Investing.com-- The latest round of U.S. export controls on Chinese semiconductor players, announced on Monday, marks a significant tightening of restrictions but stops short of the harshest measures initially feared, according to Bernstein analysts.

The U.S. Bureau of Industry and Security (BIS) has added 140 entities to its entity list, targeting Chinese semiconductor equipment suppliers and investment firms while sparing some of the country’s major players. The new measures aim to curb China’s progress in advanced chipmaking technologies, focusing on areas such as high-bandwidth memory (HBM) and chip-design software.

While the scale is smaller than the 200 entities previously feared, the move signifies heightened U.S. scrutiny, with Chinese wafer fab equipment (WFE) vendors like NAURA Technology Group Co Ltd (SZ:002371) and Piotech Inc (SS:688072), among the primary targets, Bernstein analysts said.

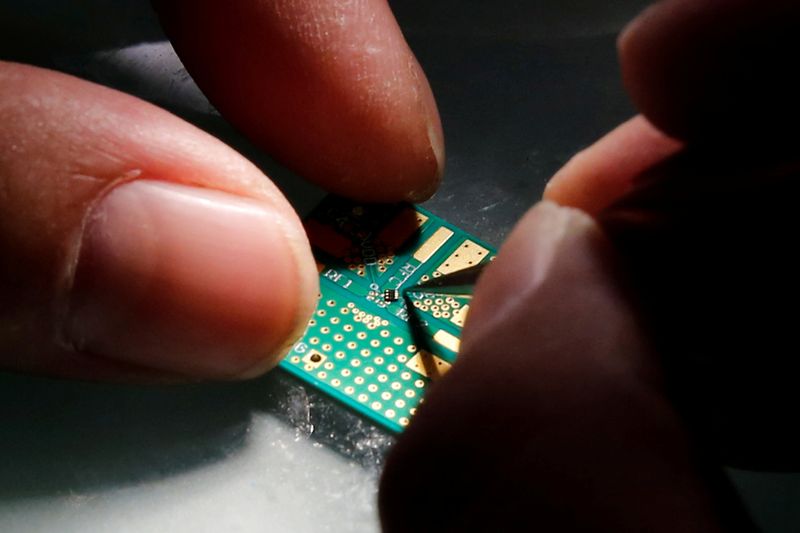

Wafer fab equipment is used to process raw wafers into finished chips for electronic devices. China is investing heavily in this equipment to increase its semiconductor production capacity.

Excluded from the list, however, is Chinese dynamic random-access memory (DRAM) chips maker Changxin Memory Technologies, a decision that analysts say benefits global memory players like Japan’s Kokusai Electric Corp (TYO:6525) and Tokyo Electron Ltd. (TYO:8035).

Global WFE players such as Tokyo Electron, Advantest Corp. (TYO:6857), and Applied Materials Inc (NASDAQ:AMAT) stand to gain modestly as the restrictions disrupt Chinese competitors' operations. The curbs on high-bandwidth memory shipments, however, are unlikely to significantly hurt global giants like Samsung Electronics Co Ltd (KS:005930), which derives less than 20% of its HBM sales from China.

Similarly, SK Hynix Inc (KS:000660) is expected to benefit in the long term as Chinese competitors face production challenges. Tighter global supply is predicted to drive DRAM prices higher, supporting SK Hynix’s profitability.

Domestic WFE firms are now largely reliant on a de-Americanized supply chain to navigate U.S. restrictions. Bernstein analysts highlighted that most have minimal overseas exposure, insulating them to some extent but raising concerns about long-term growth.