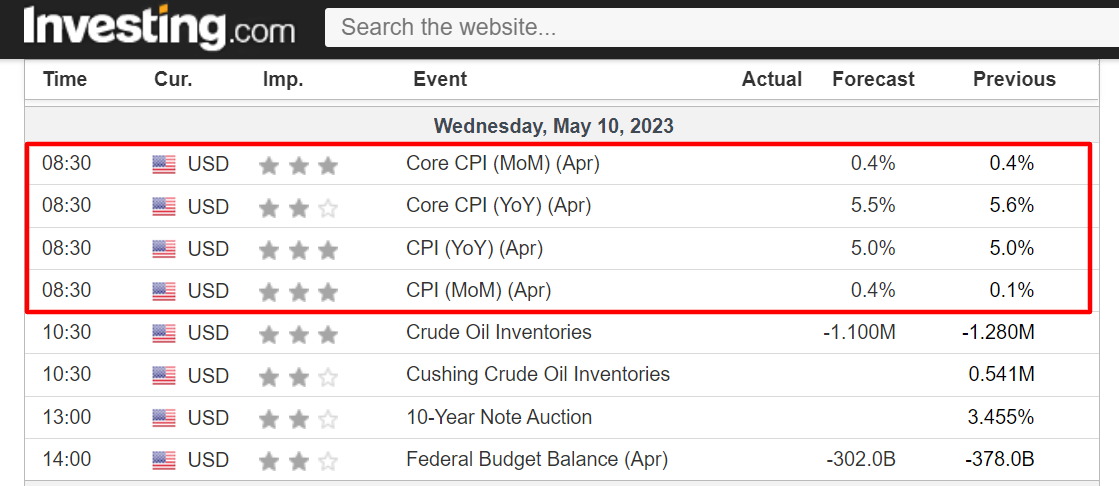

On the economic calendar, most important will be Tuesday’s U.S. consumer price inflation report for April. As per Investing.com, analysts expect both the month-over-month (+0.4%) and year-over-year rates (+5.0%) to remain at elevated levels.

The CPI data will be accompanied by a heavy slate of Federal Reserve speakers, which will surely add to the debate on the U.S. central bank’s next move.

Currently, markets overwhelmingly expect the Fed to pause its monetary tightening cycle at its next meeting in June, with odds for no action standing at 91.5%, according to Investing.com’s Fed Rate Monitor Tool.

Elsewhere, some of the key earnings reports to watch in the week ahead include updates from Walt Disney (NYSE:DIS), PayPal (NASDAQ:PYPL), Roblox (NYSE:RBLX), Palantir (NYSE:PLTR), Tyson Foods (NYSE:TSN), and Fox (NASDAQ:FOX).

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another which could see further downside.

Remember though, my timeframe is just for the week ahead, May 8-12.

