By Laura Sanchez

Investing.com - This coming Saturday, Berkshire Hathaway (NYSE:BRKb) (NYSE:BRKa), America's largest non-tech company, will host its annual "carnival of capitalism" meeting live from Omaha, Nebraska, for the first time since 2019. It will be Warren Buffett's 62nd year as CEO, and he will be joined by his partner Charlie Munger, and incoming CEO Greg Abel.

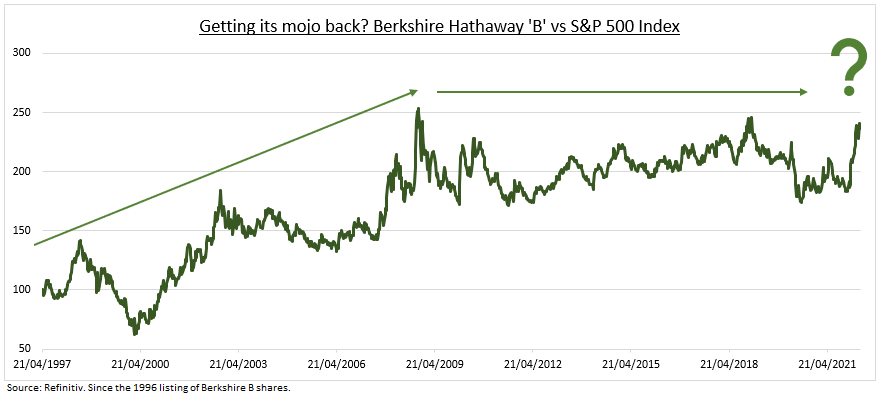

"Berkshire is regaining its profitability and its magic for doing business. Its maverick, value-driven style is being rewarded as the technology-led sell-off accelerates. Declining markets and valuations favour Buffett's mantra of being 'greedy when others are afraid' and a liquidity pile of over $100bn. Our allocation is similarly focused on cheap cyclicals and defensives," says Ben Laidler, global markets strategist at multi-asset investment platform eToro.

"Berkshire's stocks have outperformed the S&P 500 by nearly 30% this year, as its value investing style has made a strong comeback. The diverse portfolio is led by insurers (GEICO, Gen Re), railways (BNSF) and utilities (BHE), and a large 6% stake in Apple (NASDAQ:AAPL), 20% American Express (NYSE:AXP), 13% Bank of America (NYSE:BAC) and 9% Coca-Cola (NYSE:KO)," says Laidler.

According to the expert, "Buffett has become more of a buyer lately, with the $12 billion acquisition of insurer Alleghany (NYSE:Y) and large new stakes in Occidental Petroleum (NYSE:OXY) and HP Inc (NYSE:HPQ)". He adds: "But this still leaves more than $100 billion of liquidity in the tank".

Long term

Berkshire shares have replicated the performance of the S&P 500 over the past decade, a milestone given the index's profitability. However, according to eToro's global markets strategist, "Berkshire has seen great value in itself, increasing share buybacks last year to $27bn, and consistent with the reason it does not pay a dividend, unlike 80% of its peers".