Investing.com — Knowing the true value of an asset before making a move into it is one of the main attributes that separates the pros from the amateurs when it comes to making money in the markets.

While some invest blindly, guided subjective factors such as investor sentiment and FOMO, the big boys will make sure to have all the latest tools at their disposal before making a decision.

But what if you could have all the top indicators in the market combined into one, simple price target metric?

That's the case for our premium subscribers, who have been receiving top-tier, fundamentally sound stock picks for less than $8 a month using this link.

Check out this real-life case to get a better grasp of what we're talking about:

15 months ago, on 03-18-2023, Goldman Sachs Group (NYSE:GS) traded at $303.54. Using the best-in-breed combination of fundamental and technical metrics, including 17+ industry-recognized evaluation models, our Fair Value estimated the stock was undervalued by as much as 63%.

Since then, the stock has climbed by 56% to $472.83 on 07-10-2024.

Who would have guessed that a value stock such as Goldman Sachs would gain 56% in just over a year?

Well, our Fair Value tool did.

Powered by state-of-the-art fundamental analysis models, it flashed a buy on Goldman Sachs just as the stock was about to explode higher.

Fast-forward to now, and Goldman Sachs rode the bull market with above-average returns, outperforming the S&P 500 by a wide margin.

But how do you make sure you don’t miss the next GS?

Here are just a few of the undervalued stocks to consider right now*

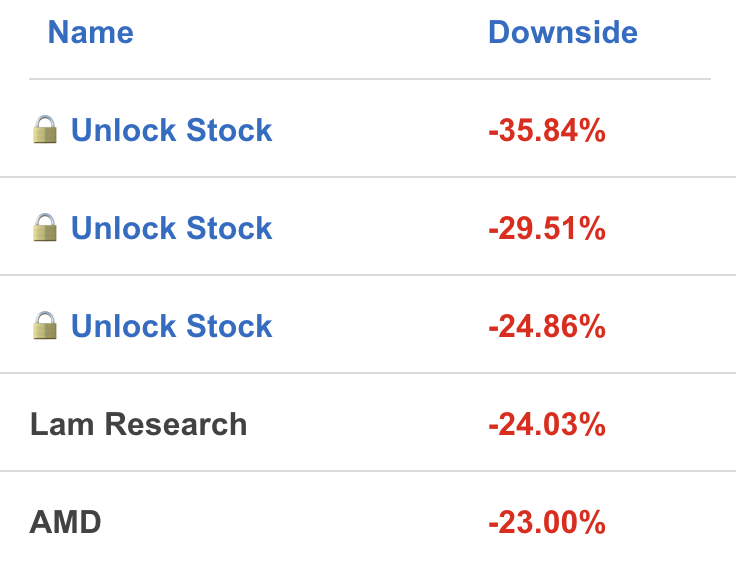

Conversely, using Fair Value also helps you find overvalued stocks to avoid right now*

Subscribing to InvestingPro gives you unlimited access to the most reliable Fair Value tool available online—the kind that hedge funds use.

Think of it as bullet-proofing your watchlist or portfolio to see which stocks may be over- or undervalued!

Learn more in our comprehensive Fair Value tool blog post

Take advantage of our exclusive summer sale and get an insight into the winners now for less than $8 a month!

*And since you made it all the way to the bottom of this article, we'll give you a special 10% extra discount on all our plans with the coupon code PROPICKS2024!