Stock To Buy: Airbnb

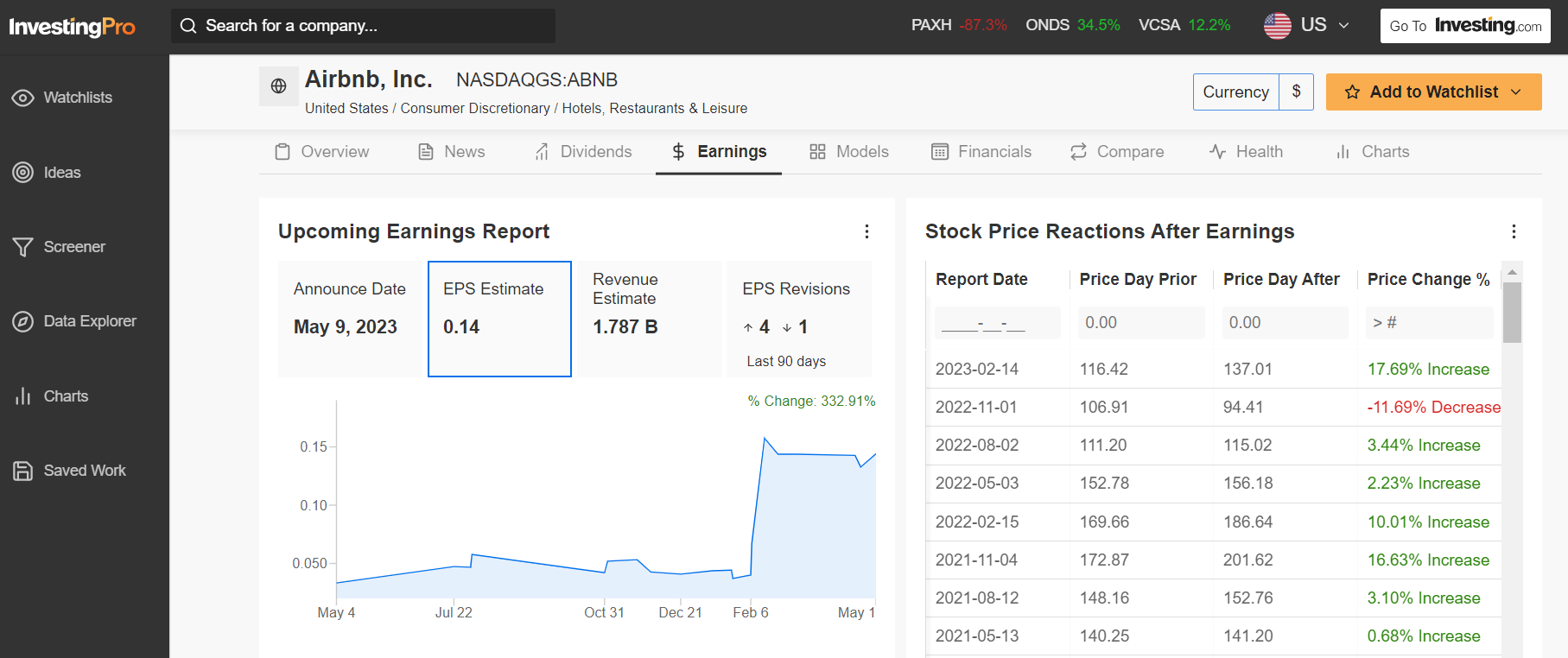

I believe Airbnb's (NASDAQ:ABNB) stock will outperform in the week ahead as the online travel giant’s first quarter earnings update will surprise to the upside in my view thanks to favorable consumer demand trends and an improving fundamental outlook.

Airbnb is scheduled to deliver its Q1 report after the U.S. market closes on Tuesday, May 9. According to the options market, traders are pricing in a swing of 8.8% in either direction for ABNB stock following the update.

Despite a challenging operating environment, I believe the San Francisco, California-based vacation rental firm is poised to deliver a better-than-expected print as it capitalizes on the ongoing recovery in the travel industry despite recession fears that have sparked concerns about consumer spending.

Airbnb - which went public in late 2020 - operates an online marketplace platform for vacation rentals, cabins, beach houses, unique homes, as well as tourism experiences around the world. It is widely viewed as a competitive threat by the hotel industry.

Source: InvestingPro

Not surprisingly, an Investing Pro survey of analyst earnings revisions points to mounting optimism ahead of the report, with analysts growing increasingly bullish on the online vacation-rental booking platform’s future prospects as it benefits from a post-pandemic recovery in travel demand.

Consensus expectations call for Airbnb to post earnings per share of $0.14, a significant improvement when compared to a net loss of $0.03 a share in the year-ago period. Revenue is forecast to rise 18.3% year-over-year to $1.78 billion, driven by strong outbound travel from the Asia-Pacific region as China lifted travel restrictions.

As such, I reckon the company’s gross nights booked and cross-border trips will both beat expectations in Q1 as travel continues to rebound from the fading impact of the Covid health crisis.

Airbnb has beaten Wall Street’s top-line expectations in each of the last seven quarters, while trailing revenue estimates only once in that span, a testament to strong execution across the company.

ABNB ended Friday’s session at $119.90, earning the company a valuation of $75.5 billion. Shares have been on a tear since the start of 2023, scoring a year-to-date gain of 40.2% to easily outperform the broader market over the same timeframe.

Investing Pro currently has a 12-month price target of about $134 for ABNB shares, implying 12% upside ahead, making it a smart time to buy.

