By Senad Karaahmetovic

BofA’s top strategist Michael Hartnett reflected on flows in the week to Wednesday with $54.2 billion inflows to cash - the largest in 6 weeks.

On the other hand, $12 billion went into equities with outflows from bonds sitting at $4.7 billion.

Given these numbers, it comes as no surprise that BofA Bull & Bear Indicator fell to 0.3 from 0.4 as it goes more deeply into “extreme bearish” territory.

Hartnett adds that “inflation shock” is ongoing.

“Natural gas 141%, gasoline 91%, oil 61%, iron ore 45%, wheat 39%, nickel 39%, soybean 33%, corn 30%, cotton 30% YTD; COVID, monetary/fiscal stimulus, war = massive 18-month outperformance of inflation assets,” Hartnett said in a client note.

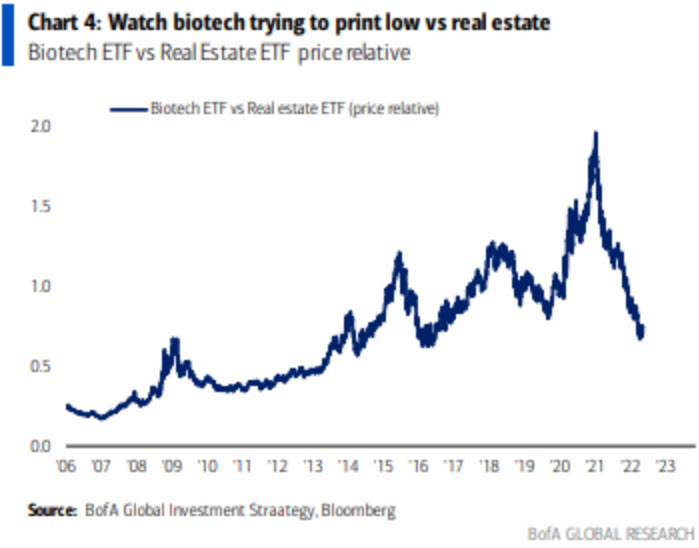

Before a potential trend reversal, the strategist urges clients to watch for low in biotech (deflation) vs real estate (inflation).”