(Bloomberg) -- U.S. manufacturing production unexpectedly declined in September, the first decrease in five months, pointing to a setback for factories as the pandemic drags on.

The 0.3% drop in output at factories followed an upwardly revised 1.2% gain in August, Federal Reserve data showed Friday. Economists projected a 0.6% increase, according to the median estimate in a Bloomberg survey of economists. Total output, which also includes mines and utilities, decreased 0.6% in September.

The September decline underscored a softening in output at the end of a robust third quarter, as production grew an annualized 39.8%. The figure nonetheless highlights a longer recovery period for factories amid supply chain disruptions, limited capital investment and weak export growth.

At the same time, a separate report Friday showed momentum in U.S. household demand at the end of the third quarter. Retail sales in September increased a stronger-than-forecast 1.9%.

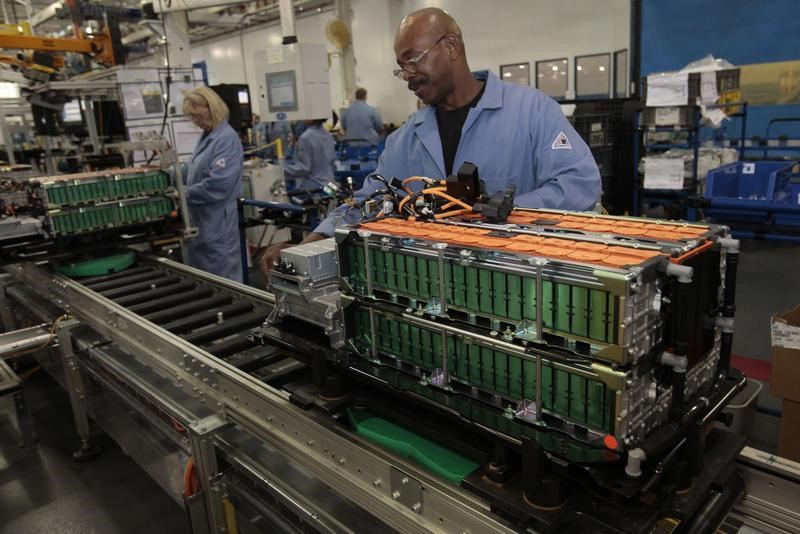

The Fed’s report showed the drop in factory output reflected weakness in production of motor vehicles and electronics. Auto production decreased 4% after sliding 4.3% a month earlier, while output of computer and electronic products fell 2.6% in September. Manufacturing excluding autos was unchanged during the month.

The Fed’s index of factory output remains below its pre-pandemic level, though rising orders, steady consumer demand and inventory restocking may help sustain the improvement in production.

October Data

A pair of regional Fed reports on Thursday showed that manufacturing gained momentum at the start of the fourth quarter.

The manufacturing plant-use rate decreased to 70.5%, well below the 75.2% in February prior to the business shutdowns, today’s report showed. Total capacity utilization, which also includes mines and utilities, declined to 71.5% from a revised 72%.

The latest industrial plant-use rate remains below the 76.9% seen in February. Excess capacity weighs on corporate profits because capital is underutilized and it also signals business investment in new equipment will remain depressed and weigh on economic growth.

The Fed’s report showed utility output dropped 5.6%, while mining rose 1.7%, the first advance since January. Oil and gas well drilling increased 3.5%.

©2020 Bloomberg L.P.