By Geoffrey Smith

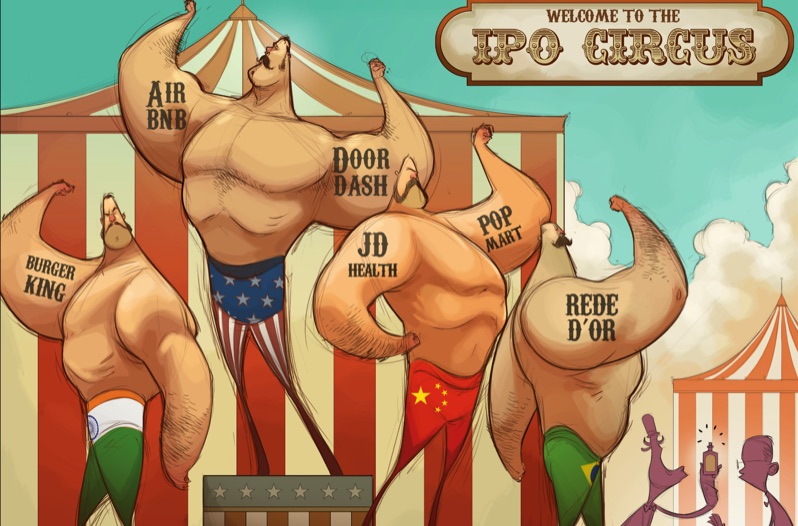

Investing.com -- Investors have had plenty of reason to think that stock valuations have become detached from reality this year – and the reasons just keep coming.

The market for initial public offerings is still running ridiculously hot, especially in the U.S. and China, where retail investors, in particular, are piling into new offerings with little thought for traditional valuations.

Last week’s debuts by home rental company Airbnb (NASDAQ:ABNB) and food delivery group DoorDash (NYSE:DASH) set new standards for an exuberance for loss-making technology stocks not seen since 1999. While they’ve come off a little this week, DoorDash still trades nearly 60% above the IPO price and even further above the price that bankers – not generally known for under-selling their products – thought advisable. AirBnB, for its part, closed on Monday nearly 100% above its IPO price.

Even in a year full of magical thinking about stocks with a growth narrative, these two stood out. Neither is profitable, although DoorDash did eke out a small profit of $23 million in the second quarter and its numbers may look better again in 2021 when it no longer has to spend tens of millions of dollars to head off campaigns for its riders to be classed as employees.

But the most telling indication of how ludicrous things had got was when AirBnB CEO Brian Chesky was left lost for words when told how high the share price had gone on its debut visibly torn between regret at all the money he’d left on the table and the urge to explain to investors why they were wrong.

As recently as April, AirBnB had had to raise $2 billion fresh capital at a reported valuation of only $18 billion. At the end of its first day of trading, it was valued at $86.5 billion.

The contradiction implied in the blowout performance of both companies is stark: DoorDash’s business has been accelerated by a pandemic that has forced restaurants to close and deliver their meals if they want to stay afloat. Covid has been good for it. By logical extension, when restaurants reopen their doors again, DoorDash’s growth will falter.

By contrast, the pandemic has been a negative for AirBnB: gross bookings were down year-on-year by as much as 67% in the second quarter before rebounding. The company may claim credit for pivoting its business away from short-term holiday lets, but the fact is that the pandemic that has, almost certainly, flattened the growth curve for the travel business in all its forms, for the foreseeable future.

So while it’s possible to make a case for one or the other having a blowout, it’s really hard to see how two blowouts can be explained, except by irrational exuberance.