By Ambar Warrick

Investing.com-- Most Asian currencies fell on Thursday as hawkish comments from the Federal Reserve showed that U.S. interest rates are likely to remain elevated for longer, while weak economic data from China also dented sentiment towards the region.

The Chinese yuan fell 0.2% and traded close to a near 15-year low after a private survey showed the country’s services sector shrank more than expected in October, due to continued COVID-linked disruptions.

The data also cooled speculation over Chinese plans to scale back COVID-linked lockdowns. The prospect of a Chinese reopening was fueled by rumors circulating on social media, and supported Asian currencies this week, given the country’s status as a major trading destination for the region.

But government officials offered no comment on social media rumors that the country will phase out its zero-COVID policy by March 2023.

Broader Asian currencies fell, with the Thai Baht and Malaysian ringgit losing about 0.2% each. The Japanese yen rose 0.4% in holiday-thinned trade.

The dollar index and dollar index futures rose 0.5% each after the Federal Reserve hiked interest rates by an as-expected 75 basis points (bps) on Wednesday.

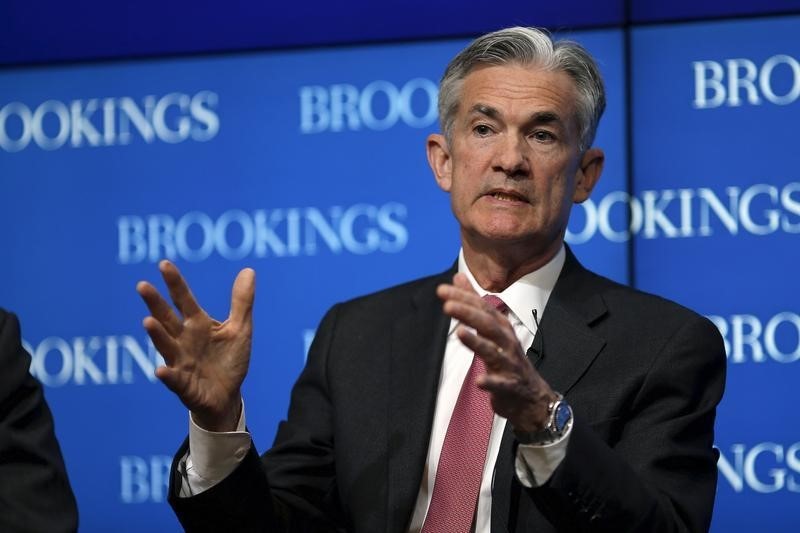

Fed Chair Jerome Powell dismissed any speculation that the bank plans to pause its interest rate hikes, and said that the Fed is set to keep raising rates for longer than initially thought. Powell said that U.S. rates, which are currently at their highest level since the 2008 financial crisis, will also peak at a much higher level than initially thought, due to stubbornly high inflation.

While the Fed Chair also raised the prospect of smaller rate hikes going forward, most risk-driven markets plummeted on his otherwise hawkish stance. Still, a majority of traders are now pricing in a 50 bps hike in December.

The Indian rupee fell 0.2%, hovering around record lows after the Reserve Bank of India kicked off an off-cycle meeting intended to address elevated inflation in the country. While markets broadly expect the bank to hold interest rates at a 3-½ year high, the bank is likely to flag higher-than-anticipated inflation in the coming months.

Among antipodean currencies, the Australian dollar bucked the trend with a 0.3% rise. Data released on Thursday showed Australia’s trade surplus rose far more than expected in September, buoyed largely by strong fuel exports.

The strong data is likely to give the Reserve Bank more economic headroom to keep raising interest rates.