Stock To Sell: Rivian Automotive

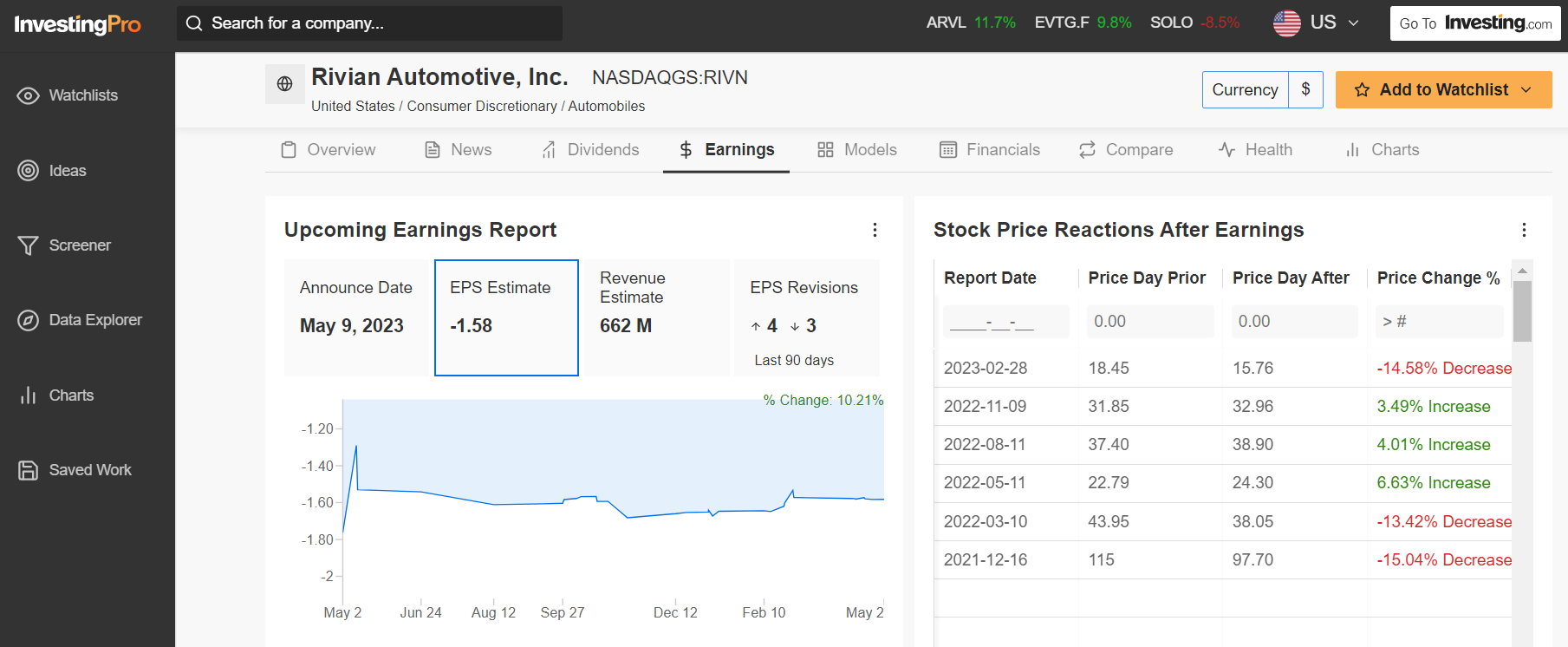

I believe shares of Rivian Automotive (NASDAQ:RIVN) will suffer a challenging week ahead, with a potential breakdown to new record lows on the horizon, as the struggling electric truck startup’s latest earnings will likely reveal another quarterly loss due to the tough economic climate.

Market participants expect a sizable swing in RIVN stock following the results - which are due after the close on Tuesday, May 9 - with a possible implied move of 15.5% in either direction, according to the options market.

According to Investing Pro, Wall Street sees the Irvine, California-based EV maker losing -$1.58 a share in the first quarter, worsening from a net loss of -$1.42 in the year-ago period, as it spends heavily in an attempt to fend off competition from more established automakers such as Tesla (NASDAQ:TSLA), Ford (NYSE:F), and General Motors (NYSE:GM).

Source: InvestingPro

Revenue is seen rising 596% year-over-year to $662 million, however that would mark a slowdown from the $663 million sales total recorded in the previous quarter as Rivian struggles in the face of weakening demand amid a deteriorating EV market.

