(Bloomberg) -- On the eve of the 2020 election, a U.S. economy that was walloped by a global health crisis in March is recovering, though it’s a ways from regaining full strength.

Trillions of dollars in fiscal support from lawmakers and ultra-low interest rates from Federal Reserve policy makers played a big role in its rejuvenation in past months. While some sectors, such as housing and retail, are flexing plenty of muscle, the number of Americans returning to work is moderating and some companies have announced new job cuts.

Moreover, a rising number of coronavirus cases remains a risk as the nation awaits widespread availability of a vaccine.

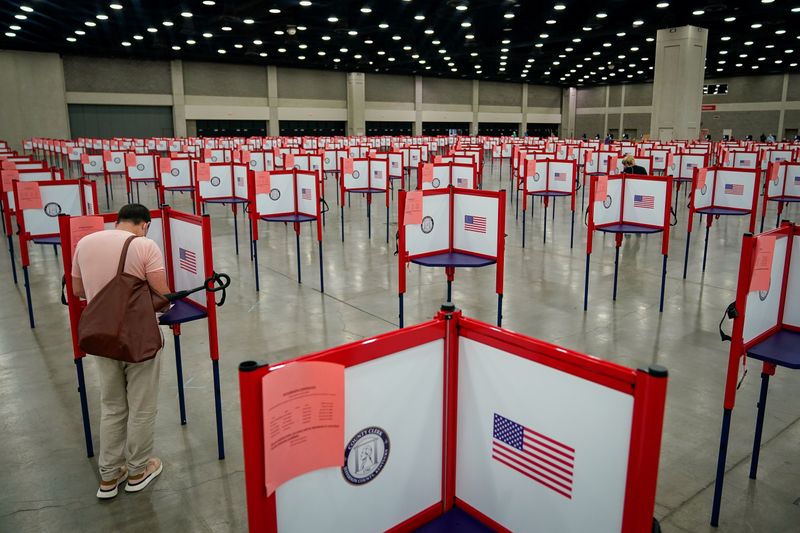

As Americans head to their local voting locations Tuesday following millions of mail-in ballots, the following charts sketch out the varying states of progress -- from the employment and real-estate markets to consumer and business spending -- since the worst of the pandemic.

The Snapback

Record household spending, led by purchases of merchandise, and the biggest jump in business spending on equipment combined to propel the world’s largest economy in the third quarter to its fastest pace in records to the 1940s.

Even with such a robust growth rate, the size of the economy remains down from its peak at the end of last year. The government’s report last week also showed incomes remain elevated, giving households the wherewithal to continue spending, while still-lean business and housing inventories have the potential of bolstering manufacturing and construction.

Consumer Firepower

The value of retail sales is firmly above its pre-pandemic level as Americans shifted their spending away from services, such as meals out and travel. Instead, they flocked to auto dealerships, home-improvement centers and online retailers.

Income growth, even excluding payments from the federal government, has outpaced spending. It’s too early yet to tell whether holiday spending in November and December will give the economy an even bigger push through year end.

Housing’s Heartbeat

Record-low mortgage rates and Americans’ desire for bigger houses -- particularly in the suburbs as the virus forced millions to work from home -- ignited a housing boom this year in one of the surprise bright spots in the pandemic economy.

In September, existing properties were on the market for 21 days on average, an all-time low. Such soaring demand has pushed prices to a record high as inventory plunged, foreshadowing stronger residential construction through at least early 2021.

Mustering Manufacturing

Manufacturing output rebounded quickly after the lockdowns, though the pace of improvement in recent months has leveled off and the Fed’s gauge of factory production remains shy of its pre-pandemic level.

The good news is that consumer demand, particularly for motor vehicles, and stronger business investment have left inventories extremely lean, signaling manufacturing will continue to pick up. Moreover, the latest regional Fed surveys show more factories are reporting stronger orders.

At the same time, the global economy is merely limping along, representing a challenging environment for U.S. producers hoping for stronger export growth.

Business Investment

Pent-up demand hasn’t been confined to just the consumer sector. Business investment in equipment such as communications gear, machinery and computers, registered a notable pickup in the third quarter. By September, the value of core capital goods shipments, as well as orders, hit a six-year high.

The outlook, however, is much less certain. Preservation of capital has moved onto the front-burner within corporate America because of the pandemic. Furthermore, plant utilization figures underscore lingering slack capacity that call into question the need for large investment outlays going forward.

Labor Market Fallout

Arguably the most scarred part of the economy is the labor market, where deep holes remain.

Employment plunged more than 22 million in March and April, at the height of the pandemic and amid government shut downs of the economy. Over the next five months, it recovered a little more than half those jobs.

Even in sectors such as construction and retail trade, where demand has bounced back sharply, payrolls are growing -- but they’re still down from their pre-pandemic peak. For the travel, leisure and food services businesses, where government restrictions remain largely in place, the job market is suffering the most.

©2020 Bloomberg L.P.