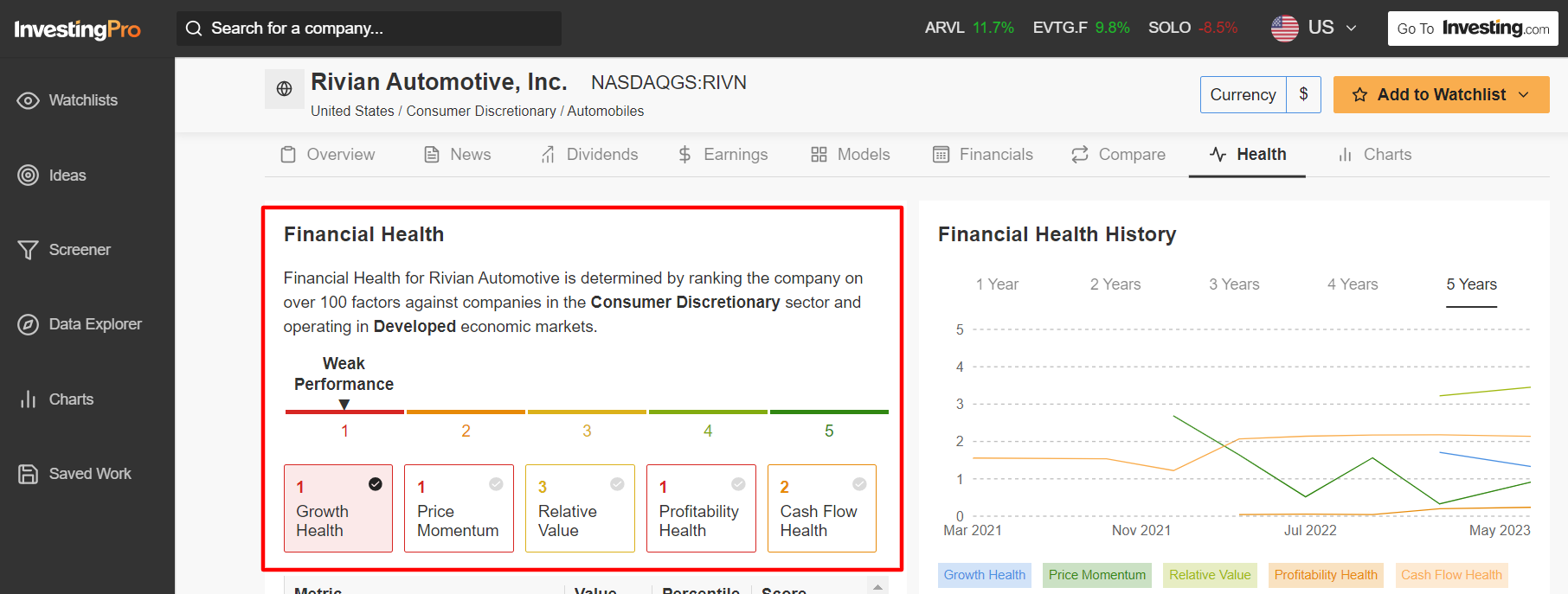

Underscoring the negative impact of several near-term headwinds, Rivian currently has an extremely poor Investing Pro ‘Financial Health’ score of 1/5. The Pro health metric is determined by ranking the company on over 100 factors against other companies in the Consumer Discretionary sector.

Source: InvestingPro

That leads me to believe that there is a growing downside risk that Rivian could cut its sales guidance and production and delivery outlook for the rest of the year to reflect higher cost pressures and lower gross margins.

RIVN stock, which slumped to an all-time low of $11.68 on April 26, ended at $13.41 on Friday. At current valuations, Rivian has a market cap of $12.6 billion.

Shares are down 27.2% so far in 2023. Even more alarming, RIVN remains more than 90% below its all-time high of $179.47 touched shortly after its IPO in November 2021 as investors dumped high-growth non-profitable companies with rich valuations that are most sensitive to rising rates and accelerating inflation.

If you’re looking for more actionable trade ideas to navigate the current volatility on Wall St., the Investing Pro tool helps you easily identify winning stocks at any given time.

Here is the link for those of you who would like to subscribe to Investing Pro and start analyzing stocks yourself.

Disclosure: At the time of writing, I am short on the S&P 500 and Nasdaq 100 via the ProShares Short S&P 500 ETF (SH) and ProShares Short QQQ ETF (PSQ). I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.